This guide will explain how to download and View your Coinbase transaction history. Downloading your Coinbase statements is ideal if you want to see your Coinbase trading history, submit your crypto tax returns or just need a statement for your personal records.

So, let’s dive into this guide to help you work out how to view Coinbase transaction history.

Please note that this guide does not provide tax advice and will only explain how you can download your Coinbase transaction history. For tax advice, please speak with a professional.

How to Download & View Coinbase Transaction History (Desktop)

Downloading and exporting Coinbase statements and transaction history is a pretty simple process. However, we will provide a step-by-step guide to show you how to check your Coinbase transaction history.

- Go to Coinbase.com & Sign-in

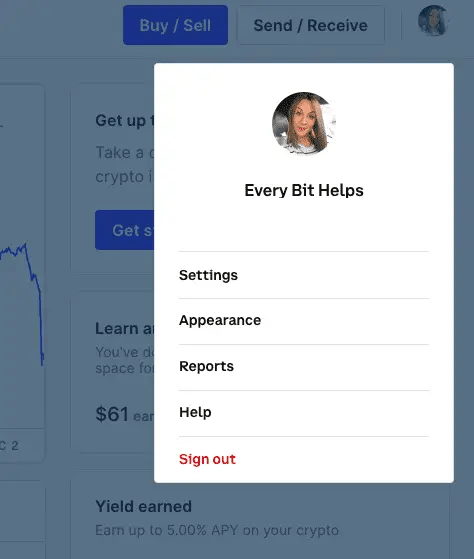

- Click on your profile photo

- Navigate to “Reports”

- Choose “Generate Report”

- Filter the information or choose from CSV or PDF Format and “Generate Report“.

- Click “Download” to download your Coinbase transaction history report

Downloading your Coinbase transaction history is only available on the Coinbase web platform. Unfortunately, you can not download your transaction history via the Coinbase mobile app. However, using a web browser on your mobile rather than the Coinbase app may also work.

Total Time: 15 minutes

Go to Coinbase.com & Sign-in

To download and View Coinbase Transaction History, you must sign in to your Coinbase account. Once signed in, click on your profile photo in the top-right corner.

Please note: The Coinbase Mobile App does not currently support downloading transaction history.

Navigate to “Reports”

Click your “Profile icon” in the top right of the screen.

Navigation will open, and then click “Reports“.

