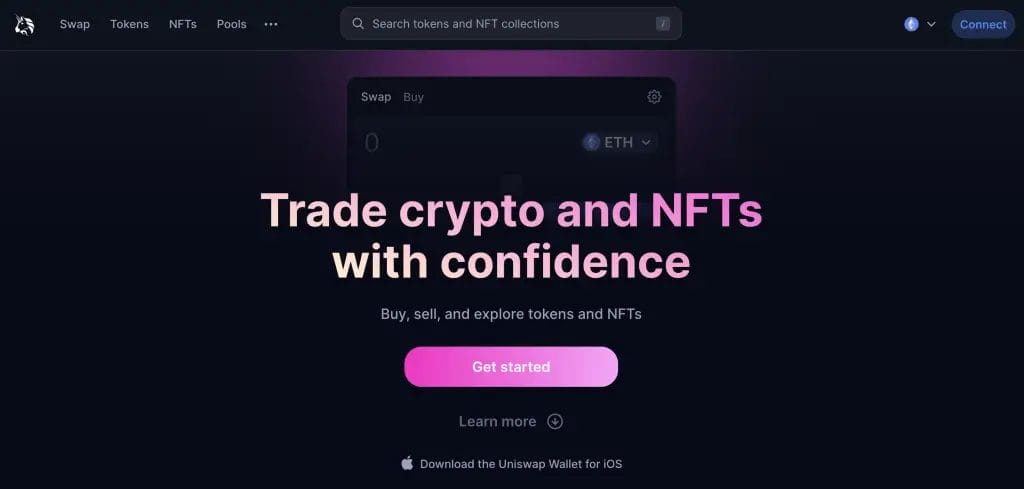

In this Uniswap review, we’ll delve into the workings of Uniswap, its key features, and why it’s become a vital cog in the DeFi machine. Whether you’re a seasoned crypto enthusiast or a newcomer to the digital currency space, this guide will help you understand why Uniswap is making waves in the crypto world.

In the ever-evolving world of cryptocurrencies, Uniswap has emerged as a game-changer. As a cornerstone of the Decentralized Finance (DeFi) revolution, Uniswap is redefining how we trade cryptocurrencies. This open-source protocol, built on the Ethereum blockchain, offers a unique platform where anyone can list and trade tokens, breaking away from the traditional norms of cryptocurrency exchanges.

Uniswap Review: How to Use Uniswap

What is Uniswap?

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. Unlike traditional exchanges, which rely on order books to match buyers and sellers, Uniswap uses an innovative model known as automated liquidity provision.

But what does this mean? Let’s break it down.

In the world of finance, liquidity refers to how easily an asset can be converted into cash without affecting its market price. In the context of a DEX like Uniswap, liquidity is provided by pools of tokens held in smart contracts. These pools are funded by users who deposit an equivalent value of two tokens. In return, they receive liquidity tokens representing their share in the pool.

Uniswap’s automated liquidity provision model allows trades to be executed directly against these liquidity pools. When you want to trade one token for another, Uniswap uses a mathematical formula to determine the trade price based on the relative quantities of the tokens in the pool. This formula ensures that trades do not significantly impact the token prices and that the pool remains balanced even after the trade.

The purpose of Uniswap is to create a decentralized platform where anyone can trade ERC20 tokens directly from their wallets without the need for an intermediary. It also allows anyone to create a new token pair, providing a platform for even the newest and least known tokens.

Uniswap V3

Uniswap V3 is the latest version of the Uniswap protocol, introducing several significant improvements and features designed to enhance capital efficiency and flexibility for liquidity providers.

One of the most innovative features of Uniswap V3 is the concept of Concentrated Liquidity. In previous versions, liquidity providers would deposit their funds into a global pool, spreading liquidity across all possible price ranges. With V3, liquidity providers can specify the price ranges in which their liquidity is used. This means they can concentrate their capital at the price ranges they believe are most likely to be traded, resulting in higher potential returns.

