If you’ve currently got LUNA tokens sitting idle on an exchange, you may be interested to hear that you can earn staking rewards around 8% to 10%. Staking allows you to earn interest from your crypto when you deposit your funds to support the operations of a blockchain network, and, in return, you’re rewarded for your contribution.

In this guide, I explain how to buy LUNA tokens on Binance and then how to stake LUNA to earn interest using the Terra Station wallet and Ledger Nano hardware wallet.

What is the Terra Protocol?

The Terra Protocol was created in 2018 by a Korean blockchain company called Terraform Labs, founded by Daniel Shin and Do Kwon with the idea to facilitate the mass adoption of crypto by creating digitally native assets that are price-stable against the world’s major FIAT currencies.

Terra runs on a delegated Proof of Stake (PoS) blockchain and is powered by Tendermint consensus, which relies on a set of validators to secure the network. Miners need to stake a native cryptocurrency named “Luna” to mine Terra transactions.

Transactions on the Terra blockchain take seconds to complete. Plus the cost of transaction fees when interacting with smart contracts is lower than the gas fees on the likes of Ethereum. Making it an ideal alternative for developers seeking smart-contract-enabled blockchains.

Terra is responsible for the development of several successful crypto projects, including Mirror Protocol, which is a way to mint crypto assets that mimic the value of shares in publicly traded companies like Apple or Tesla.

Anchor Protocol offers saving products for Terra stable coins with the aim of delivering a fixed rate of 20% APY on your deposits.

What is LUNA?

Luna is essentially the backbone to the whole Terra network by being used for staking to secure the network; governance and the burning of LUNA coins help to stabilize the Terra stable-coin ecosystem and incentivize usage.

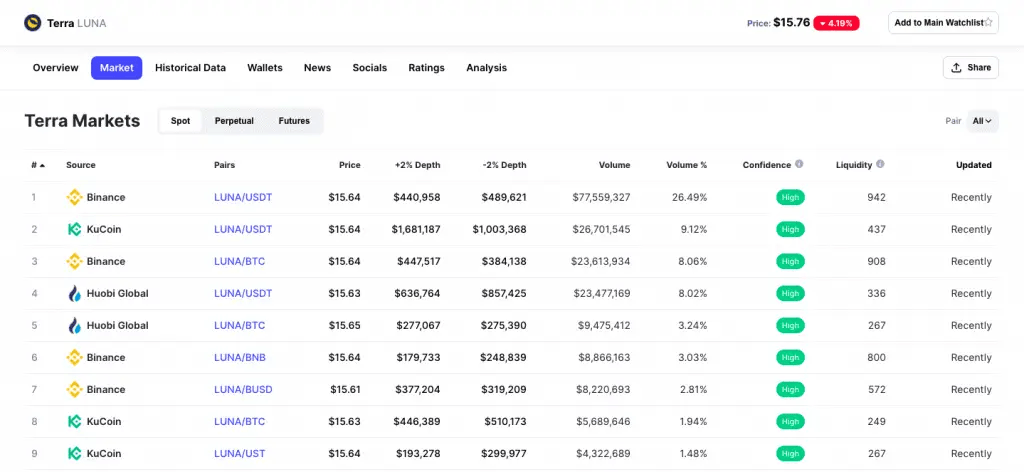

Where to buy Terra Luna?

If you want to buy or trade for Terra Luna, you can use popular cryptocurrency exchanges such as the likes of KuCoin, Binance, or Bittrex where you can trade with the likes of BTC, BNB, ETH, EUR, and USDT. Plus, you can swap between native Terra tokens within the Terra Station wallet.

For a full list of available exchanges, you can check out the likes of CoinMarketCap or CoinGecko.

Terra Luna Supported Wallets

Once you have purchased or traded for your LUNA tokens, storing them in a supported wallet is important. Keeping your tokens on an exchange is not recommended as it is a far more likely target for hackers. Plus you don’t have control over your assets without access to your private keys.

TerraStation Wallet

Terra Station is the official wallet (by Terra) for holding Terra assets and interacting with the Terra blockchain. It’s available as a web extension for the likes of Chrome or Brave or as a standalone desktop application for Windows or Mac. You can also use it with Ledger hardware wallets to keep your funds securely offline.

Within the Terra Station wallet, you can store, send, receive and swap your Terra assets as well as stake.

