In this beginner’s guide, we will explore the Best Crypto Tax Software for crypto investors. First, we will begin by looking at crypto tax software and what factors you should consider when finding the best crypto tax software for your needs. We also provide a full-scale comparison of the best available options.

Earning 5-10x on your favourite cryptocurrency feels great. But to keep your money, you must pay taxes where you reside. This won’t be limited to your cryptocurrency assets but also any gains from NFTs and DeFi. Even for the experienced investor, crypto tax accounting can be daunting and overwhelming!

So, let’s jump in and see what the best crypto tax software is available for you to file your next tax return. Hopefully, it will help you keep some of that hard-earned money.

Top 8 Crypto Tax Software in 2025

We have compiled the 8 best crypto tax software we believe you should consider when filing your next crypto tax return! If you choose the right crypto tax software, you can quickly and easily file your crypto taxes in under an hour.

This guide will discuss tax software pricing, API Integrations, available tax reports, safety, and their compatibility with tax filing platforms.

- BlockPit – Best Crypto Tax Software for Newbies!

- Coin Ledger – Best for Active Traders

- CoinTracking – Best for Mobile Users

- Koinly – Best for Altcoin Traders

- ZenLedger – Best for Security

- CoinTracker – Best for NFTs & DeFi Traders

- Token Tax – Best for Crypto Trading Businesses

- TaxBit – Best for Users in the US

1. Blockpit

Blockpit stands out as the go-to choice for beginners and seasoned crypto enthusiasts seeking a comprehensive solution for managing their crypto taxes and portfolios in one place. Blockpit combines cryptocurrency tax reporting and portfolio tracking in one user-friendly platform, simplifying the complex task of managing crypto taxes.

Its intuitive interface presents your data through clear, easy-to-understand graphical representations, making it accessible even to those new to cryptocurrency. Whether you’re looking to dive deep into your investment insights or want a quick overview of your tax liabilities, Blockpit’s dashboard is customizable to suit your needs.

Understanding tax strategies might not be your forte if you’re starting in crypto. Blockpit also guides you through executing effective tax strategies with tools designed to simplify the process. Adding exchanges is a breeze with Blockpit’s guided processes, ensuring you’re well-supported every step of the way. And for those invested in the evolving world of NFTs, you’ll be pleased to find comprehensive support within Blockpit’s ecosystem.

Blockpit caters to a broad audience, supporting tax reports for major countries like the US, Germany, Switzerland, the UK, Australia, and India. This focus ensures that if you reside in these countries, you’ll find Blockpit’s offerings tailored to your needs. And even if you’re outside these regions or don’t use the FIFO or LIFO methods for tax calculations, Blockpit provides generic reports that can still serve your needs effectively.

Blockpit Trustpilot Rating: Blockpit currently has a Trustpilot rating of Excellent 4.5 out of 5, with 478 reviews.

Does Blockpit have a mobile app? Yes, Blockpit has a mobile app available for download on the Apple App Store and Google Play.

Blockpit Safety:

Blockpit places paramount importance on the safety and security of its users’ data. It employs a read-only access model to ensure all customer information remains secure and invulnerable to unauthorized changes. This approach guarantees that your data is safe and strictly used for tax calculation and portfolio tracking without any risk of transactional interference.

Furthermore, Blockpit’s security measures are rigorously tested against the OWASP Top-10, representing web applications’ most critical security risks. This continuous evaluation of their security infrastructure against recognized benchmarks demonstrates Blockpit’s commitment to maintaining a secure platform for their users, making it a reliable choice for confidently managing your crypto assets.

Blockpit Pricing:

Blockpit’s pricing structure is tailored to accommodate a wide range of needs, offering different plans based on the number of transactions. They provide a “Lite” plan for up to 50 transactions at $49, a “Basic” plan for up to 1,000 transactions at $109, and a “Pro” plan, which is their most popular, for up to 25,000 transactions at $269. For users with up to 500,000 transactions, the “Unlimited” plan is available at $639. These plans ensure that users can select the option that best fits their transaction volume, making Blockpit a versatile choice for both casual and serious cryptocurrency users.

A standout feature of Blockpit is its free version, which allows for unlimited integrations and usage of all portfolio tracking features without any cost. This is particularly useful for users who want to manage and track their crypto investments without needing a tax report. Purchasing a tax license is necessary for those requiring detailed crypto tax reports. Once a license is purchased, users can create and download unlimited reports for the tax year the license is valid for, providing flexibility and control over tax reporting needs.

| Plan | Price per Year | Number of Transaction |

|---|---|---|

| Free | $0 | |

| Lite | $49 | 50 |

| Basic | $109 | 1000 |

| Pro | $269 | 25,000 |

| Unlimited | $639 | 500,000 |

For a complete comparison of all the features offered, visit Blockpit Pricing.

