In this Wise Review, we’ll delve into the high-street bank alternative, looking at its features, fees, pros, and cons. Giving you a comprehensive understanding of the banking platform.

“Wise, formerly known as TransferWise, has become a popular choice for international money transfers and investment options. But how does it stack up against its competitors in 2023? From cost-saving transfer options to stock investment opportunities, Wise offers a range of services to meet your financial needs. Read on for our in-depth Wise analysis and expert evaluation.”

Wise Review: How to use Wise

What is Wise?

Wise is a money transfer platform allowing users to send, receive, and spend internationally. With Wise, you can send money abroad, get paid in other currencies, and spend abroad using your debit Mastercard.

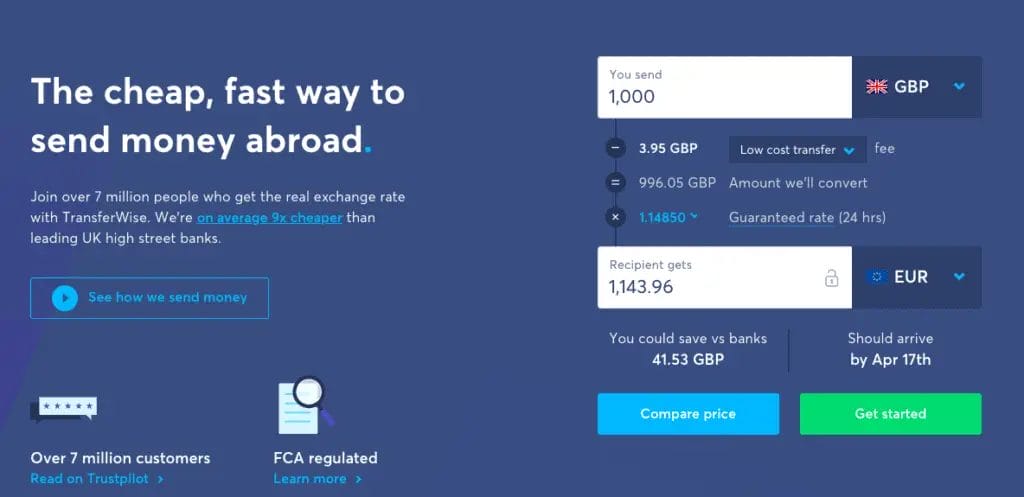

When exchanging your funds, it’s at the real Interbank rate, and they state that they are nine times cheaper than the UK high street banks with no hidden fees or sneaky charges on top like you find with most banks. The rate you see is like the rate you’ll find on Google.

With Wise, people can send you local money directly to your account. You can create local accounts with a click of a button for up to 5 accounts, such as US Dollars, Aus Dollars, EUR or GBP. And all at zero fees.

The company launched in 2011, and with the help of investors such as Richard Branson and Paypal founds Max Levchin and Peter Thiel, it now has over 7 million customers, moving 4 million dollars every month.

Wise Pros & Cons

- Convenient and easy to use, accessible from a mobile device

- Automated savings and budget tracking features

- Encourages wise spending habits and financial discipline

- Offers insights and advice to improve financial health

- Secure, with bank-level encryption to protect personal information and transactions

- May have limited functionality compared to a traditional bank account

- Fees and charges may apply, such as overdraft fees or account maintenance fees

- Limited access to physical bank branches or ATMs

- Dependent on stable internet connection and device compatibility

- Customer service and support may be limited compared to traditional banking options

Borderless Accounts

A foreign currency account allows you to send money worldwide, avoiding pricey exchange rates set by banks. You can get paid with your bank details by creating a foreign currency account. You can receive free money with your own US, UK, EU, Poland, Australia, and New Zealand bank details.

