In this eToro review, we assess the pros and cons of the popular investment and social trading platform and compare it to other providers on the market.

eToro is the leading social trading and investment platform, allowing investors to invest in stocks, crypto, and CFDs. Plus, with eToro’s CopyTrader feature, complete beginners can automatically copy experienced traders.

So, let’s dive in and take a look into what eToro offers so you can decide if eToro is the right investment platform for you

eToro Review: How to use eToro?

eToroX crypto exchange is no longer available for retail investors. PayPal/credit card as a MOP is not available to UK FCA Users. Trading Crypto with leverage is restricted for UK users.

What is eToro?

eToro is a popular platform for investors to trade stocks, ETFs, cryptocurrencies, and CFDs. Founded in 2007 by three entrepreneurs, the platform is now trusted by millions of customers worldwide. EToro aimed to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

There are hundreds of different financial assets to trade on eToro, which can be traded using various investment strategies. Sometimes, you will own the underlying assets, such as long (BUY), non-leveraged positions on stocks and cryptos. They will also employ CFDs, enabling various options, such as short (SELL) positions, leveraged trades, fractional ownership, etc.

Looking for a Mobile Investment App? Check out our Guide on the 9 Best Investing Apps for UK Investors.

eToro Features

One of eToro’s best selling points is its unique features on its trading platform. If you’re an experienced investor or a beginner, eToro will have you covered. Making the process of investing simple, fun, and sociable.

Fractional Shares

With eToro, you can invest in stocks with fractional shares. Fractional shares allow users to own a fraction of a single stock. For example, if a stock is priced at $500, you dont have to pay $500; you could buy $50 and own a fraction of that share. This allows users to gain access to expensive stocks without significant investment capital.

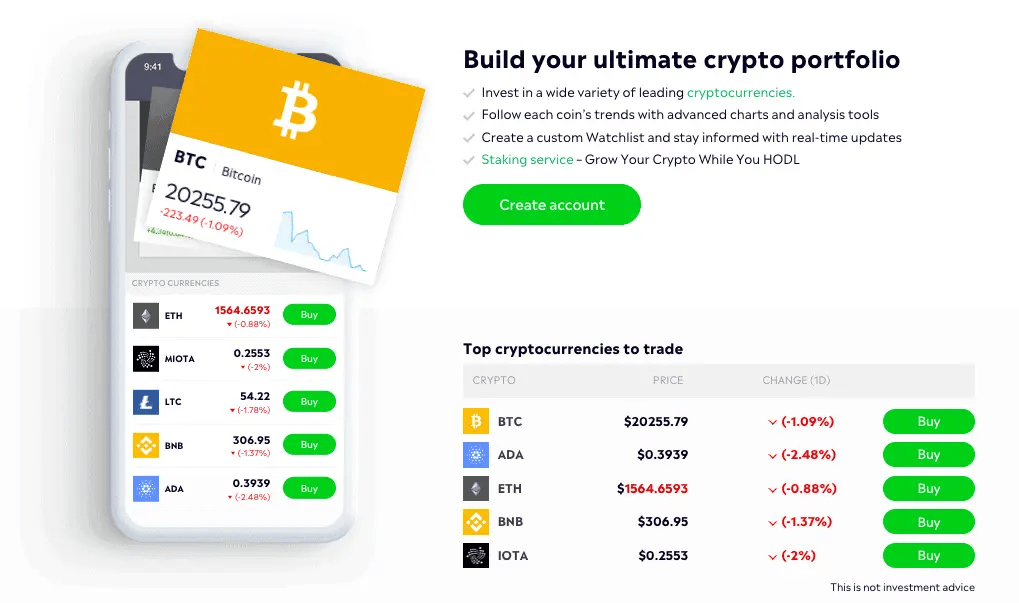

Crypto on eToro

After pioneering Bitcoin trading via CFDs in 2013, eToro expanded its cryptocurrency offering, enabling clients to trade and invest in Ethereum, Litecoin, and other popular cryptocurrencies. With eToro, users can buy and sell crypto instantly and own the underlying assets. They can also track real market data and follow each coin’s trends.