Verdict: Should you use Blockpit?

Blockpit offers robust portfolio tracking and comprehensive crypto tax reporting, making it a versatile choice for casual traders and serious investors. Its security features, such as encryption and read-only data access, ensure your information is safe. With support for a broad range of transactions and compliance with global tax laws, Blockpit caters to users worldwide. Its flexibility and user-friendliness make it an excellent option, but evaluating your specific needs and comparing it to alternatives is crucial for making the best decision.

Their customer support is excellent, and if you live in a country that uses FIFO or LIFO, this might be the best option for you.

2. Coin Ledger

Coin Ledger was founded in 2018 by three passionate founders who wanted to automate crypto taxes for users. With more than 300,000 users and 70 billion dollars in transactions processed, CoinLedger is one of the kingpin crypto tax software on the market.

Coin Ledger integrates with major platforms like Coinbase, Gemini, and OpenSea. It also integrates with most crypto wallets and four different tax preparation platforms, such as TaxAct, TurboTax, TaxSlayer, and H&R Block. You can also pull data from a public blockchain address or upload a CSV file.

One great feature of Coin Ledger is that you can hire a certified crypto tax accountant directly from their website directory. Once your tax professional has created their free Tax Pro account, they can view and download your tax reports.

CoinLedger.io Trustpilot Rating: Coin Ledger currently has a Trustpilot rating of 4.8 out of 5, with 590 reviews.

Does Coin Ledger have a Mobile App? Coin Ledger has no mobile app to download on the Apple app store or Google Play.

FUN FACT: Coin Ledger was originally named CryptoTrader.Tax.

Coin Ledger Safety:

Yes, Coin Ledger is a safe tool. Like other crypto tax software, it requests read-only access to your financial and personal details. All data is encrypted in transit, with zero chances of theft or unauthorized access.

Coin Ledger Pricing:

With Coin Ledger, you can view your capital gains/losses for free. You only need to pay when you want to download and view tax reports.

Coin Ledger offers customers a 14-day money-back guarantee, so if you’re unhappy, you can request a refund. For more information about their pricing plans, check out their website.

| Plan | Price per Year | Number of Transaction |

|---|---|---|

| Hobbyist | $49 | 100 |

| Day Trader | $99 | 1,500 |

| High Volume | $199 | 5,000 |

| Unlimited | $299 | Unlimited |

To compare all the features offered, visit Coin Ledger Pricing.

Verdict: Should you use Coin Ledger?

Coin Ledger has all the features of an excellent crypto tax software, and if you have a high volume of transactions, this is the most budget-friendly option for you. However, they do not accept crypto payments, which is strange for crypto tax software. Secondly, you might face problems importing transaction data from some crypto wallets and might have to upload a PDF.

3. CoinTracking

Founded in 2013, CoinTracking is a German-based company with an active user base of 1,253,000. However, few know CoinTracking was the first software to offer crypto portfolio tracking and tax reporting.

CoinTracking is supported in more than 100 countries, has multiple languages, and offers active customer support that strives to keep customers happy. With the software, you can track over 20,000 cryptocurrencies across 70 exchanges.

One of the unique features of CoinTracking is that you can use their crypto tax consultant database of 75 countries. Provided free of cost, you can read the tax laws of your country of residence and hire a tax specialist. You can find more than 25 different crypto tax reports on their platform and play around with different accounting methods.

CoinTracking.info Trustpilot Rating: CoinTracking currently has a Trustpilot rating of 3.1 out of 5, with 6 reviews.

Does CoinTraking have a Mobile App? Yes, CoinTracking has a mobile app available to download on the Apple app store and Google Play.

CoinTracking Safety:

CoinTracking can see activity on all your connected accounts, but it does not store any information. You can enable 2-factor authentication from your dashboard, and they have created secure import processes for exchanges like Gate.io that do not offer read-only API keys. In terms of security, all bases are covered!

CoinTracking Pricing:

With a free plan of up to 200 transactions, CoinTracking can be an excellent option for traders on a budget. When you sign up for one of their premium packages, you can avail discounts on Binance.US, Gemini, Crypto.com and other exchanges. Choose the best package according to your needs:

| Plan | Price per Year | Number of Transaction |

|---|---|---|

| Free | $0 | 200 |

| Pro | $132 | 3,500 |

| Expert | $204 | 20,000 |

| Unlimited | $660 | Unlimited Transactions |

For a full comparison of all features, visit CoinTracking Pricing.

