In this Nexus Mutal review, we delve into this groundbreaking insurance alternative tailored for the cryptocurrency and DeFi landscape.

Nexus Mutual leverages blockchain technology, particularly Ethereum, to enable users worldwide to share insurance risks collaboratively, bypassing traditional insurance companies. By becoming members of the mutual, individuals can access many features.

In this review, we’ll discuss how members can secure protection against smart contract vulnerabilities, participate in staking for rewards, and engage in the platform’s governance. Additionally, we’ll explore the role of Nexus Mutual’s native token, NXM, in this pioneering ecosystem.

Join us as we uncover the ins and outs of Nexus Mutual and its impact on the world of decentralized finance.

Netus Mutal Review

Who Are Nexus Mutual?

Nexus Mutual was founded by Hugh Karp and is a UK-based decentralized insurance platform. Nexus Mutual offers unique insurance products, starting with smart contract covers that protect users from financial loss caused by misusing value-storing contracts.

They are also approved by the Financial Conduct Authority (Bank of England) to use the protected word “mutual” in their company name.

Nexus Mutual aims to simplify and innovate the insurance industry. Its first product, smart contract covers, allows members to buy protection against others’ misuse of smart contracts.

With plans to expand into more mainstream products, Nexus Mutual started building its platform with a focus on earthquake risk coverage. As the platform continues to grow, it’s expected to attract more users seeking innovative and transparent insurance solutions.

What Does Nexus Mutual Cover?

Nexus Mutual is a user-friendly platform offering insurance-like plans to safeguard people from various risks in decentralized (DeFi) and centralized (CeFi) financial systems. Smart Contract Cover’s main offering protects against unexpected issues with smart contracts that could cause significant financial losses.

This protection covers situations where weaknesses in the smart contract code are taken advantage of, making funds impossible to recover. Nexus Mutual members can purchase coverage for different types of risks using resources from one or more pools where users contribute.

The available cover Nexus Mutual offers includes:

- Protocol Cover

- ETH Staking Cover

- Yield Token Cover

- Custody Cover

- D&O Cover (Coming Soon)

- Real World Risk (Coming Soon)

Is Nexus Mutual Decentralised?

Nexus Mutual is not fully decentralised and requires some KYC to be completed, such as entering personal information such as name, address, and photographic ID. They hope to become decentralised in the near future, but this is not yet the case.

NXM Coins

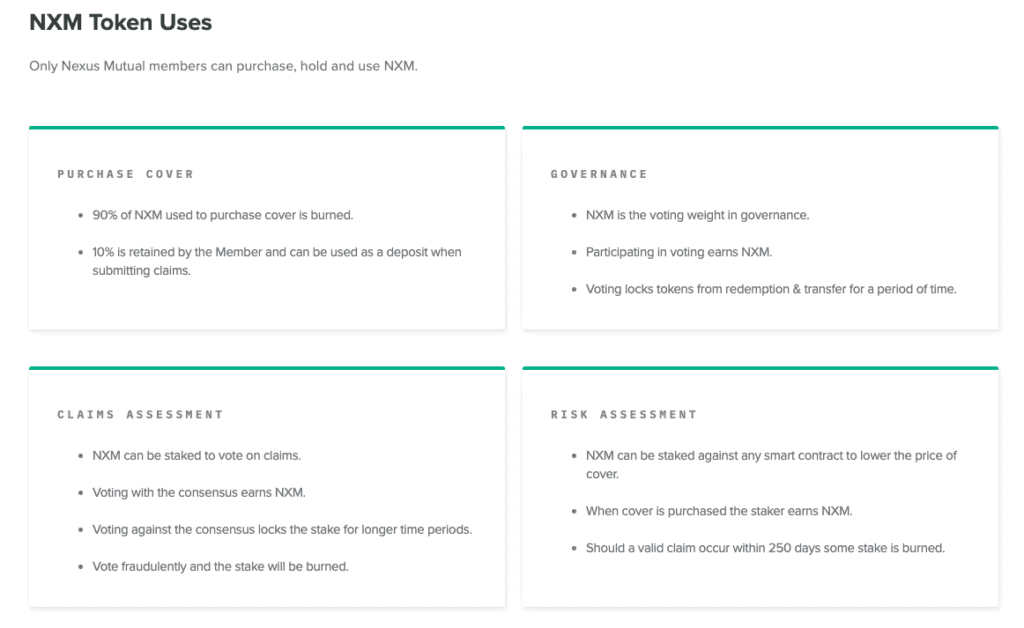

Nexus Mutual’s native token, NXM, represents membership rights in the mutual, with all members owning the mutual together. It runs on a bonding curve, a mathematical curve that defines the token price based on specific financial metrics.

The token has multiple purposes and can be used to purchase cover, and it can be staked to vote on claims or against any smart contracts to lower the price of cover. It can also be used as a voting weight in governance. The NXM tokens can only be bought and sold by members with the Nexus Mutual application.

