This guide will explain how to bridge MATIC tokens from Ethereum to the Polygon Network. Plus, how to stake MATIC tokens to earn rewards.

The Polygon Wallet is a non-custodial web wallet that allows users to interact with the Polygon Network. However, the wallet is not only used to store your MATIC tokens.

Let’s dive into this Polygon tutorial and find out How to Bridge & Stake MATIC Tokens with Polygon Wallet.

How to Bridge MATIC Tokens to the Polygon Network

The Polygon Bridge can move your tokens from the Ethereum Network to the Polygon or vice versa.

If you’re using the wallet to bridge Ethereum to Polygon, you must set up Polygon within Metamask. You can check out our step-by-step guide on how to add Polygon Network within Metamask.

The steps outlined in the below guides will explain how to bridge MATIC tokens from Polygon Network across to Ethereum. We will also explain how to reverse this and bridge Ethereum to the Polygon Network. Both processes are similar; however, the time it takes for the tokens to cross will differ. So, let’s get started;

How to Bridge MATIC to Ethereum?

- Connect your supported wallet on the “Polygon Network“

- Go to “Apps” and choose “Polygon Bridge“

- Select the Polygon token you would like to Bridge

- Enter the amount and choose “Transfer“

- Read the “Important Notice” and “Continue“

- “Continue” again at the transfer overview screen

- You must then pay a gas fee for the transaction and “Confirm” in your connected wallet.

Once the transaction has been submitted, just be aware that it might take 45 minutes to 1hr to reflect in your wallet. For those using the Plasma Bridge, this can take seven days.

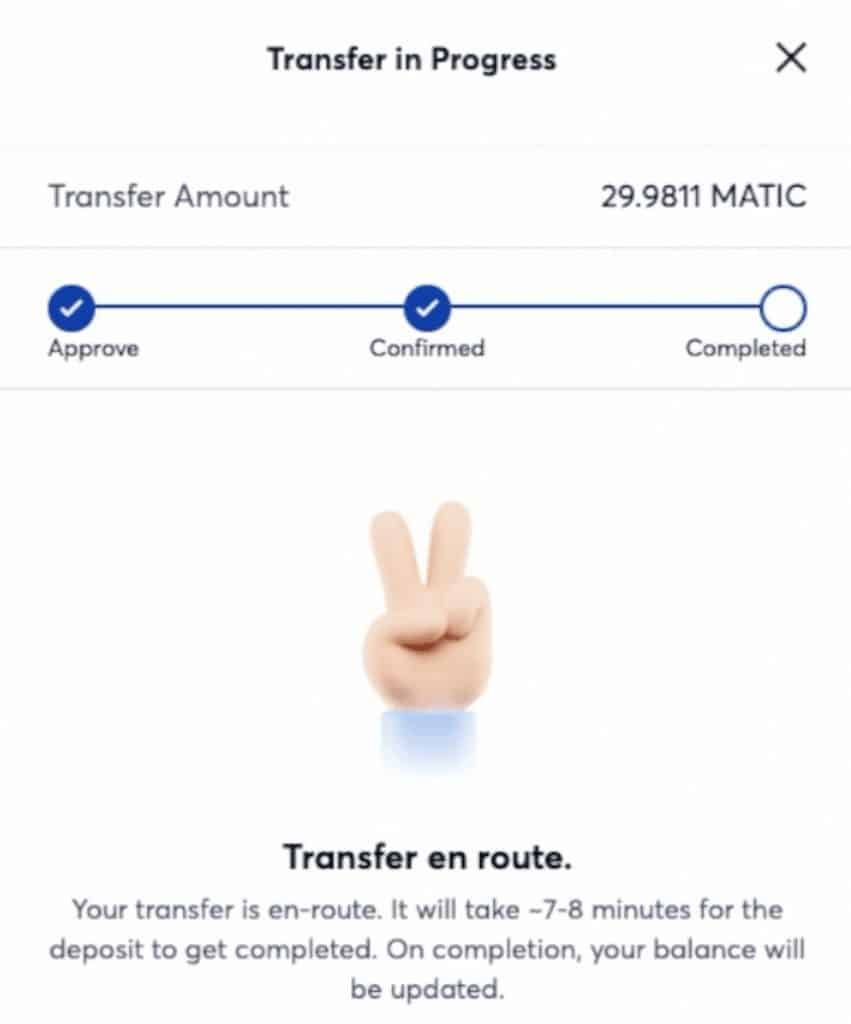

How to Bridge Ethereum to Polygon Network?

