In this guide, we have compiled a list of the top 8 cryptocurrency exchanges for US investors in 2025. We’ve researched to make it easier for you to select the best exchange to meet your trading needs. We evaluate each exchange and compare their offerings, costs, and supported cryptocurrencies.

Cryptocurrency is becoming increasingly popular in the US, and American investors will have numerous options in 2025. However, several factors, such as liquidity, trading volume, fees, and security, must be considered when selecting a platform. This can be incredibly overwhelming for those new to the space.

So, let’s delve into our guide on the best cryptocurrency exchanges for US investors in 2025 and assist you in finding a suitable exchange for you.

Best Cryptocurrency Exchanges for US Investors

As the demand for digital assets increases, American investors are searching for reliable methods to buy and sell crypto. Selecting a trustworthy trading platform is crucial for finding the best cryptocurrency exchange. However, it can be difficult for newcomers to choose which platform to use.

Fortunately, there are numerous high-quality cryptocurrency exchanges accessible to American investors. This guide will present some of the best crypto exchanges that we have personally utilized. It will also identify why we chose them as our top picks and outline the advantages and disadvantages of each platform. This will help you decide which is the best cryptocurrency exchange for you.

So, without further ado, let’s get started! Here is our list of the best crypto exchanges US investors should consider for 2025;

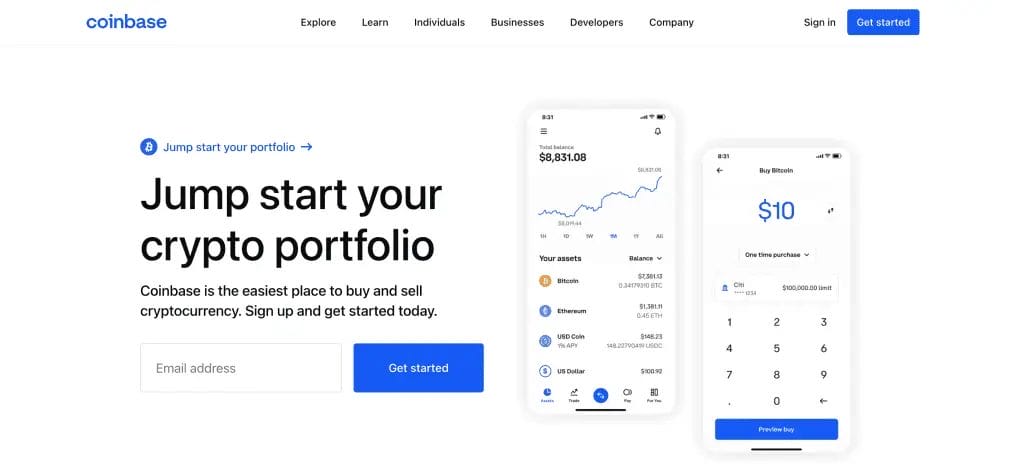

1. Coinbase

Next is Coinbase, which, in contrast to Binance, can be expensive in terms of fees. However, Coinbase is very user-friendly, and most people getting into crypto tend to start here, especially with sign-up offers such as their £5 free Bitcoin. The interface is easy to use and ideal for newbies because of its simple buying process.

However, these newbies will soon be aware that Coinbase has some of the highest trading fees among all the crypto exchanges, ranging from 1.49 to 3.99% for trading digital assets on Coinbase and from 0.5% with Advanced Trade, which has a broader range of tokens and is more aimed at experienced traders.

Coinbase supports customers in over 30 countries, including the United States, most of Europe, Singapore, Canada, and Australia, with some very high volume and liquidity.

Coinbase Features:

Coinbase offers a wide range of features for users. It offers a simple and user-friendly interface for various trading pairs between cryptocurrencies and supports FIAT to crypto pairs. They also offer advanced order types and charting with Advanced Trade for more advanced traders.

The cryptocurrency exchange platform is not limited to trading. Coinbase Earn offers ways to put your crypto to work and earn rewards, or you can take quizzes and earn free crypto. Plus, there’s the Coinbase self-custody crypto wallet, the Coinbase Card, ways to borrow, create and collect NFTs and a subscription-based service.