Generate Coinbase Report

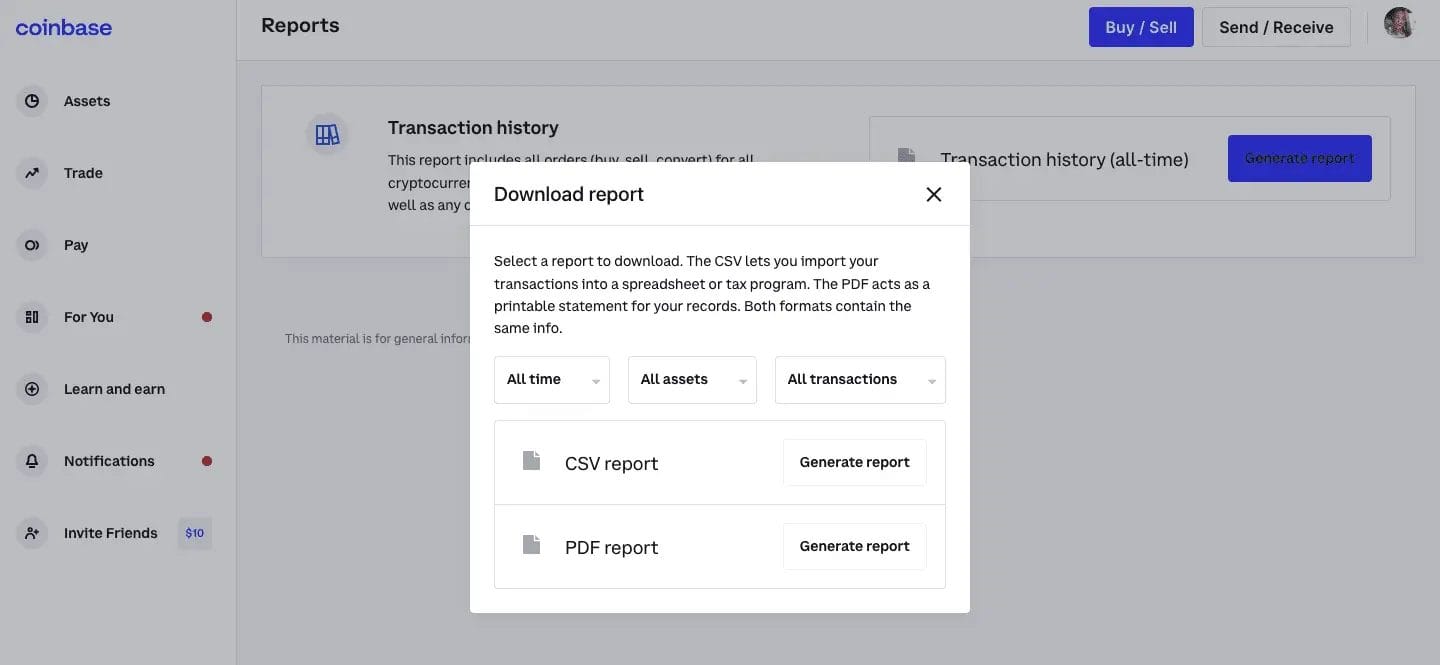

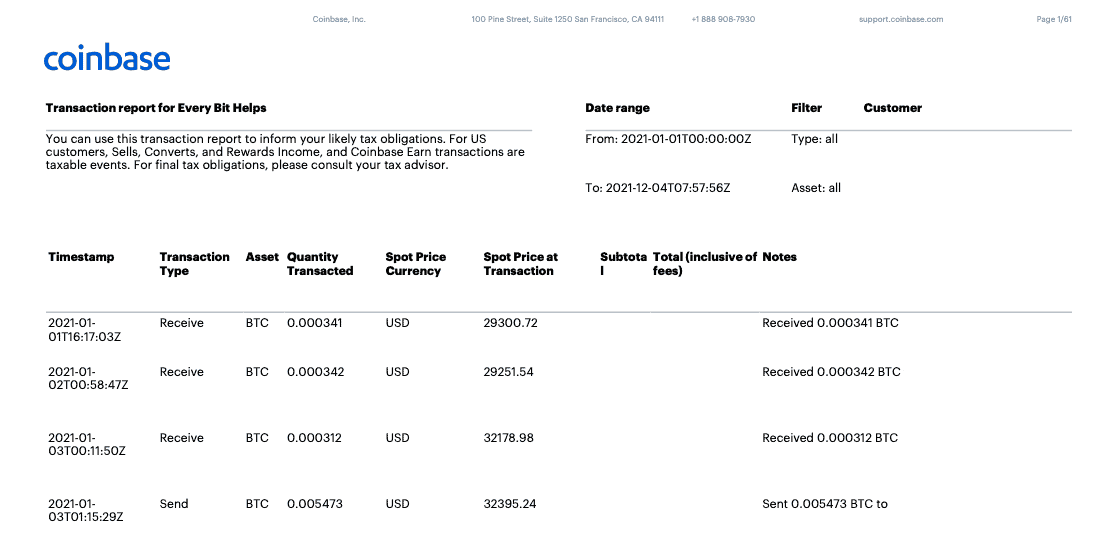

The Coinbase reports page has a section named “Transaction History“.

This will allow you to run a report on all orders (buy, sell, convert) for all cryptocurrencies associated with your Coinbase account and any crypto you have sent or received.

You will then need to click on “Generate Report“.

