Looking to start crypto trading futures contracts on Binance Exchange? Before starting Futures Trading on Binance, you must answer all the questions on the Binance Futures quiz. This assessment tests your knowledge of trading with futures, its associated risks, and the relevant measures you should take for financial security.

Until you pass the Binance Futures quiz, you cannot trade futures. Whilst the Binance quiz is relatively straightforward, this requirement can create problems for many crypto investors who want to start trading Futures.

So, let’s dive into this beginner’s guide to Binance Futures, where we provide you with the Binance Futures Quiz answers for 2025 and everything you need to get started.

Binance Futures Quiz Answers for February 2025

To take the Binance Futures quiz, you must have access to the desktop version of Binance (binance.com); as with the Binance mobile app, the questions will be different.

Below is a list of answers to all the Binance Futures Quiz to help you start trading futures.

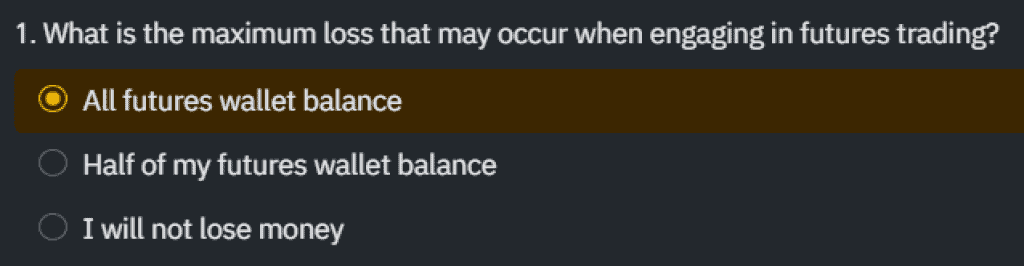

Binance Futures Quiz Question 1: Maximum Loss

Question 1: What is the maximum loss that may occur when engaging in futures trading?

Answer Options:

- All futures wallet balance

- Half of my futures wallet balance

- I will not lose money

Binance Futures Quiz Answer 1: All futures wallet balance

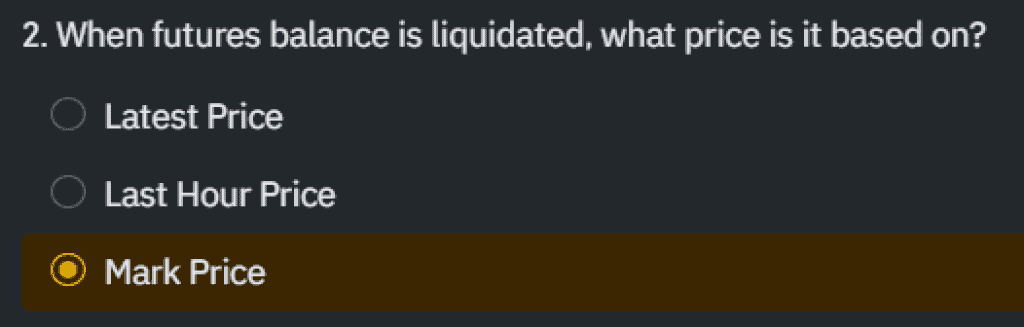

Binance Futures Quiz Question 2: Balance Liquidation Price

Question 2: When futures balance is liquidated, what price is it based on?

Answer Options:

- Latest Price

- Last Hour Price

- Mark Price

Binance Futures Quiz Answer 2: Mark Price

Binance Futures Quiz Question 3: Insurance Clear Fees

Question 3: Are you aware that after the future is forcedly liquidated, in addition to the loss of the position, Insurance Clear Fee (= Position nominal value * Liquidation fee rate) will occur, which may decrease your futures wallet balance to zero?:

Answer Options:

- No, I don’t know the calculation of the Insurance Clear Fee.

- Yes, I am aware of the existence and calculation of the Insurance Clear Fee and the risks that may cause the balance to return to zero.

- No, I don’t know the liquidation can cause the futures wallet balance to return to zero.

Binance Futures Quiz Answer 3: Yes, I am aware of the existence and calculation of the Insurance Clear Fee and the risks that may cause the balance to return to zero.

Binance Futures Quiz Question 4: Maximum Quantity Limits

Question 4: There is a maximum number of orders for each future. Which action should I take?

Answer Options:

- Once the maximum quantity limit is reached, the order will fail. An error will be reported. At this time, I should continue trying to place the order with the same quantity and blame the Binance platform if the system continues reporting errors.

