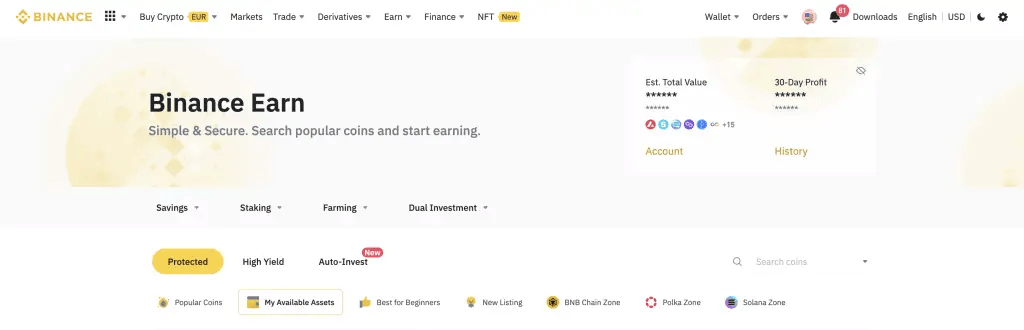

In this beginner’s guide to Binance Earn, we will explain how to earn interest with Binance Earn. Plus, the available products for investors include rates and investing terms. Plus, you can start earning interest on your crypto assets with Binance Earn.

Binance Earn is the one-stop hub where Binance users can earn interest on their crypto assets within the exchange. Choose from dozens of crypto financial products, with over 60+ supported cryptocurrencies, including Bitcoin, Ethereum, and their own BNB token.

So, let’s jump into this Binance guide to help you work out if you should invest your crypto into Binance Earn.

What is Binance Earn?

Binance Earn is a complete suite of products that are available to Binance customers. Essentially, Binance Earn acts as your crypto savings account, where you’ll find a great variety of options for earning passive income with your crypto holdings. Binance offers a whole host of savings options, which are available depending on your desired level of risk, term, and returns.

Plus, you can stake your coins, lend your funds for interest, or safely deposit them into a DeFi service through Binance. To start using any of the Binance Earn solutions, you’ll need to transfer your funds from your exchange spot wallet across to Binance Earn.

The savings options available are split between Flexible, Fixed, and High-Risk Products.

If you´re not already signed up for the Binance exchange, you can use our referral code to receive a 20% discount on trading fees.

How Does Binance Earn Work?

Binance Earn allows users to earn interest on their cryptocurrency by offering various financial products, including staking, lending, and yield farming. Users can choose flexible, fixed, or high-risk terms depending on their investment strategy and risk appetite. The platform is user-friendly, enabling easy transfer of funds from the Binance spot wallet to Binance Earn to start earning interest.

Each option comes with its own risks and rewards, requiring users to assess and choose based on their investment goals and risk tolerance.

What is Binance?

Binance.com is an online exchange platform founded in China by Changpeng Zhao in 2017. Where you buy and sell cryptocurrencies using digital assets such as Bitcoin and Ethereum.

The Binance exchange is well known for its low trading fees, a wide range of available cryptocurrency pairings, and high liquidity. However, Binance has recently become more than just a crypto exchange and now offers its customers a wide range of financial services.

Binance also has its own Binance Coin (BNB). This token allows you to receive discounts on the services of the Binance platform. Users of Binance can receive a 25% discount on trading fees by paying with Binance’s BNB token.

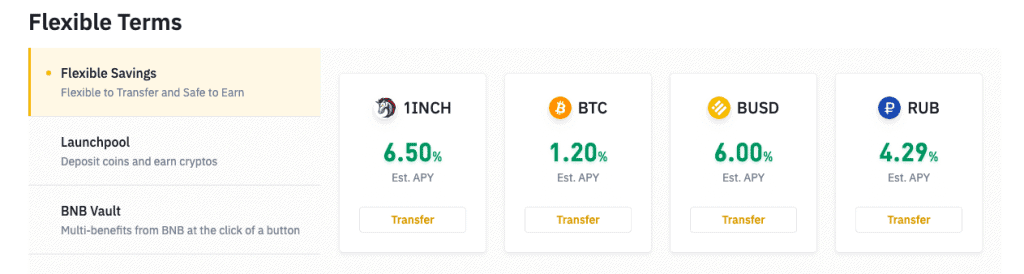

Binance Earn Flexible Terms

Within Binance Earn, the flexible options allow users to earn interest without locking in their funds for set periods. The interest rates will be lower with these options. However, these will come with a lower risk, plus the ability to withdraw at any time.

