JPMorgan Chase UK has announced a stringent policy, effective from October 16, prohibiting its customers from conducting cryptocurrency transactions through bank transfers or debit cards. This decision comes in light of the escalating number of crypto scams targeting UK consumers, prompting the bank to enhance measures to safeguard customer funds.

A spokesperson for Chase elucidated that the bank is unwavering in its commitment to maintaining the security and integrity of customer funds. The ban encompasses wire transfers to cryptocurrency exchanges, and any attempt to make crypto-related transactions will be declined from October onwards.

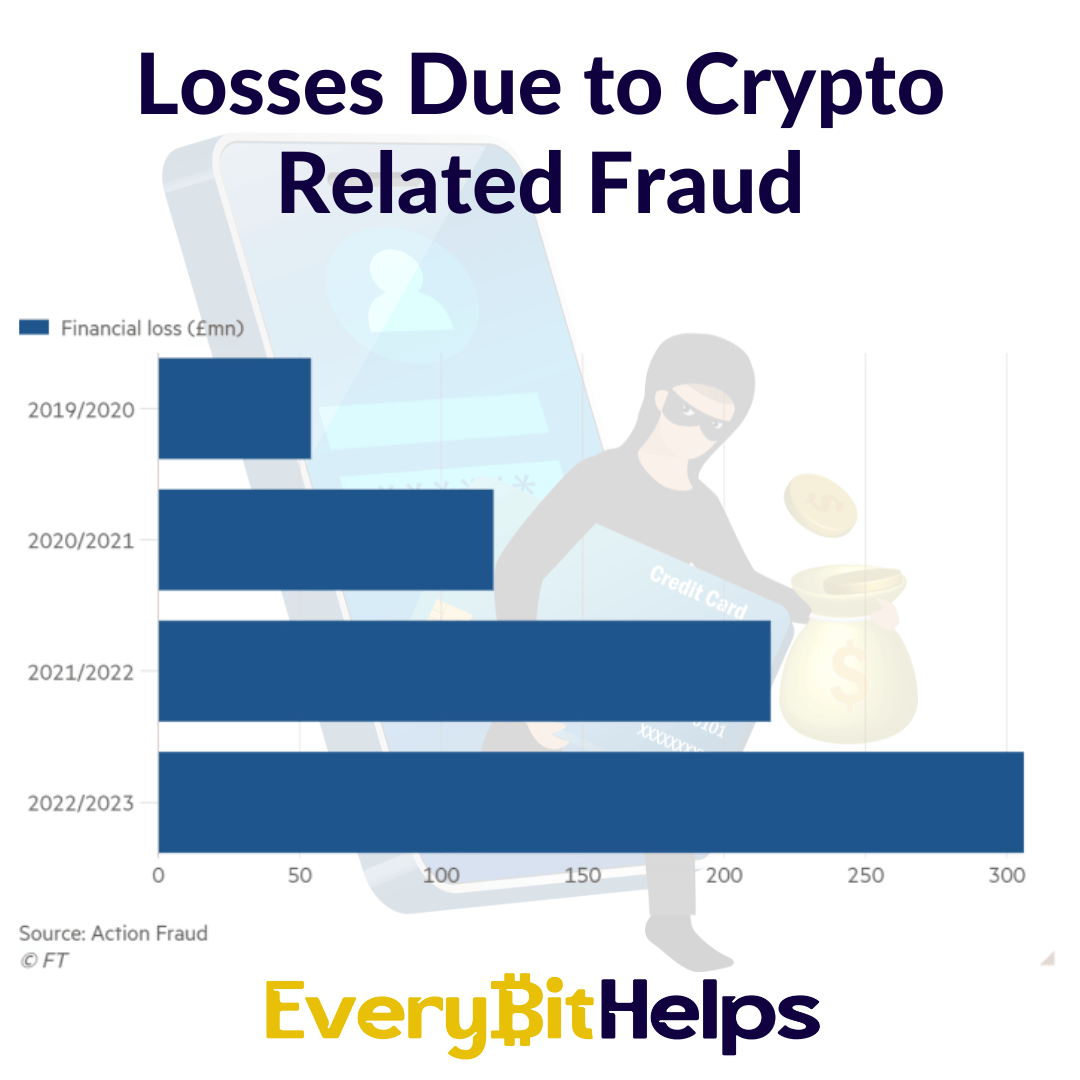

This move by JPMorgan Chase UK is underscored by a report from Action Fraud, the UK’s fraud reporting agency, revealing a 40% surge in consumer losses due to fraud, exceeding 300 million British pounds sterling. The bank has advised its customers that switching banks or providers is an option, but they should be wary of the risk of not being able to recover money involved in fraudulent or scam-related payments.

JPMorgan Chase UK is not the first to impose restrictions on crypto transactions. Earlier this year, several banks, including The Royal Bank of Scotland and Santander, implemented tighter controls on customers utilizing cryptocurrencies, citing similar concerns over fraud and scams.

However, customers looking for a UK crypto-friendly bank still have alternatives like Revolut and Monzo, which allow transactions with a range of cryptocurrency exchanges as part of personal banking services.