- Once the maximum quantity limit is reached, the order will fail, and an error will be reported, but I believe the order will be placed successfully if I try as many times as I can.

- Once the maximum quantity limit is reached, the order will fail, and an error will be reported. At this time, I should divide the order into several smaller quantities.

Binance Futures Quiz Answer 4: Once the maximum quantity limit is reached, the order will fail, and an error will be reported, but I believe the order will be placed successfully if I try as many times as I can.

Binance Futures Quiz Question 5: Stop Market Orders

Question 5: Which of the following apply when using a stop-market order?

Answer Options:

- The transaction price must be similar to the trigger price.

- After the stop-profit and stop-loss price is triggered, the transaction will be executed immediately at the market price, and the transaction price may not be equal to the trigger price.

- The transaction price must be greater than the trigger price.

Binance Futures Quiz Answer 5: After the stop-profit and stop-loss price is triggered, the transaction will be executed immediately at the market price, and the transaction price may not be equal to the trigger price.

Binance Futures Quiz Question 6: Stop Limit Orders

Question 6: Which of the following is correct to use Stop-Limit Order?

Answer Options:

- After the stop-profit and stop-loss price is triggered, the order will be placed at the limit price immediately, but the limit order may not necessarily be filled because the price has moved away.

- The limit order will be executed after it is listed.

- The limit order will not be executed after it is listed.

Binance Futures Quiz Answer 6: After the stop-profit and stop-loss price is triggered, the order will be placed at the limit price immediately, but the limit order may not necessarily be filled because the price has moved away.

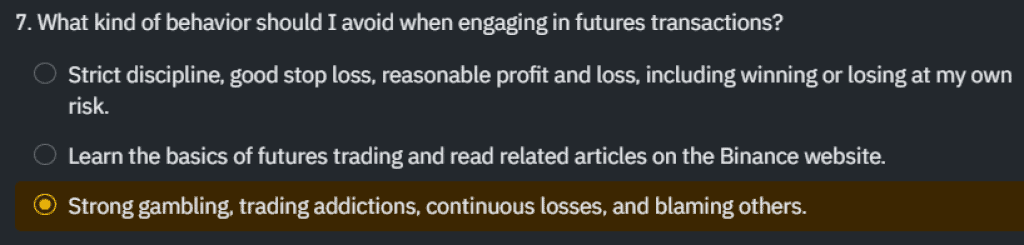

Binance Futures Quiz Question 7: Behaviours to Avoid

Question 7: What kind of behaviour should I avoid when engaging in futures transactions?

Answer Options:

- Strict discipline, good stop-loss, reasonable profit and loss, including winning or losing at my own risk.

- Learn the basics of futures trading and read related articles on the Binance website.

- Strong gambling, trading addictions, continuous losses, and blaming others.

Binance Futures Quiz Answer 7: Strong gambling, trading addictions, continuous losses, and blaming others.

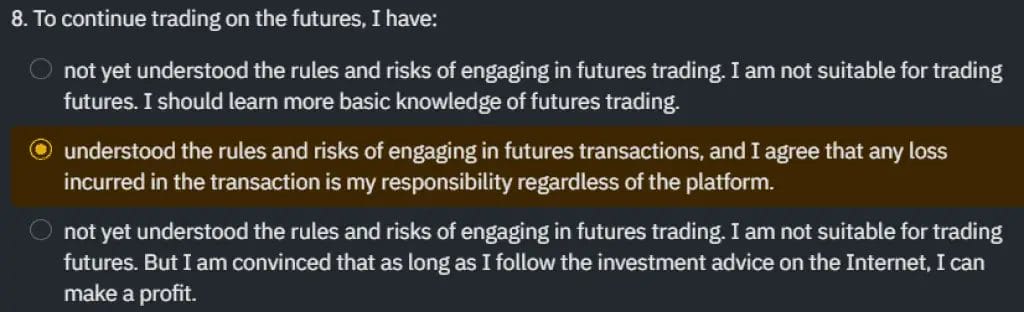

Binance Futures Quiz Question 8: Understanding the Rules

Question 8: To continue trading on the futures, I have:

Answer Options:

- Not yet understood the rules and risks of engaging in futures trading. I am not suitable for trading futures. I should learn more basic knowledge of futures trading.

- Understood the rules and risks of engaging in futures transactions, and I agree that any loss incurred in the transaction is my responsibility regardless of the platform.

