Are you new to cryptocurrency trading or looking to switch platforms? This article is a comprehensive step-by-step guide tailored to help beginners understand how to trade on Binance.

Binance is a globally recognized cryptocurrency trading platform that offers a wide array of digital assets for trading. Its platform combines ease of use with advanced features, making it suitable for traders of all experience levels.

Understanding how to navigate and trade effectively on Binance can be the key to maximizing your cryptocurrency investments. Whether you’re a first-timer or someone with some experience looking to switch platforms, this guide aims to cover all the basics and help you trade confidently and securely.

Beginner’s Guide on How to Trade on Binance

What is Binance?

Binance is a cryptocurrency trading platform that facilitates the buying, selling, and trading a broad spectrum of digital assets. Since its inception, Binance has grown exponentially and is recognized for its user-friendly interface, extensive coin listings, and robust security measures. Beyond basic trading, Binance also offers features like staking, savings, and futures trading, broadening its appeal to various types of investors.

Binance was founded in 2017 by Changpeng Zhao (often called “CZ”) and Yi He. Its origins can be traced back to China; however, due to tightening regulations around cryptocurrency, Binance shifted its operations overseas.

Binance’s rapid growth can be attributed to its wide range of cryptocurrency listings, responsive platform that caters to beginners and professional traders, and its relentless expansion into various financial services.

Today, Binance is more than just a trading platform. It encompasses a whole ecosystem, including Binance Academy (an educational platform), Binance Labs (an incubator for blockchain startups), and Binance Chain (its proprietary blockchain).

In just a few years, Binance has transformed from a startup into one of the dominant players in the crypto industry, drawing millions of users worldwide and handling billions in trading volume daily.

What are the Advantages of Trading Binance?

The advantages of trading on Binance lie in its diverse offerings, robust security measures, and continuous innovations, making it a preferred choice for many in the cryptocurrency trading community.

- Extensive Coin Selection: Binance offers many cryptocurrencies, from popular ones like Bitcoin and Ethereum to lesser-known altcoins. This variety allows traders to diversify their portfolios and explore different assets.

- User-Friendly Interface: Designed for beginners and experienced traders, Binance’s platform is intuitive, with clean graphics and a streamlined trading experience.

- High Liquidity: Due to its large user base and massive trading volume, Binance ensures that large trades can be executed quickly without causing significant price slippage.

- Robust Security: Binance emphasizes strong security protocols, including two-factor authentication, withdrawal whitelist, and the use of cold wallets to store the majority of users’ funds.

- Low Fees: Binance boasts competitive trading fees. Users can reduce these fees further by paying them with Binance Coin (BNB).

- Advanced Trading Tools: Beyond basic spot trading, Binance offers futures and options trading, margin trading, and staking capabilities, catering to various trading strategies and needs.

- Global Presence: Binance has expanded its reach globally, offering multi-language support and localized versions for different regions.

- Educational Resources: Binance Academy provides a wealth of educational content, from articles and videos to webinars, assisting traders in making informed decisions.

- Binance Smart Chain (BSC): Binance’s proprietary blockchain, BSC, facilitates swift and low-cost transactions. It has become a hub for decentralized apps (dApps) and DeFi projects.

- Community and Ecosystem: Binance has fostered a strong community through regular updates, token launches via its Launchpad, and engagement initiatives. Its ecosystem extends to ventures like Binance Labs and charity endeavours.

- Customer Support: Binance offers a comprehensive help centre and 24/7 customer support to address user queries and issues.