- Connect your supported wallet on the Ethereum network.

- Go to “Apps” and choose “Polygon Bridge“

- Select the Ethereum token you would like to Bridge

- Enter the amount and choose “Transfer“

- Read the “Important Notice” and “Continue“

- “Continue” again at the transfer overview screen

- You must then pay a gas fee for the transaction and “Confirm” in your connected wallet.

Once the transaction has been completed, just be aware that it might take 7-8 minutes to reflect in your wallet.

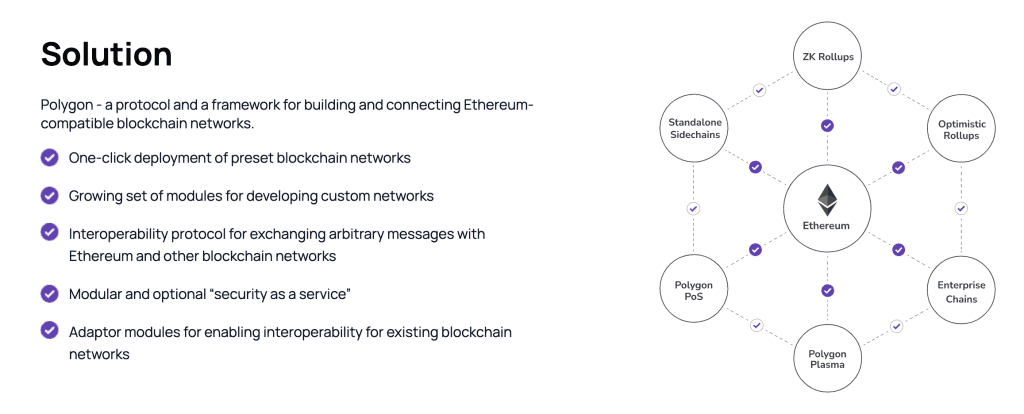

What is Polygon?

Polygon is a cutting-edge protocol designed to enhance the Ethereum ecosystem by building and connecting Ethereum-compatible blockchain networks. Its core mission is to address some of the prevalent challenges traditional blockchains face, like high transaction fees and slow processing times, while maintaining top-notch security.

Drawing parallels with other blockchain ecosystems such as Polkadot, Cosmos, and Avalanche, Polygon distinguishes itself with its unique architecture that is more open and fully leverages Ethereum’s established network effects. This approach improves scalability and cost-effectiveness and ensures that Polygon remains a secure and integral part of the Ethereum landscape.

The appeal of Polygon is evident in its growing popularity among decentralized applications (Dapps). Thanks to its lower transaction costs and quicker block times, major Dapps like Aave, 0x, and SushiSwap have adopted Polygon, significantly enhancing user experience and fostering wider adoption.

What are MATIC Tokens?

MATIC tokens are the backbone of the Polygon Network, serving multiple vital roles to ensure the network’s smooth operation. Just as Ethereum uses ETH for transaction fees, the Polygon Network relies on MATIC tokens to pay transaction costs. MATIC tokens are also essential for the network’s governance and staking processes, enabling users to contribute to the network’s security and decision-making.

Originating on the Ethereum blockchain, MATIC tokens bridge two major ecosystems. If you’ve acquired MATIC on the Ethereum network but wish to engage with applications on Polygon, you’ll need to use a bridge to transfer your tokens to the Polygon network.

Where Can I Buy Polygon MATIC Tokens?

If you don’t already have some MATIC tokens, you can trade for these on centralized exchanges such as the Binance Exchange or OKX. Both have some of the lowest trading fees and widest ranges of tokens available.

Alternatively, you can use decentralized exchanges such as Uniswap to swap for MATIC tokens.

