Looking to trade margin on Binance? In this guide, we look at crypto margin trading and provide 3 tips for crypto margin trading on Binance. Plus, we explain the Binance Funday Friday rewards scheme.

Margin trading is an exciting and potentially profitable way to leverage crypto assets to trade and earn even more significant profits. However, we do have to caution you that this isn’t for those who can’t afford to lose the money. Margin trading is about leveraging (borrowing) what you’ve got to trade with those leveraged funds.

Let’s jump into this beginner’s guide to trading crypto with margin on the Binance exchange.

What is Crypto Margin Trading?

Margin trading is borrowing against crypto funds you already have and then using this loan to trade crypto. Margin trading aims to make a profit and repay the loan.

Margin trading is nothing new. It started in investments, traditional financial institutions, and stockbrokers. These concepts have become popular in the crypto space, with traders leveraging billions in funds to trade on margin, with many opening long and short positions.

Margin trading amplifies what you’ve already got so that traders can make larger profits. Depending on eligibility and what you are willing to risk, you could trade crypto margins on Binance from 5:1 up to 100:1 (although most don’t leverage as much as that). In crypto margin trading, this is often shown as 5x, 10x, 20x, etc. With the more significant number showing how much you are currently leveraging.

Example:

You have $1,000 in a Binance account but want to make more money and buy that Lambo. Using margin trading, you could use that $1,000 and leverage it on a 10:1 ratio. This means you now have $10,000 to trade with, and you can now attempt to trade your way up, amplifying your returns (or losses).

3 Tips for Crypto Margin Trading on Binance

If you want to get into crypto margin trading, we recommend you start small. Only leverage a small amount (say 100 BUSD) and have the funds available to clear the leveraged amount in the event the market moves against you. Also, it’s crucial to use intelligent financial trading tools, such as stop-limit orders to reduce the potential risk.

1. Watch Your Margin Level

You need to watch your margin level closely to avoid automatic liquidation.

For example, if you are in profit is 2x the total amount being leveraged (borrowed funds + interest), then your margin account is in a good position. This means you don’t need to worry about it being liquidated. Binance shows this as >2.

However, once it drops below 2x the total leveraged amount, you run the risk of liquidation. Here’s how Binance explains it if the amount is 3x the value of assets being leveraged:

- “When your margin level > 2, you can trade and borrow, and transfer assets to the Spot Wallet;

- When 1.5 < margin level ≤ 2, you can trade and borrow, but you can’t transfer funds out of your Margin Account;

- When 1.3 < margin level ≤ 1.5, you can trade, but you can’t borrow or transfer funds out of your Margin Account;

- When 1.1 < margin level ≤ 1.3, a margin call will be triggered. You will receive a notification through mail, SMS and website to inform you to add more collateral (transfer in more collateral assets) to avoid liquidation. After the first notification, you will receive the notification every 24 natural hours.

- When the margin level ≤ 1.1, the liquidation engine will be triggered, and all your assets will be liquidated to pay back the interest and loan. The system will notify you through mail, SMS and website to inform you. The system will stop liquidation when the margin level returns to 1.5.”

That ratio can go up or down depending on the amount being leveraged. So, if you are leveraging 5x, then the margin level decreases to reduce risk to margin traders. Here are Binance’s margin trading rules for more information.

2. Make Use Of Your Cooling Off Period

Anyone trading on a margin position can fully use a cooling-off period. You can set a cooling-off period for one day, three days, and even a week.

Binance says this allows users to “temporarily suspend all crypto margin trading activity for a specified period.”

Once you set a cooling-off period for however many days, it can’t be lifted until the end. This is a valuable feature and a chance for traders to re-assess trading positions and what they want to do if the market does not move the way they hoped.

3. Use An Isolated Margin Or Cross Margin

When trading using a margin position, there are two main options: Isolated Margin or Cross Margin. Either can be selected on the main Binance Margin account page.

