In this SushiSwap review, we provide an overview of the popular DeFi platform and its controversial background. Plus take a look at their SUSHI token, supported blockchains, fees, features, and the platform’s safety and security.

SushiSwap is a decentralized cryptocurrency platform, that allows users to swap, earn, lend, borrow and leverage all on one decentralized, community-driven platform. Even with its controversial background, SushiSwap is still one of the most popular Defi platforms in the industry.

SushiSwap Review: How to Use SushiSwap?

What is SushiSwap?

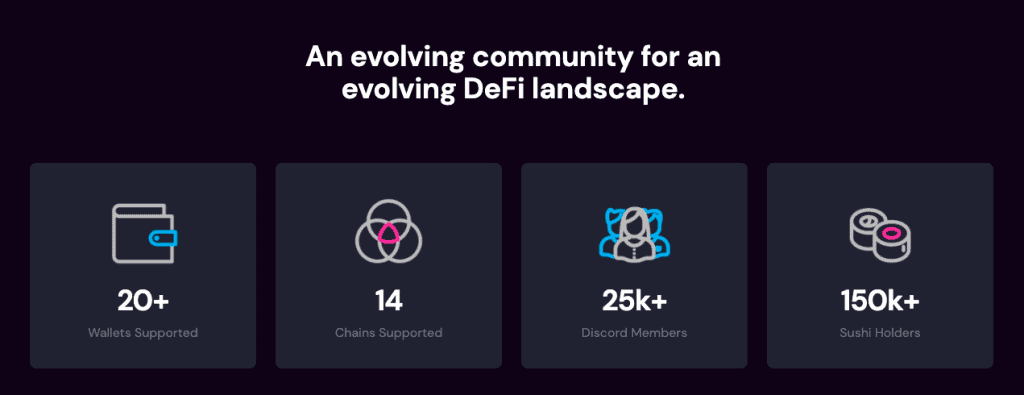

SushiSwap is a fork of UniSwap, one of the most popular decentralized exchanges (DEXes), and therefore has a very similar look and feel to the platform. However, SushiSwap continues to evolve, with over 20 supported wallets and 14 chains including the likes of Ethereum, Binance Smart Chain, and Polygon. Plus there are now more than 150,000 holders of their own SUSHI token.

The decentralized cryptocurrency platform, SushiSwap launched in 2020 and was founded by the entity known as Chef Nomi. Chef Nomi controversially made a sudden departure in September 2020 taking $14 million in Ether with him. He subsequently handed back and transferred ownership of SushiSwap to FTX CEO Sam Bankman-Fried.

SUSHI Token

The SushiSwap token SUSHI is a multi-chain token that is also available on Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche, Xdai, and Fantom.

SUSHI can not only be traded for on their own platform but also on other decentralized exchanges such as UniSwap or PancakeSwap. Or centralized exchanges like Binance, Crypto.com, and FTX.

SushiSwap Sign-up

Because SushiSwap is decentralized and non-custodial, there is no sign-up procedure to follow. Also, there’s no KYC (Know your customer) to complete or any ID checks.

Simply connect up a supported wallet to start using the app.

Supported Wallets

SushiSwap supports a wide range of wallets, including the likes of Metamask, WalletConnect (for those using the likes of Binance’s Trust Wallet), the Coinbase Wallet, Formatic, etc.

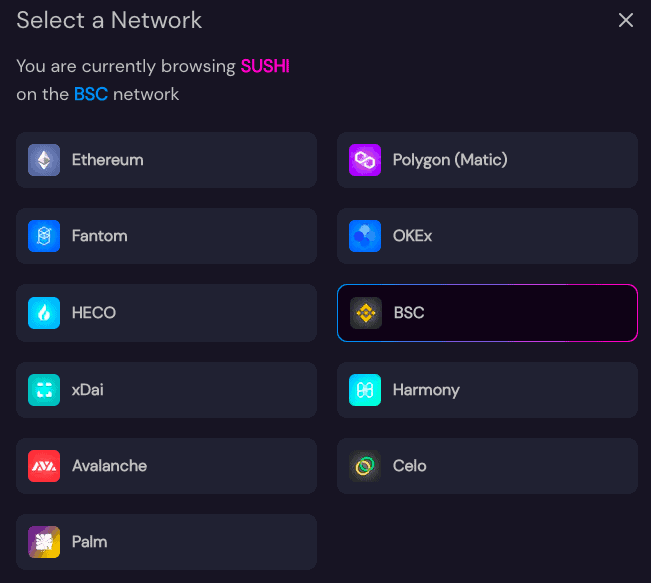

When you connect your wallet, the network will automatically detect it. Sushiswap can connect to a whole host of different chains or networks which could potentially save you on transaction fees as at the time of writing this SushiSwap review, Ethereum fees are currently high.