For example, if a liquidity provider believes that the price of a particular token will remain between $100 and $120, they can choose to provide liquidity only within this range. This allows them to make more efficient use of their capital, as it’s more likely to be used in trades.

Another key feature of Uniswap V3 is Multiple Fee Tiers. This allows liquidity providers to be compensated appropriately for taking on varying degrees of risk. In V3, liquidity providers can choose from three different fee tiers per pair — 0.05%, 0.30%, and 1.00% — depending on the expected volatility of the pair. This means that pairs which are expected to be more volatile and, therefore, riskier for liquidity providers will have higher fees.

Uniswap V3 also introduces Improved Price Oracles. The protocol uses the “time-weighted average price” (TWAP) for its price oracle, which has been made more efficient and flexible in V3. This allows for more accurate and up-to-date price information, which is crucial for many DeFi applications.

UniswapX

UniswapX is a new, open-source, and permission-free protocol that facilitates trading across Automated Market Makers (AMMs) and other liquidity sources. It operates on an auction-based system.

UniswapX is in its beta phase and is being gradually rolled out on the Uniswap Labs Web App. It’s available for the Ethereum Mainnet, and plans are in place to expand it to other chains and the Uniswap Wallet in the future.

UniswapX enhances the swapping process in several ways:

- Better Prices: It aggregates liquidity sources to provide more competitive prices.

- Fee-Free Swapping: It eliminates network fees for swapping.

- Protection Against MEV Attacks: It offers protection against Miner Extractable Value (MEV) attacks, including front-running.

- No Fees for Failed Transactions: Users are not charged any network fees if a transaction fails.

- Cross-Chain Swaps: UniswapX plans to introduce gas-free cross-chain swaps in the coming months.

For more information about UniswapX, you can review the code, read the whitepaper, or check out the announcement blog post. Please note that as it’s still in the beta phase, features and functionalities may change or be updated.

Uniswap Pros & Cons

- No Sign-up or KYC

- Wide range of cryptos

- Earn crypto with Pools

- No FIAT payments

- Gas fees can be high

- Complicated for beginners

Features

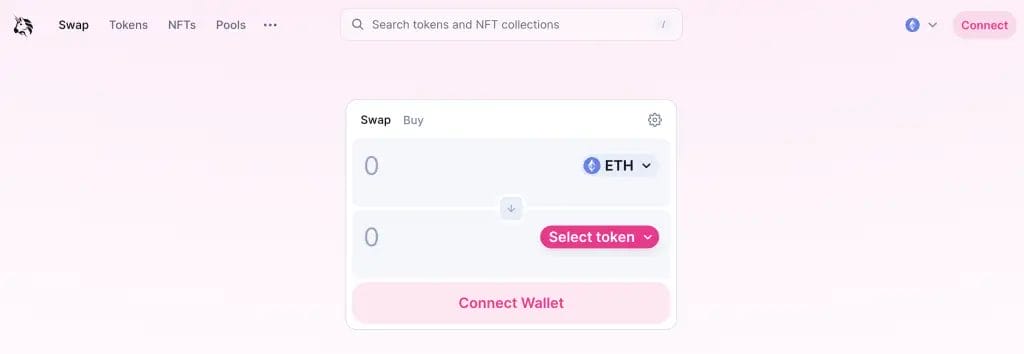

Swap Token

The Uniswap swap feature is a fundamental function of the platform that allows users to exchange one type of cryptocurrency token for another easily. This process, known as “swapping,” is facilitated by liquidity pools, which are collections of tokens deposited by other users.

When you want to swap tokens, you simply select the type of token you have and the token you want to receive, then enter the amount you wish to swap. Uniswap’s automated system takes care of the rest, finding the best available exchange rate for your swap.

This feature is designed to be user-friendly and efficient, offering a wide range of tokens for swapping. It’s an essential tool for anyone looking to trade in the decentralized finance (DeFi) space.