Verdict: Should you use CoinTracking?

Most exchanges offer a free plan, but only for 25-50 transactions. With CoinTracking, you can file your taxes for up to 200 transactions for zero charges. CoinTracking is also great for mobile users, with applications available for iOS and Android users.

With extensive API tracking across 70 different exchanges, CoinTracking is one of the best crypto tax software options.

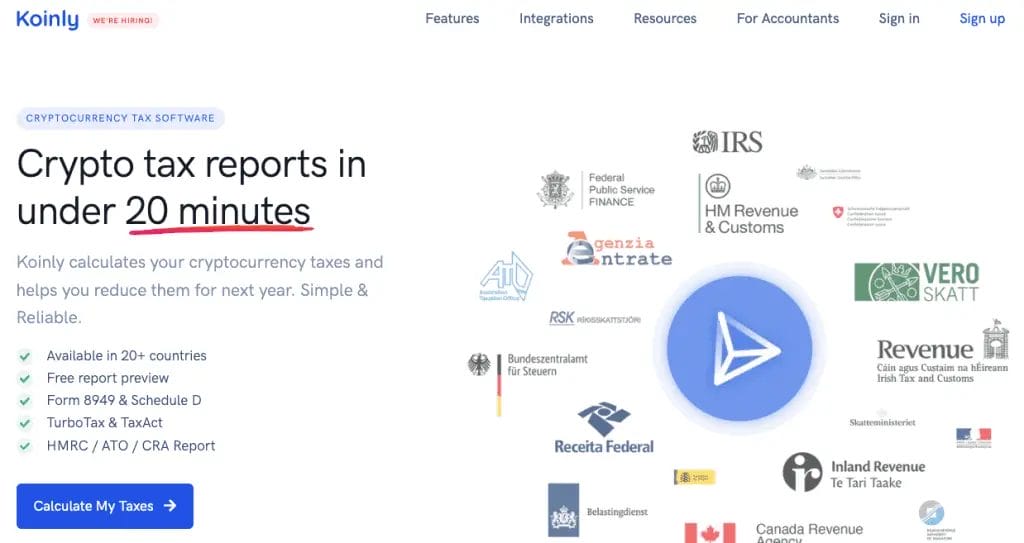

4. Koinly

Koinly crypto tax software was founded by Robin Singh in 2018 and has its headquarters in Silicon Valley. Koinly.io will help you file your taxes in less than 20 minutes. More than 110,000 tax reports have been filed using this software, and it is entirely free to start!

With Koinly, you can file your taxes in 20+ countries, and even if your country is not supported, you can still use the platform if it uses any of the cost-basis methods. If you don’t know, the cost basis is the method used to calculate capital gains/losses for your crypto taxes.

What is particularly attractive is that Koinly supports most altcoins. Koinly supports 17,000+ tokens listed on Coin Market Cap and keeps adding more tokens. The software also supports over 100 wallets and 400 crypto exchanges, including Binance, Coinbase and Crypto.com as well as services such as Nexo and Compound. All you need to do is integrate your crypto exchange or wallet with Koinly, and all transactions will be automatically updated inside the software dashboard.

With Koinly, you can generate detailed reports for futures, options, crypto staking, lending, and mining and export them to TurboTax and H&R tax preparation platforms.

Koinly.io Trustpilot Rating: Koinly currently has a Trustpilot rating of 4.7 out of 5 with 855 reviews.

Does Koinly have a Mobile App? Koinly has no mobile app to download on the Apple app store or Google Play.

Koinly Safety:

Koinly hosts most of its facilities on AWS and does not collect any personal details like transaction data or card details. This means Koinly cannot share your data with tax authorities. To start using Koinly, you only need an email address to sign up!

Koinly Pricing:

Koinly offers a free lifetime trial for viewing up to 10,000 transactions. However, if you want to download any tax reports (like Form 8949), you must purchase one of their paid plans, depending on your annual transaction count. You can pay using crypto (BTC, ETH, DAI, USDC) or your credit/debit card.

| Plan | Price per Year | Number of Transaction |

|---|---|---|

| Newbie | $49 | 100 |

| Hodler | $99 | 1,000 |

| Trader | $179 | 10,000 |

All Plans Include Downloadable Tax Reports

Verdict: Should you use Koinly?