If you’re not too sure how to connect Metamask to the Binance Smart Chain or how to connect Metamask to the Polygon network, check out the links for our step-by-step guides.

Supported Blockchains

SushiSwap supports a whole host of tokens across the 14 different chains or networks. Which include Ethereum based or ERC20 tokens, Binance Smart Chain BEP20 tokens, and MATIC tokens.

SushiSwap Fees

When swapping with SushiSwap, users pay a fee of 0.3%. Plus users will also need to pay transaction fees for approving and interacting with the connected network. These fees will depend on the network. For example, at the time of writing this SushiSwap review, the fees with Ethereum are quite high.

How to Earn with SushiSwap

There are 4 different ways that you can earn rewards with SushiSwap;

- Providing Liquidity

- Farming

- Staking SUSHI

- Lending

Providing Liquidity

By providing liquidity you can earn 0.25% of all trade on the pair that you add to the pool. You can claim these rewards when you withdraw later.

To be a liquidity provider you will be adding an equal share of 2 different tokens and in return, you receive SushiSwap liquidity provider (SLP) tokens that represent your share of the pooled liquidity for that token pair. Depending on the pool and the network you are connected to, you may be able to stake your SLP tokens in a farm.

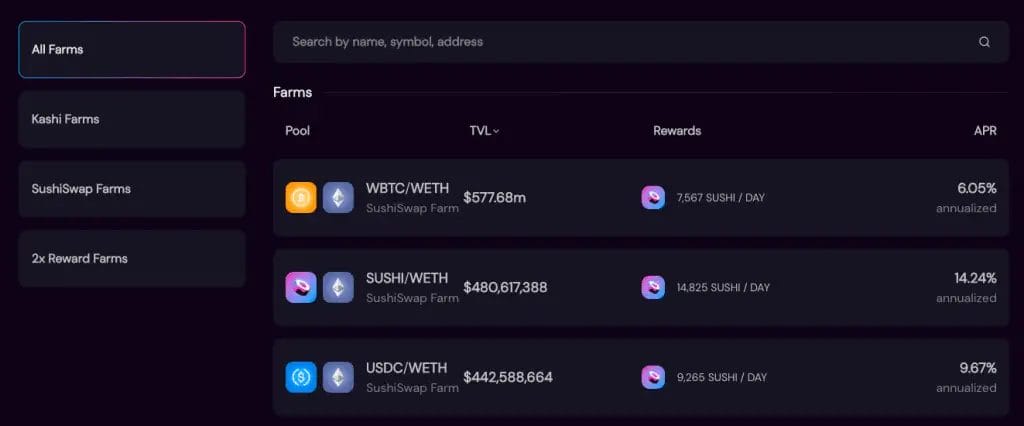

Yield Farming

Depending on the network that you are connecting to, you can sometimes stake your SushiSwap Liquidity Provider (SLP) tokens, with varying amounts of annual interest and SUSHI you can earn per day. These will depend on the pair, the farm, and the risks.

For example, where rates are high, this could be because the Total Value Locked (TVL) rate is low. Therefore it’s worth checking out the available farms and doing an element of risk management before just going for the farm with the highest APYs.

With some farms such as Polygon, you can earn double the rewards. In fact, at the time of writing this SushiSwap Review, you can currently earn both SUSHI and MATIC.