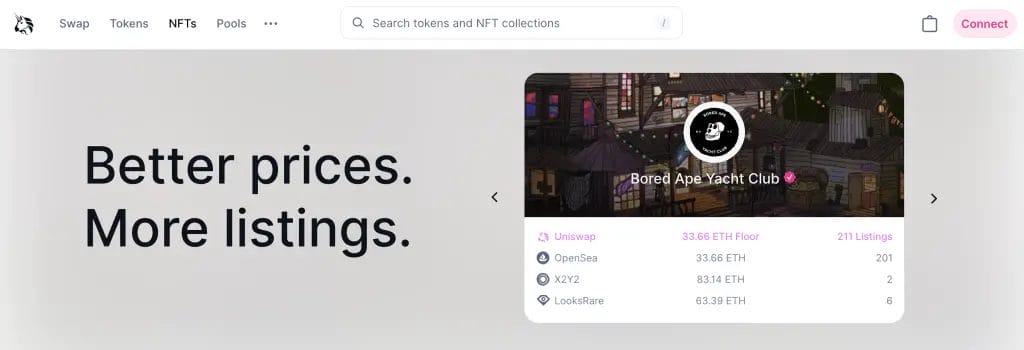

Trade NFTs

Uniswap introduced support for Non-Fungible Tokens (NFTs), allowing users to trade NFTs directly on the platform. This means you can trade your favourite tokens and NFTs together. The NFT marketplace on Uniswap aims to aggregate NFTs from major marketplaces to provide more listings and better prices.

The NFT marketplace on Uniswap supports trading NFTs from various platforms, including LooksRare and OpenSea. If a collection does not appear, it may be part of a marketplace that’s not yet integrated into the Uniswap platform.

In addition to buying and selling, Uniswap also introduced a new kind of NFT with the launch of Uniswap v3. These are Liquidity Provider NFTs, which represent a liquidity provider’s position in a Uniswap v3 pool. Each LP NFT includes information about the pool, the range of prices, and the amount of liquidity provided.

Earn

Uniswap’s “Pools and Earn” feature is a key component of its decentralized exchange platform. It allows users, referred to as liquidity providers, to deposit their tokens into a shared pool. These pooled tokens are then used to facilitate the swapping of tokens by other users on the platform.

As a liquidity provider, you can earn fees from the trades that occur in your pool. Whenever a user swaps tokens in a pool you’ve contributed to, they pay a small fee. This fee is then distributed to all pool liquidity providers, proportional to their share of the total pool.

In addition to earning from fees, some pools also offer “liquidity mining”, where you can earn a token (often the platform’s native token) as a reward for providing liquidity. This can be an additional incentive to contribute to a liquidity pool.

“Pools and Earn” is a way to earn passive income on your crypto assets. However, it’s worth noting that risks are associated with being a liquidity provider, such as asset price volatility and impermanent loss.