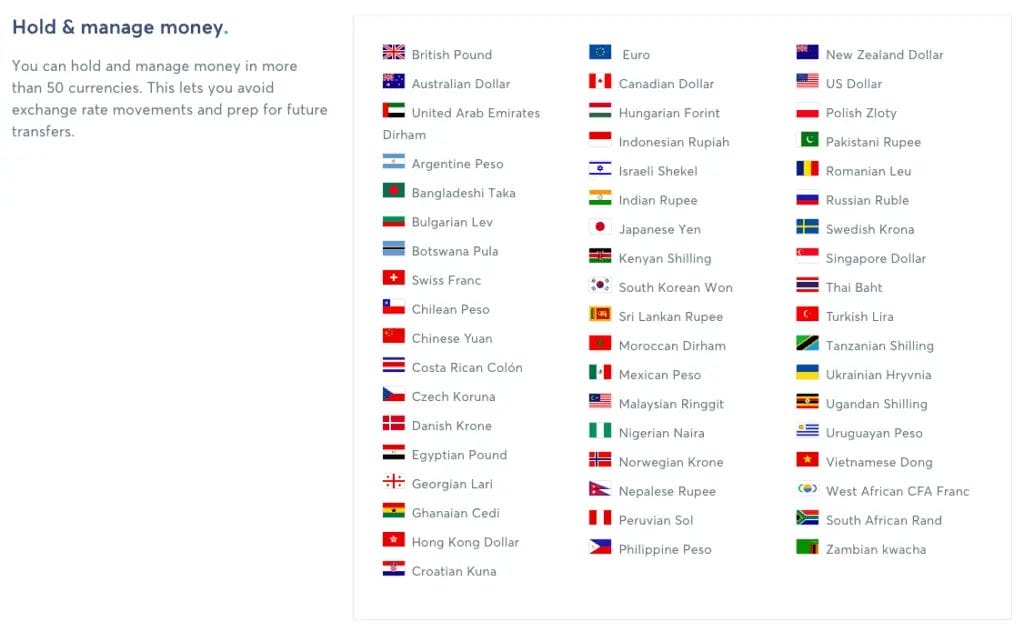

This could be great for freelancers working multi-nationally or ex-pats needing to send money back to their home countries. You can also hold more than 50 currencies at once and can convert between them in seconds.

Wise Supported Currencies

Wise supports more than 50 different currencies, allowing users to send to any of the currencies on Wise. Further down in this Wise review, I provide a step-by-step guide to exchanging your currencies within the platform.

Wise Debit Card

With the Wise Debit Card, you can pay in any currency, anywhere. It will simply take the funds from your account. Or if you don’t have enough of the right currency, it’ll automatically convert the balance with the lowest fee. The card has 30-day cash withdrawal limits, depending on your location and you will be charged 2% for anything over this limit.

The Mastercard debit card is currently available for users with a multi-currency account in the UK, Switzerland, Australia, New Zealand, Singapore, and most of the EEA, and people with a multi-currency account in the US. You can also use your Wise card with Apple Pay.

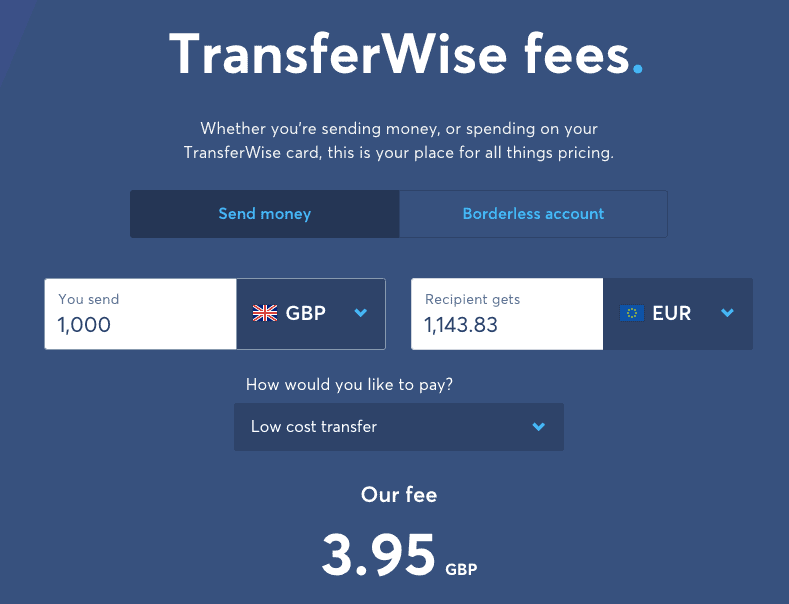

Wise Fees

The fees you will pay with Wise will vary depending on what you are doing. Because of the variables, this can be complicated. However, Wise fees are transparent and shown upfront, so there are no nasty surprises. And you can calculate how much you will pay on their website using their Fee Calculator.