How to Trade on Binance Exchange

Trading on Binance is a systematic process broken down into three primary steps: opening an account, funding it, and initiating trades. Let’s delve into each of these phases:

1. Open Your Binance Account

Account Registration:

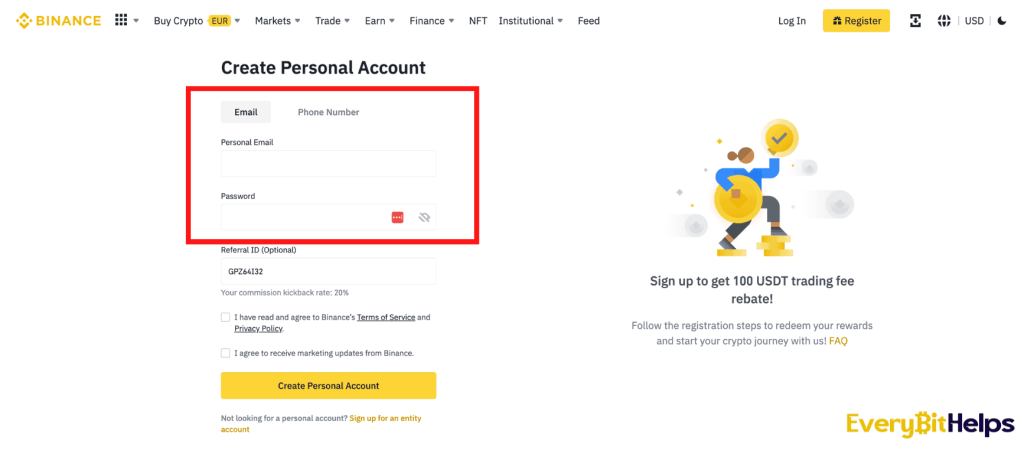

- Navigate to Binance’s main page and click on “Register.”

- On the registration page, provide a frequently used, valid email address. Choose a strong password that combines numbers, letters, and symbols for enhanced security.

Agree to the Terms:

- Familiarize yourself with Binance’s Terms of Use. Once you understand and are comfortable with them, agree to proceed.

Verify Your Humanity:

- A unique puzzle captcha ensures you’re not a bot. Solve it to move forward.

- After you complete the captcha, a verification link will be sent to the email you provided. Click on “Verify Email” to confirm your registration.

Boost Your Security:

- Before diving into trading, it’s wise to heighten your account’s security. Enable Two-Factor Authentication (2FA) for an additional protective layer, ensuring exclusive access to your funds.

2. Fund Your Binance Account

Adding Funds to Binance:

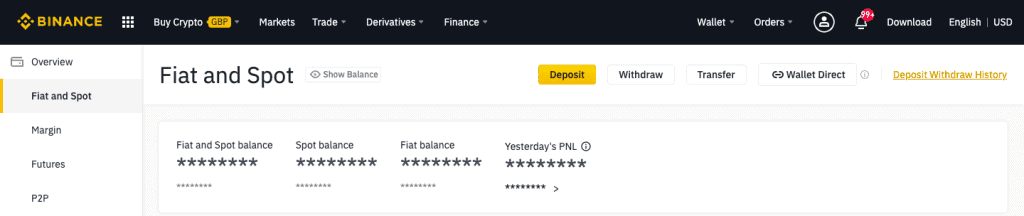

- We’ll use Ethereum (ETH) as our funding currency for this illustration.

- After logging in, select “Accounts” and then click “Send” on the ETH Wallet. As you send funds to Binance, ensure an Ethereum address is ready on your Binance profile.

- Navigate back to Binance and click “Funds,” followed by “Deposits.” Specify the cryptocurrency you’re transferring, in this case, Ethereum. Binance will generate a unique ETH Deposit Address for this purpose.

- Copy this address and input it into your external wallet (like Coinbase) as the recipient. Define the amount you wish to transfer and finalize by clicking “Send.” Once the Ethereum network processes the transaction, your funds will be visible on Binance.

3. Start Trading on Binance

Initiate Your Trade:

- Hover over the “Trade” option and select your preferred mode – “Basic” or “Advanced.” This action will showcase the prevailing market details.

- Suppose you aim to trade BNB for BTC. On the right panel, select BTC.

- Now, click on the BNB/BTC pairing, which redirects you to the designated trading page. Navigate downwards until the “Buy BNB” and “Sell BNB” sections are visible.

- To liquidate BNB, use the “Sell Coin” function. Specify the BNB amount you wish to offload and finalize by hitting the “Sell BNB” button. A “Limit Sell Order Created” notification confirms your action.