Another factor making Coinbase one of the top crypto exchanges is its security. While multiple attempts have breached the exchange’s security, Coinbase has yet to suffer a major hack, and it stores 97% of bitcoins offline.

| CoinGeko Trust Rating | ★★★★★ |

| Location | US |

| Supported Cryptos | 220+ |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | Yes |

| Referral Bonus | £5 Bitcoin Sign-up Bonus |

Is Coinbase FDIC Insured?

Coinbase is not an FDIC-insured bank, and cryptocurrencies held on the platform are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation (SIPC). However, the fiat value of your Coinbase wallet is insured up to $250,000; this is due to a large portion of Coinbase’s customer deposits held by custodial banks that the FDIC insures.

It is important to note that cryptocurrency itself is not legal tender, is not backed by the government, and is not insured by the FDIC or SIPC.

2. Kraken

Kraken Exchange is one of the oldest crypto exchanges, having operated since 2013. The platform is another great option for new American traders, with a simple and basic interface to get started with. It is also a good option for more advanced traders. It offers American users more than 150 different cryptocurrencies to trade, buy, and sell.

With Kraken, American users can trade with six fiat currencies: USD, Japanese Yen, American dollars, Euros, and Australian dollars. Kraken trading fees range from 0% to 0.26%, which is pretty low for a crypto exchange. It’s also considered a very secure space to trade digital currencies, with most of its cryptocurrency stored offline.

Kraken Features:

With Kraken Exchange, you can take advantage of many trading features, including spot markets, futures trading with up to 50x leverage, and margin trading to open larger positions. Plus, they offer various order types like limit, market, stop, trailing stop, and fill or kill.

Regarding staking options, users can stake Polkadot, Cosmos and Tezos with Kraken. Plus, in some countries, you can even stake FIAT currencies such as Euros and US dollars.

| CoinGeko Trust Rating | ★★★★★ |

| Exchange Location | San Francisco, USA |

| Supported Cryptos | 214 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Charges Spread |

| Withdrawal Fee | Yes |

| Referral Bonus | Sign-up for Kraken Exchange |

Is Kraken FDIC Insured?

Kraken is not FDIC insured. Cryptocurrency exchanges, including Kraken, do not qualify for deposit insurance programs because they are not savings institutions. Deposits at Kraken Bank, when operational, will not be insured by the Federal Deposit Insurance Corporation (FDIC).

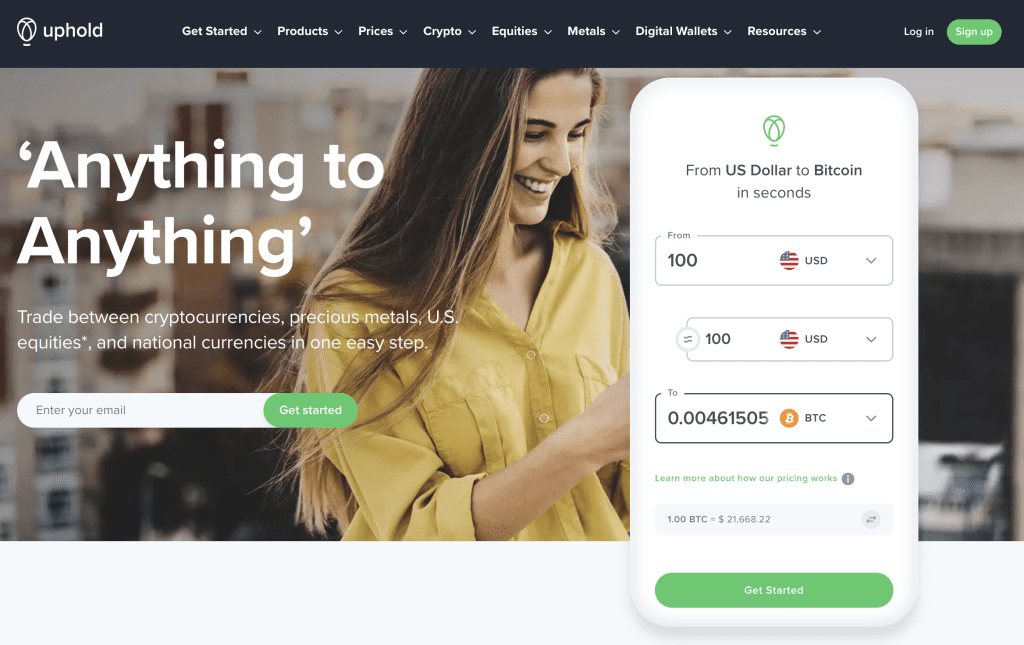

3. Uphold

Uphold is a multi-currency investment provider founded by serial entrepreneur Halsey Minor in 2013. The company is headquartered in the US and is one of the best American crypto exchanges. It operates in six countries: the US, Spain, Ireland, Switzerland, Australia, and New Zealand.