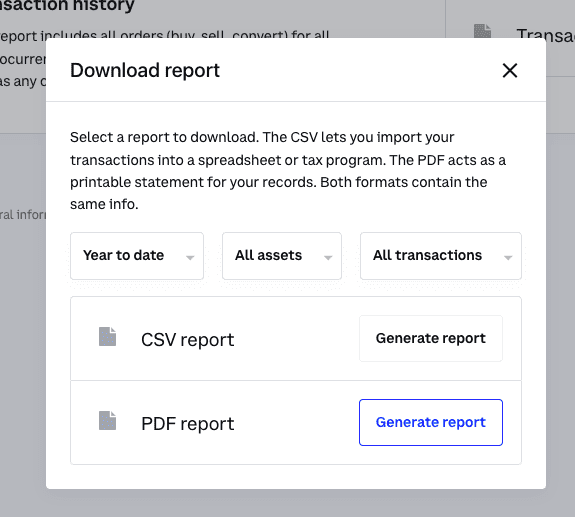

Filter & Download Coinbase Transaction History

The information displayed in your report can be filtered by “All time“, “All assets“, and “All transactions“.

You can also choose whether the report is in CSV format or PDF. Once you filter the information and choose the format you require, click “Generate Report“.

When the report is generated, you will have the option to “Download“.

The report will either automatically open or check your downloads folder for your transaction history!

Coinbase IRS Forms 1099-MISC

Coinbase began issuing IRS Forms 1099-MISC for US customers to report their gains and losses to the IRS. Any US-based customers who sold or converted crypto are subject to US taxes. You are required to report gains/losses when using Coinbase.com, Coinbase Pro, and Coinbase Prime.

Non-US Coinbase customers will not receive any forms and need to download their transaction history to fulfil their local tax obligations.

Create a Coinbase Tax Report with Crypto.com

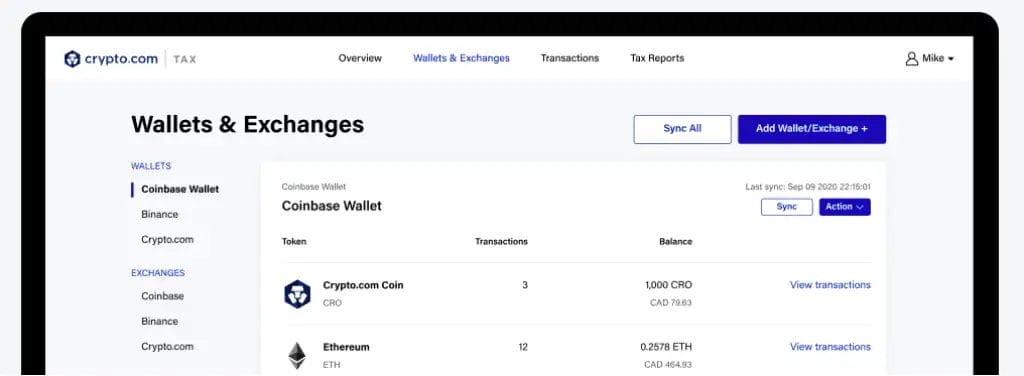

If you’re looking to create a Coinbase Tax report, Crypto.com has a feature where you can connect your Coinbase account using APIs or CSV files and run an online tax report. As long as you have an account, the Crypto.com Tax feature is completely free, regardless of how many transactions you have.

Related Posts

Here are some of our articles you may also find helpful;

- How to Create a Crypto Tax Report with Crypto.com Tax

- How to Withdraw from Coinbase to a Wallet? (2022)

- Beginners Guide to the Best Crypto Tax Software

- Coinbase Earn Quiz Answers

- How to Delete a Coinbase Account

*After you make a crypto purchase, BTC will be added to your portfolio. Limited time offer. Offer available to new users only. Offer not available to new users who were referred to Coinbase through the Referral Program or who have previously opened an account using the different contact information. Coinbase may update the conditions for eligibility at any time.

“Cryptocurrency is not regulated by the UK Financial Conduct Authority and is not subject to protection under the UK Financial Services Compensation Scheme or within the scope of jurisdiction of the UK Financial Ombudsman Service. Investing in cryptocurrency comes with risk and cryptocurrency may gain in value, or lose some or all value. Capital gains tax may be applicable to profits from cryptocurrency sales.”