- Scroll to the “Open Orders” segment for a snapshot of your order. Patiently wait for your open order to execute. Upon its completion, your trade is officially sealed.

With these outlined steps, embarking on your trading journey with Binance becomes straightforward, ensuring you transact confidently and precisely.

Binance Basic vs. Advanced Trade

Binance’s Basic and Advanced trading interfaces cater to different levels of traders. The Basic interface, as the name suggests, offers a straightforward, streamlined experience, prioritizing ease of use. It’s perfect for newcomers or those who prefer not to get bogged down with too many details. Users will find essential information such as a simple price chart, buy/sell options, and an uncomplicated order book.

On the other hand, the Advanced interface dives deeper, providing seasoned traders with a suite of tools for a comprehensive trading experience. This mode boasts a detailed price chart equipped with advanced charting tools for in-depth technical analysis. Users can access an array of metrics, indicators, and a detailed order book, granting them a granular view of market movements. The expansive layout shows real-time data on price charts, order books, and trade history simultaneously.

While Basic focuses on simplicity and quick trades, Advanced offers depth and detailed analytics, allowing traders to tailor their trading strategies precisely.

How to Use Binance for Any Basic Trade

Navigating Binance for basic trades is a straightforward process designed to facilitate even the newest of traders. To get started, here’s a step-by-step guide:

- Accessing the Platform: Log into your Binance account. Register and undergo the necessary verification processes if you haven’t created one yet.

- Navigating to the Basic Trade Interface: Go to the “Exchange” option on the top taskbar once logged in. From the dropdown menu, select “Basic.” This will redirect you to Binance’s simplified trading interface, optimized for straightforward and quick trades.

- Selecting Your Trading Pair: In the trading interface, you’ll notice a plethora of trading pairs available. This indicates which cryptocurrencies can be exchanged for one another. For instance, if your funds display only Ethereum (ETH), then ETH-related trading pairs are what you’ll work with. To choose, simply type in or select your desired pair from the list.

- Determining the Trade Type: Binance offers several trading order types, ensuring flexibility. You can opt for:

- Limit Orders: Set a specific price you wish to buy or sell. The trade will only execute once the market price matches your set price.

- Market Orders: Allows you to buy or sell instantly at the best available market price.

- Stop-Limit Orders: A two-part order where you set a stop and limit prices. Once the stop price is reached, a limit order is automatically placed at your specified limit price.

- Setting the Trade Amount: Finally, determine how much cryptocurrency you want to buy or sell. Input the desired amount in the respective box. Ensure you check current prices and your available balance before confirming the trade.

Once you’ve made your selections, review the details and, when ready, click on the appropriate button to finalize your trade, either “Buy” or “Sell.” After execution, you can view your transaction in the order history or your portfolio balance. Always conduct trades cautiously, especially if you’re new to the platform or cryptocurrency trading.

Advanced Trading on Binance

With its powerful features, unlock Binance’s advanced trading potential! This section delves into two key aspects: margin trading and futures trading.

Margin Trading

Margin trading on Binance is a feature that allows users to borrow funds to execute larger trades. It is essential to understand the risks involved, as margin trading can increase both profits and losses.

Users must have sufficient funds in their margin wallet to participate in margin trading. Day Traders can amplify their purchasing power and potentially increase profits by utilizing leverage. It is crucial to exercise caution and avoid excessive leverage to manage risk effectively.

When engaging in margin trading on Binance, it is essential to closely monitor the market and implement stop-loss orders to limit potential losses. Traders should also familiarize themselves with various margin trading pairs and carefully analyze market trends before making trading decisions.

Traders can enhance their trading performance by utilizing features such as long or short positions and adjusting leverage ratios. However, it is important to fully understand these features and assess their impact on trading strategies.

Margin trading requires a solid understanding of the market, technical analysis, and effective risk management. Traders should conduct thorough research, stay updated with the latest market trends and news, and set attainable goals.