Koinly is a trusted and feasible option for traders who want to keep things simple and hassle-free. You must connect your crypto trading platforms and wallets, and Koinly will take care of the rest!

If you dabble too much into altcoins, then Koinly offers support for an extensive range of altcoins. The only thing that goes against Koinly is they do not have a mobile application.

Overall, Koinly is one of the best crypto tax software available.

5. ZenLedger

ZenLedger is a comprehensive crypto tax solution! ZenLedger has a wide variety of transactions, for example, income from mining, staking, airdrops, gifts, and personal use. They also have a Crypto as Income feature, ideal for businesses that want to accept cryptocurrencies as payments.

From their Grand Unified Spreadsheet, you can get a macro view of your crypto portfolio and tax liabilities. With ZenLedger’s CPA Access feature, you can share your tax details with a tax professional directly from your dashboard and let them take over the process!

Although it has support in most countries, only US tax forms are available to download.

Experience hassle-free cryptocurrency tax management with ZenLedger Tax Software, a user-friendly, comprehensive tool designed to streamline tax filing for both novice and experienced traders. Maximize your profits and stay compliant with ZenLedger's powerful features and robust security measures.

Is ZenLedger Safe?

Although most crypto tax software does not store your data, ZenLedger’s security game is on another level! Since their storage is encrypted, your data is safe even if it is hacked. Not only that, all communication between you and ZenLedger is encrypted with HTTPS and TLS 1.2. This means no one can listen to your conversations, and you can even share personal financial details with their customer support. With their multi-factor authentication, you can add an extra layer of security for your financial data.

ZenLedger.io Trustpilot Rating: ZenLedger currently has a Trustpilot rating of 3.4 out of 5, with 27 reviews.

Does ZenLedger have a Mobile App? Yes, ZenLedger has a mobile app available for download on the Apple App Store and Google Play.

How Much Does ZenLedger Cost?

ZenLedger has a free version for 25 transactions with detailed reports. If you have more than 25 transactions, have your pick from one of the following packages:

| Plan | Price per Year | Transactions |

|---|---|---|

| Starter | $49 | 100 |

| Premium | $149 | 5,000 |

| Executive | $399 | 15,000 |

| Platinum | $999 | Unlimited +Dedicated Support |

They have additional packages for consultations and done-for-you services, which can be viewed on the ZenLedger Pricing page.

Verdict: Should you use ZenLedger?

ZenLedger has basic functionality for free users, and you must purchase at least their Premium plan for NFT and DeFi support. A major deal breaker for ZenLedger is that only US tax forms are available for download. Overall, it’s a decent, easy-to-use option, but if you reside in the US, we recommend TaxBit!

6. CoinTracker

We now know that crypto tax software is great, but most of us will need an accountant to check our tax reports before we file them with the tax authorities. With CoinTracker, you can share all your tax reports directly with your accountant so that they can review them before filing.

Founded by Jon Lerner and Chandan Lodha in 2016 and used by 1 million users, CoinTracker.io provides full support in the US, UK, Canada, Australia and India and partial support in other countries. Moreover, CoinTracker also integrates with popular NFT and DeFi platforms like OpenSea, Compound and Uniswap.

Using the software, you can pull data of 10,000+ cryptocurrencies from more than 300 exchanges. If you want to check whether your desired exchange/wallet is supported, check their Integrations page. If the crypto platform is unavailable on CoinTracker, you can pull your data using your crypto wallet’s public address. This is far better than uploading CSV files of your crypto transaction history.

CoinTracker also offers support for TurboTax, and the best part is you also have the option to automate your tax reports. The CoinTracker Blog regularly publishes advice on crypto taxes and detailed guides for filing taxes in support countries.

CoinTraker.io Trustpilot Rating: CoinTracker currently has a Trustpilot rating of 3.1 out of 5, with 204 reviews.

Does CoinTraker have a Mobile App? CoinTracker has a mobile app available to download on the Apple app store and Google Play.

CoinTracker Safety:

Your coins are 100% safe with CoinTracker, as they will only obtain read-only access to the connected platforms. All API keys obtained are encrypted, and if you want, you can turn on 2-factor authentication in the Account Settings. Read all their security procedures!

CoinTracker Pricing:

For beginner traders and crypto holders, CoinTracker offers a free account with up to 25 transactions. This is a great free option if you have minimal transactions. However, transactions can quickly add up, and you may soon find yourself on the CoinTracker paid plan!

