In this beginner’s guide to Coinbase Earn, we will help you get started earning a passive income by staking your cryptocurrency. We will also discuss if Coinbase is the right platform for staking your crypto or if better options are available.

What is Coinbase Earn & How Does it Work?

Looking to earn some passive income by staking your crypto assets? Well, you’re in luck. Coinbase Earn offers users an easy and secure way to earn passive income by staking their crypto and earning rewards of up to 5% APR.

Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network. Essentially, it just means holding onto crypto assets and earning rewards. Similar to having pounds, euros, and US dollars in a savings account and earning interest.

You can stake on your own, but you’d need to run a node on your own hardware, sync it to the blockchain, and then fund the node with enough cryptocurrency to meet minimum thresholds, including providing a sizable deposit and bond. But with it being on Coinbase, they do all this for you. Meaning that they stake, generate and sign blocks on your behalf whilst you retain full ownership of your tokens and earn rewards.

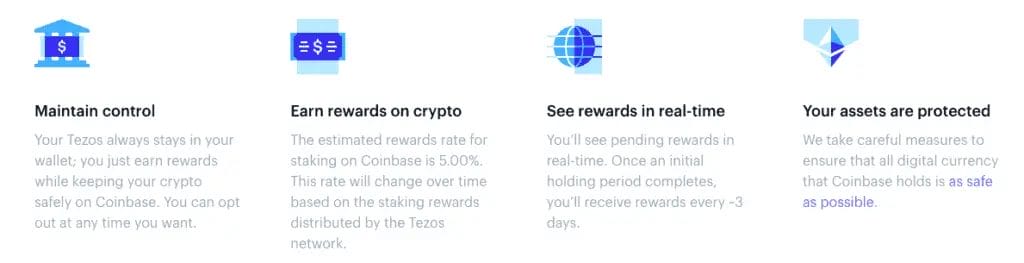

Coinbase Earn stakes crypto on behalf of its customers and deposits rewards directly into their wallets. Once the initial holding period completes, users will receive rewards roughly every three days.

What is Crypto Staking?

Crypto staking is a way to support a blockchain network and potentially earn cryptocurrency in return. When you stake your crypto assets, you are essentially locking them up for a set period of time to help validate new transactions and add new blocks to the blockchain.

This process is part of a consensus mechanism called proof of stake, which many blockchains use to ensure that only legitimate data and transactions are added to the blockchain. By staking crypto, network participants offer insurance against improper validation of flawed or fraudulent data.

If you decide to stake your crypto, you may earn more cryptocurrency as a reward for your contributions to the network. However, if you validate flawed data, you may lose some or all of your stake as a penalty.

Popular cryptocurrencies like Solana (SOL) and Ethereum (ETH) use staking as part of their consensus mechanisms. If you are interested in staking, you can research different cryptocurrencies and blockchain networks to find out which ones offer staking and how you can participate.

What is Proof of Stake?

Proof of Stake (PoS) is a newer and more energy-efficient consensus mechanism used by some blockchain networks to validate transactions and add them to the blockchain. Unlike the traditional Proof of Work mechanism, which relies on miners to solve complex mathematical problems, PoS relies on network participants who hold a stake or ownership in the network.

To participate in PoS, users must “stake” or lock up a certain amount of their cryptocurrency holdings as collateral. By doing so, they become eligible to validate transactions and add new blocks to the blockchain. Stakers are also responsible for maintaining the network’s security and ensuring that only valid transactions are added to the blockchain.

The specifics of PoS implementations vary from project to project. Still, the overall idea is to make the process of validating transactions more efficient and cost-effective while ensuring network security.

What Crypro can you Stake with Coinbase Earn?

Coinbase Earn allows users to stake six popular cryptocurrencies and state that they will add more crypto assets in the future.

Depending on your location, Coinbase currently allows their customers to stake Ethereum, Cardano, Algorand, Cosmos, Tezos, Dai, Tether and Solana.

Ethereum

Ethereum (ETH) is a decentralized global software platform powered by blockchain technology that is best known for its native cryptocurrency, ether. It supports smart contracts, an essential tool behind decentralized applications, and is designed to be scalable, programmable, secure, and decentralized.