There are fixed fees for the following;

- To send money (which varies by currency),

- Convert currencies

- Add money to your account

- Convert a currency using your card

- ATM withdrawals of over £200/per month

You can select from 3 different types of money transfers; “Low-Cost Transfer”, “Fast and Easy Transfer”, or “Advanced Transfer”.

Is Wise Safe?

Although Wise is not a bank, in the UK, Wise is fully regulated by the Financial Conduct Authority (FCA). Under FCA regulations, Wise holds all customer funds separately from the money used for the everyday running of the business.

Although every country is different, you can check out how it’s regulated in each country here.

They also use HTTPS encryption and a 2-step login to protect all your transactions and ensure your communications with them are secure. They state that they never misuse or sell your data. And have real-live people who watch over every transaction and confirm every customer’s identity.

How to use Wise Bank Account

To sign up for an account, simply click on this link (and you’ll also get a free international transfer of up to £500). You’ll need to enter your email address and create a password and country of residence. And you’ll also need to confirm your email address.

https://transferwise-creative.prf.hn/creative/camref:1100l9JER/creativeref:1100l34228How to Open a Wise Account?

To be able to get all the benefits of a Wise account, the first thing you’ll need to do is “Get Started” or “Open a Balance”.

If you haven’t already set up your Personal Profile, you will be requested to do so at this point. After this has been completed, you can “Select the Currency” you’d like to open first.

You’ll then be prompted to order your debit card if you haven’t done so already. Follow the instructions on the screen, and your account will be created.

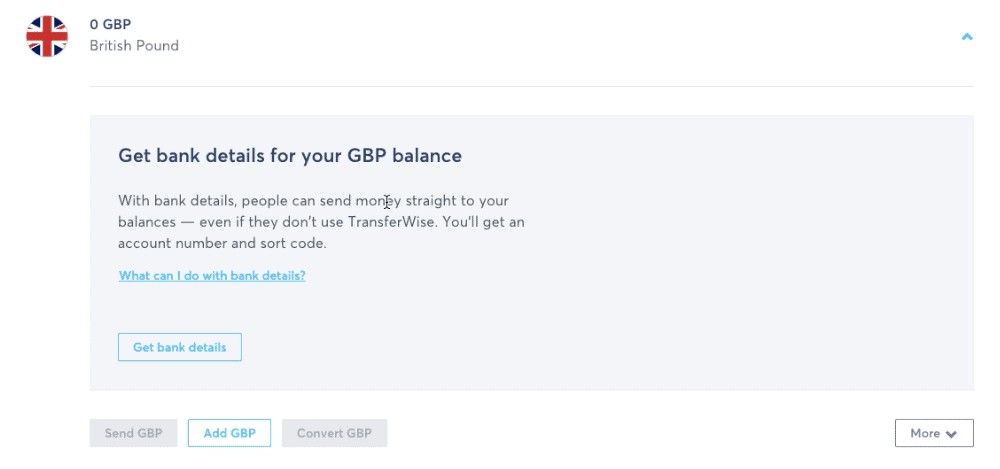

You will then need to select “Get Bank Details“. At this point, because your balance is zero, you will be prompted to “Add GBP“.

How to Add Funds to Wise?

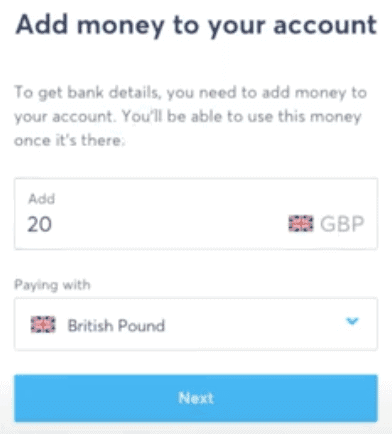

To be able to get bank details. You’ll need to add funds to your account. If this is the first time you add funds, you’ll be prompted to do this when you click the “Get Bank Details” button. Alternatively, you can reach this by clicking on “Add GBP“.

You’ll then need to enter the amount you’d like to add, select the currency, and click “Next“.

There are then a few options for how you would like to transfer your funds;

- Low-Cost Transfer – Manual Bank Transfers or Authorise Funds from your Bank Account

- Fast and Easy Transfer – Debit or Credit Card

- Advanced Transfer – Swift Transfer

Choose your preferred method and click on “Continue to Payment“.

Follow the instructions on the screen for your method. If you have selected a bank transfer, ensure that you made a note of the reference, as this will be used to map your transaction to your Wise account.