- Not yet understood the rules and risks of engaging in futures trading. I am not suitable for trading futures. But I am convinced that as long as I follow the investment advice on the Internet, I can make a profit.

Binance Futures Quiz Answer 8: Understood the rules and risks of engaging in futures transactions, and I agree that any loss incurred in the transaction is my responsibility regardless of the platform.

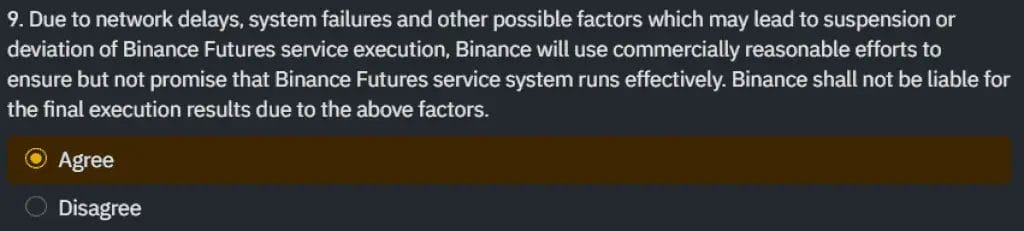

Binance Futures Quiz Question 9: Futures System Services

Question 9: Due to network delays, system failures and other possible factors which may lead to suspension or deviation of Binance Futures service execution, Binance will use commercially reasonable efforts to ensure but not promise that Binance Futures service system runs effectively. Binance shall not be liable for the final execution results due to the above factors.

Answer Options:

- Agree

- Disagree

Binance Futures Quiz Answer 9: Agree

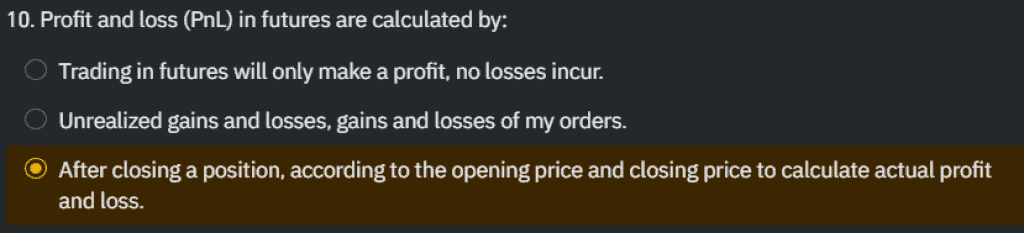

Binance Futures Quiz Question 10: PNL Calculations

Question 10: Profit and loss (PnL) in futures are calculated by:

Answer Options:

- Trading in futures will only make a profit, no losses incur.

- Unrealized gains and losses, gains and losses of my orders.

- After closing a position, according to the opening price and closing price to calculate actual profit and loss.

Binance Futures Quiz Answer 10: After closing a position, according to the opening price and closing price to calculate actual profit and loss.

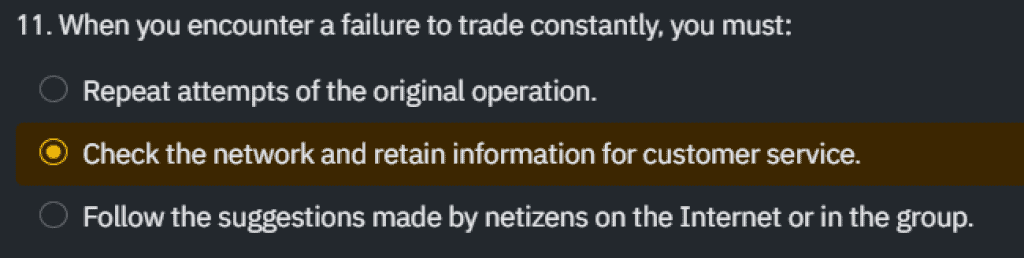

Binance Futures Quiz Question 11: Trading Failures

Question 11: When you encounter a failure to trade constantly, you must:

Answer Options:

- Repeat attempts of the original operation.

- Check the network and retain information for customer service.

- Follow the suggestions made by netizens on the Internet or in the group.

Binance Futures Quiz Answer 11: Check the network and retain information for customer service.

