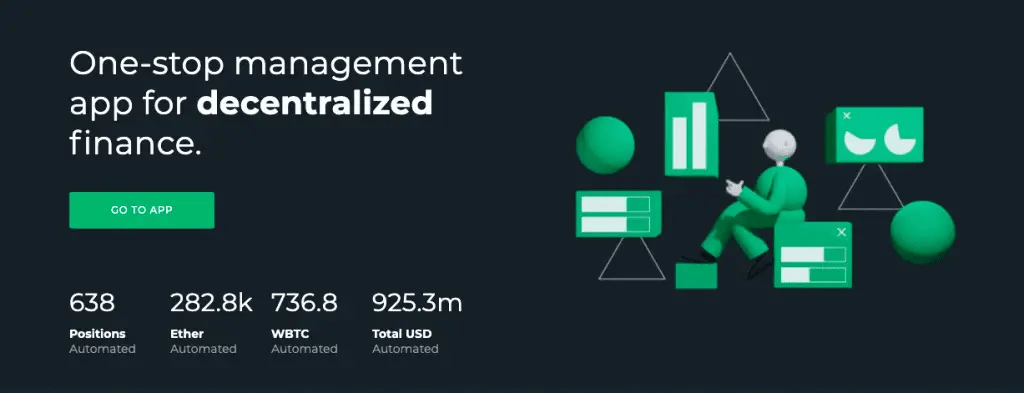

In this DeFi Saver review, we’ll take a look at the all-in-one management app for decentralized finance. We explain what DeFi Saver is, its features and its fees. Plus, how to manage leverage, convert positions, and earn all within the app.

DeFi Saver is an advanced all-in-one DeFi app, allowing users to manage their assets across multiple protocols. Providing easy-to-use dashboards for creating and managing leveraged or yield farming positions. The platform also includes unique automated asset management and liquidation protection features.

So, let’s jump into this DeFi Saver review to help you work out if DeFi Saver is the right DeFi management platform for you.

DeFi Saver Review: How to use DeFi Saver?

What is DeFi Saver?

DeFi Saver is an all-in-one management app for decentralized finance. Supporting the most trusted Ethereum-based protocols, including the likes of Maker, Compound, Aave, Liquidity, Reflexer and many more. They have also recently launched on Layer 2’s Arbitrum and Optimism, bringing DeFi Saver to Aave v3 with drastically lower transaction fees, making their product a lot more accessible to everyday users.

Launched in 2019, the protocol was originally named CDP saver and has since expanded its services to other protocols and added additional tools and solutions. DeFi Saver allows users to easily manage their DeFi portfolio with advanced features that are made simple.

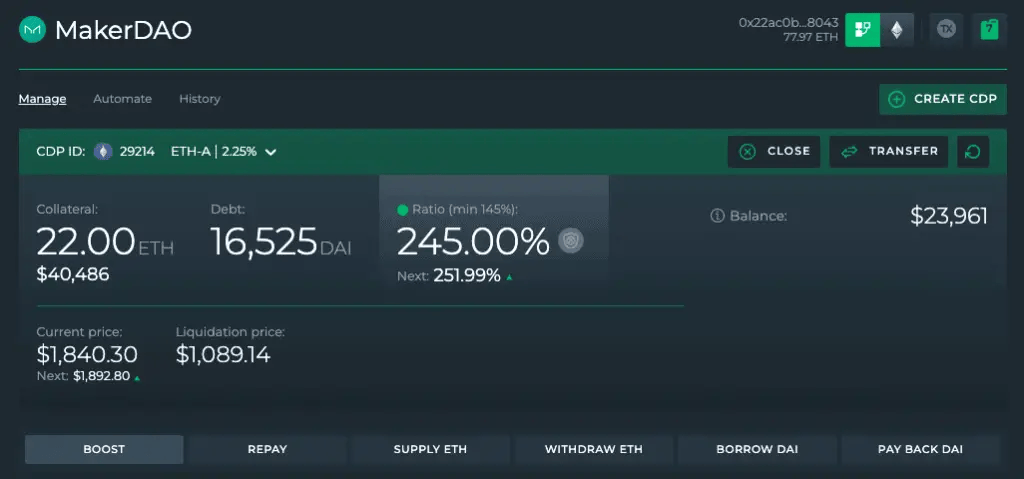

The Defi app is best known for its leverage management tools. Users can manage leverage positions, increasing or paying back debt within just one transaction. On Layer 2’s, this is now possible with a minimum debt requirement of only $500. You can also loan shift and use refinancing tools to move your positions to a completely different protocol or change your collateral or debt asset.

