This guide will provide the 8 Best Places to Stake Solana SOL Tokens. Plus, how to stake SOL to earn up to 9% interest in passive income.

Instead of holding Solana SOL tokens on an exchange like Binance and OKX or a hardware wallet like Ledger, you can stake your SOL tokens and earn interest. We have been doing this for a while now and earn around $300 monthly in passive income.

So, let’s jump into this beginner’s guide to Solana staking and show you how to start earning interest on your SOL tokens.

6 Best Places to Stake Solana SOL Tokens in 2024

We have compiled the six best places to stake Solana SOL tokens in 2024. Staking Solana SOL tokens is a great way to earn passive income, but SOL can be very volatile, like all crypto assets.

Before you choose your method of staking SOL tokens and making any investment, please research, as staking crypto comes with risk.

Want to find the best rates to stake & lend your crypto assets? Check out our DeFi rates table to find the best returns on your crypto.

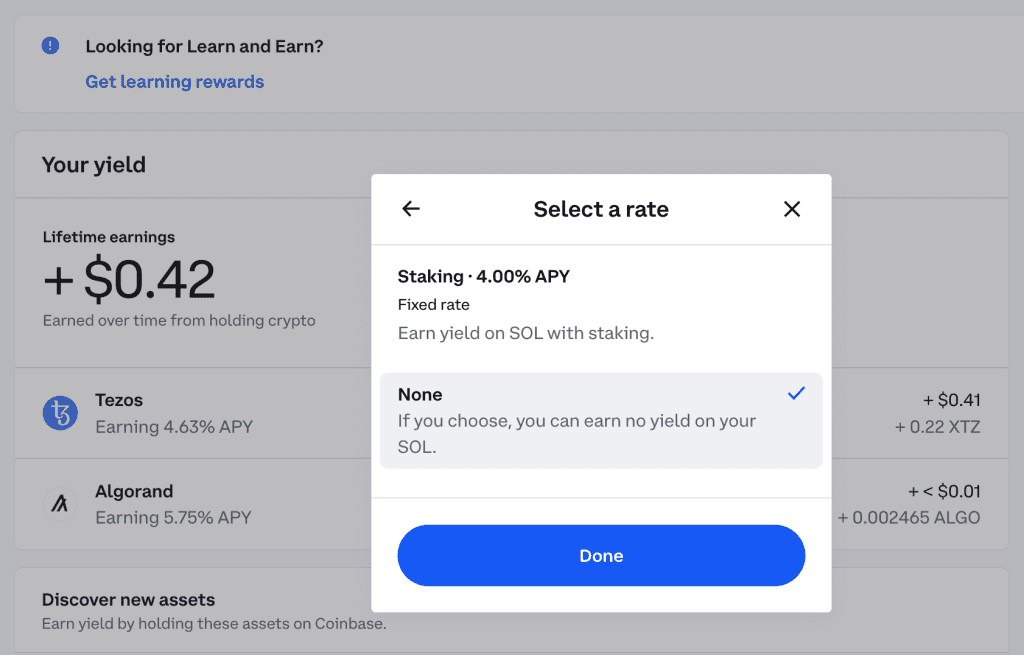

1. Coinbase

Coinbase is one of the most popular crypto platforms in the world and introduced Solana staking in June 2022. Staking SOL on Coinbase is a great option, especially for beginners, as you don’t need to worry about setting up validators, and you start with as little as $1.

When you stake Solana on Coinbase, you will automatically start earning rewards every 3 to 4 days. The current APY for SOL on Coinbase is around 4% APY; however, this can fluctuate. Coinbase makes entry into crypto very easy for newbies, but this also comes with a price. Staking Solana on Coinbase comes with a staking fee of 25%.

Coinbase Solana Staking Rate: 4% APY

Staking Verdict: Coinbase makes it easy to stake Solana, but the rate you receive will be lower than that of its competitors. Coinbase may be worth considering if you already have an account and don’t mind not getting the best interest rate.

Coinbase Sign-up Bonus: Click here to get a $10 BTC Bonus when you sign-up for Coinbase.