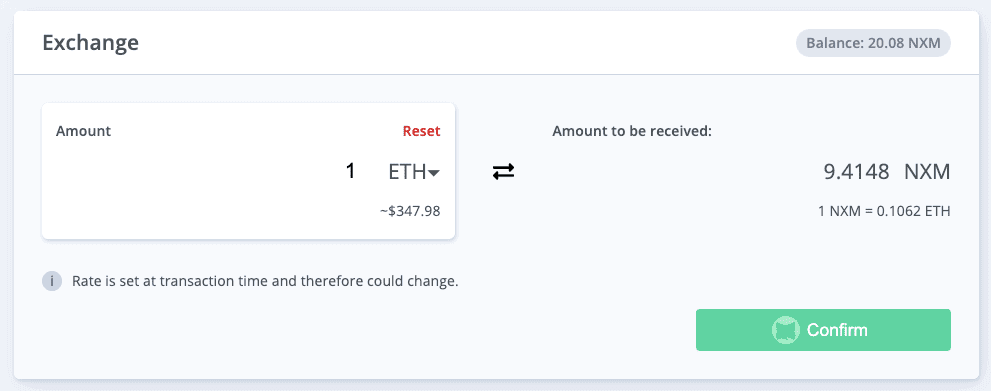

How to Buy or Sell NXM Coins

The only place to buy or sell Nexus Mutual’s token, NXM, is on the Nexus Mutual site, using their exchange. To buy NXM, you’ll also need to become a Member of Nexus Mutual, which will include completing KYC, entering personal information such as your name and address, and uploading a photographic ID, which will link your address to you.

If you do not want to enter your personal details and link this to your Ethereum address, there is also Wrapped NXM (WNXM), which you can purchase on decentralised exchanges such as UniSwap.

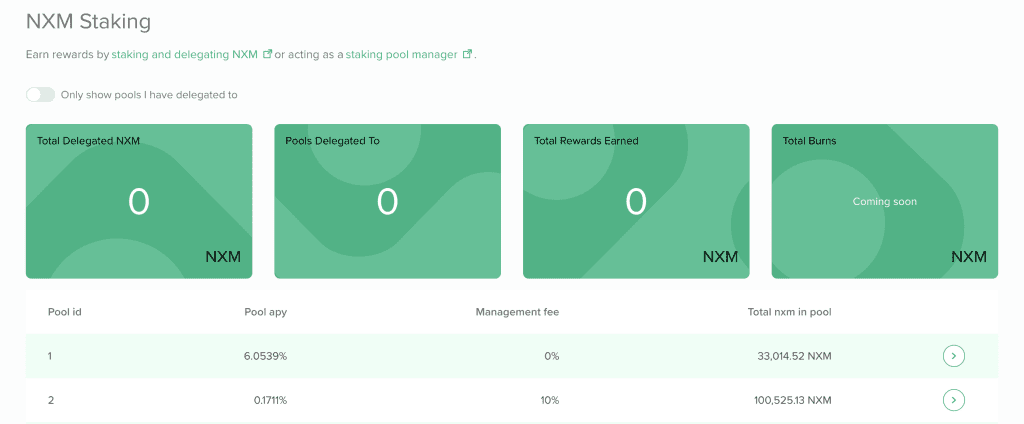

How to Stake NXM Tokens

Once you have purchased your NXM tokens, you can earn rewards by staking them against contracts that you think are secure. To stake, you simply select the contract and decide how much you want to deposit. You can stake your deposit up to 10 times across as many contracts as you like.

Then as the cover is purchased, you start to earn your rewards, increasing or adjusting your deposit stakes at any time. If a successful claim is made on a contract you’ve staked against, you will lose some or all of your deposit. If you want to unstack, this will require a 90-day lock-up period.

To stake NXM tokens, follow these steps:

- Visit the Nexus Mutual staking platform at https://app.nexusmutual.io/staking

- Connect your wallet

- Choose the staking pool

- Decide on the length of the staking period.

- Delegate your NXM tokens to the chosen staking pool

By staking NXM tokens, you create an open capacity for other members to buy cover. When the cover is purchased, NXM stakers are rewarded with a share of the cover fee in NXM.

Conclusion

Nexus Mutual has established itself as a pioneering force in decentralized insurance. By leveraging blockchain technology and smart contracts, it has successfully reimagined traditional insurance models, fostering greater transparency, trust, and accessibility. While it is not without its challenges, Nexus Mutual’s unique approach to governance and risk-sharing is a testament to DeFi’s potential and the future of insurance.

We hope you found our Nexus Mutual review helpful; if you have used Nexus Mutual, let us know in the comments below.

FAQs

Is Nexus Mutual a DAO?

Yes, Nexus Mutual operates as a decentralized autonomous organization (DAO). The Nexus Mutual DAO offers a framework that lets members purchase insurance-like plans, evaluate risks, handle claims, and create risk management ventures. In doing so, members can collectively share risks and reap the rewards of being part of the organization.

How can I invest in Nexus Mutual?

One way to invest in Nexus Mutual is to purchase its native token, NXM. You can acquire NXM through decentralized exchanges (DEXs) like Uniswap, SushiSwap, and 1INCH.