Only specific trading pairs can be included in the margin trade with an Isolated Margin. If you want to trade a range of pairs at any one time, you could open several Isolated Margin accounts, with two trading pairs in each account.

Each position, and therefore, trading pair, is separate. So, if you need to increase margin collateral funds, you must top this up manually.

On the other hand, instead of isolated positions, you could open a Cross Margin trading account. This way, you can trade across multiple positions simultaneously with the same source of leveraged funds. Risks are often higher, but so are the potential rewards.

Remember, never borrow more for cryptocurrency margin trading than you can afford to lose. Your capital is at risk.

How to Trade Margin with Binance

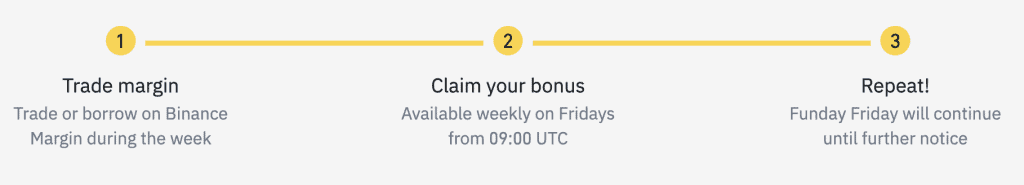

Every Friday, Binance runs a Funday Friday reward for Binance margin traders, where users can earn 20% of margin trading fees every Friday!

That’s right, Thank God It’s Friday (TGIF), when you can earn back 20% of margin trading fees, depending on the volume you trade and the amount you are leveraging.

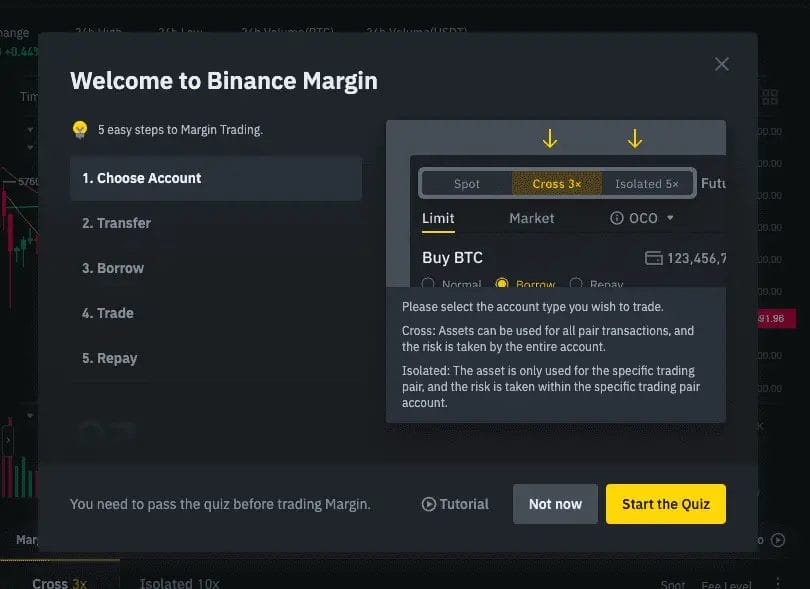

How to an Open Binance Margin Account?

Opening a margin account on the Binance platform allows trading assets using crypto funds. Margin trading gives you access to more significant amounts of crypto as capital for investments for a borrowing fee.

Total Time: 15 minutes

1. Log in to your Binance Account

From the Binance Home Screen, go to “Wallet” and then click “Margin” This will then take you to the Margin screen.

2. Watch the Margin Trading Video Tutorial

It’s essential to watch the Binance Margin Trading video and improve your understanding of margin trading to complete the test after. This way, you’ll be able to hit the ground running!

3. Answer the Binance Margin Quiz

Once you have watched the video, you can go ahead and answer the Binance Margin Quiz.