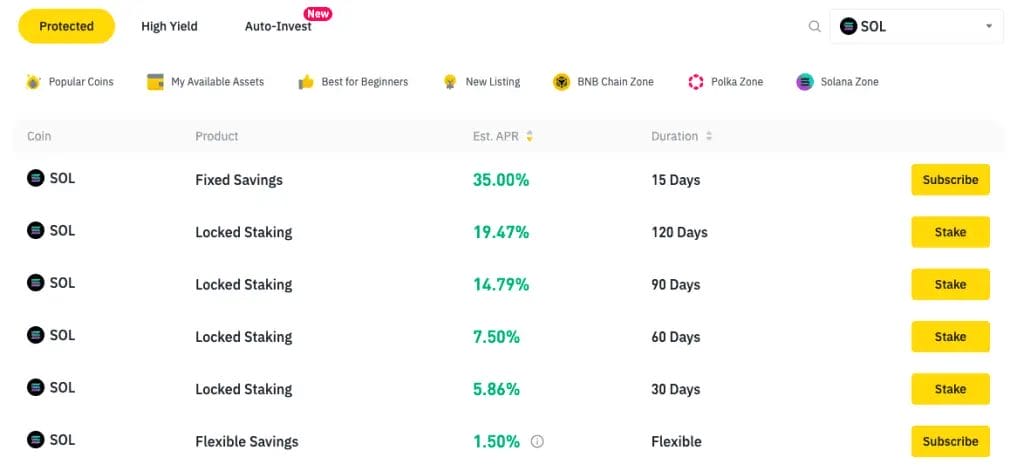

2. Binance Exchange

Binance is the world’s largest crypto exchange, offering investors some of the lowest fees in the industry, high liquidity and hundreds of trading options. Created by Changpeng Zhao in China in 2017, the crypto exchange relocated to the Cayman Islands.

Binance.com has a few options for staking SOL and offers its users some of the best Solana staking rates. However, these promotions are only for short amounts of time. Realistically, to stake Solana on Binance Earn, you will be looking to lock up your SOL tokens for either 30, 60 or 90 days. Usually, the longer you lock up your tokens, the higher the interest rate you will receive. Just be aware that these subscriptions expire, and interest rates change.

Binance Solana SOL Staking Rates;

- 30 Days Locked Staking – 5.86%

- 60 Days Locked Staking – 7.50%

- 90 Days Locked Staking – 14.79%

- 120 Days Locked Staking – 19.47%

- 15 Days Fixed Savings – 35%

- Flexible Savings – 1.50%

Binance calculates its staking interest daily, but if you break the lock-up period early, you will lose any accrued interest.

With so many features, Binance can be a little daunting for users new to investing, but you will quickly get used to it. We also have a few Binance beginner tutorials if you need further assistance. For those looking for an easy way to earn interest from their SOL tokens, Binance could be a great choice. Not only does Binance offer ways that you can trade SOL, but you can also stake and earn a yield.

Binance Solana Staking Rate: up to 35% APY

Staking Verdict: We stake crypto on Binance and have never experienced any issues. If you have a Binance account and trust the platform, it may be worth considering staking SOL on Binance. However, we don’t stake Solana on Binance Earn.

Binance Sign-up Bonus: Click here to get 20% off trading fees, plus a bonus of up to $100 when you sign up for Binance.

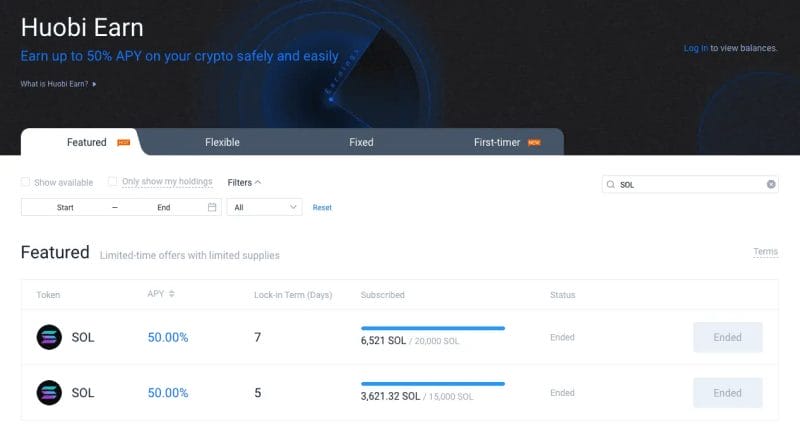

3. Huobi Global

Huobi Global is a crypto-to-crypto exchange founded in China in 2013 and has since been relocated to Seychelles. Although available in most countries worldwide, Huobi isn’t available in the U.S.