Flexible Savings

Flexible Savings offer Binance users the ability to deposit crypto and gain interest on a daily basis. This option is great for crypto, which may otherwise sit idle in your spot wallet.

With Flexible Savings, there are currently 56 savings products. Users can earn up to 10% interest on 1INCH, BUSD, BAL, BTC, ETH and USDT. You can also auto-transfer, automatically using your available spot wallet balance to purchase flexible savings.

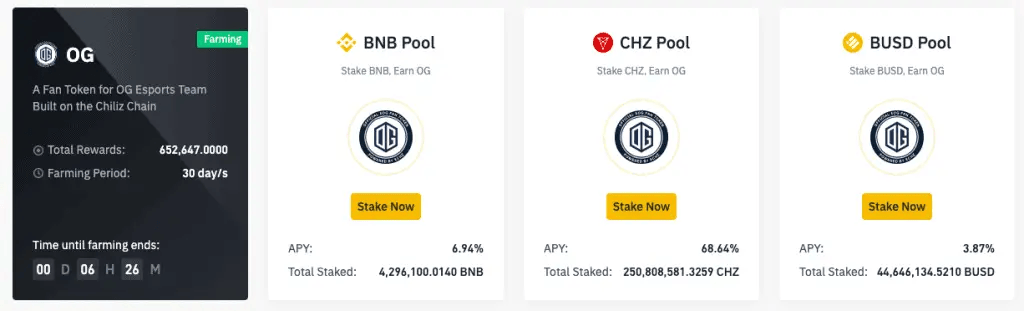

LaunchPool

With Launchpool, you can deposit the likes of BNB, BTC, and other cryptocurrencies to get a share of new tokens that are being launched on the Binance exchange. Currently, there are rates as high as 68.64%. You can view information such as the total rewards, the farming period and available tokens to stake for each event.

LaunchPool is deemed as flexible terms. This is because although you lock up these tokens, you can still redeem them at any point during the event.

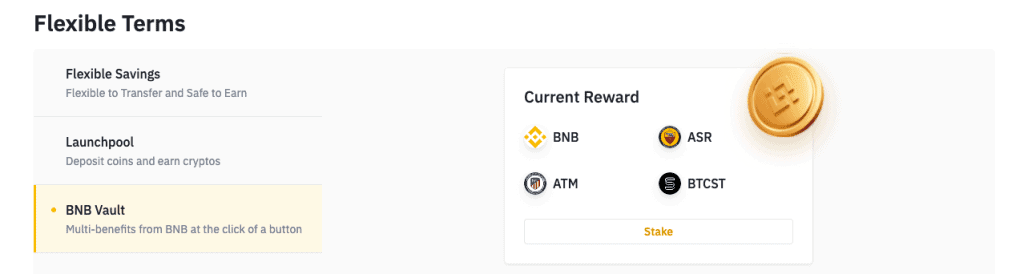

BNB Vault

The BNB Vault is a BNB yield aggregator that combines Flexible Savings, BNB DeFi Staking and Launchpool to give you the best APY returns.

When you stake your BNB tokens, you will receive BNB Vault assets. These rewards will be sent to your spot wallet. With BNB Vault, you have flexible terms and can un-stake your funds.

Binance Earn Fixed Terms

Fixed Terms essentially mean you’ll regularly deposit your funds for a specific “Fixed” period. With fixed terms, you’ll find that the interest rates are higher than those available on Flexible Terms.