If this is the first time you have added funds, you will be prompted to upload your photographic ID.

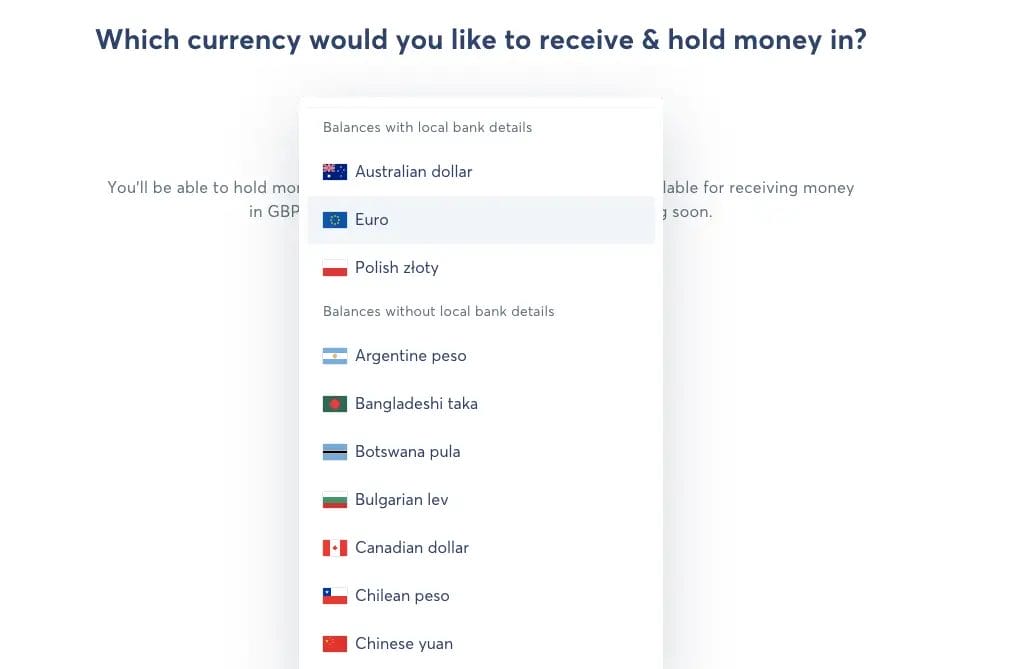

How to Create a Foreign Currency Account on Wise?

Before you can exchange your funds in Wise, you will first need to create a foreign currency account to exchange your funds.

Firstly, you will need to “Open a Balance“.

You will then be prompted to select a currency for your account. If you want to create an account with local bank account details, you can select either GBP, EUR, USD, PLN or AUS from the dropdown. Alternatively, you can create an account without bank details in over 50 different currencies.

If the account is created with Local Bank Details, you can retrieve these details from the “Balances” section. Otherwise, your foreign currency account will just show under “Balances” ready for exchanging funds.

How to Exchange Currencies on Wise?

To exchange into a particular currency, the first thing that you will need to do is open a foreign currency account/balance for the currency you wish to convert to.

Click on the currency you wish to convert and the “Convert” icon.

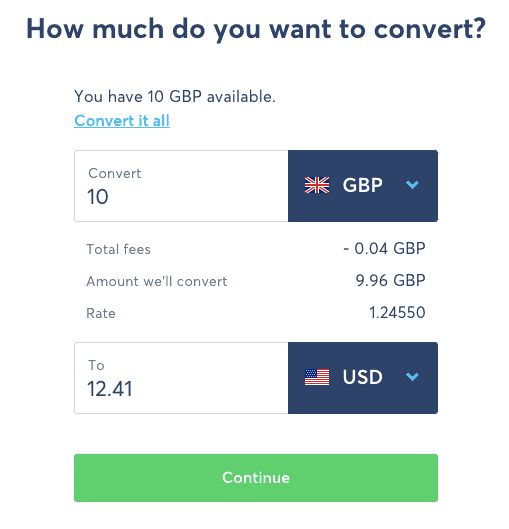

You’ll then need to enter how much you want to convert and the currency you want to convert to. Only currencies where you have an “Open Balance” will appear from the list.

When you are happy with the rates and fees, you can “Continue”.

How to Send Funds with Wise

To send funds, locally or internationally, click on the balance you’d like to send and click on “Send“.

How to Send Funds Locally with Wise?