Uphold’s US subsidiary, Uphold US Inc., has received regulatory approval as a Registered Crypto Asset service provider. This means that it is in compliance with the US Anti-Money Laundering and Counter-Terrorism Financing regulations.

With Uphold, businesses and individuals can invest and exchange various assets, including cryptocurrencies, national currencies, precious metals, and US equities.

Uphold offers commission-free trading on various products, with crypto trading pairs available via its app and web platforms. Additionally, account holders can benefit from digital wallets, in which currencies can be easily stored and exchanged. Uphold is a popular choice for those looking to trade online with confidence and security as a well-regulated and robustly safeguarded investment provider.

Uphold Features:

One of Uphold’s primary USPs is their ‘anything to anything’ asset conversion offering. Depending on your location, you can trade assets directly with a bank account, cryptocurrency network, precious metals, US equities or debit/credit card.

Uphold also has a debit card, enabling smooth transactions using a range of cryptos, metals, and currencies. Plus, you can earn 1% back in USD for every USD-sourced transaction and 2% back in the cryptocurrency used for every crypto purchase.

Uphold also offers a mobile app for on-the-go trading.

| CoinGeko Trust Rating | n/a |

| Exchange Location | New York, USA |

| Supported Cryptos | 250+ |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | No |

| Referral Bonus | Sign-up to Uphold |

Is Uphold FDIC Insured?

Uphold crypto assets are not covered by the Federal Deposit Insurance Corporation (FDIC), SIPC insurance, or any other type of insurance. However, deposits of U.S. dollars held on the platform in U.S. dollars may be eligible for pass-through FDIC insurance if the associated bank fails, with coverage up to $250,000 per depositor.

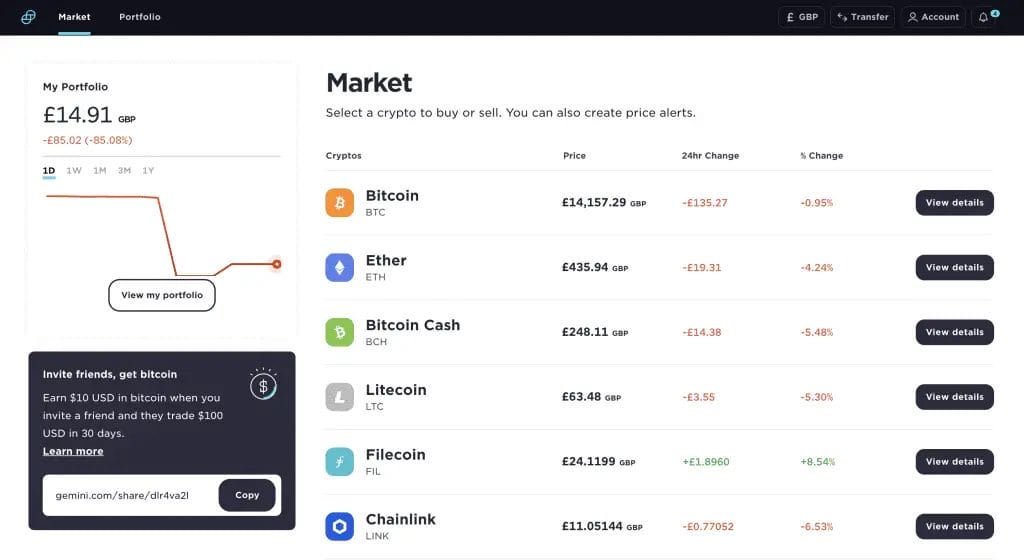

4. Gemini

Gemini Exchange is a good option for users looking to buy crypto or sell it with fiat money, bank deposits and withdrawals.

It is a regulated cryptocurrency exchange, wallet, and custodian that makes buying Bitcoin, Ethereum, and various other digital assets simple and secure. The cryptocurrency exchange was launched in 2015 in the US by the Winklevoss twins Cameron & Tyler, who rose to fame in 2004 after they sued Mark Zuckerberg over Facebook. The company has now expanded its operations to Europe and Asia.