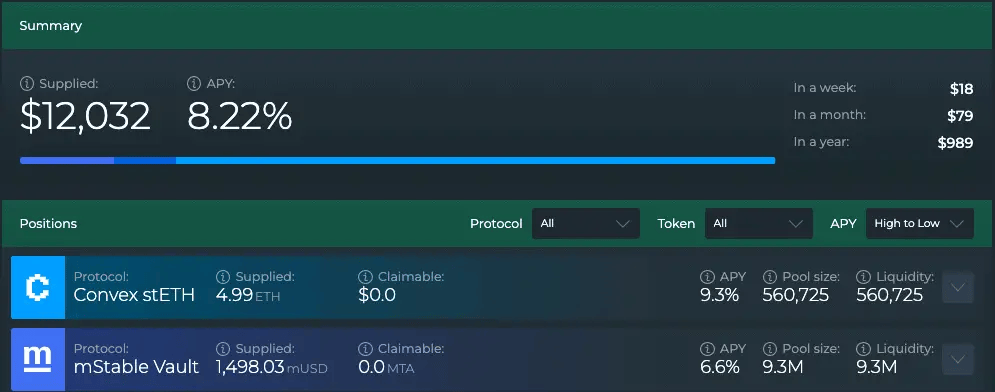

There’s a Smart Savings dashboard, where you can earn interest on your deposited assets. Plus, users can find the best rates across multiple protocols and simply move their position from 1 protocol to another with a single click.

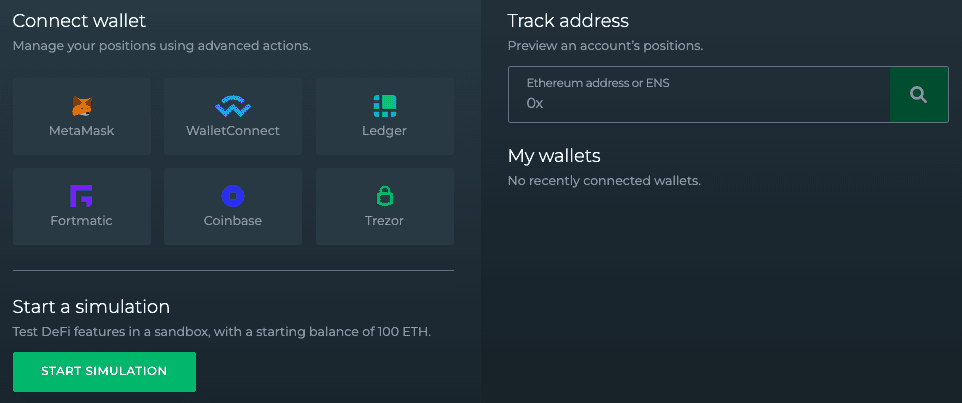

DeFi Saver Supported Wallets

With DeFi Saver, you can connect to a whole host of Web3 wallets, including the likes of MetaMask, Ledger, Trezor, Argent, and Trust Wallet. Users can also connect to any wallet app that supports WalletConnect.

DeFi Saver Features

DeFi Saver has an array of features to simplify the management of your positions. Including ways to swap or bridge your tokens, earn from yield farming, create complex transactions with multiple actions and try out the DeFi Saver features without having to spend any money on transaction (or gas) fees.

DeFi Saver continues to innovate and add more features to its platform, we have covered some of these below;