Huobi Global Solana staking is similar to Binance but has lower interest rates. They offer a few staking options on their Huobi Earn feature, with Fixed, Flexible, and First Timer investing options.

Previously, with staking SOL on Huobi, you could earn around 5.35% APY, much lower than some of its competitors. Huobi runs special promotions and has offered limited-time rates as high as 50% APY for SOL.

Huobi Global Solana Staking Rate: 4.60% APY

Staking Verdict: If you want to stake Solana on an exchange, we think you can get better rates elsewhere. We would personally avoid staking Solana on Huobi Global.

Huobi Global Sign-up Bonus: Click here to get 20% off your trading fees when you sign up to Huobi Global and use our referral code y3mz2223.

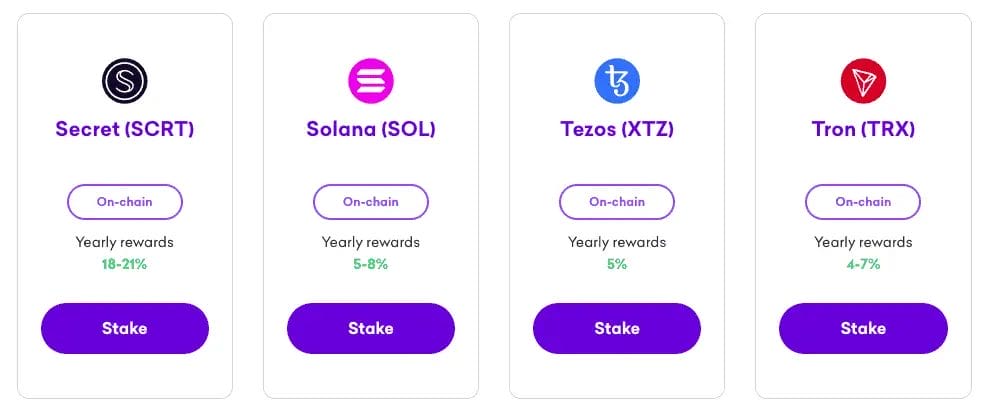

4. Kraken Exchange

Kraken is a U.S.-based crypto exchange with excellent security and low trading fees, making it a popular choice for crypto investors. Although Kraken is a U.S.-based exchange, you may notice some restrictions depending on location.

Solana is one of 14 tokens available to investors for staking; the others include the likes of ETH, DOT and ADA. If you don’t have SOL, you can trade for some on the exchange for USD, EUR, GBP and BTC. Once you have your SOL tokens, you can start stake SOL and earn between 6-8% APY. To stake Solana on Kraken, you must deposit at least 0.2 SOL. Unlike other options in this list, there are no lockup periods to stake SOL, and your tokens can be withdrawn anytime.

Although we are not a big fan of the Kraken exchange user interface and user experience, they make staking crypto very easy. In our opinion, Kraken is one of the safest exchanges, and we do use Kraken for staking, but we don’t stake Solana.

Kraken Solana Staking Rate: 5-8% APY

Staking Verdict: Staking SOL tokens on Kraken is worth considering if you already have a Kraken exchange. We use Kraken for staking crypto but don’t currently stake any Solana.

5. Exodus Wallet

Exodus is a free desktop and mobile wallet where you can store and stake your SOL tokens. Under the Rewards tab, you’ll find several tokens where you can stake, which include Solana at 5.23% APY, and this currently has an estimated staking period of 4 days.

If you don’t have any SOL to stake, you can exchange for some within the Exodus wallet. However, just be aware that this won’t be the cheapest way to exchange your tokens due to high spreads. But it means you don’t have to swap and send your tokens from one platform to another.

When you stake SOL with Exodus, you will be staking with the Everstake API provider.