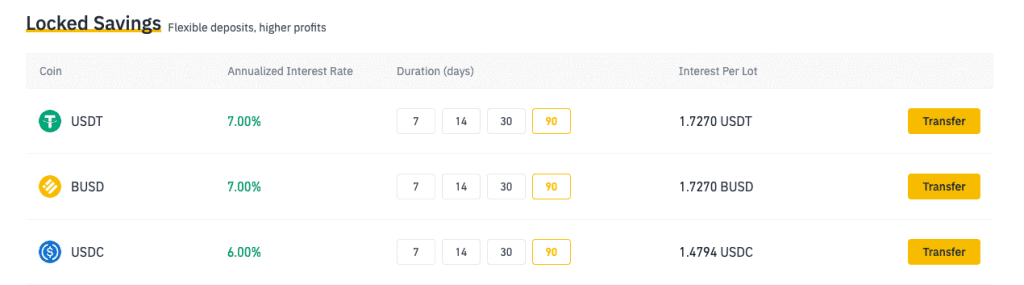

Fixed Savings

With Fixed savings, you deposit your crypto for fixed terms between 7 to 90 days. These rates will increase the longer you deposit your crypto.

You can currently deposit the likes of USDT, BUSD and USDC. These deposits are currently at rates of up to 7% for a 90-day term. During this term, your crypto is locked in.

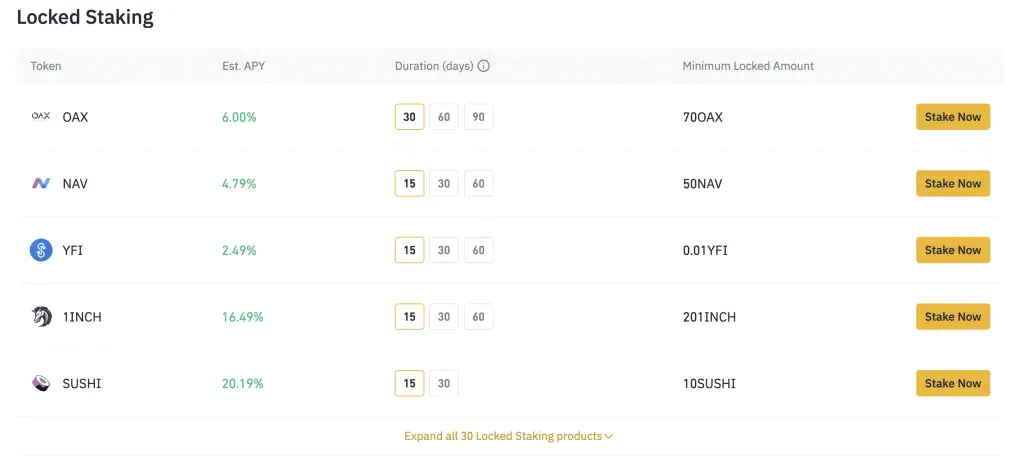

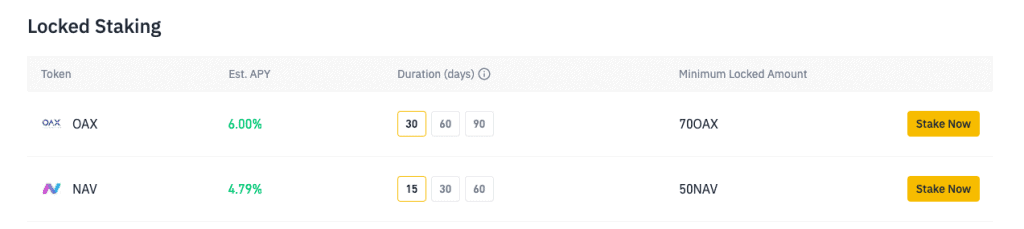

Locked Staking

With Locked Staking, users can gain rewards through staking assets on the blockchain. Around 30 staking products are available, including popular staking tokens such as 1INCH, SUSHI, YFI, ATOM, EOS and DASH, with the highest rate currently at 30%.

These products also come with minimum locked amounts and vary in term lengths.