Gemini Features

Gemini exchange offers an array of features for its users, including a streamlined trading view and simple ways to trade assets, manage your holdings, and set recurring buys.

For the more advanced trader, Gemini has ActiveTrader, which is an inbuilt advanced trading platform with more advanced order types, charts, and lower trading fees.

Plus, they have their own Gemini wallet, a secure way to store your crypto assets.

| CoinGeko Trust Rating | ★★★★★ |

| Exchange Location | New York, USA |

| Supported Cryptos | 105 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Varies |

| Withdrawal Fee | No |

| Referral Bonus | $10 Bitcoin Sign-up Bonus |

- FIAT Markets

- Gemini ActiveTrader

- Strong Security

- High Fees

- Confusing fee structure

Is Gemini FDIC Insured?

Gemini is not FDIC-insured for cryptocurrencies. However, U.S. dollars in your Gemini account may be eligible for FDIC “pass-through” insurance, subject to applicable limitations. According to the Gemini User Agreement, U.S. dollars held within your Gemini account are eligible for FDIC insurance. Still, digital assets or cryptocurrencies held within your account are not FDIC insured.

5. Crypto.com

Crypto.com was founded in 2016, and its headquarters are situated in Singapore. They were previously known as Monaco before being rebranded to Crypto.com in July 2018, paying between $5 million and $10 million for the domain.

Since its launch in 2016, it has become one of the fastest-growing companies in the crypto space, with over 10 million users worldwide. It continues to innovate and add more features to its platforms, such as its popular Visa debit card and, more recently, NFTs, making it a one-stop shop for crypto enthusiasts.

Crypto.com Features:

Crypto.com offers users various features and products, including the Crypto.com App, where users can buy crypto, including Bitcoin and 100+ cryptocurrencies, with a credit/debit card or via bank transfers.

One of the most popular features is their Crypto.com Visa Debit Card, where users can receive cashback on purchases between 1% and 8%, plus free Spotify, Prime and Netflix subscriptions.

The Crypto.com exchange is a platform for users to trade crypto to crypto with more advanced order types, low fees, and deep liquidity. The exchange also offers an additional range of products, including The Syndicate, Supercharger, and Lending.

There are also ways for users to stake and earn from their crypto, DeFi services and an NFT marketplace.

| CoinGeko Trust Rating | ★★★★★ |

| Exchange Location | Singapore |

| Supported Cryptos | 247 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | No |

| Referral Bonus | Up to $50 Sign-up Bonus |

- User-friendly platform

- Variety of assets to trade

- Wide range of fiat currencies

- Visa debit card for easy transactions

- Mobile app for on the go trading

- Wide range of services

- NFTs available

- Limited support for certain regions

- High fees on some transactions

- Card rewards have been downgraded

Is Crypto.com FDIC Insured?

Crypto.com is not FDIC-insured for crypto asset investments. FDIC insurance only applies to USD balances held at insured depository institutions, covering up to $250,000 if the respective FDIC member fails. It does not protect your funds in the event of Crypto.com’s failure or from the risk of theft or fraud.

However, Crypto.com has secured a $100 million direct insurance policy led by Arch Underwriting at Lloyd’s Syndicate 2012 to cover its cold storage assets on custodial partner Ledger Vault, providing some security protection for its users.

6. eToro

eToro is a popular platform for investors to trade cryptocurrencies. Founded in 2007 by three entrepreneurs, the platform is now trusted by millions of customers worldwide. EToro aimed to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. eToro is regulated by the UK’s Financial Conduct Authority (FCA).

eToro offers hundreds of different financial assets to trade, which can be traded using various investment strategies. Sometimes, you will own the underlying assets, such as long (BUY), non-leveraged positions on crypto.

eToro Features:

For those interested in crypto trading, clients can trade Bitcoin, Ethereum, Litecoin, and other popular cryptocurrencies.