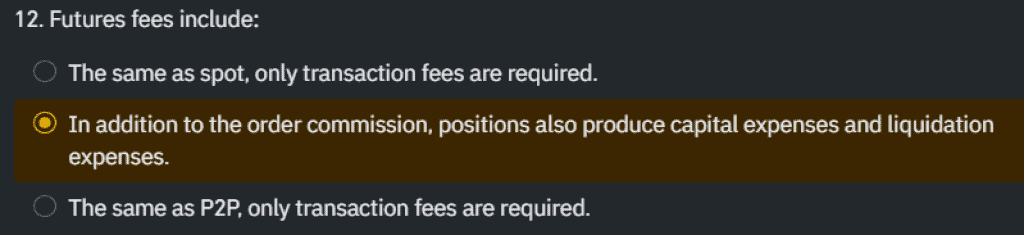

Binance Futures Quiz Question 12: Binance Futures Fees

Question 12: Futures fees include:

Answer Options:

- The same as spot, only transaction fees are required.

- In addition to the order commission, positions also produce capital expenses and liquidation expenses.

- The same as P2P, only transaction fees are required.

Binance Futures Quiz Answer 12: In addition to the order commission, positions also produce capital expenses and liquidation expenses.

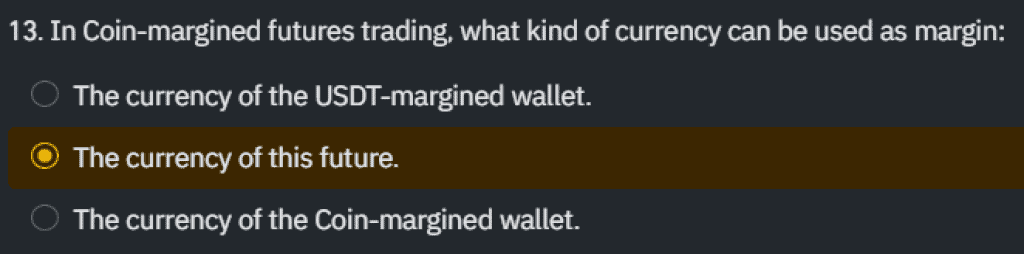

Binance Futures Quiz Question 13: Coin-margined Currencies

Question 13: In Coin-margined futures trading, what kind of currency can be used as margin:

Answer Options:

- The currency of the USDT-margined wallet.

- The currency of this future.

- The currency of the Coin-margined wallet.

Binance Futures Quiz Answer 13: The currency of this future.

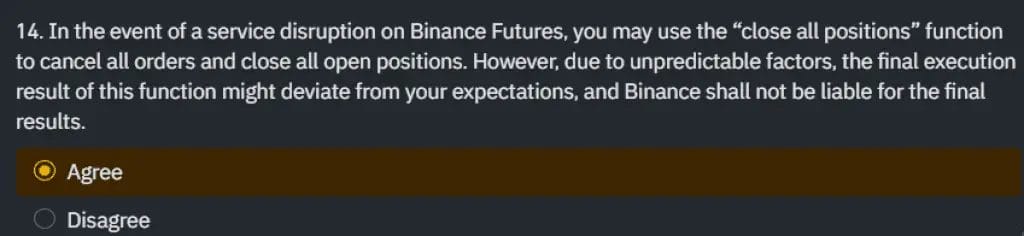

Binance Futures Quiz Question 14: Binance Futures Disruption

Question 14: In the event of a service disruption on Binance Futures, you may use the “close all positions” function to cancel all orders and close all open positions. However, due to unpredictable factors, the final execution result of this function might deviate from your expectations, and Binance shall not be liable for the final results.

Answer Options:

- Agree

- Disagree

Binance Futures Quiz Answer 14: Agree

What is Binance Futures Trading?

Binance Futures Trading allows users to predict the future price of a cryptocurrency. As stock indices or commodity futures contracts work, Crypto futures are based on cryptocurrency’s future value instead of speculating on an asset’s future value.

With crypto futures, traders can obtain exposure to digital currencies without owning any underlying assets. When a crypto futures contract expires, users use cash instead of physically dealing in crypto.

Before trading, it is necessary to be knowledgeable about crypto futures trading; therefore, new users must complete a Binance Futures Quiz.

Binance Futures Fees

Binance Futures fees consist of trading fees and funding fees. For trading fees, Binance Futures has a maker-and-taker fee structure. The taker fee rates start at 0.04% and can go as low as 0.017%, while the maker fee rates start at 0.02% and go as low as 0.0000%.