Exodus Wallet Solana Staking Rate: up to 5.23% APY

Staking Verdict: Exodus was the first wallet we ever used when we first got into crypto, and it’s still a favourite of ours. The Solana staking rates on Exodus are on the low end, but I would prefer to stake Solana in the wallet rather than on a crypto exchange.

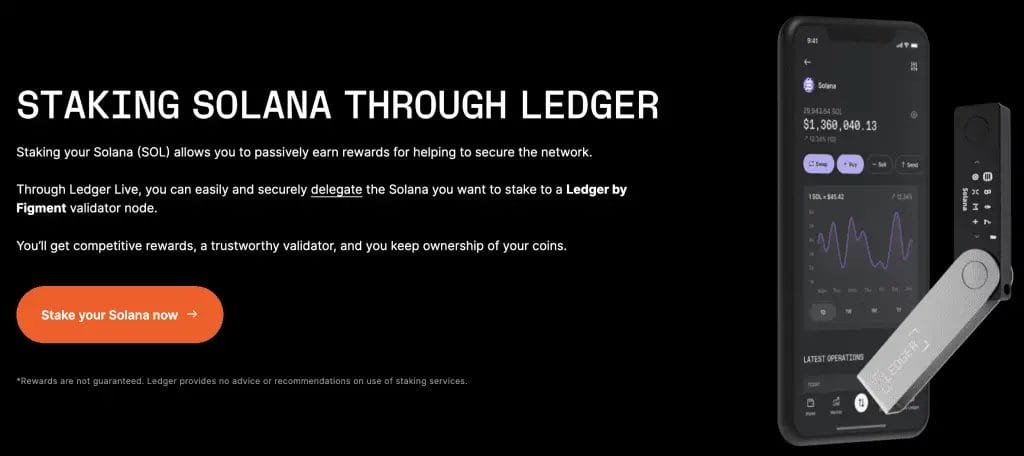

6. Phantom Wallet & Ledger Nano

The Phantom Wallet is the non-custodial wallet for Solana, similar to the likes of Metamask. Phantom Wallet allows users to safely store and stake SOL tokens with access to their private keys. You can also connect Phantom to a Ledger hardware wallet for extra security.

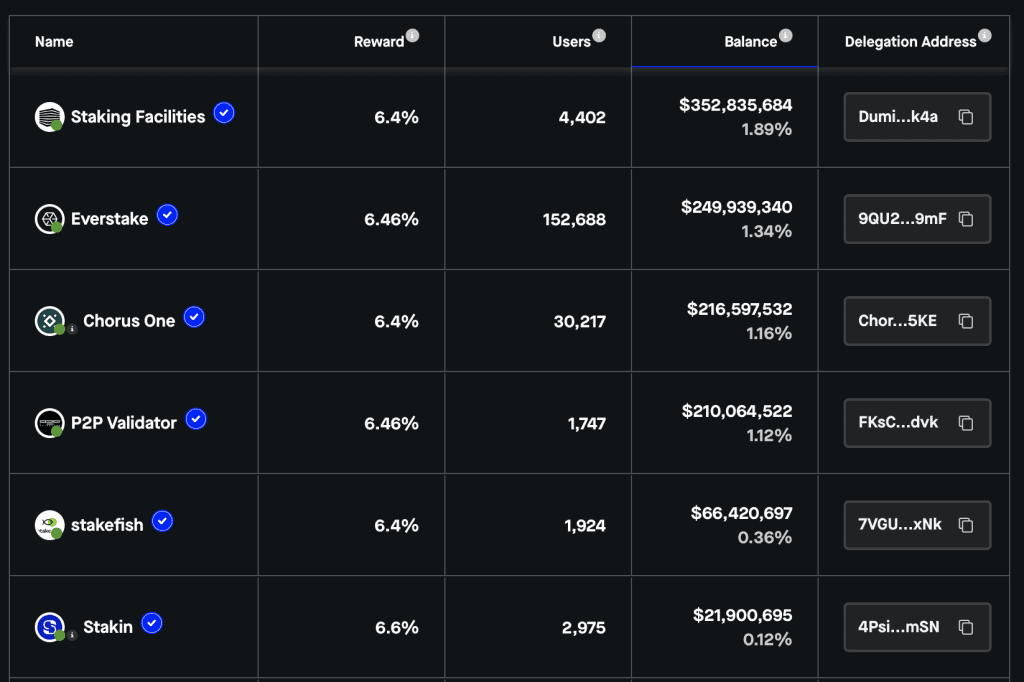

When staking your SOL within the Phantom Wallet, you’ll be presented with a list of validators you must choose from. It is important to research these Validators, as you will be entrusting them to earn your interest. Before you stake with your validator, all the information will be broken down, such as the validator’s commission rate and the number of current delegators.

