In this beginner’s guide to Decentralized Finance, we will explain what is DeFi? Plus, help you better understand the future of our financial system and how it may affect you.

DeFi is a buzzword nowadays, but what is DeFi (Decentralized Finance)? And what does it actually mean? If it’s decentralised, where is your money stored? Who is making sure the system is functioning correctly, and how is it safe if no single authority is guarding it?

Decentralized Finance Explained: What is DeFi?

Banks hold your money and even make decisions about it in the traditional financial system. Having centralized authorities and intermediaries for transferring your money is time-consuming, expensive, and a serious pain in the butt!

When you send a cross-border transaction on PayPal, this money will be deducted from your local bank first. Once that is done, it will be deposited in the recipient’s bank and made available to them. For sending a cross-border transaction, three intermediaries are involved: PayPal, your bank and the recipient’s bank!

By leveraging the power of smart contracts, decentralized finance eliminates the centralization of power.

What is DeFi?

Defi is short for Decentralised Finance. Now we’re all familiar with centralised finance or CEFI without actually realising that’s what we’re using. This is where a central authority (such as the government or a bank) controls the money flow and makes its decisions.

These authorities can do whatever they want with your money: they can print more money, bringing the value down or stopping you from borrowing. These authorities can even restrict access to your funds anytime by freezing your bank account, which happens to millions of people each year.

The traditional, centralised finance system is also expensive to use, especially if you consider credit card rates or personal or payday loans, where rates can be as high as 500%. These rates are high because of two main reasons: firstly, the bank employs workers, and their salaries come from the interest that you pay on your loans, and secondly, you don’t have access to any other financing options. If you want a loan for your house or your car, you are bound to go to a bank in your country for financing.

Now, what if I told you there was a cheaper, more accessible option where no banks or governments are involved? An option where you could borrow money for lower interest rates regardless of whether you’re 18 or 65 years old. This option is called Decentralized Finance or DEFI.

Decentralised finance is an emerging finance ecosystem that does not require any supervision to function. With decentralised finance, there is just a piece of open-source code that runs and acts as a bank, accessible by anyone. Plus, since these DeFi institutions hire zero employees, they are automatically a far cheaper alternative to centralised finance. Think of it as a bank on autopilot!

The Defi ecosystem has three main foundational aspects: Cryptography, Blockchain technology, and Smart Contracts, which we’ll cover in other explainer posts.

DeFi Fundamentals

DeFi encompasses a broad range of financial applications that function on a decentralized network, providing an alternative to traditional, centralized banking systems. Here are some fundamentals of DeFi:

Stablecoins

Let’s start with stablecoins. Stablecoins such as USDT, DAI or USDC are a bridge between the world of centralised and decentralised finance. They are pegged 1 to 1 to the US Dollar and are used to convert your fiat currency to cryptocurrency or vice versa.

A new USD coin is minted when you buy one unit of stablecoin for a dollar. Similarly, when you withdraw your crypto gains to a fiat currency, the equivalent USD coins are burned, maintaining the demand and supply balance so that one stablecoin is always worth one US Dollar.

Say you bought crypto-like Solana when it was $10, but now it’s worth $200, and you want to sell and withdraw your profits to your fiat bank account. You must use a centralised exchange like Coinbase, KuCoin or Gemini, and no stablecoins will be involved in the transaction.

However, because they’re centralised, they’ll be charging you a fee for doing so because they hire people who need to be paid and essentially need to run a business. Also, since you are withdrawing the money to your bank account (depending on your location), you may be liable to pay taxes on your profits.

Another issue with centralised exchanges is that they can take a few days to transfer the money to your bank account, and if you’re in a rush to buy or collect your gains, this isn’t ideal.

Suppose you decide to hold your profits in a stable coin like the USDT or DAI. In that case, you can purchase crypto later without incurring deposit fees every time. You will only be charged a small transaction fee (anywhere from around 0.1%) when you convert your stablecoins to the crypto you want to buy.

Another advantage of using a decentralised exchange is that your account can never be hacked, nor can your money be taken by the government, which has happened in the past with some centralised crypto exchanges.