Ethereum can be used by anyone to create any secured digital technology, and its blockchain technology enables secure digital ledgers to be publicly created and maintained. Many emerging technological advances are based on Ethereum, including non-fungible tokens, decentralized finance, decentralized autonomous organizations, and the metaverse.

What is ETH 2.0?

ETH 2.0 is an upgrade to the Ethereum network that will move it from a “Proof of Work” to a “Proof of Stake” model, improving security and scalability. With Proof of Stake, users can stake their ETH and earn rewards for helping to secure the network.

With Proof of Stake, users can now stake their ETH and earn rewards for helping to secure the network. The amount of ETH you will receive in rewards will depend on how much ETH is validated and the rewards the network offers. With Coinbase ETH 2.0 staking, Coinbase takes care of all of this and will stake, product and sign the blocks for you. Also, there are no minimum amounts to start staking.

How To Stake ETH 2.0 with Coinbase?

When you stake your ETH, it will convert to ETH2 on Coinbase. The price of ETH2 is exactly the same as ETH. Then once the upgrade to the Ethereum network is complete, both ETH and ETH2 will merge into one token.

To start staking your ETH in ETH2.0;

- Open an account with Coinbase or Login

- Ensure you meet the requirements (i.e. check your country and verify your identity).

- If you don’t already have some ETH, buy or trade for it.

- From your portfolio, go to the Ethereum page.

- You’ll then see an option to convert your ETH to ETH2

Please note: when your ETH is staked in ETH2.0, you won’t be able to send, sell, or trade it. However, when the ETH2.0 upgrade is complete, you can send, sell or trade these and your rewards.

Algorand

Algorand (ALGO) is a blockchain platform and cryptocurrency that processes transactions quickly, with the ability to host other cryptocurrencies and blockchain-based projects. Its native currency, ALGO, is used to secure the blockchain and pay processing fees. Algorand uses a pure proof-of-stake consensus mechanism and is open-source. It was founded in 2017 by Silvio Micali, a professor at MIT, and has a total supply of 10 billion coins, with 7 billion already circulating.

Cosmos

Cosmos (ATOM) is a network of interconnected blockchains allowing independent networks to share data and tokens without a central party. Each new blockchain is called a “zone” and is tethered to the Cosmos Hub, which maintains a record of the state of each zone.

Cosmos is powered by its native cryptocurrency, ATOM. The Interchain Foundation helped develop and launch Cosmos, and developers Jae Kwon and Ethan Buchman co-founded the Cosmos network in 2014, creating the consensus algorithm Tendermint, which powers Cosmos.

Tezos

Tezos or XTZ is a blockchain network linked to a digital token called a Tez or a Tezzie. Unlike Bitcoin, Tezos is not based on the mining of Tez. Instead, token holders receive a reward for taking part in the proof-of-stake consensus mechanism.

So Tezos holders who stake their tokens can receive additional Tezos tokens as a reward. And Coinbase stakes Tezos on your behalf and deposits the rewards directly into your accounts.

Once you have Tezos in Coinbase, your Tezos will always stay in your wallet. You just earn rewards while keeping your crypto safely on Coinbase. You can also opt-out at any time you want and move your Tezos to another wallet.

The “estimated” rewards rate for staking on Coinbase is 5.00%. However, this rate is only estimated as it will change over time based on the staking rewards distributed by the Tezos network. You’ll see pending rewards in real time, and once an initial holding period completes, you’ll receive rewards roughly every three days.

How to Stake Tezos with Coinbase Earn?

To start staking Tezos on Coinbase Earn, you must first hold Tezos in Coinbase. If you don’t already have XTZ to deposit, you can buy Tezos on the Coinbase exchange.

When writing this guide, you could also get $6 of free Tezos with Coinbase Learn Rewards by completing a few quizzes. Also, check out our guide on Coinbase Learn Rewards to see which other crypto you can earn for free.

DAI

DAI is a cryptocurrency stablecoin that is designed to maintain a stable 1:1 value with the U.S. dollar by locking other crypto assets in contracts. Unlike other asset-backed cryptocurrencies, DAI is created by an open-source software called the Maker Protocol, a decentralized application running on top of the Ethereum blockchain.

DAI is collateralized by other cryptocurrencies, such as ether, enabling borrowers to generate new DAI tokens in the form of loans. The Maker Protocol is now governed by a decentralized autonomous organization called MakerDAO.