CopyTrader was brought to the platform in 2010 and is great for those getting started investing or who don’t have the time to watch the markets constantly. CopyTrader lets you view what real traders do in real time and copy their trades automatically.

| CoinGeko Trust Rating | n/a |

| Exchange Location | Israel |

| Supported Cryptos | 73 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | Yes |

| Sign-up | Go to eToro.com |

Is eToro FDIC Insured?

eToro is not FDIC-insured for its general services. However, cash held in eToro Options accounts is deposited with Apex Clearing Corporation, their clearing firm, which sweeps available cash into FDIC-insured deposit accounts at FDIC-insured banks. These funds are insured for up to $250,000.

New cash deposited with eToro USA after April 4, 2023, will be temporarily held in bank accounts set up by their Payment Service Providers: PayPal, Checkout.com, and PayWithMyBank, with accounts currently at Wells Fargo and Cross River Bank. It is important to note that FDIC insurance does not protect against the failure of eToro itself.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1519299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

7. Gate.io

Gate.io is a well-known crypto exchange platform that facilitates trading various blockchain assets, including BTC, LTC, Ethereum, and Qtum. This platform has gained global recognition quickly and is now accessible in almost all countries worldwide. The exchange is unavailable in China, and its registered office has been relocated to Virginia, USA.

Gate.io supports over 1400 leading cryptocurrencies, with over 1,000 trading cryptocurrency pairs. The platform also offers spot trade and margin trade services, as well as ETF, Options, futures, and derivatives trading, catering to the needs of professional traders. However, even beginners with minimal experience can benefit from using this platform. If you want to learn more about Gate.io, read this comprehensive Gate.io review for more information.

Gate.io Features:

At Gate.io, you can engage in margin trading, potentially allowing you to borrow from other users to amplify your profits and losses. Additionally, you can enjoy leveraged trading of up to 5X with the platform’s Leveraged ETF Tokens. If you need to swap one currency for another, you can do so easily with just one click. Finally, the platform offers plenty of strategy trading bots that are user-friendly and straightforward to use.

| CoinGeko Trust Rating | n/a |

| Exchange Location | Cayman Islands |

| Supported Cryptos | 1,400 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | Yes |

| Referral Bonus | Yes |

- More than 1,300 tradable coins

- Low fees

- Simple interface

- Good for beginners

- May be too advanced for beginners

- Hacked in 2019

8. KuCoin

KuCoin is a cryptocurrency exchange platform that launched in September 2017. Since then, it has quickly become one of the most popular exchanges in the world, with a reputation for being reliable, secure, and easy to use.

The platform allows users to buy, sell, and trade many cryptocurrencies, including Bitcoin, Ethereum, Litecoin, etc. Users can trade in various trading pairs, including fiat-to-crypto, crypto-to-crypto, and stablecoin-to-crypto pairs.

KuCoin Features:

One of KuCoin’s unique features is its support for margin trading, which allows users to borrow funds to increase their trading power. This allows traders to increase their potential profits but also exposes them to greater risks.

In addition to margin trading, KuCoin also offers futures trading, which allows users to bet on the future price of a cryptocurrency. This type of trading is popular with more experienced traders who are comfortable taking on higher levels of risk.

KuCoin also offers a peer-to-peer (P2P) trading option, which allows users to buy and sell cryptocurrencies directly with each other without the need for an intermediary. This can be a great option for users who prefer more privacy and control over their transactions.

Another way that users can earn rewards on KuCoin is through staking and lending. Staking involves holding a certain amount of a cryptocurrency for a set period of time in exchange for rewards, while lending involves loaning out your cryptocurrency to other users in exchange for interest.

| CoinGeko Trust Rating | n/a |

| Exchange Location | Hong Kong |

| Supported Cryptos | 725 |

| Fiat Markets | Yes |

| Maker & Taker Fees | Variable |

| Withdrawal Fee | Yes |

| Referral Bonus | Yes |

- Over 600 cryptocurrencies are supported.

- Multiple payment methods.

- Supports exchange of fiat-to-crypto and vice versa.

- Easy to download mobile apps for android and iOS devices.

- Does not support trading of fiat pairs.

- Different trading pairs supported different markets.

What Should You Look for from a Crypto Exchange?

It is crucial to take into account the following factors when selecting a cryptocurrency exchange:

- Platform Security: Choose a cryptocurrency exchange that employs strong security measures, such as two-factor authentication and cold storage for user funds.

- Fees: For long-term trades, exchanges with lower fees are more suitable.

- Currency Support: Ensure that the exchange offers a diverse selection of currencies for trading.

- Trading Features: Evaluate the features provided, including margin trading, futures, and over-the-counter (OTC) trading.