With a DEX, your money will only move from wallet to wallet. There is no central reserve of funds and hence no chance for hackers to hack those reserves. Also, suppose you are planning on HODLing crypto tokens. In that case, I recommend checking out deals for hardware wallets in the description below.

Another advantage of decentralised exchanges is speed. When moving big chunks of money, a bank representative will call you to verify if you are making the transaction. Or, if you are performing an online transaction, you will have to add a beneficiary first to your account; your bank will then send you an OTP, which you enter on your screen. Once a beneficiary is successfully added, you can perform the transaction and get another OTP to complete the transaction. Could it be more inconvenient?

Instead, by using stable coins, you can simply move millions of dollars from one location or address to another in a matter of minutes. It’s extremely simple and fast!

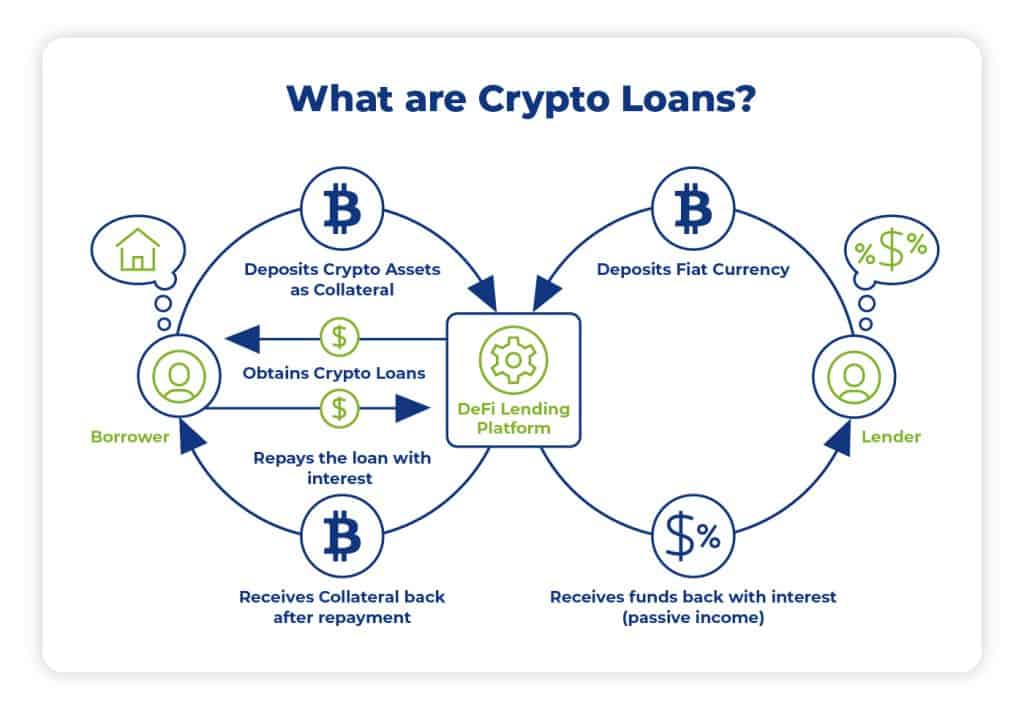

Lending & Borrowing

When borrowing from your local banks, you can get humiliated by the bank representatives if you cannot pay the money back on time. They might come to your house, charge you extra interest, or even jail you if you fail to pay your specified repayment on time.

When borrowing with crypto lending sites like Aave, your identity remains anonymous, and the only consequence you might face is getting your assets liquidated. Smartphones have allowed us to stay connected with our friends and family on social platforms without the need to meet them. Smart contracts have allowed us to lend our funds to borrowers on interest while keeping full custody of it.

Suppose someone wants to earn interest on their crypto. In that case, they can deposit it into the smart contract of crypto lending platforms such as Aave or Compound. Once deposited, the smart contract will give you A or C tokens which you can use at any time to get back the money you have deposited into the contract plus the interest you have earned on your deposit.

Once deposited, the smart contract finds people who want to borrow money and releases your money to them with an interest rate. When you want to withdraw, you will exchange your A or C tokens for your deposit in the smart contract.