CFD’s Crypto is restricted for UK/FCA users.

eToro Smart Portfolios

Formerly known as CopyTrader, eToro Smart Portfolios revolutionized the platform when it was introduced in 2010. This feature is perfect for those new to investing or those who don’t have the time to monitor the markets constantly. With Smart Portfolios, you can effortlessly replicate the strategies of successful traders while maintaining complete control over your investments. You can stop, pause, add, or remove funds anytime, ensuring your portfolio always aligns with your goals.

How does Smart Portfolio work?

eToro Smart Portfolios allows you to view and automatically copy the trades of real investors in real-time. When they trade, you trade. It’s that simple. You can explore a diverse range of top-performing traders, analyze their strategies, and choose the best match for your investment style. With the ability to copy up to 100 traders simultaneously, you can diversify your investments and reduce risk.

eToroX crypto exchange is no longer available for retail investors. The minimum investment in a copy portfolio is $500 USD.

eToro Virtual Account

eToro’s Virtual account comes with an available balance of $100,000. Before committing your funds, you can test the market and try new features.

eToro Deposit Methods

You can deposit your funds on eToro using various methods, including debit cards, Skrill, Neteller, and Bank transfers. However, some of these methods have limitations and terms, which can be found here.

There are currently minimum deposits of $500 for bank transfers and $10 for debit cards.

All eToro trading accounts are in USD. Therefore, when depositing with a different currency, the amount will be converted to the current market rate. Please note that this is subject to a conversion fee. However, using an eToro money account can save on fees.

eToro Fees

With eToro, there are no fees to open an account or deposit your funds onto the platform. Withdrawals are charged at a cost of $5, and they state that there are no clearance fees. There is, however, a minimum withdrawal amount of $30.

They also have no management or ticket fees, and stock investments have zero commission.

With crypto, eToro charges only spreads as trading fees, which are listed on their fees page. CFDs also include overnight fees and spreads, which are listed here.

They also have a fee named an “Inactivity fee”. This means that after 12 months with no login activity, a $10 monthly inactivity fee will be charged on any remaining available balance. No open positions will be closed to cover the fee.

Is eToro Safe?

The eToro platform is regulated by the Financial Conduct Authority of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the US FinCEN, and the Australian Securities and Investments Commission (ASIC).

They also state that your funds are protected by industry-leading security protocols and that they will never share your private data without your permission.

eToro Support

Customers can contact eToro support via a live chat or web-based ticketing system that will respond to emails. I found the live chat system very hard to find on their website, which I eventually found under their customer services page. Just note that this is only available in certain regions.

Verdict: Should you Invest with eToro?

eToro has some cool features like CopyTrader, which will appeal to new and younger investors. I would avoid (if you can) buying Bitcoin and Cryptocurrency with eToro. If you want to participate in crypto, look at my Binance Exchange or Coinbase tutorials.

Some investments are held on eToro (not crypto), and buying and selling are easy. One of their major selling points is their free trading feature, but is it free, or is it only a sales tactic? I still use Hargreaves Lansdown to buy stocks and ETFs, and they charge a minimum of 11.95, which will put off the smaller investor.

The major downfall with eToro is their support, and it’s really poor. Somehow, Trust Pilot gives eToro a generous 2.3 rating. But I have wasted hours trying to resolve issues. Hopefully, their support will improve; otherwise, someone else will take their market share away.

We hope you found this eToro review helpful. If you have already tried eToro, let us know what you think in the comments below or to start using it yourself.

eToro is a multi-asset investment platform. The value of your investments may go up or down, putting your capital at risk.

eToro FAQs

Do people make money on eToro?

Yes, trading on eToro can be profitable, and people make money from the platform. However, there is no guarantee that you will make money, and you can also easily lose money when investing in stocks and crypto.

Is eToro free?

There are some fees that eToro charges, including withdrawal and inactive fees.

Related Posts

- Beginners Guide on How to Sell on eToro

- How to Withdraw from eToro

- Beginners Guide on How to Close a Trade on eToro

- 7 Best Exchanges to Buy Bitcoin in the UK?

- 9 Best Investment Apps for UK Investors

- Freetrade Review: Features, Fees, Pros & Cons

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation, and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity-specific information about eToro.