CoinTracker offers customers a 30-day money-back guarantee, so if you’re unhappy, you can request a refund. For more information about their pricing plans, check out their website.

| Plan | Price per Year | Number of Transaction | Support |

|---|---|---|---|

| Free | $0 | 25 | Forum |

| Hobbyist | $59 per year | 100 | |

| Premium | $199 per year | 1,000 | Priority |

| Unlimited | Priced individually | Unlimited | Concierge |

If you have more than 1,000 transactions, you can check CoinTracker Pricing here, which varies by country!

Verdict: Should you use CoinTracker?

If you dabble in NFTs and DeFi, CoinTracker.io could be your one-stop solution. With CoinTracker, you can consolidate all your transactions in one place!

Their free version might suit hodlers or beginner traders who do not want to spend too much on their tax obligations. Unlike Koinly, they have a mobile app that can be used to manage your crypto portfolio.

7. Token Tax

Token Tax allows you to file your tax reports in a few minutes from anywhere worldwide. Most countries have complex tax standards for cryptocurrencies, but Token Tax is a great option for filing taxes in your local currency. Token Tax has a beginner-friendly user interface, and its intuitive dashboard guides you through the main steps of the taxation process.

Token Tax also offers in-house specialized services to crypto businesses, such as initial coin offerings, hedge funds, and even ad-hoc accounting projects. Token Tax is compatible with TurboTax and TaxAct and can create specialized reports to lower your taxes, like an ETH gas fees report. If you are heavy on DeFi and NFTs on Ethereum, Token Tax is worth considering!

TokenTax.co Trustpilot Rating: Token Tax currently has a Trustpilot rating of 4.3 out of 5, with 125 reviews.

Does Token Tax have a Mobile App? Token Tax doesn’t have a mobile app to download on either the Apple app store or Google Play.

Token Tax Safety:

Since they offer specialized services for your crypto business, Token Tax might collect and use personal information. According to their privacy page, they might share your data with regulatory authorities, law enforcement agencies, and even Token Tax sponsors/marketers. To know more about how they might share your data, read their Privacy Policy.

Token Tax Pricing:

Token Tax does not have a free version that you can try. Other pricing plans are:

| Plan | Price per Year | Number of Transaction |

|---|---|---|

| Basic | $65 | 500 |

| Premium | $199 | 5,000 |

| VIP | $3,499 | 30,000 |

For a full comparison of all features, visit Token Tax Pricing.

Verdict: Should you use Token Tax?

The software is beneficial for diverse forms of income from cryptocurrencies, such as margin trading, Options Trading, and DeFi. It is the best solution for crypto trading businesses with the capacity to process millions of transactions daily.

8. TaxBit

What if you could know the tax you must pay before making a transaction? TaxBit’s unique Tax Optimizer shows the tax you must pay before you buy or sell an asset.

Moreover, with Automated Data Feeds from 500+ exchanges, TaxBit is an excellent option for watching your crypto taxes in real-time. TaxBit also offers dedicated NFT and DeFi suites to its paid users to help them calculate real-time taxes on all their blockchain trades.

With support from all significant blockchains like Ethereum, Bitcoin, BSC, and Polygon, TaxBit can be a one-stop solution for all your crypto tax needs. However, the software is designed for users in the United States, and if you are not residing in the US, you might not find the best reports and guidelines on TaxBit.

TaxBit.com Trustpilot Rating: TaxBit currently has a Trustpilot rating of 3.9 out of 5, with 364 reviews.

Does Taxbit have a Mobile App? TaxBit doesn’t have a mobile app that can be downloaded from either the Apple app store or Google Play.

TaxBit Safety:

According to its Data Minimization policy, TaxBit collects no more data than is essential. Moreover, all collected data is encrypted, meaning it would be hard to access your data on the servers even if they are hacked. Lastly, they do not share your details with the IRS but only use the data collected to tailor your tax experiences.

TaxBit Pricing:

With unlimited transactions on the free plan, this is the most budget-friendly option for beginner traders in the US. Whereas most software differentiates their pricing on the number of transactions, TaxBit adds customized support as you move upwards in their packages. Here are TaxBit prices:

| Plan | Price per Year | Includes |

|---|---|---|

| Basic | $50 | Live Web Chat Support |

| Plus+ | $175 | – Live Web Chat Support – NFT Suite – Portfolio Performance Suite |

| Pro | $500 | – Dedicated Concierge – Free Pre-prepared Tax Forms – Free CPA Consultation |

For a full comparison of all features, visit TaxBit Pricing.

Verdict: Should you use TaxBit?