Like codes on a website that run automatically, smart contracts are pieces of code that run without any human interaction or supervision. If a specific condition is met, smart contracts will perform the necessary functions that your local loan officer does.

These crypto banks over-collateralise your loans to ensure you never lose your money. This means that the borrowers need to deposit more collateral than the loan they are applying for. This ensures that lenders keep their investments safe and earn interest on them.

But you might ask: Louise, what is the point of a loan if you have to deposit collateral higher than you actually want to borrow? Well, with over-collateralised crypto loans, you do not need to sell your crypto, which you think might go big one day. You can take a loan, use it where you want, and give it back when your financial situation improves. So crypto loans allow you to keep your crypto investments safe in the long run.

An extremely unique concept in the crypto lending circle is flash loans. These loans last for a flash second and allow you to make a quick buck. For example, if you could buy Ethereum for $10 on Coinbase and then sell it for $11 on Gemini, you can literally make an extra dollar by buying from one marketplace and selling on another.

You can potentially make millions of dollars with a flash loan by buying from one exchange and selling on another. The best part of flash loans: you are not even required to put any money down as collateral. If you cannot complete all the transactions in under 10 seconds, the money will never leave the bank. However, if you could make the trades on both exchanges and return the funds to the smart contract in under 10 seconds, you would have made 1 million dollars. All that is required now is to pay a small fee to the bank for borrowing, and you can keep the rest.

Now we understand this is an advanced method of borrowing in the world of Defi. Still, you couldn’t have imagined earning money like this in the centralised finance ecosystem.

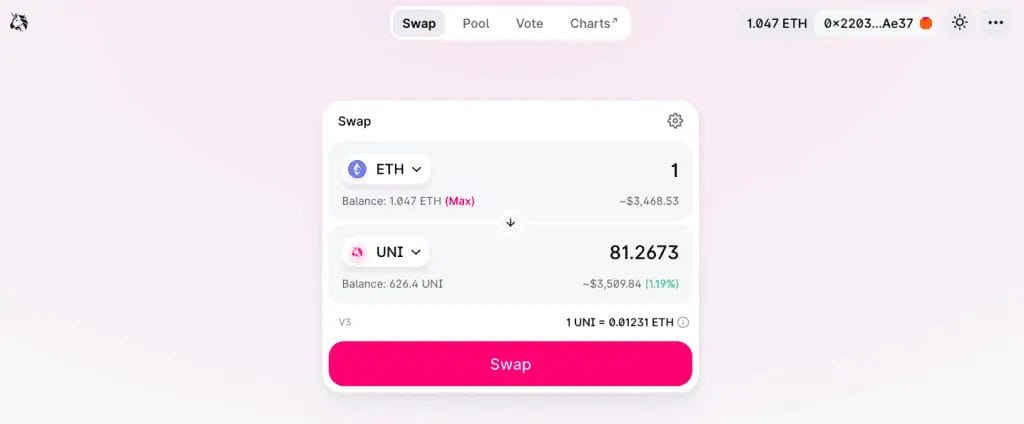

Decentralised Exchanges DEXes

The next part is decentralised exchanges or DEXes such as UniSwap and 1Inch, which we have already discussed, but this is where you can exchange one cryptocurrency for another. In the world of traditional finance, when you want to send your USDs to India, for example, you must pay hefty foreign exchange fees, which can go as high as 20%.

Fees are incredibly low when trading from one cryptocurrency to another using a decentralised exchange. DEXes work so that investors pool their money together, and traders can trade it. The fee of every trade goes back to those investors, and it’s all written in code, so it doesn’t change.

Decentralised exchanges also give exposure to far more tokens and coins. With centralised exchanges, tokens are added to a list once they reach specific regulations. However, decentralised exchanges can hold hundreds or thousands because a single body doesn’t regulate them.

Insurance

With something like home insurance, you pay an amount every month or year to protect your home. The insurance company runs some numbers and determines your premium based on their data.

With decentralised finance, smart contracts become the insurance company. For example, if a farmer buys insurance through a smart contract for his crop and dies due to high temperature, the smart contract will repay him. The smart code knows the temperature by connecting the real world to the blockchain using Oracles, the topic for another video. The smart contract knows the temperature limit. Once that limit is reached, the contract automatically releases insurance money to the farmer.

