In this Zapper review, I explain how to use Zapper Fi to easily track & manage all your DeFi assets & liabilities in one simple-to-use interface. I show you how to use Zapper to track your DeFi Investments whilst also adding liquidity with a single click.

What is Zapper?

Zapper.fi was born out of a hackathon in 2019, and Zapper came together when DeFi Zap and DeFi Snap merged. This meant you could zap in and out of liquidity pools and, at the same time, use one of the best portfolio analytics tools in the space. More recently, with further investment from the MetaCartel community, Zapper now has access to some of the most progressive minds in crypto.

One thing to mention is that Zapper is a DeFi product and not a protocol. This means that it cannot be decentralized, even though it’s completely non-custodial. Zapper’s main feature is allowing DeFi users to enter and exit liquidity pools on the likes of UniSwap, Curve Finance, and Balancer with a single click.

Zapper.fi Review: How to Use Zapper.fi

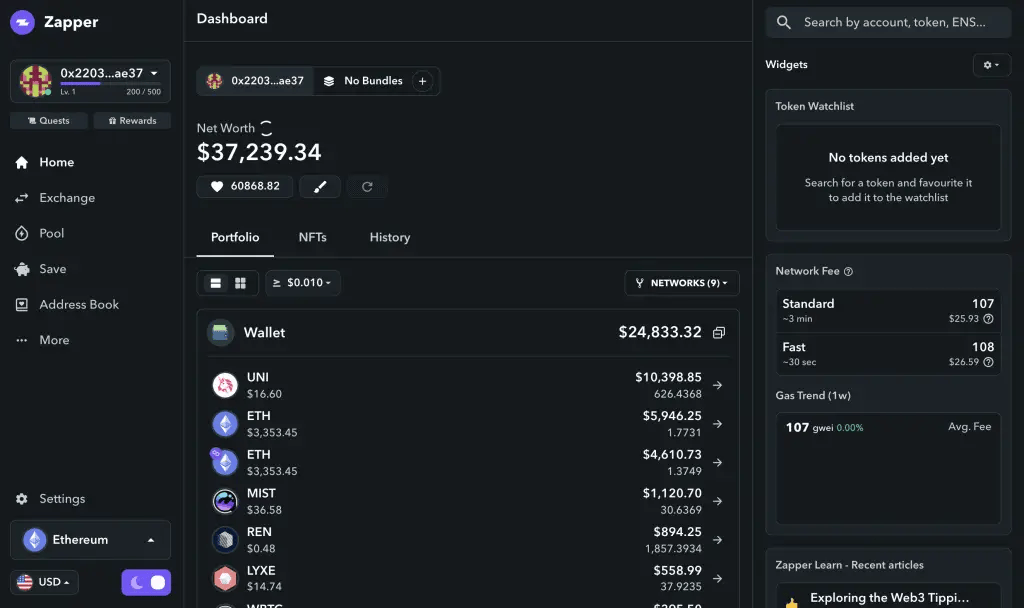