Tether

Tether (USDT) is a stablecoin cryptocurrency that is pegged to the value of the U.S. dollar and is backed by Tether’s reserves. It was created in 2014 as RealCoin and later rebranded as Tether. Tether is the largest stablecoin by market capitalization and supports various blockchain protocols such as Bitcoin, Ethereum, TRON, EOS, Algorand, Solana, and Bitcoin Cash.

It is used by investors who want to avoid the volatility of other cryptocurrencies. Its parent company, iFinex, has been fined for mishandling and misrepresenting its reserves.

Solana

Solana (SOL) is a blockchain that is often referred to as an “Ethereum killer.” It uses a unique proof-of-history consensus mechanism that relies on timestamps to define the next block in its chain. Unlike the proof-of-work mechanism, Solana’s proof-of-history system is faster and more energy-efficient.

If you’re interested in staking Solana SOL tokens on Coinbase, you may be interested to hear you can get better interest rates on other platforms. Check our guide to the 6 Best Places to Stake Solana SOL Tokens to learn more.

USD Coin

USD Coin (USDC) is a digital currency that is fully backed by U.S. dollar assets, which makes it a stablecoin. Its value is designed to remain stable, pegged 1:1 to the value of one U.S. dollar, in contrast to the price fluctuations of other cryptocurrencies like Bitcoin and Ethereum.

While USDC is not issued or backed by the U.S. government, the reserve assets are held in segregated accounts with U.S.-regulated financial institutions. USDC is an open-source project, which means anyone can view and contribute to the project’s code.

Cardano

Cardano is a third-generation blockchain project founded in 2017 by Ethereum co-founder Charles Hoskinson. It aims to build a highly scalable and energy-efficient smart contract platform that improves on the technology pioneered by Bitcoin and Ethereum.

The Ouroboros consensus mechanism, which is based on peer-reviewed research by a team of computer scientists and cryptographers from various institutions, ensures that transactions are validated in a scalable and secure way while maintaining energy efficiency.

Cardano’s native cryptocurrency is ADA, which can be used for various purposes, including storing value, sending and receiving payments, and staking on the network. While smart-contract functionality is currently unavailable, an upgrade in Q2 2021 will unlock this feature, making Cardano an even more robust and energy-efficient platform for developers to build decentralized apps and crypto tokens.

If you’re interested in staking Cardano ADA tokens on Coinbase, you may be interested to hear you can get better interest rates on other platforms. Check our guide to the 8 Best Ways to Stake Cardano ADA Tokens to learn more.

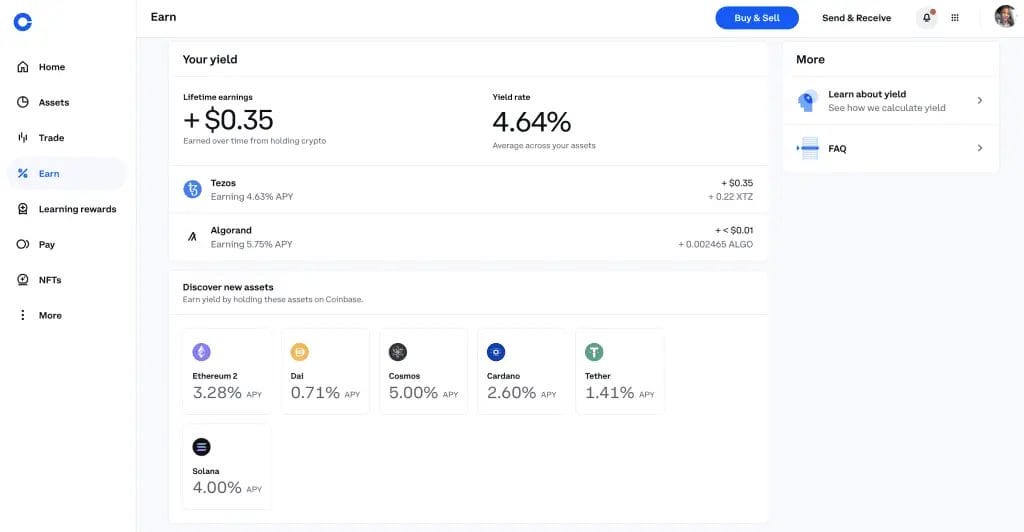

What are Coinbase Earn Staking Rates?