In this example, an Oracle is created to read temperatures of the real world and is verified by humans who are experts in this. The smart contract then uses this as the data for monitoring the insurance policy for the farmer.

The money paid to the farmer in this example will come from other people who are also buying insurance. Or perhaps with investors who want to earn money by lending their money to the insurance company.

Margin Trading

Margin trading is a great way for traders to maximise their gains. When trading with margin within centralised finance, you must first prove who you are and complete KYC, known as “Know Your Customer” Then, you borrow funds from an exchange or lending platform to invest more than you currently hold in your wallet. This is so that you can open larger positions to maximise your profits.

Usually, this means depositing funds onto an exchange that is then used as collateral by the exchange. As part of your margin trade, you will be charged interest and transaction fees, which can cut your profits.

In the world of decentralised finance, Margin trading will differ between platforms. Still, the platforms you can perform margin trading on include the likes of DYDX, where users can trade with up to 5x leverage using their own funds as collateral. Margin trading is anonymous and accessible to anyone with money. However, the users will likely need to pay interest and transaction costs, which will be much lower than centralised exchanges.

Governance

There is an increase in the number of decentralised autonomous organisations, also known as DAOs. This is where smart contracts will manage the Governance of a company. So instead of having the likes of board members, instead decisions are made by the community who will vote. A few companies, including Shapeshift and 1inch, are or are becoming entirely run by the community.

Why DeFi?

- Decentralized: Since there are no middlemen, the cost of sending money across borders is extremely cheap. Moreover, with zero intermediaries, you always remain in control of your assets unless you deposit them in a smart contract in a DeFi protocol.

- Global: DeFi protocols have no information about where you live; hence, all customers are treated equally! If you cannot get a loan from your local bank because your salary doesn’t meet the threshold, DeFi is the answer!

- Transparency: Since everything is transparent on the blockchain, you can audit the financial health of your DeFi protocol before investing and see how your funds are moving.

- Convenience: When you want to open a bank account, you must submit lengthy application forms. On DeFi protocols, anyone can open their account regardless of age, employment, or credit history. Also, when taking a loan, you don’t need to fill out lengthy forms explaining your worthiness. On a DeFi protocol, all you need is collateral for your loan!

Different Uses of DeFi?

- Lending and Borrowing: Due to high operating and human resources costs, banks can only offer a measly 0.5-1% return on your savings. With DeFi lending protocols like Aave and Compound, you can easily earn 5-10% interest on your savings. This is because DeFi protocols eliminate operating and labour costs, running on code only!

- Decentralized Exchanges: With smart contract magic, you can swap cryptocurrencies directly from your crypto wallets while keeping full custody of your assets. Uniswap, Curve Finance and Balancer are the top DEXes on the blockchain today.

- Identity: Decentralized finance protocols open access to users that are left out by your traditional financial system. With minimal loan collateral needs and zero background checks about your income and ownership, DeFi enables everyone to participate in the financial system and make money for themselves.

Conclusion

Decentralized Finance (DeFi) is set to have a significant impact on the future of the financial sector, with experts predicting that it will continue to grow and evolve rapidly. It’s envisaged that DeFi will continue to mirror traditional financial systems but in a decentralized way. This could include a variety of decentralized exchanges, lending and borrowing of different asset types, or insurance products.

DeFi’s future is further characterized by increased institutional investment and interest. As recognition of blockchain and cryptocurrency expands, the consensus seems to be that DeFi is an integral part of the future of finance.

However, this future is not without challenges. The current DeFi ecosystem has seen its fair share of infrastructural mishaps, hacks, and scams. Its unregulated nature raises concerns about security and reliability. Despite these issues, the potential benefits of DeFi are still driving its growth and development.

It’s essential to note that while Bitcoin and other cryptocurrencies often dominate the headlines, the developments happening in the DeFi space may have far-reaching implications for the future of finance. Hence, understanding its structure, opportunities, and risks can help individuals and businesses prepare for a financial future that is increasingly digital and decentralized.