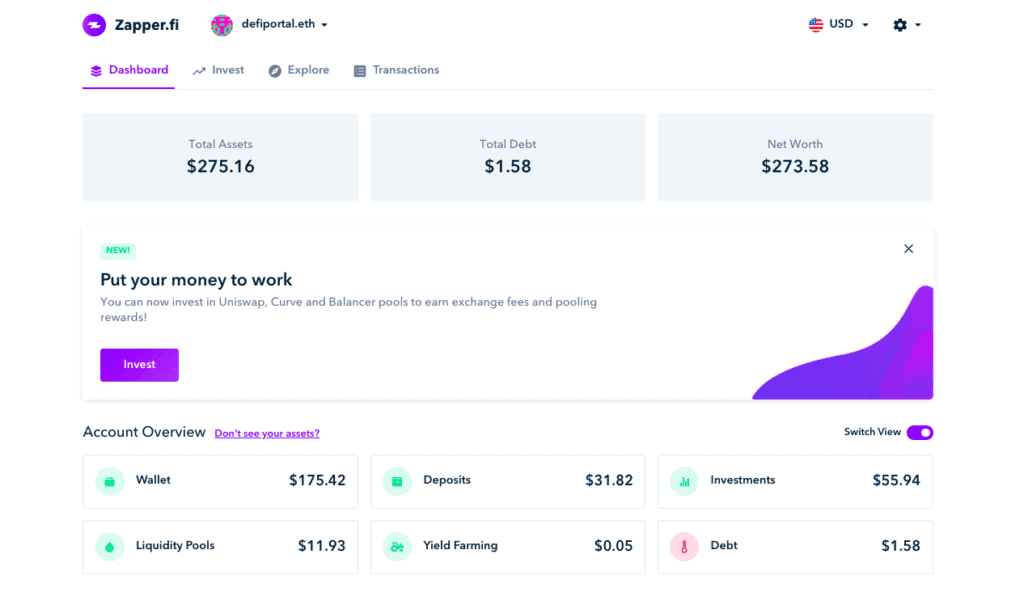

Zapper Dashboard

Zapper’s dashboard tracks each address and breaks up its activity into six categories: wallet holdings, liquidity pools, deposits, yield farming, investments and debts. Assets are also split across some of the most popular DeFi platforms, including Uniswap, Aave, Compound, dYdX and Synthetix.

Then there’s the breakdown of your asset allocation vs where your assets are according to the platform they’re on. This dashboard is brilliant, especially if you’re currently investing and getting involved in a lot of DeFi protocols, as it really helps you to keep track of where your assets are.

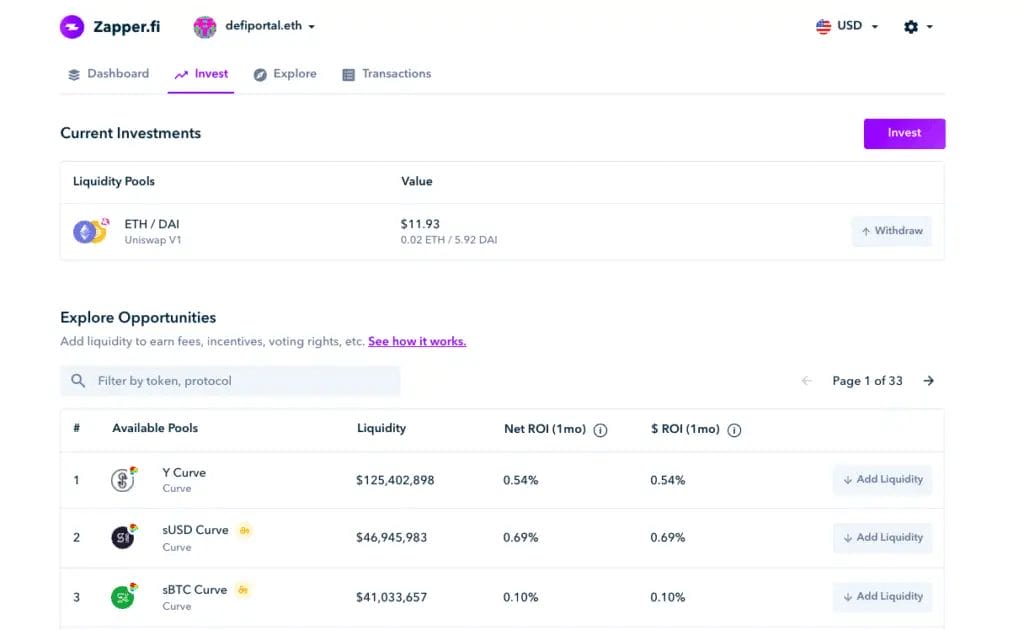

Zapper Invest

One of the advantages of using Zapper is its one-click liquidity feature, and this is where you can start “zapping” and find all the liquidity-providing opportunities. Zapper brings all these pooling opportunities together in one place so that you can add liquidity to earn fees, incentives and voting rights.