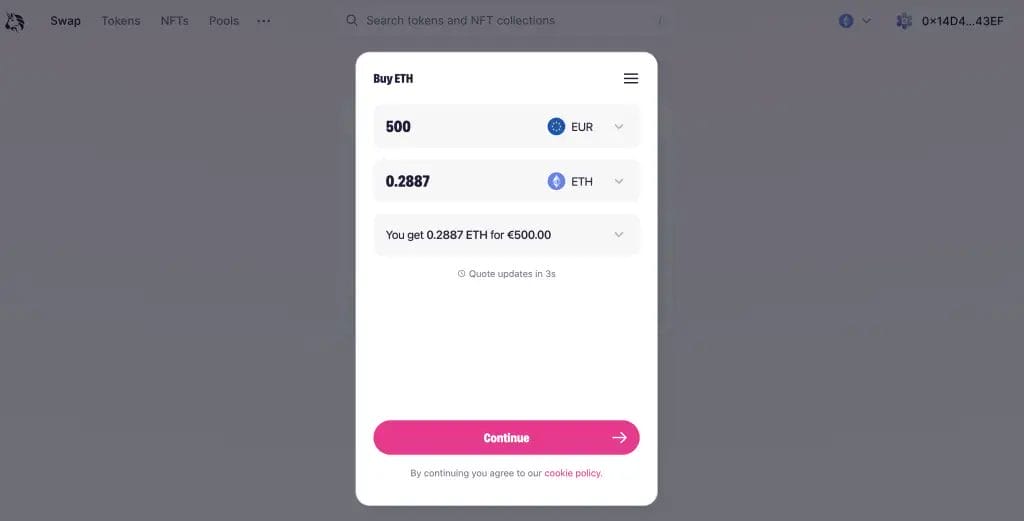

Buy Crypto

Uniswap has introduced a feature that allows users to purchase crypto directly on the Uniswap Web App using a credit card, debit card, or bank transfer. This feature is available in over 160 countries and is facilitated by their partner, MoonPay. The aim is to provide users with the best fiat on-ramp experience, which includes no spread fees on USDC, the lowest processing fees in the market, and instant access to purchased crypto.

To make a purchase, users need to connect their wallet to the Uniswap Web App, click the wallet dropdown, and then they can buy crypto and use it instantly. Major payment methods like cards and bank transfers are supported, although availability may vary depending on the region.

To purchase crypto on Uniswap with a card or bank account, users need to observe MoonPay’s KYC/AML policy. However, Uniswap does not collect or store any financial or personal data. The fees for this service are some of the lowest in the market, with no minimum fee, no spread on USDC, and low spread and processing fees on all supported currencies.

UniSwap Tokens (UNI)

The UNI token is the native governance token of the Uniswap platform. It was introduced in September 2020 as a way to give users a say in the development and operation of the protocol.

The primary purpose of the UNI token is to facilitate community governance. Holders of UNI tokens have the right to vote on proposals that can shape the future of the Uniswap platform. This includes decisions about future development, changes to the protocol, and how the community treasury should be used.

In addition to governance rights, UNI token holders may also benefit from any fees or rewards distributed by the protocol. For instance, a portion of the fees generated by trades on Uniswap could be distributed to UNI holders, although the specifics of such distributions are subject to community governance decisions.

It’s also worth noting that the UNI token is an ERC20 token and can be traded on any exchange that supports ERC20 tokens, including Binance and Coinbase.

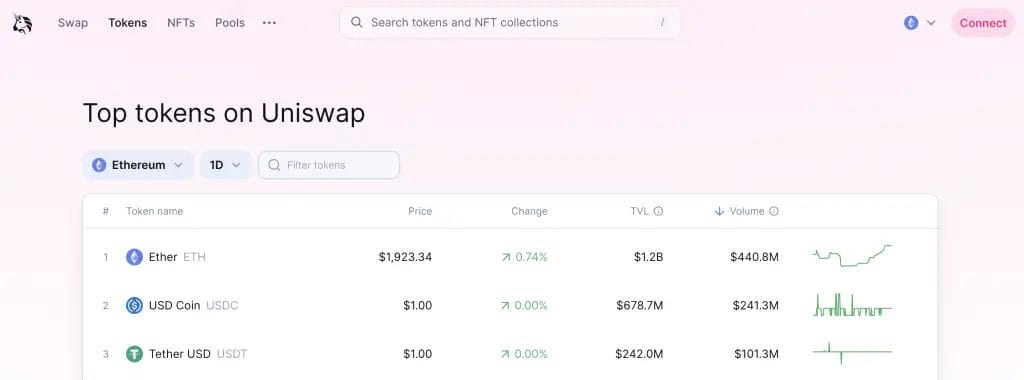

https://files.coinmarketcap.com/static/widget/currency.jsSupported Tokens

Uniswap opens up a world of possibilities by supporting any ERC-20 token within the Ethereum ecosystem. This allows you to seamlessly swap a wide array of popular tokens, including ETH, LINK, and WBTC, as well as stablecoins like DAI and USDT.

With the advent of Uniswap V3, the platform expanded its horizons, enabling trading across multiple networks such as Ethereum, Optimism, Arbitrum, Polygon, and Celo. This multi-network support is a game-changer, saving users significantly on transaction (or gas) fees.