TaxBit is highly recommended for crypto users in the US as they have dedicated support for filing your taxes with the IRS. A lack of mobile applications and limited support to users in other countries are two features that make TaxBit not my first option for crypto tax software!

Crypto Tax Software Comparison

| Tax Software | Cost | Free Trial | Supported Exchanges | Discount |

|---|---|---|---|---|

| Blockpit | $0 to $639 | Yes | 300+ | Get 20% Off Plans |

| Koinly | $0 to $179 | Yes | Unlimited | Check Out Offers |

| CoinTracker | $0 to $199 | Yes | 100+ | Get 10% Off Plans |

| Coin Ledger | $49 to $299 | Yes | Unlimited | Use code EVERYBITHELPS for 20% Off |

| CoinTracking | $0 to $660 | Yes | 70+ | Get 10% Off Plans |

| TaxBit | $0 to $500 | Yes | 500+ | Check Out Offers |

| TokenTax | $65 to $3,499 | No | Unlimited | Check Out Offers |

| ZenLedger | $0 to $999 | Yes | 500+ | Check Out Offers |

What is a Crypto Tax Software?

Crypto tax software simplifies the process of preparing and filing crypto taxes according to the laws of your local jurisdiction. Using tax software, you pay the exact amount of liable tax and do not get in trouble with the authorities. Using crypto tax software, you can save money by harvesting your tax losses during market crashes. More on tax loss harvesting will be discussed in the latter part of this article!

Crypto tax software can also consolidate and organize your crypto portfolio in one place, especially if you use multiple crypto exchanges for your trading.

What to Consider when Choosing Crypto Tax Software?

These are some of the most essential features to look for when choosing your crypto tax software;

- API Integrations: First and foremost, our software must have API integrations with the wallets, exchanges, and crypto platforms we use for our crypto trading. This will help the software automatically track all our transactions and calculate our taxes. Although most crypto tax software allows you to import transaction data in a CSV format, which is relatively simple, we do not ideally want to go through that hassle.

- Safety & Privacy: The software you choose should not store or share your data because that can then be shared with financial authorities or hacked by malicious actors. Financial security and data privacy are the cornerstones of Web3.

- Tax Filing Platforms: If you file your taxes on TaxAct or TurboTax, your crypto tax software should be able to export your files directly to these tax filing platforms.

- Other Platforms: When you dabble in NFTs, crypto mining, and DeFi services, you are liable to pay taxes for these gains. Importing and calculating taxes for NFTs and DeFi services should be supported if your platform does not connect directly.

- Pricing: We are paying for crypto tax software because it saves us time and hassle, but it should not cost more than hiring a tax professional.

Verdict: What is the Best Crypto Tax Software?

Crypto tax software is highly recommended, as it can help you file your taxes in under 20 minutes. The best crypto tax software for you will depend on your circumstances and priorities. Do you want a free option? Or do you like the ease of use or exposure to altcoins? It’s a decision you will need to consider.

All the crypto tax software mentioned in this guide are highly trusted and some of the best available options for crypto investors and traders. Choose wisely 😊

FAQs

Do I have to pay taxes on crypto gains?

The IRS and most tax authorities worldwide treat cryptocurrencies as assets and levy capital gains tax on your crypto gains. For example, if you invested $1000 in crypto last year and had gains of $500, you will be liable to pay capital gains tax on the $500 you have earned with crypto investing.

You are also liable to pay taxes on any gains in NFTs, crypto staking, crypto mining and DeFi.

How is crypto taxed?

The percentage of tax depends on a variety of factors, including your country of residence, your income level and tax bracket and how long you have been holding your cryptocurrency.

You should read crypto tax guides or see a professional accountant if you are unsure how much crypto tax you must pay.

Can I do my crypto taxes myself?

Yes, you can file your crypto taxes yourself in under 20 minutes using crypto tax software, and you do not necessarily need a tax professional or accountant to do so.

However, we recommend you review your tax documents before filing them with the relevant tax authorities.

Is there free crypto tax software?

Yes, various free crypto tax software allows you to file your crypto taxes for free, such as Crypto.com Tax. However, most free software has a limitation of 25 transactions, which is relatively low.

If you have many transactions, choosing paid software is the best long-term option.

What is the best crypto tax software in 2025?

It is difficult to determine the absolute “best” crypto tax software in 2025 as it depends on the specific needs and preferences of the user. Some of the most popular crypto tax software has been included in this article. However, it is recommended to research and compare the features and pricing of different crypto tax software options to find the one that best fits your needs.