LUNA Staking

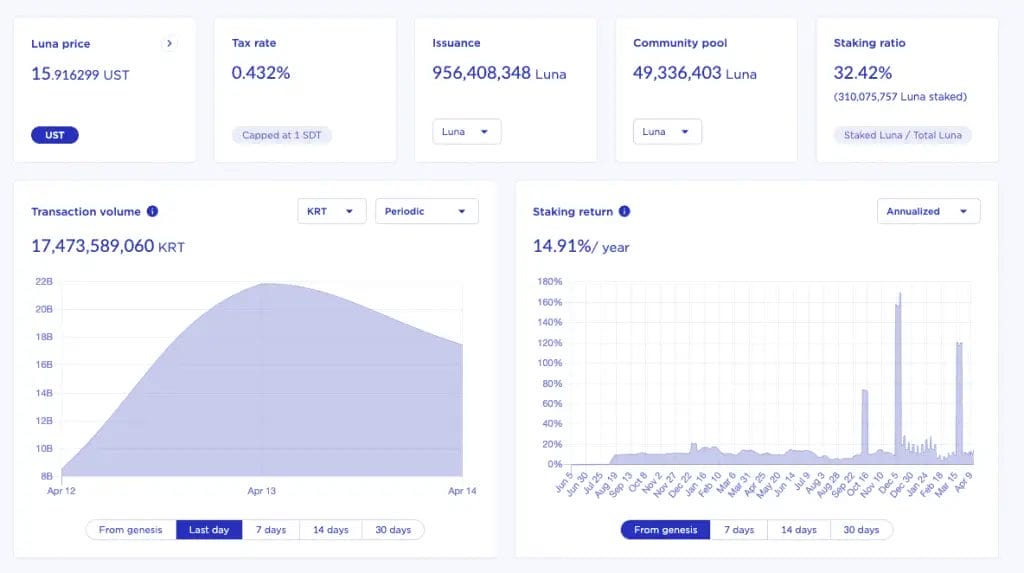

Luna holders who want to stake their assets can do this as a validator (which requires running a full node 24/7) or by delegating to a validator and becoming a delegator.

Currently, Luna validators offer interest of up to 14%. However, this rate will vary depending on the amount of the stake, the number of validators, and their commission. Plus, the rate should also increase as the transaction volume in the network increases.

What are Staking Validators and Delegators?

“Validators” essentially secure the network by running full nodes to provide consensus for the network. They commit new blocks to the blockchain and receive rewards for this.

Then you have “Delegators”, who are LUNA token holders who use the Terra Station wallet to delegate their LUNA tokens to a validator, in exchange, they receive a proportional amount of the staking revenue.

Plus, the Delegators also take on the responsibilities of the validators. So you will need to choose wisely. This means that if a validator misbehaves and is slashed, the delegator is also slashed in proportion to their stake.

How to Choose a Validator?

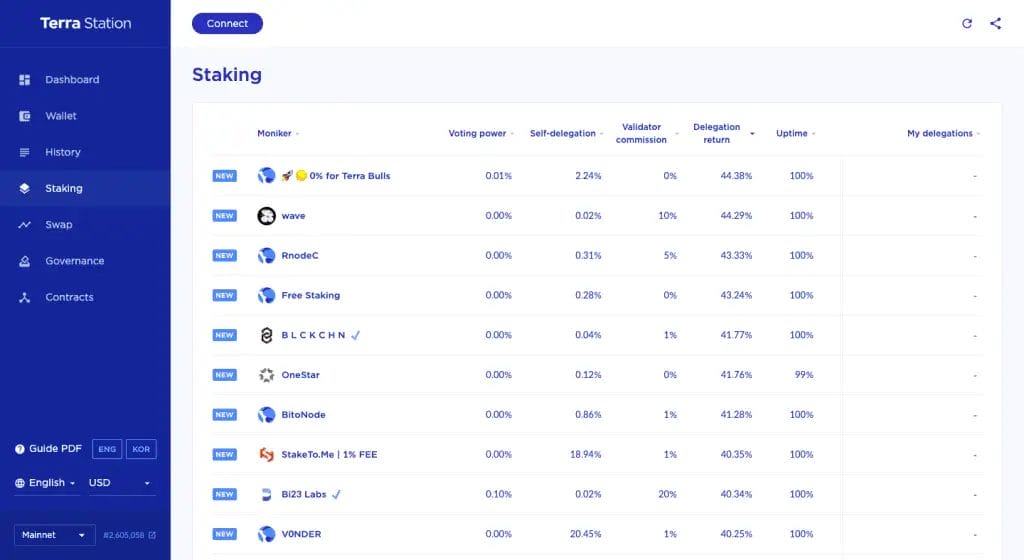

There are a lot of validators to choose from when staking your LUNA. So, how do you decide which validator to choose? And how are they different?