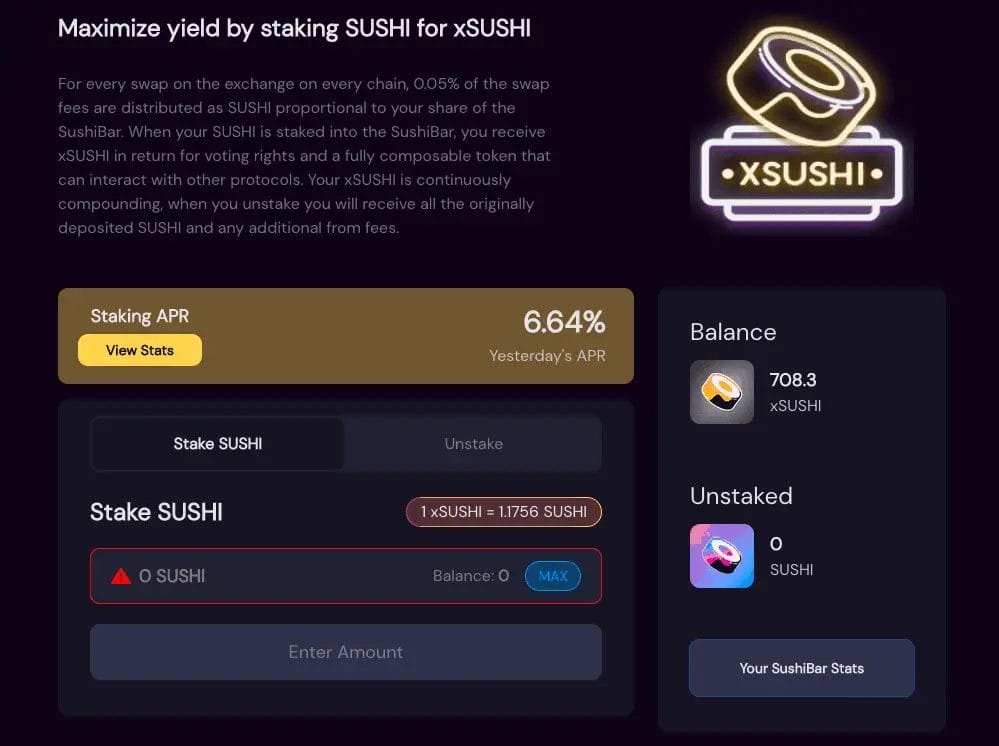

Staking

Another way of earning interest is by simply staking your SUSHI for xSUSHI. For every swap on the exchange, 0.05% of the fees are distributed as SUSHI (proportional to your share of the SushiBar). When you stake your SUSHI you receive xSUSHI in return, Which can be used for voting.

The xSUSHI is continuously compounding. When you unstake you will receive all the originally deposited SUSHI plus any additional fees.

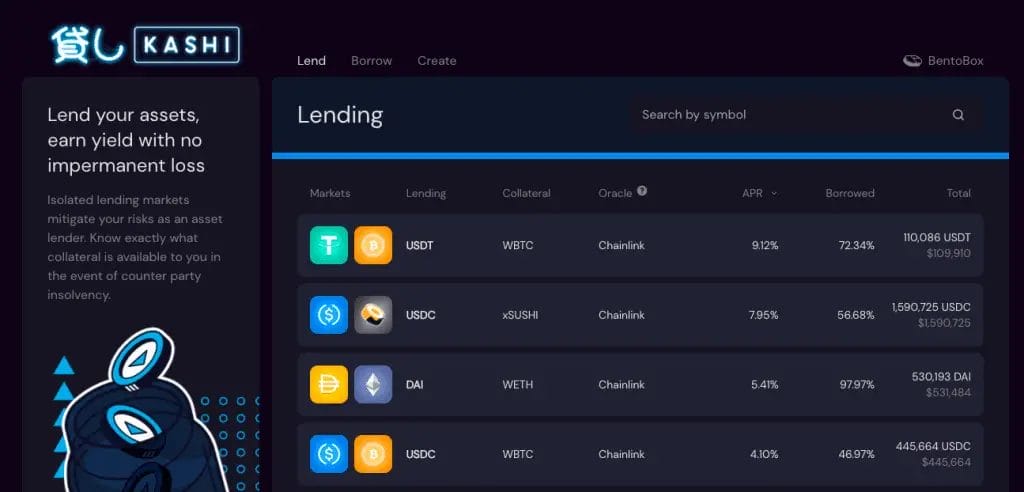

Lending

With lending, you can lend your assets with no risk of impermanent loss by using “isolated lending markets“. In other words, if you have assets that you want to earn interest on, you can lend them and earn interest from borrowers.

You can currently lend the likes of USDC at a rate of 9.93% without having to enter a pool or stake SLP tokens.

Support

Due to its decentralized nature, there is not one dedicated in-house support team available to answer support queries. However, there is a community-run documentation site that can be used for assistance with the SushiSwap site.