For a comprehensive list of supported tokens on Uniswap, please click here.

UniSwap Token Lists

Uniswap’s Token Lists feature is a community-driven initiative designed to curate and distinguish reputable tokens from potential scams or fake tokens. This innovative feature enhances user trust and safety in the DeFi space.

Token Lists are maintained by various projects within the Ethereum ecosystem. Adhering to a standard JSON schema, these lists are publicly hosted on platforms such as ENS, IPFS, or HTTPS. The projects stake their reputation on these lists by hosting them on a domain they control. For instance, CoinGecko hosts its list on CoinGecko.com, while CoinMarketCap uses an ENS domain it controls.

Supported Networks

Uniswap currently supports the following networks:

In addition to these main networks, the Uniswap interface also supports some testnets. The Uniswap Labs team chooses which networks to support based on their usage, security, and the team’s capacity to maintain them.

It’s important to note that the Uniswap Protocol may be deployed on other chains that may not be supported on the Labs interfaces. These deployments are determined by a vote of the governance community, which operates independently of Uniswap Labs. Uniswap Labs does not participate in these governance votes.

Please note that the networks marked with an asterisk (*) are not currently available in the Uniswap Wallet app.

Uniswap Fees

Another advantage of Uniswap is its low trading fees, currently at 0.3% per trade. Uniswap implements a fee structure primarily aimed at rewarding liquidity providers (LPs).

Users will also need to pay gas (or network) fees for completing their transactions on the network, which will vary depending on the congestion of the network. These fees can be reduced using layer two networks such as Optimism or Arbitrum.

- Liquidity Provider Fees

- For every token swap on Uniswap, a 0.3% fee is applied. Uniswap does not pocket this fee but is instead distributed among liquidity providers proportional to their contribution to the liquidity reserves. The fees are instantly deposited into the liquidity reserves, thereby increasing the value of the liquidity tokens and functioning as a payout to all liquidity providers based on their share of the pool.

- Protocol Fees

- Uniswap does not charge any protocol fees. However, it’s worth noting that there is a provision for a potential 0.05% fee that could be activated in the future. This fee, if implemented, would not affect the fee paid by traders but would impact the amount received by liquidity providers.

Security

Uniswap takes security seriously and has implemented several measures to protect its users and their assets. Being a decentralized protocol built on the Ethereum blockchain, Uniswap inherits the security properties of Ethereum, which is secured by a large network of miners or validators.

Uniswap’s smart contracts have undergone multiple audits by reputable security firms to ensure their safety. These audits aim to identify and fix potential vulnerabilities in the code. However, it’s important to note that no system is entirely immune to risks, and past audits do not guarantee future security.

Regarding past security incidents, Uniswap has not been directly compromised. However, users have been targeted by scams and phishing attacks. For instance, scammers have created fake tokens and listed them on Uniswap in an attempt to trick users into buying worthless assets.

To stay safe when using Uniswap, users should:

- Do thorough research: Before trading a token, ensure it’s legitimate. Check the token contract address and verify it on trusted platforms.

- Beware of phishing attacks: Always double-check the URL to ensure you’re on the official Uniswap site. Be wary of suspicious links or requests for personal information.

- Secure your wallet: Use a secure wallet, keep your private keys safe, and consider using hardware wallets for added security.

- Understand gas fees: High gas fees can sometimes signify a scam token. Always check and understand the gas fees before confirming a transaction.

- Stay updated: Follow Uniswap’s official channels for the latest news and updates. This can help you stay informed about any potential issues or updates.

Remember, while Uniswap has robust security measures in place, the safety of your assets ultimately depends on your actions and vigilance.

Is Uniswap Safe?

Uniswap’s non-custodial nature and absence of order books significantly enhance its security profile. Unlike centralized exchanges, Uniswap doesn’t store or hold any funds, which means the safety of your assets is directly in your hands. Essentially, the security of Uniswap is as robust as the Ethereum blockchain itself and the precautions you take to safeguard your assets.