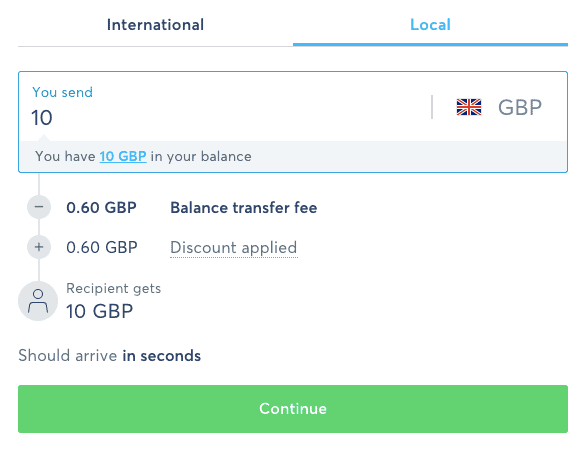

Select “Local” and enter the amount that you would like to send.

The balance fee and any associated discount will then show on the screen. You can then click on “Continue“.

You’ll then be asked to whom you are sending your funds, and you can select from “Myself”, “Someone else”, or a “Business or Charity“.

Then, the next screen will ask you to enter the recipient details such as the bank details, sort code, etc.

You’ll then need to review the details before confirming.

How to Send Funds Internationally with Wise?

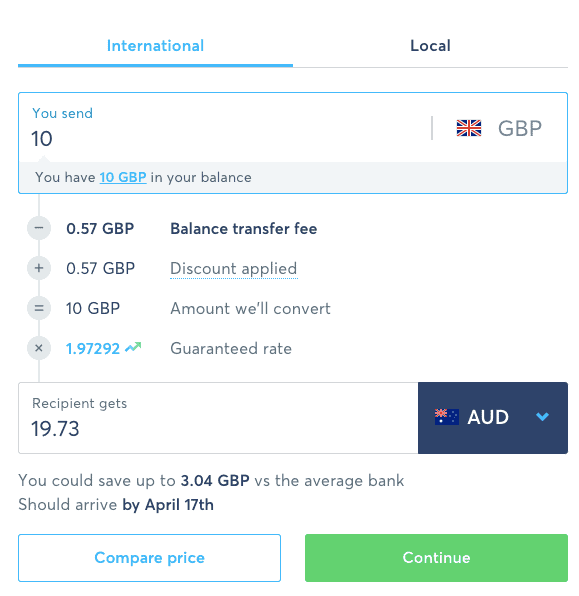

Select “International” and enter the amount that you would like to send.

You’ll then need to select “Currency” from the dropdown your recipient will receive.

The balance fee and any associated discount will then show on the screen. You will also see your Guaranteed Rate at this stage. This amount is guaranteed for a period of 24/48 hours.

When you are happy, you can click on “Continue”.

You’ll then be asked to whom you are sending the funds, and you can select from “Myself”, “Someone else”, or a “Business or Charity“.

Then, the next screen will ask you to enter the recipient details such as the bank details, sort code, etc.

You’ll then need to review the details before confirming.

How to Get a Wise Mastercard?

To get a Wise card, just click on the “Debit card” tab on the website or select “Account” within the app, and you’ll then see the option to “order” the card.

Once your card has been received, you’ll need to activate it with a 6-digit code available on your card.

Wise vs Revolut

Wise and Revolut are two popular mobile banking apps that offer similar features, such as virtual accounts, currency exchange, and money transfers. Here is a comparison of the two:

Pros of Wise:

- Clear and transparent fee structure

- Emphasizes financial education and encourages wise spending habits

- Offers borderless accounts with local bank details for multiple countries

Pros of Revolut:

- Wide range of features, including insurance, cryptocurrency exchange, and investment options

- Offers metal and premium subscriptions with additional benefits and rewards

- Allows for contactless debit card usage with extended benefits such as airport lounge access

Cons of Wise:

- A limited number of supported countries for debit card use

- No investment options

- No premium subscription options

Cons of Revolut:

- Complex fee structure with some hidden fees

- No overdraft options

- Limited customer support in certain regions

Ultimately, both Wise and Revolut have their own strengths and weaknesses, and the best option depends on the individual’s specific financial needs and preferences.

FAQs

Where is Wise Located?

Although the Wise was founded by Estonians Kristo Käärmann and Taavet Hinrikus, the company is actually based in London.

Related Posts

Here are some of our articles you may also find helpful;