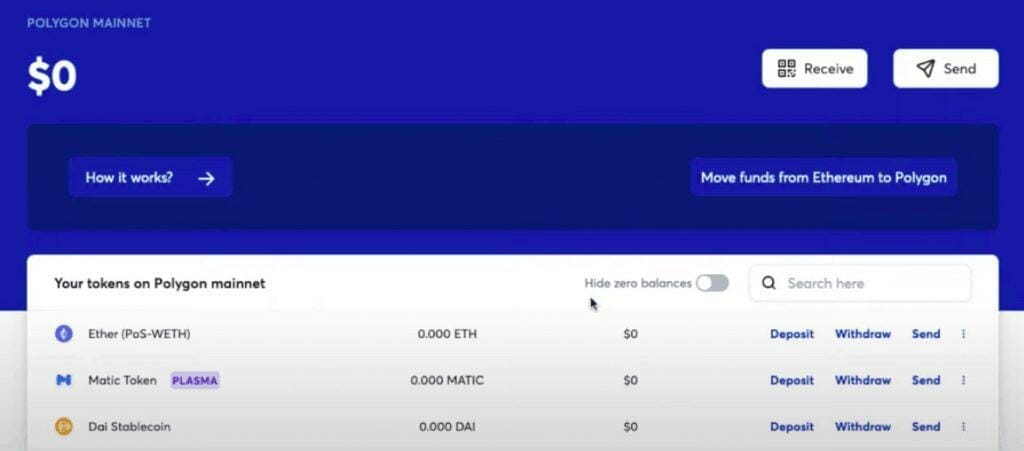

What is the Polygon Wallet?

The Polygon Wallet V2 is a user-friendly, secure way to manage your digital assets on the Polygon network. It’s a non-custodial wallet, which means you’re in full control of your funds without any intermediary.

Designed for seamless integration, it allows connections with popular wallets like MetaMask and WalletConnect right from your browser. With the Polygon Wallet, you can easily send and receive MATIC tokens, bridge your assets between Ethereum and Polygon to enjoy the benefits of both platforms and even stake your MATIC tokens to earn rewards.

Polygon Wallet V2 offers a comprehensive solution for managing your digital assets, bridging networks, and contributing to the Polygon ecosystem through staking.

Polygon MATIC Staking

To stake your Polygon MATIC tokens within the Polygon Wallet, you must ensure that your tokens are on the Ethereum network. If they are not already on the Ethereum network, you can use their bridge to transfer them (see below).

You can stake your tokens in two ways, either as a validator or a delegator. Becoming a validator involves setting up a node, but delegating simplifies the process.

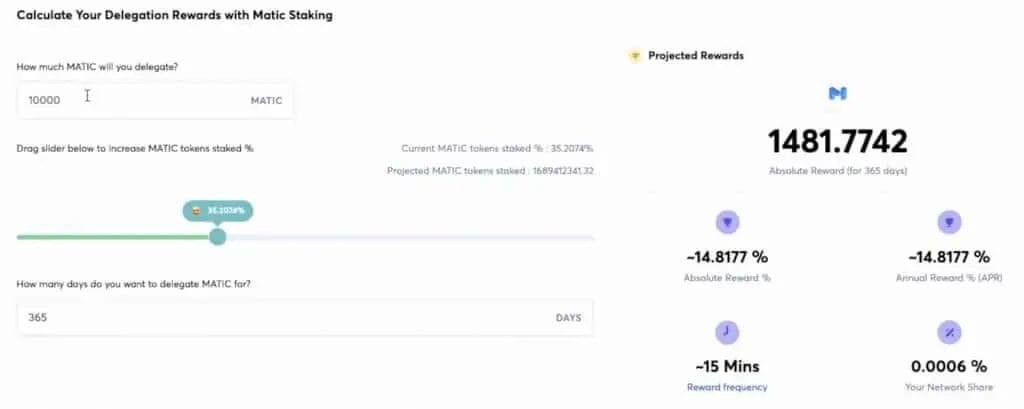

You can use the “Reward Calculator” on their site to get an idea of your projected rewards, and this will change depending on the number of tokens you delegate and the number of days you stake for.

There’s a total of 100 validators that you can currently choose from, and you can sort by their performance, the commission they take, their stake or random. It’s worth doing your research here to which validator you choose.