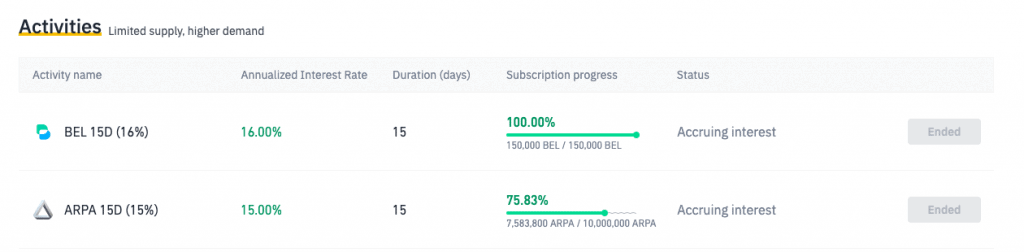

Activities

Activities are special events with limited supply and higher demand. Because they are generally at a capped supply, you sometimes need to subscribe quickly.

There have been around 155 of these activities events, with the highest rate of 88%. Activities can offer even higher returns than Fixed Savings usually do.

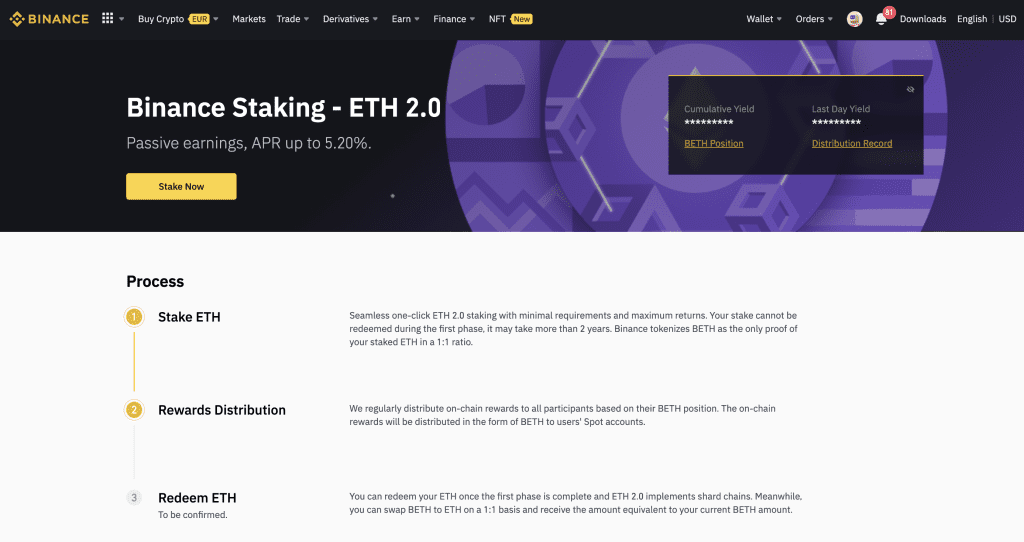

ETH 2.0 Staking

ETH 2.0 staking is another fixed-term product and a safe and secure place for ETH staking, with up to 20% APY.

When you stake your ETH, this can’t be redeemed during the first phase, which may take more than two years. However, Binance will regularly distribute on-chain rewards to all participants based on their BETH position (which is the token provided as proof of your staked ETH) in a 1:1 ratio.

Once the first phase is complete, you can redeem your ETH. However, in the meantime, you can swap your BETH for ETH on a 1:1 basis. You can swap BETH back to ETH at any time and receive the amount equivalent to your current BETH amount.