Every validator will come with its own unique offerings. Some validators are community members of Terra, some are professional service providers, and some are investors. Understanding who the validators are is good before you stake with them. The majority will have a website that you can visit to see what services they provide, etc. and their offerings.

Validators can get jailed and get a percentage taken from them if they are malicious. So checking out all this information is really helpful and could avoid picking a bad validator. Therefore, most people will choose a few validators to spread the risk.

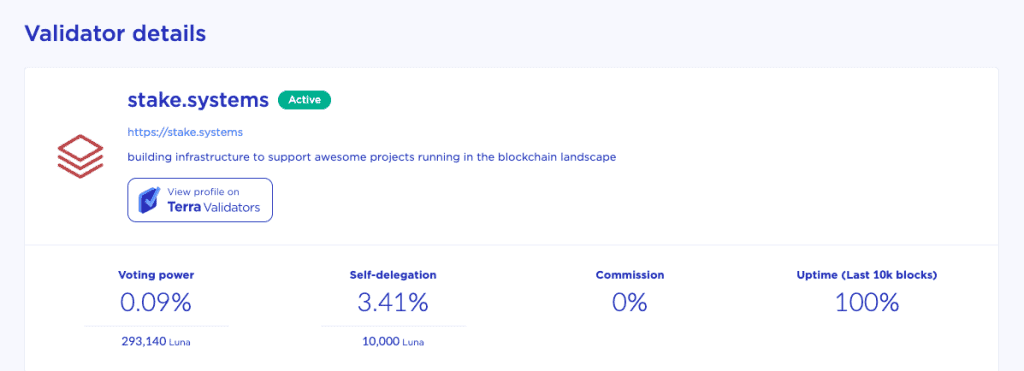

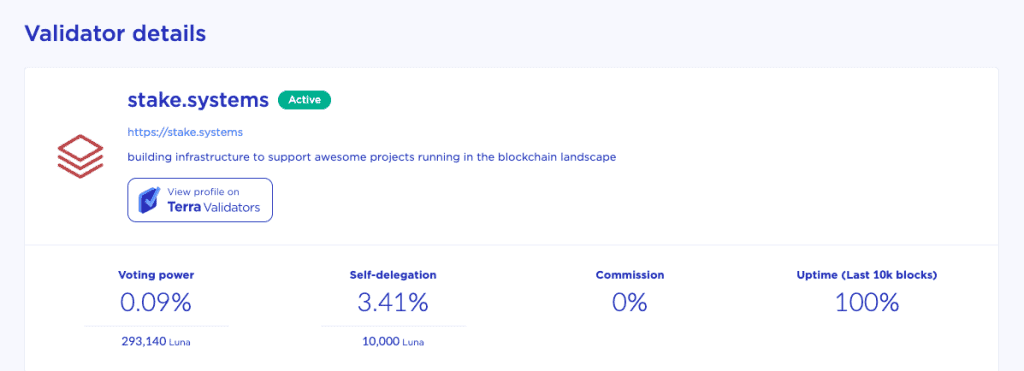

You can view all the validators ranked by “Delegation Return” which is essentially the annual APY return. This is obviously a factor you can choose from when selecting your validator.

Plus, you can view their “Voting Power”, which is an indicator of how big the validator is. There’s “Self Delegation” which shows you how much of their own they are staking.

Under “Commission”, it shows how much they’ll be taking, and you’ll find that this is usually at 0% when they want to encourage people to use their service or are new. However, it’s worth also checking out the “Max Commission Rate”, which is on their profile page. As well as the max daily amounts, they can change in a day. As this may affect who you decide to choose.

Then finally, the “Uptime” will cover the last 10,000 blocks, so it is just a short-term measure. You then have validators that have a tick beside them, and this is because they have a profile on the Terra site.