If you trade COIN-M Futures contracts on Binance, the maker fee is 0.01%, and the taker fee is 0.05%. Your VIP level on Binance can also impact your trading fees when opening and closing positions, potentially resulting in lower fees.

Additionally, you can receive discounts on trading fees by using BNB, the native Binance token, to pay for them. Binance offers a 25% discount on spot trading fees and a 10% discount on USDⓈ-M Futures trading fees when using BNB for fee payments.

Funding fees are periodic payments made between traders holding positions in perpetual futures contracts. The funding rate determines these payments, known as funding fees.

| Level | 30d Trade Volume | USDT Maker / Taker | USDT Maker/Taker BNB 10% off | BUSD Maker / Taker | BUSD Maker/Taker BNB 10% off |

|---|---|---|---|---|---|

| Regular User | < 15,000,000 BUSD or ≥ 0 BNB | 0.0200%/0.0400% | 0.0180%/0.0360% | 0.0120%/0.0300% | 0.0108%/0.0270% |

| VIP 1 | ≥ 15,000,000 BUSD & ≥ 25 BNB | 0.0160%/0.0400% | 0.0144%/0.0360% | 0.0120%/0.0300% | 0.0108%/0.0270% |

| VIP 2 | ≥ 50,000,000 BUSD & ≥ 100 BNB | 0.0140%/0.0350% | 0.0126%/0.0315% | 0.0120%/0.0300% | 0.0108%/0.0270% |

| VIP 3 | ≥ 100,000,000 BUSD & ≥ 250 BNB | 0.0120%/0.0320% | 0.0108%/0.0288% | 0.0120%/0.0300% | 0.0108%/0.0270% |

| VIP 4 | ≥ 600,000,000 BUSD & ≥ 500 BNB | 0.0100%/0.0300% | 0.0090%/0.0270% | 0.0100%/0.0300% | 0.0090%/0.0270% |

| VIP 5 | ≥ 1,000,000,000 BUSD & ≥ 1,000 BNB | 0.0080%/0.0270% | 0.0072%/0.0243% | -0.0100%/0.0230% | -0.0100%/0.0207% |

| VIP 6 | ≥ 2,500,000,000 BUSD & ≥ 1,750 BNB | 0.0060%/0.0250% | 0.0054%/0.0225% | -0.0100%/0.0230% | -0.0100%/0.0207% |

| VIP 7 | ≥ 5,000,000,000 BUSD & ≥ 3,000 BNB | 0.0040%/0.0220% | 0.0036%/0.0198% | -0.0100%/0.0230% | -0.0100%/0.0207% |

| VIP 8 | ≥ 12,500,000,000 BUSD & ≥ 4,500 BNB | 0.0020%/0.0200% | 0.0018%/0.0180% | -0.0100%/0.0230% | -0.0100%/0.0207% |

What is the Maximum Leverage Available on Binance Futures?

Binance Futures allows users to open long and short positions with up to 125x leverage. However, the maximum leverage available for new users on Binance is currently 20x. For accounts within the first 60 days of their opening, leverage levels of over 20x are unavailable.

Utilizing leverage in trading increases your buying or selling power even if you have limited capital in your wallet. By selecting a suitable level of leverage, you can effectively borrow a multiple of your current balance for trading purposes.

Conclusion

Trading futures is like any other investment; you need to do plenty of research and clearly understand how it works. Futures trading isn’t for beginners and is very risky and should be used with caution. Always consider the risks, fees, and margin requirements when holding Binance Futures positions and monitor and manage them accordingly.

When you complete the Binance Futures Quiz using the answers we have provided above, you can start trading with futures on the Binance exchange.

FAQs

Is Binance Futures safe?

While Binance Futures is generally safe, it is essential to note that trading with leverage, which is available on the platform, carries significant risk, especially for beginners. Leveraged trading can lead to substantial losses in a short period if not appropriately managed. It is recommended that traders gain sufficient experience and knowledge before engaging in leveraged trading on Binance Futures or any other platform.

How long can you hold Binance Futures?

Binance Futures allows you to hold positions indefinitely, as there is no specific time limit on how long you can keep them open. However, it is essential to know the risks and costs associated with holding futures positions for an extended period, especially when using high leverage.

While holding a position, you may be subject to funding fees, which are charged or credited to your account based on the difference between the perpetual swap and the mark price. These funding fees can vary and may affect your overall profitability when holding positions for a long time.

Other Crypto Quizzes

Here are some of our articles you may also find helpful;