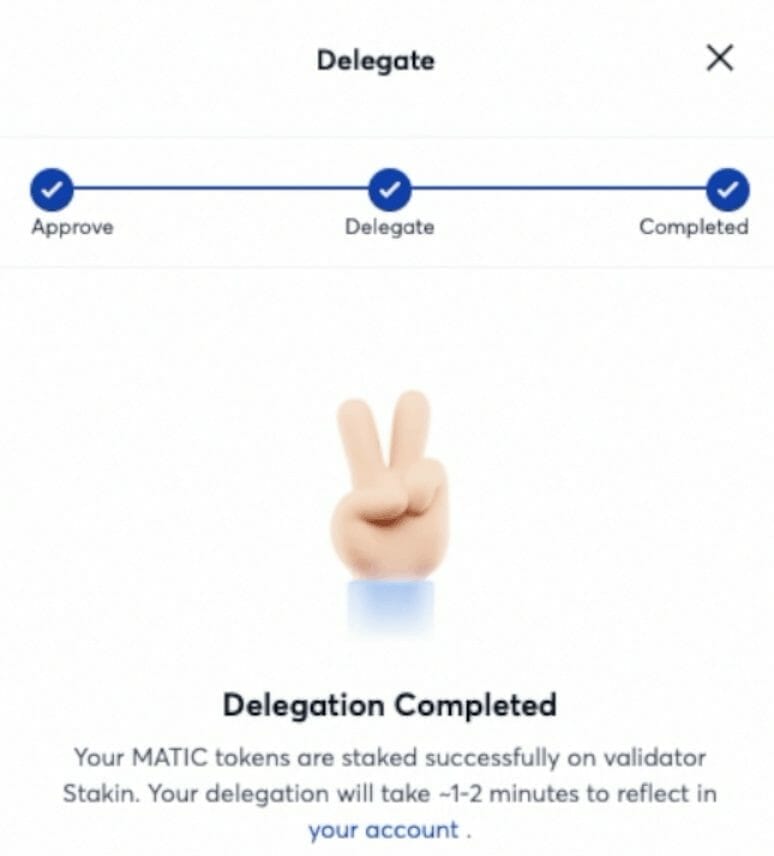

How to Stake MATIC tokens with Polygon Wallet V2

- Connect your supported wallet (MATIC tokens on the Ethereum network)

- Go to “Apps“

- Choose “Staking“

- Choose your validator from the list and click “Delegate“

- Enter the amount of MATIC tokens you’d like to stake or click on “Max“

- Click “Continue“

- You must then pay a gas fee for the approval transaction and “Confirm” in your connected wallet.

- Then, pay another gas fee to “Delegate” and “Confirm” in your connected wallet.

Once the transaction has been confirmed, just be aware that it might take a few minutes to reflect and appear under “my account”.

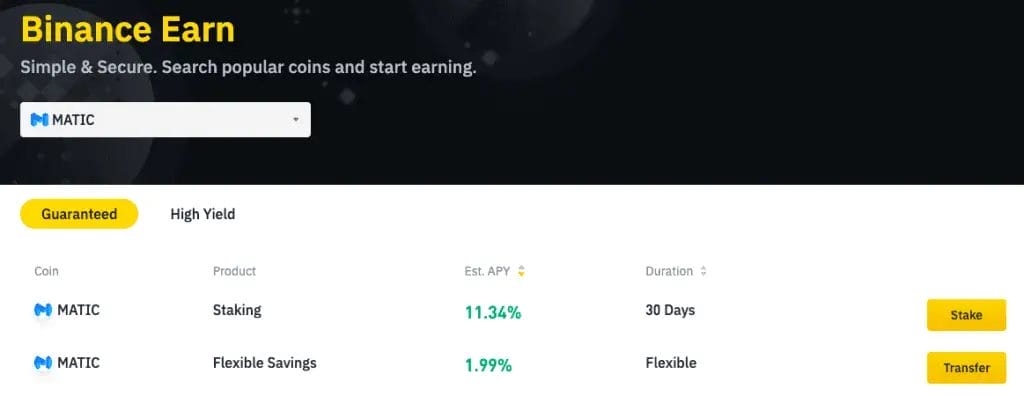

Other Ways to Stake your MATIC Tokens

Because staking with the Polygon Wallet is on Ethereum, you are governed by the gas fees (regarding how much profit you’ll get). With a return of 14%, if you take into account the fees, it may not work out profitable for you.

However, if you’re not too worried about whether your staking is centralized or decentralized, you can also find staking options like Binance. You can get around 11% in a fixed savings account or about 2% on a flexible term.