In this RAMP DeFi review, we delve into the multi-chain DeFi lending platform that offers a way to maximize value and returns on your assets. Many protocols allow you to earn a yield on your crypto. However, you can’t always borrow a stablecoin and use it to invest in other ways or vice versa.

With RAMP, you can earn yields by staking or farming on your capital, collateralize your capital and borrow RUSD stablecoin, then use the stablecoin to invest in somewhere else at the same time. In this way, users can continue to enjoy high ROI on their assets, retain capital appreciation potential while extracting liquidity at the same time.

RAMP DeFi Review

How does RAMP DEFI Work?

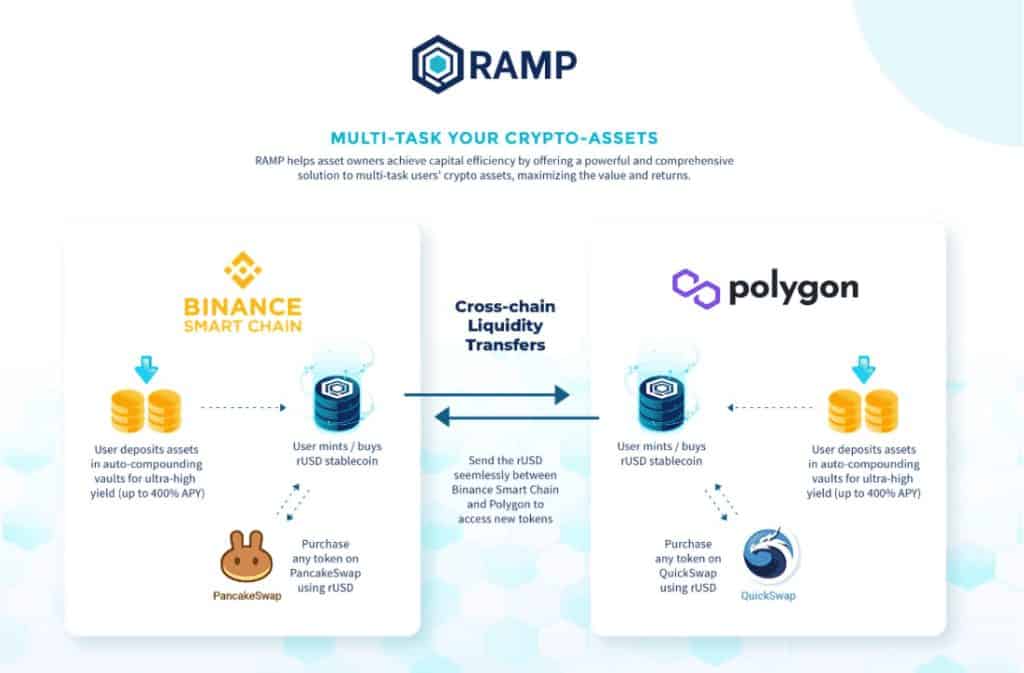

Essentially, you borrow rUSD, a stablecoin, by collateralizing your asset deposits. Whilst your collateral assets continue to generate a high yield for you, the borrowed rUSD can be used for staking or transferred between networks. Meaning you can borrow your BSC assets and send rUSD to Polygon to buy new tokens on QuickSwap, or vice versa to buy tokens on PancakeSwap!

This puts users in a unique position where their assets continue to produce high yields for them, and at the same time, they get to unlock liquidity.

The protocol offers a host of features to its users, including a cross-chain liquidity bridge, staking rewards, and yield farming opportunities.

RAMP Token

RAMP has its own utility, multi-chain token, which can be traded for on the likes of Binance, FTX, UniSwap and PancakeSwap. RAMP tokens can be used as collateral to unlock additional liquidity. Plus you can mint rUSD at zero fees when you use RAMP as collateral.

RAMP has a fixed total supply and can no longer be minted. Meaning that any RAMP burned is removed from circulation, forever.