Phantom Wallet Solana Staking Rate: 6-8% APY

Staking Verdict: We use the Phantom wallet to stake Solana in conjunction with our Ledger Nano hardware wallet. We felt this was the safest way to stake SOL and choose our validators. This won’t be the easiest way to stake Solana, but it’s worth researching if you have the time.

Best Solana Staking Rates 2024

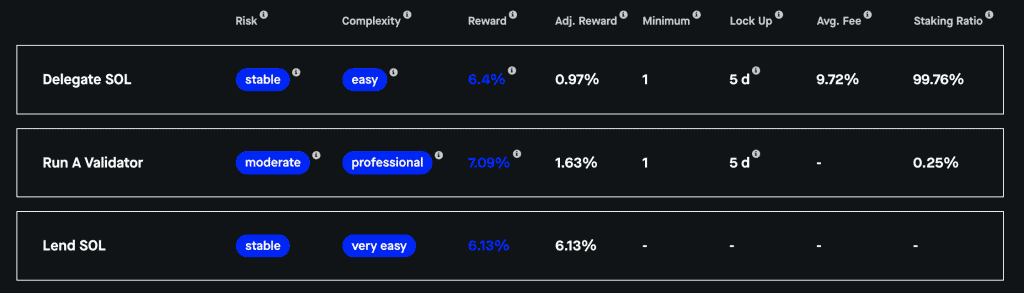

There are a few other options to stake your Solana SOL tokens we didn’t mention in the guide, and you can also check out our staking and lending table to find the best SOL interest rates.

| Platform | Solana Staking Rate | Sign-up | Review |

|---|---|---|---|

| Coinbase | 4% APY | $10 BTC Bonus | Read Review |

| Binance | up to 35% APY | 20% Off Fees & $285 Bonus | Read Review |

| Huobi Global | 4.5% APY | Go to Huobi | Read Review |

| Kraken | 6-8% APY | Go to Kraken | Read Review |

| Phantom Wallet | 6-8% APY | Go to Phantom Wallet | Read Review |

| Exodus Wallet | 6.47% APY | Go to Exodus | Read Review |

| Nexo | 6-8% APY | Up to $100 Bonus | Read Review |

Please let us know in the comments below if we have missed a way to stake Solana SOL tokens.

What is Solana?

Solana has one of the fastest-growing ecosystems in the cryptocurrency space with its highly scalable blockchain, which they claim to be the fastest in the world. You can buy or trade for Solana using cryptocurrency exchanges such as Binance, Huobi, or Crypto.com.

With Solana, you can connect to a vast array of DeFi solutions, and it’s probably best known for its successful SOL token, which has gone from strength to strength since its release and is currently in the top ten on CoinMarketCap.

How to Stake Solana SOL Tokens?

By staking your SOL tokens on the Solana blockchain, not only can you earn rewards, but you will also be helping to secure the network. To stake your tokens on Solana, you’ll first need to have bought or traded for your tokens, which will need to be transferred across to the platform you chose to stake your tokens with.

With Solana, you can choose from several platforms or apps. Firstly, you can stake these directly on a supported exchange. Usually, we don’t recommend storing your crypto on an exchange where you don’t have access to your private keys, but these platforms can offer attractive rates. Alternatively, you can stake Solana within a wallet, where you’ll have access to your private keys.

What is Crypto Staking?

Crypto staking is a way to participate in the maintenance and operation of a blockchain network that uses a system called Proof of Stake. Unlike traditional banking systems, where banks or payment processors verify transactions, cryptocurrencies use this method to ensure that all transactions are secured and verified by the network.

Deciding to stake your cryptocurrencies means you are contributing your digital assets to support this verification process. By doing so, your crypto assets help validate transactions and secure the network, making you an active participant in the blockchain’s operation.

Is Staking SOL Safe?