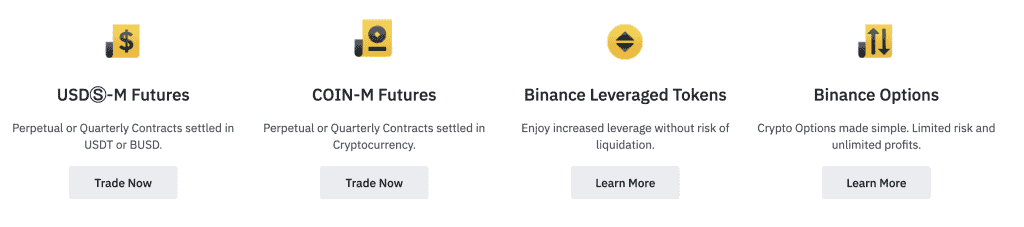

Futures Trading

When trading futures on Binance, there are important factors to consider. Familiarise yourself with how futures contracts work, including expiration dates, settlement methods, and leverage options.

Evaluate available trading pairs on Binance and select the right one that aligns with your strategy and goals. To make informed trading decisions, stay updated on the latest market trends, including price movements, volume, and sentiment. Manage risk by setting realistic goals and establishing risk management strategies, such as stop-loss and take-profit orders, to protect your capital and minimise losses. Implement technical analysis using indicators and chart patterns to identify potential entry and exit points for your futures trades.

Consider liquidity and trading volume for your chosen futures trading pair to ensure the smooth execution of your trades. Remember, futures trading offers the opportunity for high returns but also carries risks due to leverage. Therefore, it is crucial to understand the market and employ risk management strategies to succeed in futures trading on Binance.

Executing Trades on Binance

If you want to master the art of executing trades on Binance, you’re in for a treat! This section will dive into the nitty-gritty of placing trades on this popular cryptocurrency exchange. From market orders to limit orders to stop-limit orders, we’ve got you covered.

Market Orders

Market orders on the Binance platform allow users to buy or sell cryptocurrencies at the current market price. Please follow these steps to place a market order:

- Log in to your Binance account.

- Navigate to the trading interface.

- Select the trading pair you desire.

- Click on the market order tab.

- Choose the amount of cryptocurrency you wish to buy or sell.

- Review and confirm the order details.

- Your market order will be executed immediately at the current market price.

When placing a market order, it is essential to note that it will be executed at the best available price. Due to fluctuations, the execution price may slightly differ from the current market price. Before confirming, it is advisable to double-check the order details, as market orders cannot be cancelled or modified once submitted.

To make the most of market orders, consider these suggestions:

- Monitor the market closely for favourable price movements.

- Set price alerts to receive notifications of price changes.

- Understand the risks associated with market orders, as they do not guarantee a specific price and may be influenced by slippage.

Limit Orders

When trading on Binance, it is highly recommended to utilize limit orders as a beneficial strategy. To do so, please follow these steps:

- First, visit the Binance website and log in to your account.

- Once logged in, proceed to the trading interface and select your desired trading pair.

- In the trading interface, you will find different tabs. Choose the “Limit” tab to access the limit order section.

- Within the limit order section, enter the price you want to buy or sell the cryptocurrency.

- Specify the quantity of cryptocurrency you intend to trade.

- Decide if you want to place a buy or sell limit order.

- Please review all the order details carefully to ensure accuracy. Click “Buy” or “Sell” to place the limit order when ready.

Pro Tip: When using limit orders, it is advisable to set a realistic price that aligns with current market conditions. This will help you avoid unfavourable prices and provide greater control over your trades.

Stop-Limit Orders

Stop-limit orders combine both stop orders and limit orders on Binance. These orders allow investors to specify a trigger price, the stop price, at which the order will be activated. Investors can set a limit price at which the order will be executed.

Utilizing stop-limit orders can be beneficial in protecting investments, particularly in volatile markets. Investors can exploit market fluctuations by automatically triggering a trade when the price reaches a predetermined level.

When placing a stop-limit order, carefully considering the stop price and limit price values is crucial. The stop price should signify a significant market change, while the limit price should reflect the desired execution price. It is important to note that stop-limit orders do not guarantee execution. The order may not be filled if the market moves rapidly and surpasses the limit price.