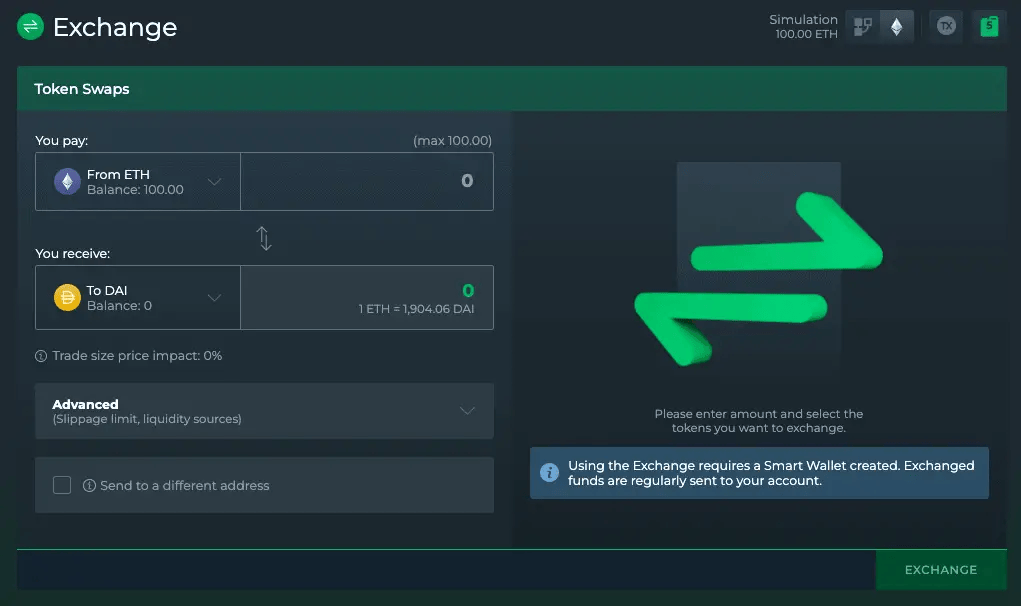

DeFi Saver Exchange

The DeFi Saver Exchange feature built into DeFi Saver can be used for trading crypto tokens. DeFi Saver will find the best prices sourced across multiple exchanges.

Plus, you can copy the token address and quickly swap and send your tokens.

Smart Savings

DeFi Smart Savings is a lending dashboard that supports several protocols allowing users to quickly move their funds between protocols with a single click.

At the time of this DeFi Saver review, Smart Savings integrates with mStable, Yearn, and Convex. This is all managed from a single dashboard. Enabling users to track their rates across these applications and move them for more favourable rates with one transaction.

Smart Wallet

The DeFi Saver Smart Wallet is a smart contract wallet with no limitations regarding how complex transactions you can run on it. It’s used so you can use advanced features such as Boost, Repay, Automation and any other complex, multi-step actions on your DeFi positions.

If you’ve already created a smart wallet to manage your Compound or Aave positions, you’ll already have one associated with your account, and DeFi Saver will use the same one. If not, you will be prompted to create one. Please note that you will need to pay a gas fee for the smart wallet’s creation.

Recipe Creator

DeFi Recipe Creator is a newer feature of the protocol. Allowing users to create complex transactions which include multiple actions. With the idea to make flash loans and DeFi Legos available to all, even those with less technical backgrounds.

For those less technical, Recipe Creator can be used by users to tell the interface what they want and let the app prepare their recipe with natural language processing. For example, a user could state that they want to “borrow 100 Dai from Aave v2, sell DAI for UNI”, and the app will create it.

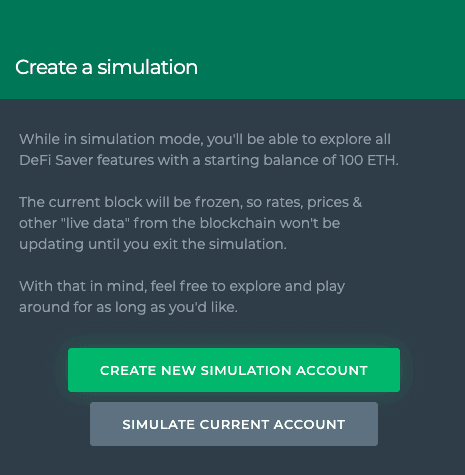

Simulation Mode

DeFi Saver has a “Simulation Mode” also built into their platform. Allowing users a way to test out DeFi protocols without having to set up an account or spend anything in transaction costs. With Simulation Mode, you’ll be provided with an account holding 100 ETH and appearing like it’s running on the Ethereum, Optimism or Arbitrum Network.

DeFi Saver takes a copy of the Ethereum network when Simulation starts, and all your transactions go onto that copy. The only tasks you cannot perform will be Automation for any positions you’ve created, and you won’t be able to view your Maker CDP history or Profit.

There are no fees to pay for the simulation mode, plus it has no expiry. Just be aware that the prices and stats will be outdated as these are frozen at the start of the simulation.

