In this guide, we explain how to create a crypto tax report with the Crypto.com tax tool, all for free.

In today’s fast-paced world of cryptocurrency, staying organized and on top of your taxes is important. For those of you who are preparing your crypto taxes, you may be looking for a tool to make your life a little easier. This is where the Crypto.com Tax Tool comes in, offering a hassle-free solution for creating a comprehensive crypto tax report.

So, let’s dive in and look at the Crypto.com Tax Tool and see if it can help you report your crypto taxes.

What is the Crypto.com Tax Tool?

Crypto.com Tax is a free cryptocurrency tax calculation and reporting tool provided by Crypto.com. It helps users keep track of their cryptocurrency investments and generate tax reports for filing purposes, simplifying the process of cryptocurrency tax compliance.

The tool provides features such as automated tracking of cryptocurrency transactions, real-time portfolio monitoring, and support for multiple countries and tax regimes. Crypto.com Tax allows individuals and businesses to effectively manage their crypto taxes and avoid any potential tax penalties.

The Crypto.com Tax Tool lets users connect to popular crypto exchanges and wallets using APIs or CSV files. Tax reports can then be run with an easy-to-use interface and zero cost, regardless of your crypto transactions.

How to use the Crypto.com Tax Tool?

Who Can Use the Crypto.com Tax Tool?

The Crypto.com Tax service is available to anyone (in a supported region), even those who are not currently Crypto.com users.

Crypto.com Tax currently supports Australia, Canada, Germany, the UK and the United States. Plus, they state that they have more supported jurisdictions to come.

To start, users must create an account using an email address and a secure password.

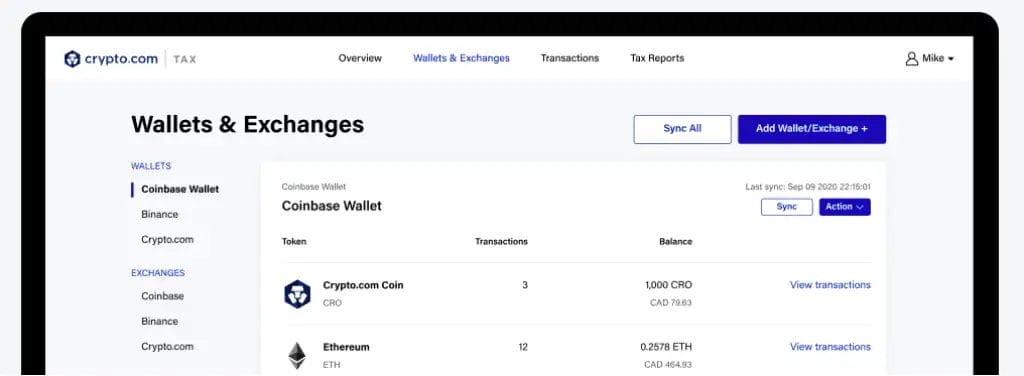

Crypto.com Tax-Supported Wallets & Exchanges

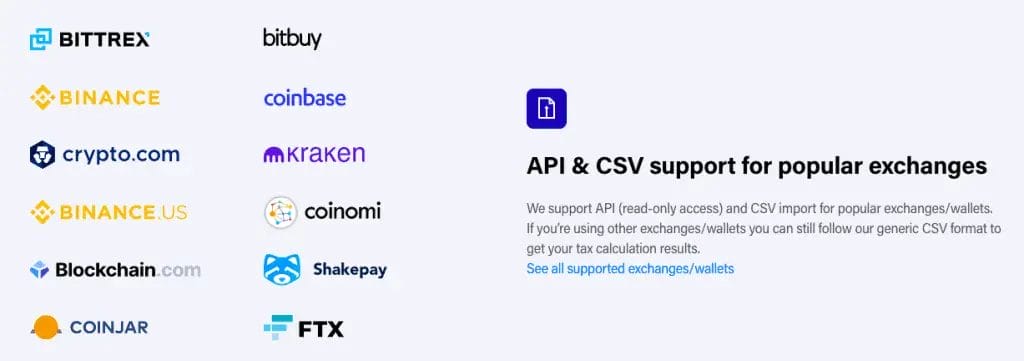

Crypto.com Tax supports a wide range of wallets, crypto exchanges and blockchains. Even if your account is not currently supported, you can simply import data through a Generic CSV Template.

The list of currently supported app and platforms include;

Wallets

Exchanges

- Crypto.com Exchange

- Binance & Binance US

- Bitfinex

- Bittrex

- Bitrue

- Blockchain.com Exchange

- Changelly Pro

- Coinbase & Coinbase Pro

- CoinJar

- CoinSpot

- Gate.io

- Gemini

- HitBTC

- Huobi Global

- Kraken

- KuCoin

- OKX

Supported Cryptocurrencies

There are over 10,000 cryptocurrencies currently supported by Crypto.com Tax, which are listed on CoinGecko. Crypto.com Tax also supports a huge range of FIAT (or traditional currencies) such as the US Dollars, GBP, Australian Dollars, Canadian Dollars and Euros.

What Reports Can I Create with Crypto.com Tax?

Currently, anyone can generate crypto tax reports free of charge using Crypto.com Tax for:

- Capital Gains and Losses: Proceeds, Cost Basis, Selling Expense, and Capital Gains/Losses

- Transaction History: Detailed Transaction history for your records

- Income Report: Detailing all the crypto you’ve received and if it’s taxable or not.