Tips & Strategies for Successful Trading on Binance

Discover the secrets to successful trading on Binance with these tips and strategies. Master the art of conducting fundamental and technical analysis to make informed trading decisions. Set realistic goals and effectively manage risk to maximize your trading potential.

1. Conducting Fundamental & Technical Analysis

When trading on Binance, conducting fundamental and technical analyses is crucial to make well-informed decisions. To do this, follow these essential steps:

- Gather Relevant Information: Perform thorough research and analyze the fundamental factors that influence the price of a cryptocurrency. This includes evaluating the team, technology, market demand, and potential partnerships of the project.

- Examine Price Charts: Utilize technical analysis techniques to study the historical price movements of the cryptocurrency. By identifying patterns and trends, you can forecast future price movements. Tools such as moving averages, support and resistance levels, and indicators like MACD and RSI can be helpful in this analysis.

- Identify Key Indicators: Look for indicators that provide insights into market sentiment and potential price direction. These indicators may include trading volume, price volatility, and market order flow.

- Stay Updated with News & Events: It is essential to keep yourself informed about the latest news and events related to the cryptocurrency market. Significant announcements, regulatory changes, or partnerships can significantly impact price and market sentiment.

- Use a Combination of Approaches: It is best to employ fundamental and technical analysis to understand a cryptocurrency’s potential. Consider qualitative and quantitative factors when making well-informed trading decisions.

2. Setting Realistic Goals & Managing Risk

When trading on Binance, setting realistic goals and effectively managing risk is crucial.

- Evaluate your Risk Tolerance: Understand the level of risk you are comfortable with and your ability to handle potential financial losses.

- Establish Specific & Achievable Objectives: Clearly define your trading goals, such as attaining a specific profit percentage, acquiring new trading strategies, or reaching a particular trading volume.

- Create a Trading Plan: Develop a comprehensive plan that outlines your trading strategies, including entry and exit points, risk management techniques, and the amount of capital you are willing to risk in each trade.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically sell an investment if its value falls below a predetermined price. This helps limit potential losses and safeguard your invested capital.

- Employ Appropriate Position Sizing: Calculate the ideal trade size based on your risk tolerance, account balance, and asset volatility. Avoid overexposing your account to a single trade.

Conclusion

Cryptocurrency trading can seem daunting at first glance. However, Binance aims to simplify this by offering interfaces tailored to novice and advanced traders. It’s essential to remember that while these platforms provide the tools, the user is responsible for using them wisely.

Trading cryptocurrencies is inherently risky. Its volatile nature can result in significant gains but also substantial losses. Before diving in, you must arm yourself with as much knowledge as possible. Do extensive research, stay updated with market trends, and consider seeking advice from seasoned traders or financial advisors.

For beginners, consider starting with a Binance demo account; many platforms offer this feature. It allows you to familiarize yourself with the trading process, try out strategies, and get comfortable, all without risking real money.

FAQs

What is the difference between trading and investing?

Trading involves buying and selling assets in short periods to take advantage of short-term price fluctuations. On the other hand, investing involves a longer-term approach where resources are allocated to generate profits over time.

Can I use fundamental and technical analysis together?

Absolutely! Fundamental analysis involves studying economic and financial factors to assess an asset’s valuation, while technical analysis uses historical price action to predict future market behaviour. Both methods can be combined to make more reliable investment decisions.

What is the spot market, and how does it work?

Trades on the spot market are settled immediately. When you buy or sell assets on the spot market, the transaction is executed on the spot at the current market price. This is different from margin trading, where you trade with borrowed funds.

Can you make money trading on Binance?

Yes, traders can make money and profit from trading crypto on Binance. However, cryptocurrency trading carries risks, and there’s no guarantee of returns.

Is Binance suitable for beginners?

Binance has several features tailored for beginner traders, plus a user-friendly interface. The platform also offers an excellent “Binance Academy” section, providing valuable resources to boost crypto knowledge.

How much do I need to start trading on Binance?

Binance has a low minimum deposit requirement, often as little as $10 or $15. However, starting with an amount you’re comfortable risking is advisable.