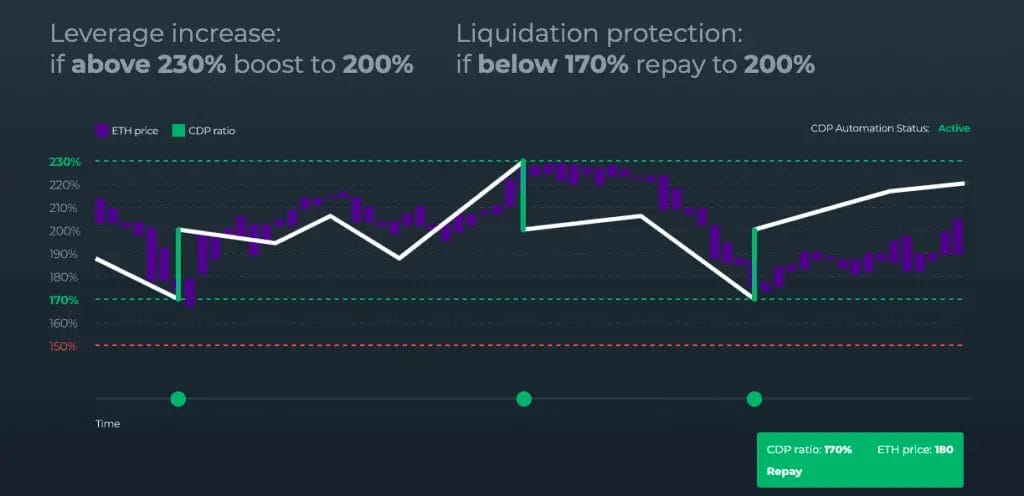

Automation

DeFi Saver Automation is an automated management system for collateralized debt positions (CDPs). Based on the settings that a user configures, it increases or decreases leverage as the price of an underlying collateral asset changes. This is a great feature to have onboard as it essentially provides automatic leveraging and liquidation protection.

This is now also available on Layer 2 networks, meaning you can rely on liquidation protection and auto leveraging for anything over $500, with up to 20x lower transaction fees compared to the mainnet.

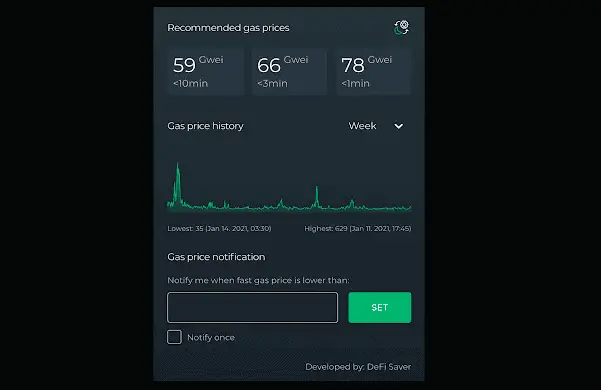

DeFi Saver Gas Prices Extension

You can track and get notified when fees are low using the DeFi Saver Gas Extension. Available as a browser extension for both Chrome and Firefox, users can set alerts adding an option of selecting cheap, standard or fast gas for tracking.

DeFi Saver Fees

In terms of fees, DeFi Saver does include service fees for their more advanced features. These include;

MakerDAO, Aave, Liquity, Compound and Reflexer Dashboards;

- 0.25% service fee for Boost, Repay, Creating and Closing Leveraged Positions

- 0.25% service fee for Automation Adjustments (for any swaps happening), and an additional 0.05% automation fee

There are currently no service fees for adding or withdrawing collateral or borrowing or paying back debt.

Loan Shifter:

- 0.25% fee for Collateral and Debt Shifts

Recipe Creator:

- 0.25% service fee

- 0.09% fee for Aave flash loan actions in the Recipe Creator

DeFi Saver Exchange:

- Crypto token swaps have no service fees

Smart Savings:

- 0.25% service fee for any advanced “Claim + Resupply” options.

DeFi Saver Support

If you have a query or need support, DeFi Saver has an extensive knowledge base that should answer the majority of your queries. If you can’t find the answer, you are looking for within these articles, you can also contact them via live chat, which is available on the Defi Saver website.

Verdict: Should you use DeFi Saver?

DeFi Saver is a great tool and makes interacting and investing in DeFi DApps very simple. Using DeFi Saver across different networks will also save you on transaction fees. However, DeFi Saver is an advanced DeFi tool and not for crypto novices; some of the trading features available are complex and should not be used without understanding the risks involved.

We hope you found this DeFi Saver review useful; if you have already tried DeFi Saver, let us know what you think in the comments below. Or click here to start using DeFi Saver for yourself.