In the world of cryptocurrencies, especially those using a system called Proof of Stake, there’s a safety feature called “slashing.” Slashing is a way to penalize validators (those who verify transactions) if they act maliciously by destroying a part of their staked cryptocurrencies. This is meant to discourage bad behaviour because a validator with less stake receives fewer rewards and might lose trust among current and potential investors.

Slashing presents a risk for those who own tokens in the Solana network. If you’ve chosen to support a validator by staking your SOL with them, and they get penalized for bad actions, you might lose some of your staked SOL. This risk encourages token owners to choose reputable validators carefully and not to put all their tokens with just one or a few validators.

However, it’s important to note that slashing doesn’t happen automatically on Solana. It only occurs under specific circumstances, such as if a validator’s actions cause the entire network to stop. In such cases, slashing can be applied when the network is restarted.

How to Choose a Solana Validator?

When choosing a Solana validator, there are a few factors to consider, these include;

- Commission Rate: This will impact your rewards, so a lower commission rate is recommended.

- Uptime: It’s important to find a validator that maintains close to 100% uptime for their services.

- Size: Some users like to delegate to smaller validators to assist in decentralising the network and the value of your SOL investment long-term. At the same time, some will find strength in numbers and prefer the larger validators.

- Values: Consider validators committed to adding value to Solana by supporting the platform app development, tooling or educational materials.

FAQ

How do you mine Solana tokens?

Solana SOL tokens can not be mined; Solana uses a consensus mechanism called Proof of Stake. However, you can stake Solana and earn staking rewards.

Does Solana have a maximum supply?

Solana has an unlimited supply of SOL tokens, unlike Bitcoin, where there can only be 21 million tokens. At the beginning of each year, the Solana blockchain issues tokens based on the year-to-year inflation rate. When SOL first launched, there was a maximum supply of around 500 million.

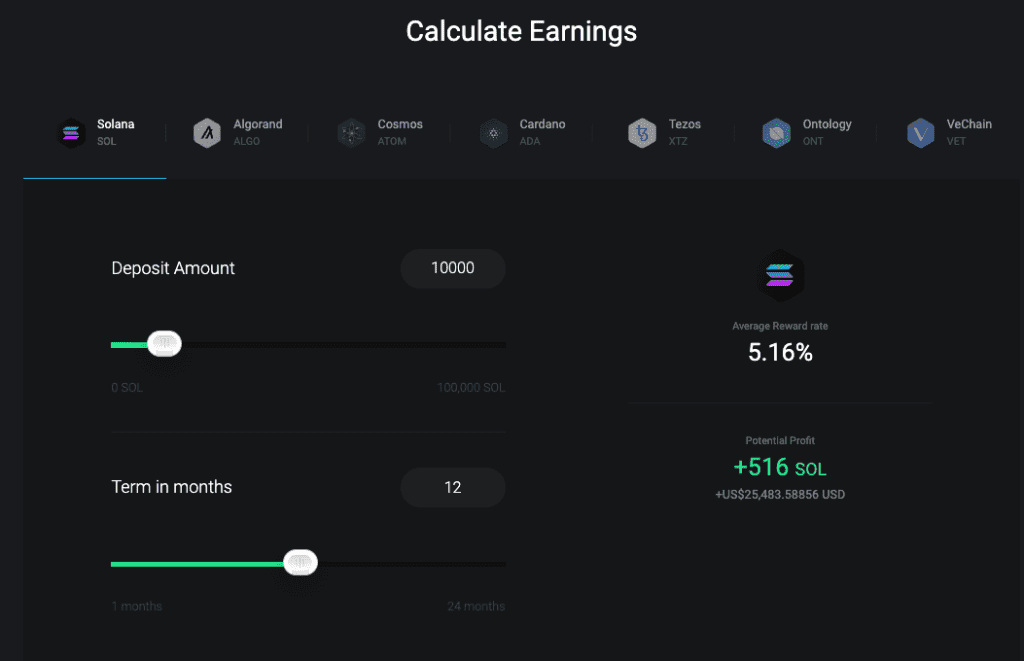

How to calculate your Solana SOL staking rewards?

To calculate your Solana APY staking rewards, you can use our Crypto Staking Calculator.