However, the platform is not immune to the presence of scam projects and counterfeit tokens. Uniswap provides token lists to mitigate this risk and help users identify legitimate projects. Users can search and verify a token’s contract address on Uniswap for added assurance, ensuring they interact with the correct token. By taking these steps, users can navigate Uniswap with confidence and security.

UniSwap Fake Tokens

There seems to be a scam around every corner in the world of crypto, and Uniswap DEX is no exception. Given its open nature, Uniswap permits any ERC20 token to be listed on its platform. This openness, while a strength, can also be a double-edged sword. It means you might encounter tokens that, despite having the correct name, ticker, or logo, are, in fact, counterfeit or scam tokens.

Regrettably, trading for a counterfeit token can lead to a loss of your cryptocurrency. Unlike traditional financial systems, there are no refund mechanisms or regulatory bodies to turn to in such situations. Therefore, it’s crucial to exercise due diligence and verify the authenticity of a token before trading.

Support

Uniswap provides a variety of support channels to assist users with any issues or queries they might have. The first port of call for most users is the Uniswap site’s FAQ section, which answers the most common questions and issues.

If the FAQ section doesn’t provide the answers you’re looking for, Uniswap has a vibrant community on Discord where you can seek further assistance. This platform allows for real-time discussion and problem-solving with other Uniswap users and experts.

In addition to Discord, Uniswap maintains active communities on Twitter, Discourse, and Reddit. These platforms provide additional avenues for support, as well as updates, discussions, and insights into the Uniswap ecosystem.

It’s important to note that while these communities can be incredibly helpful, they are also public forums. Always be cautious about sharing sensitive information and be wary of potential scams or misinformation.

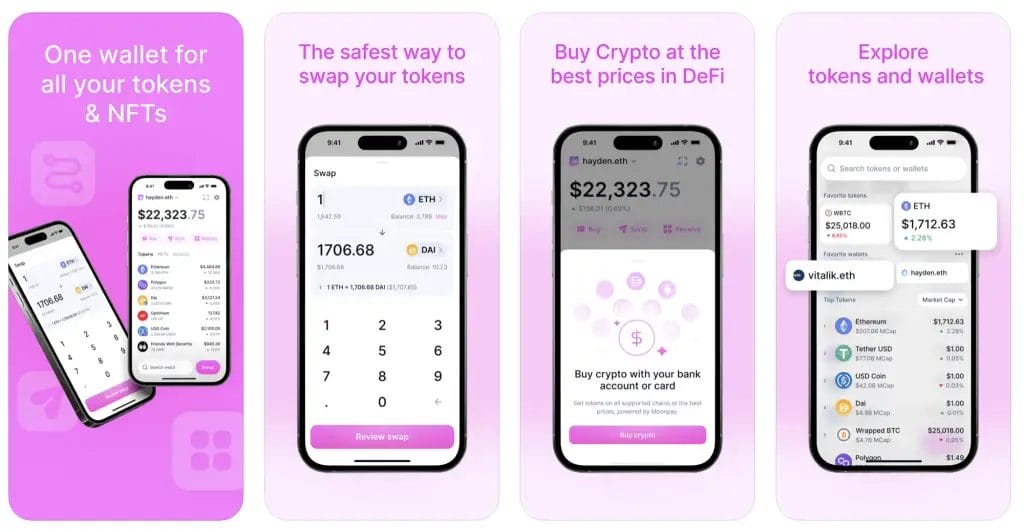

Uniswap Mobile App

Uniswap mobile wallet is available on the iOS App Store. The Uniswap mobile wallet is self-custodial, ensuring a centralised party can’t misuse your crypto. It has undergone a thorough security audit from Trail of Bits, and its code is open-sourced for review. The Uniswap mobile wallet is designed to provide a simple, safe, and secure way to trade tokens on the go.