- Gifts, Donations & Payments Report: Detailing all the crypto you’ve sent

- (US specific) IRS Tax forms

- Form 8949 (Pre-selected box C for Part I and box F for Part II. If users receive the 1099-B tax forms, please check the boxes A-B for Part I and E-F for Part II)

- Schedule D

- (US specific) Tax filing software, import file for;

- TurboTax Online

- TurboTax CD/Download

- TaxAct

How to Connect Crypto.com Tax to an Exchange or Wallet

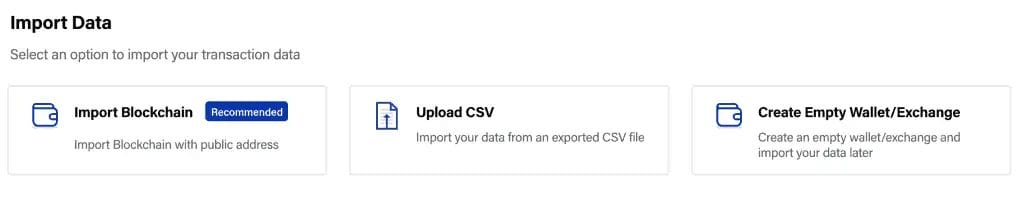

The method of uploading your CSV import file or connecting your API keys will depend on the wallet or crypto exchange you are connecting to.

For example, if you are connecting to the Crypto.com App to import your transactions, you will be taken through the steps to export your complete transaction history as a . CSV file and import these into the platform.

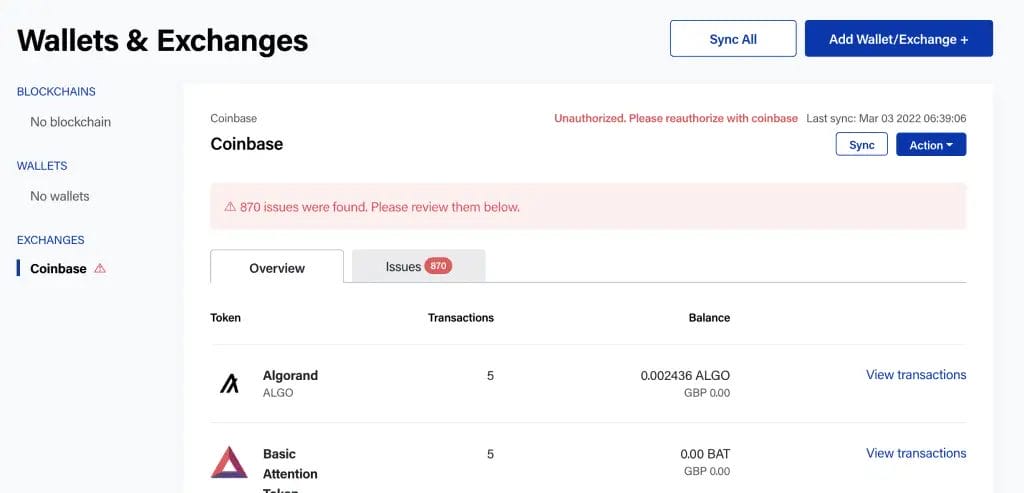

Whereas with Coinbase, you can easily connect your API keys through a series of prompts, and your transactions will automatically sync for you.

However, regardless of the wallet or the exchange you are connecting to, Crypto.com Tax has step-by-step instructions for every method available.

Why am I Getting Errors After importing?

When you import your crypto tax data, there may be errors due to the complex import transactions. It’s important to review the transactions to ensure they match your records. If something does not match, click on the three dots and update the details manually.

If you receive skipped transactions, these are usually FIAT deposits and withdrawals or staking transactions. You can find a full list of errors and resolutions in their help centre.

Can I Exclude Transactions?

If transactions are shown on the report, these can be excluded or “ignored”. To exclude a transaction;

- Go to Transactions at the top of the screen.

- Choose the three dots to the right of your transaction

- Click Ignore

If you want to re-include a transaction, simply select “restore” from the same menu.

Conclusion

Creating a crypto tax report has never been easier with the Crypto.com Tax Tool. The tool provides a comprehensive solution for tracking cryptocurrency investments and generating accurate tax reports. With its user-friendly interface and automated features, users can effortlessly stay compliant with tax laws while saving time and reducing stress.

Whether you are an individual or a business, Crypto.com Tax Tool is a great free solution for your crypto tax needs. Start using it today and experience the benefits of having a streamlined and efficient tax reporting process.

FAQs

Is Crypto.com Tax-Free?

The Crypto.com Tax tool is free for anyone needing to prepare their crypto taxes, even for those who were not previously Crypto.com users.

How Do I Get My Tax Report from Crypto.com?

To get your tax report from Crypto.com Tax, simply log in to your Crypto.com account, go to the “Tax” section, select the tax year and report type, and then click the “Download Report” button to generate a PDF or CSV file of your report. This report can be saved and printed for your records or for filing your taxes.

Why Do I Need to Pay Taxes On My Cryptocurrency?

Just like other forms of income, profits from cryptocurrency trades are subject to taxes. Accurate reporting and paying taxes on cryptocurrency transactions is important to avoid penalties and legal consequences.

What Happens If I Don’t Pay Taxes On My Crypto?

Failing to pay taxes on crypto transactions can result in penalties and legal consequences. It’s important to accurately report and pay taxes on cryptocurrency transactions to avoid these issues.