We have added the below staking rates Coinbase currently offer. These rates were correct when writing this article; however, the interest rate APY does change.

| Cryptocurrency | Interest Rate APY |

|---|---|

| Ethereum (ETH) | 3.96% |

| Algorand (ALGO) | 5.75% |

| Cosmos (ATOM) | 6.12% |

| Cardano (ADA) | 2.00% |

| Tezos (XTZ) | 3.19% |

| Dai (DAI) | 1.25% |

| Tether (USDT) | 2.42% |

| Solana (SOL) | 2.40% |

| USD Coin (USD) | 1.00% |

Who Can Stake on Coinbase?

To be able to stake your crypto on Coinbase, first, you’ll need a Coinbase account. You’ll also need to verify your identity by providing your personal details.

You’ll also need to reside in a supported region. Some regions are not eligible for staking and inflation. If you want to check out which countries/regions support Coinbase staking, you can check out their support article here.

How Often is Coinbase Earn interest Paid Out?

Coinbase Earn interest payout schedule varies depending on the crypto you stake. For more information on the payout schedule, check out the table below:

| Asset | Reward | Payout | Available Countries |

|---|---|---|---|

| DAI | Interest | Daily | Australia, Austria, Belgium, Canada, France, Germany, Ireland, Netherlands, Norway, Slovakia, Spain, the United States (except Hawaii), and the UK. |

| USDC | Interest | Monthly | United States (except Hawaii) |

| ALGO | Inflation | Quarterly | Australia, Austria, Belgium, Canada, France, Germany, Ireland, Netherlands, Norway, Slovakia, Spain, the United States (except Hawaii), and the UK. |

| ATOM | Staking | Every 7 days | United States (except Hawaii & New York), Belgium, France, Slovakia, Spain, the UK, Africa, Asia, the Middle East, and South America. |

| ETH 2 | Staking | Daily | North America (except Hawaii & New York), South America, Europe, the Middle East, Asia, and Africa. Learn more |

| XTZ | Staking | Every 3 days | United States (except Hawaii & New York), Belgium, France, Slovakia, Spain, the UK, Africa, Asia, the Middle East, and South America. |

| ADA | Staking | Every 5 days | United States (except Hawaii & New York), Belgium, France, Slovakia, Spain, the UK, Africa, Asia, the Middle East, and South America. |

What are Coinbase Staking Fees?

Although there are no additional fees for Staking. Coinbase takes a commission on the rewards they receive, and their customer’s return rate reflects the commission.

If you want to find out more about Coinbase’s commission fees, you can check out their user agreement.

Verdict: Should you stake with Coinbase?

Coinbase Earn makes staking crypto very simple. However, the interest rates Coinbase offers their client are much lower than their competitors. Personally, we wouldn’t use Coinbase Earn to stake our crypto and would look for alternative methods with higher APYs.

Coinbase Earn FAQs

Can you earn money on Coinbase?

You can earn money on Coinbase using their feature Coinbase Earn. In this way, you earn crypto rewards by staking your crypto. What you do with your rewards is up to you. You can HODL them, exchange or simply sell them for FIAT, i.e. traditional currencies and send them back to your bank account.

Is Coinbase Earn for everyone?

Coinbase Earn is for all Coinbase users who have verified their identity and who reside in a supported region.

Does Coinbase give you free money?

Coinbase rewards those who stake (deposit) their crypto on Coinbase for a period of time.

Related Post

Here are some of our articles you may also find helpful;

- How to Withdraw from Coinbase

- Coinbase Earn Quiz Answer

- Coinbase Wallet Review

- How to Delete a Coinbase Account

- How to Download Coinbase Transaction History

*After you make a crypto purchase, BTC will be added to your portfolio. Limited time offer. Offer available to new users only. Offer not available to new users who were referred to Coinbase through the Referral Program or who have previously opened an account using the different contact information. Coinbase may update the conditions for eligibility at any time.

“Cryptocurrency is not regulated by the UK Financial Conduct Authority and is not subject to protection under the UK Financial Services Compensation Scheme or within the scope of jurisdiction of the UK Financial Ombudsman Service. Investing in cryptocurrency comes with risk and cryptocurrency may gain in value, or lose some or all value. Capital gains tax may be applicable to profits from cryptocurrency sales.”