Binance Referral Code

Binance Referral Code | Use Binance Referral ID Code GPZ64I32 at Sign-up |

Sign-up Bonus | Up to $600 Bonus & 20% Off Trading Fees (Lifetime Discount) |

Referral Terms | |

Bonus Last Validated | May 2024 |

What are the Risks of Crypto Margin Trading?

Crypto margin trading is risky. Cryptocurrency prices are highly volatile and can suddenly fall below the liquidation price. If that happens, traders must cover those losses, usually when the margin ratio gets too close or when a margin call is made. Failing to put in extra funds can cause the position to be automatically liquidated, and then you must pay back the original loan and fees.

Although margin trading can produce impressive profits, it can also cause heavy losses. It should only be attempted by experienced traders who know how to use proper risk management practices and have the funds to cover any potential losses, including the total loan amount.

- Price Fluctuations: Cryptocurrency prices can change very quickly. If the price drops too much, you might owe more than you initially borrowed.

- Margin Calls: If your investment value drops to a certain level, you’ll get a “margin call.” This means you need to add more money to your account. If you don’t, your investment might be sold off to repay the borrowed amount.

- Potential for Big Losses: While you can make a lot of money with margin trading, you can also lose a lot. If things don’t go as planned, you’ll lose your investment and have to pay back the money you borrowed, plus any fees.

- Experience Matters: Margin trading isn’t for everyone. It’s best for those with trading experience and who know how to manage risks. Before diving in, ensure you’re comfortable with potentially losing more than you invest.

What is a Margin Call?

A margin call means that the price has moved too far in the other direction. This means they need to put more funds into a margin account to keep the position open, hoping the price will still move in the direction they want it to go.

If a trader doesn’t add additional funds, their margin account is usually liquidated immediately to cover the losses. Traders may then need to negotiate with the lender, to either make a payment to cover the loan or work out a repayment plan.

What is a Long or Short Position?

Long Position (Going Long):

- When you take a “long” position, you’re essentially betting that the price of an asset will rise.

- You buy the asset at a lower price with the hope of selling it later at a higher price, thereby making a profit.

- For example, if you believe the price of a cryptocurrency will increase, you might buy it now with the intention of selling it later at a higher price.

Short Position (Going Short):

- When you take a “short” position, you’re betting that the price of an asset will fall.

- Instead of buying the asset, you borrow it and sell it at its current price. Later, you plan to repurchase it at a lower price and return the borrowed amount.

- The difference between the price you sold the borrowed asset and the price you later repurchase it at is your profit (or loss if the price goes up).

- For example, if you believe the price of a cryptocurrency will decrease, you might borrow and sell it now, hoping to repurchase it later at a lower price.

Binance Funday Friday Promotion

Anyone can participate, provided you already have a Binance Margin account, have completed KYC verification (Know Your Customer), and daily active margin trading is above 1,000 BUSD or more.

Unfortunately, Binance Funday Friday isn’t available in every country, and those from restricted countries and territories currently can’t participate, including the U.S. and UK.

How do I Claim Binance Funday Friday Rewards?

Binance Funday Friday payments aren’t made automatically. Bonuses are only paid out once claimed and expire if a bonus isn’t claimed after five days.

If you are eligible and actively trading using a Binance Margin account, why not participate today and earn a 20% reward every Friday?

FAQs

Is margin trading crypto illegal?

Margin trading crypto isn’t inherently illegal. However, its legality depends on the country or jurisdiction you’re in. Some countries allow it with regulations, while others may prohibit it. Always check local laws and regulations before engaging in margin trading.

Is margin trading crypto a good idea?

Margin trading can offer higher potential profits, but it also comes with higher risks. If the market moves against your position, you can lose more than your initial investment. Understanding the risks and having a clear strategy before considering margin trading is essential. If you’re new to crypto, it might be a good idea to gain more experience before diving into margin trading.

What is 10x leverage in crypto?

10x leverage means that for every $1 you deposit as collateral, you can trade with $10 worth of cryptocurrency. So, if you deposit $100, you can trade with $1,000. It amplifies both potential profits and potential losses.