Can you Leave Cryptocurrency on an Exchange?

It would be best if you did not keep cryptocurrency in a crypto exchange for the long term. No matter which crypto exchange you use or how safe it’s reported, you should never keep large amounts of crypto on an exchange.

It is always much safer to withdraw your coins back to a secure wallet, such as a Trezor One or a Ledger Nano S or Nano X, where you have control over your private keys and, therefore, your digital currencies.

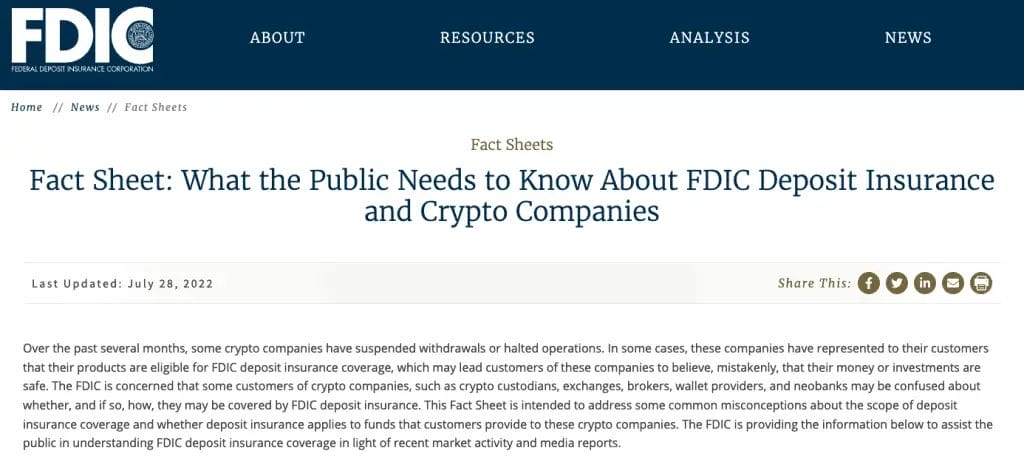

How Does FDIC Insurance Work for Crypto Exchange?

FDIC insurance for crypto exchanges works by protecting cash held in custodial accounts at FDIC-insured banks. For a crypto exchange to be insured by the FDIC, it must first be a member of the FDIC. Once a crypto exchange is a member of the FDIC, it can apply for FDIC insurance. It is important to note that FDIC insurance only covers cash deposits held in accounts and does not apply to financial products such as stocks, bonds, money market mutual funds, other types of securities, commodities, or crypto assets. Additionally, FDIC insurance does not protect against losses due to theft or fraud.

Are all Crypto Exchanges FDIC-Insured?

Not all crypto exchanges are FDIC-insured. By federal law, the FDIC only insures deposits held in insured banks and savings associations and does not insure assets issued by non-bank entities, such as crypto companies.

Conclusion: What is the Best Crypto Exchange for US Investors?

The ever-evolving world of cryptocurrency has become more accessible for US investors. By carefully examining the user experience, security, fees, available cryptos, and customer support, we’ve provided a comprehensive guide to help you make an informed decision.

Whether you’re a seasoned crypto trader or a newcomer to cryptocurrency, one of these US crypto exchanges will suit your needs. Don’t forget to research and keep up-to-date with the latest news.

If we have missed one of your favourite crypto exchanges available to US investors, let us know in the comments below.

FAQs

Is crypto legal in the United States?

In the United States, cryptocurrency exchanges are permissible by law and are subject to regulation under the Bank Secrecy Act (BSA). This implies that cryptocurrency exchange service providers must register with FinCEN, institute an AML/CFT program, uphold adequate records, and present reports to the authorities.

Can the US government shut down crypto?

Since Bitcoin operates decentralized, a single government can’t shut down the network. Nevertheless, several governments have tried prohibiting cryptocurrencies or limiting their usage within their jurisdiction.

What are crypto Maker and Taker fees?

Maker and taker fees are costs charged to a trader by an exchange when an order is placed and filled. A maker order is an order you place that is not immediately matched with an order on the order book, whereas a Taker order is.

Will cryptocurrency take over the dollar?

According to the leading banking regulator in the United States, it is improbable that crypto tokens will supplant conventional currency. Therefore, banks should exercise caution while testing the asset class.