Uniswap Alternatives

There are several alternatives to Uniswap in the DeFi space, each with its unique features and benefits. Here are some of the top alternatives:

- 1inch: Known as a DeFi aggregator, 1inch sources liquidity from various exchanges and can offer better prices and lower slippage. It operates on multiple chains, including Ethereum, Binance Smart Chain, and Polygon.

- PancakeSwap: This is a popular alternative for those using Binance Smart Chain. PancakeSwap offers similar functionality to Uniswap but with lower transaction fees due to the efficiency of the Binance Smart Chain.

- SushiSwap: Originally a fork of Uniswap, SushiSwap has added additional features such as yield farming and staking. It operates on multiple chains, including Ethereum, Binance Smart Chain, and Polygon.

- KyberSwap: Powered by the Kyber Network, this platform allows users to quickly swap between Ethereum-based crypto assets.

- Balancer: Balancer is an automated portfolio manager and liquidity provider. It allows users to create liquidity pools with multiple tokens and varying weights, which can be used for portfolio management and earning trading fees.

Conclusion

Uniswap is a pioneering force in decentralized finance (DeFi), offering an open-source, permissionless, and highly functional platform. Its unique automated liquidity provision model has revolutionized how trading is conducted in the crypto world, eliminating the need for traditional order books.

Uniswap’s native token, UNI, holds monetary value and empowers its holders with governance rights, allowing them to participate directly in shaping the platform’s future. The platform’s upgrade to Uniswap V3 has introduced innovative features like concentrated liquidity and multiple fee tiers, enhancing capital efficiency and flexibility for liquidity providers.

However, like any financial platform, Uniswap has risks and challenges. Users need to be aware of potential price slippage, impermanent loss, and the presence of counterfeit tokens. While Uniswap has robust security measures in place, the safety of your assets ultimately depends on your actions and vigilance.

In light of these features, benefits, and potential drawbacks, Uniswap is a powerful tool for those interested in DeFi. It offers high control and transparency, making it attractive for users who value decentralization and direct participation in their financial transactions. However, users must thoroughly understand the platform’s workings and risks before diving in.

FAQs

Is Uniswap better than Binance?

Uniswap and Binance serve different purposes and have different strengths. Uniswap is a decentralized exchange that allows anyone to list and trade tokens, while Binance is a centralized exchange that offers a wider range of services, including spot trading, futures trading, and staking. The best platform for you depends on your specific needs and preferences.

How trustworthy is Uniswap?

Uniswap is one of the most well-known and widely used decentralized exchanges in the cryptocurrency space. It’s built on the Ethereum blockchain, which is public and transparent. However, like all DeFi platforms, it’s important to do your research and understand the risks before using it.

What are the risks of Uniswap?

The main risks of using Uniswap include price slippage, impermanent loss, and smart contract vulnerabilities. Price slippage can occur when large trades significantly change the price of a token. Impermanent loss can happen when the price of the tokens you provide as liquidity changes compared to when you deposited them. Lastly, while Uniswap’s smart contracts have been audited, there’s always a risk of bugs or vulnerabilities.

When is Uniswap V4 released?

As of now, there’s no official release date for Uniswap V4. The Uniswap team has released the draft code for V4 and is currently in the process of gathering feedback and making improvements. This is expected to be a months-long process. It’s best to check Uniswap’s official blog or social media channels for the most accurate and up-to-date information.

Can US citizens use Uniswap?

Yes, US citizens can use Uniswap. However, it’s important to note that all users are responsible for complying with local laws and regulations regarding cryptocurrency and DeFi platforms.

2 responses

Comment

395/5000

UniSwap has only been the biggest fraudsters for weeks, take your gas fees, and not so little, but they do not deliver any exchanges for a quarter of the time, just wanted to exchange ETH for tape again after about 30 minutes, I got a message that the Exchange failed, but 5, -USD fees were deducted. Avoid this scam Exchance UniSwap.

I feel your pain, I have $25 worth of transactions fail. I’m not sure its UniSwaps fault, I think it’s down to the congestion on the network. However, I used ZapperFi to do the same transaction and it went through straight away and at a cheaper cost