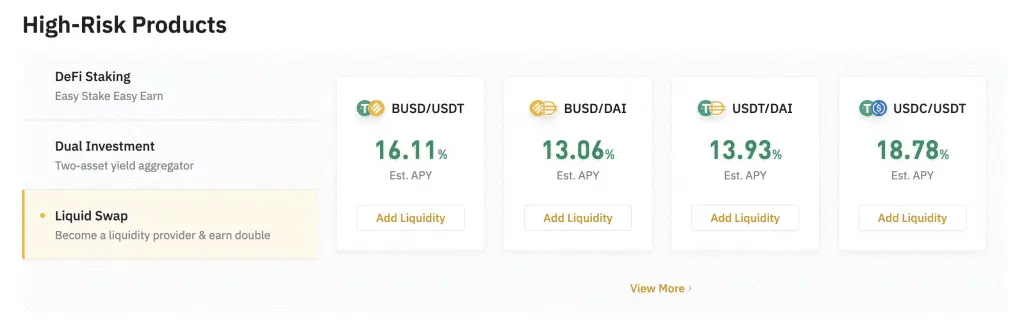

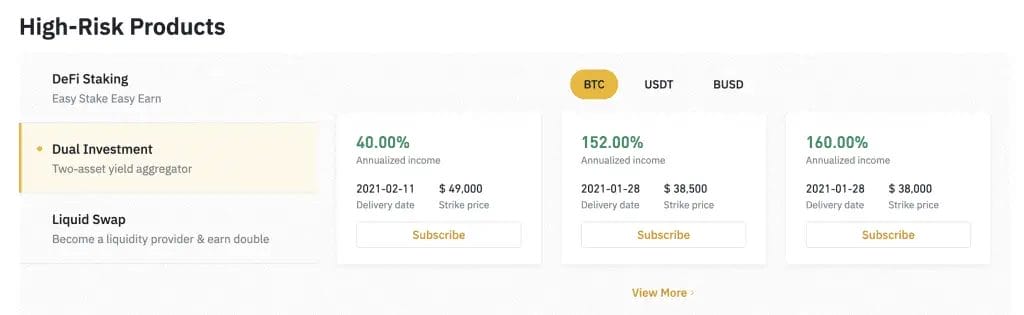

Binance Earn High-Risk Products

These products can offer some of the highest interest rates. However, they come at a higher risk, and users should invest cautiously once they fully understand the risks.

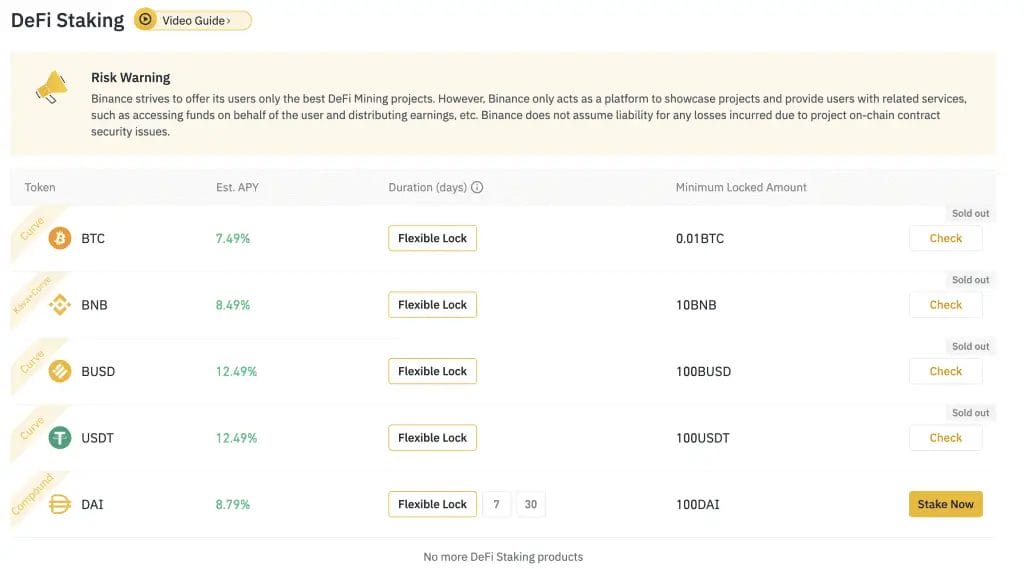

DeFi Staking

DeFi Staking is a way to access DEFI without having to manage your private keys, make trades or perform other complicated tasks required to participate in DeFi Staking. Decentralized Finance (DEFI) staking provides financial services to users through smart contracts and higher earnings for specific currencies.

Currently, the interest rates reach 8.79% for staking the likes of DAI. Plus, they offer both flexible locking and fixed locking deposits. DeFi staking also comes with minimum lock amounts.