Therefore, it saves you from having to find all the various sites required to provide liquidity and from exchanging your tokens for the correct ones for that pooling opportunity as it converts your Ethereum or ERC-20 tokens into the necessary tokens for each pool. Meaning that you no longer have to convert your holdings first, saving you money on the ever-increasing gas fees. So unless you’re already holding the required tokens to provide liquidity to a pool, Zapper is by far the best solution.

Plus, if you already have current investments, these will also show on your dashboard and feature the ability to withdraw, claim rewards, un-stake, or add further liquidity, all from right inside the platform.

Zapper Explore

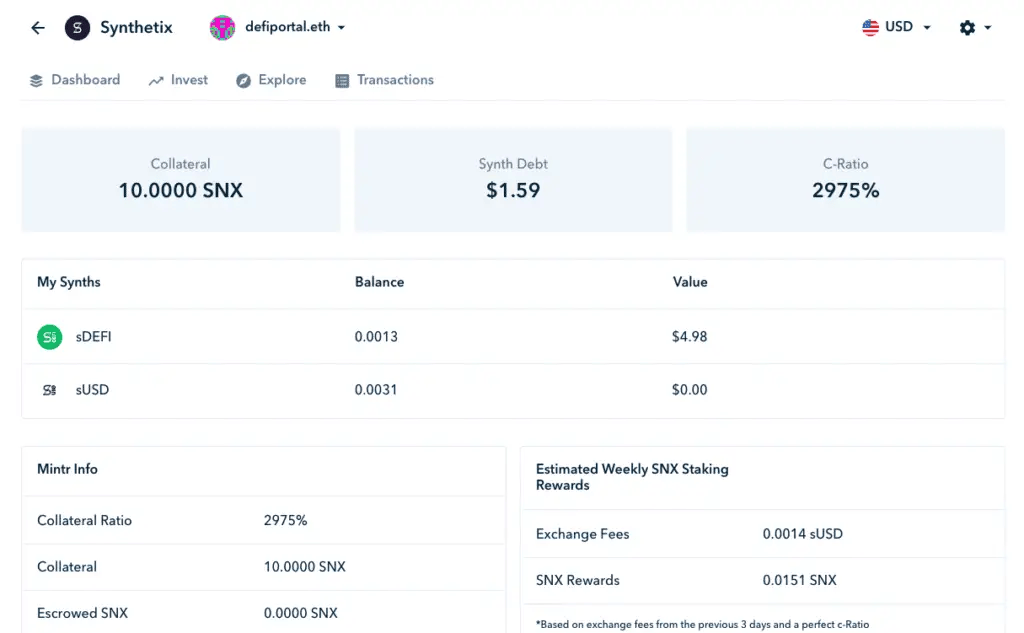

Under the Explore feature, users can view how their assets are allocated across some of the most popular DeFI applications. These include Compound, Synthetix, UniSwap, dYdX, Aave and PoolTogether.

Depending on the DApp that you select will depend on the information you are shown. For example, if you take a look at Synthentix, you will be able to view your collateral, synth debt, ratio, etc. Then you’ll have your Synths with balances and ratios. Plus, all the Mintr information for staking and the estimated weekly staking rewards. And it’ll also show you corresponding information under other platforms too.

Zapper.Fi vs Zerion

Zapper and Zerion are similar platforms providing a gateway or single point of entry to the most popular DeFi Platforms. Both have an easy-to-use interface with the aim of simply DeFi investing.

Previously, Zapper had a slight advantage by converting your tokens in one transaction when you’re adding liquidity. However, Zerion now also provides this functionality. Zerion, however, boasts of having the cheapest transaction costs in the space, which includes Zapper—helping to save their users on gas fees.