Dual Savings

Dual Investments/Dual Savings are another way to earn, but this time, it doesn’t matter which direction the price goes. With Dual Savings, you deposit a cryptocurrency and earn a return based on two assets. You commit your holdings lock in a yield but earn more if your holdings’ value increases when they’re locked up.

The annualised rates of return are as high as 160% (for BTC), and users can deposit BTC, BUSD or USDT.

Although the rate of return is fixed, the final settlement is determined based on the settlement and pegged prices. Therefore, the risk associated with Dual Currency Investments mainly lies in the high rate of market volatility. Users are advised to invest with caution once they fully understand the risks.

Liquid Swap

The final high-risk savings option is Liquid Swap. This is where you can become a liquidity provider and earn double rewards with rates up to 15.67%.

Liquid Swap, also known as BSwap, is obviously not risk-free either. When the market price of tokens fluctuates greatly, the staking income may be lower than that of ordinarily holding the tokens, and losses may even occur at this point.

Is Binance Earn Safe?

Binance Earn is a reliable platform for earning interest on crypto assets. However, it’s essential to acknowledge the inherent risks associated with staking or lending digital assets. The platform implements robust security measures and protocols to mitigate these risks and ensure the safety of users’ investments. To maintain a balanced and secure ecosystem, Binance Earn employs real-time monitoring of on-chain staking and Loan-to-Value (LTV) ratios.

Furthermore, Binance Earn is committed to transparency and integrity, ensuring users are well-informed about the potential risks and rewards. The platform maintains a balanced portfolio of liquid and locked offerings to cater to diverse investor needs while minimizing risk exposure.

In addition to these measures, Binance Earn strongly emphasises user education. The platform provides resources and tools to help investors make informed decisions understanding the nuances and complexities of staking, lending, and other earning mechanisms. Users are encouraged to assess their risk tolerance and investment objectives to select the most appropriate earning options.

Conclusion

Binance Earn offers a diversified portfolio of financial products designed to optimize the earning potential of your crypto assets. From the flexibility of accessing funds to the allure of high returns, Binance Earn caters to a spectrum of risk appetites and investment horizons.

However, as with any investment venture, the promise of returns is accompanied by inherent risks. The key to a successful investment journey lies in a balanced approach, combining informed decisions, risk management, and diversification. Binance Earn, while offering a robust platform equipped with security and versatility, underscores the importance of investor awareness and education.

Remember, the journey to financial growth in crypto is a marathon, not a sprint. Take the time to understand, analyze, and strategize before diving into the diverse offerings of Binance Earn.

FAQs

Can you make money on Binance earn?

Absolutely! Binance Earn provides a plethora of opportunities to grow your crypto assets. Users can earn interest on their holdings by engaging in activities like staking, lending, and yield farming. The platform supports a variety of cryptocurrencies, offering flexibility and options to enhance your earning potential. Always consider the associated risks and ensure your choices align with your investment goals and risk tolerance.

How risky is Binance Earn?

Investing in Binance Earn involves a level of risk, as it does with all types of investments. The risk varies depending on your specific financial product within Binance Earn. While there are safer options like flexible savings, high-risk products offer higher returns but come with increased volatility and potential loss of investment. It’s crucial to understand each product’s nature, associated risks, and potential rewards before investing.

Can you lose money with Binance earn?

Yes, there is a potential to lose money with Binance Earn. The value of cryptocurrencies can be highly volatile, and the returns on products within Binance Earn are often correlated with the market performance of the underlying assets. It’s essential for investors to assess their risk tolerance and diversify their portfolios to mitigate potential losses.

Does Binance stake automatically?

Binance offers an “Auto Subscription” feature that enables automatic compounding of your savings and staking yields daily, optimizing your earning potential. The “Auto Invest” feature is another handy tool that schedules recurring crypto purchases and earns APY on those purchases using stablecoin funds from your wallet, making the earning process seamless and hassle-free.

How do you make $100 a day on Binance?

Making $100 a day on Binance requires a well-thought-out strategy, understanding the market, and considering risk factors. Users can engage in trading, staking, or lending to potentially earn daily profits. However, it’s essential to remember that the cryptocurrency market is volatile, and earnings can fluctuate.