Are you one of those who have always dreamed of being a millionaire? If you were lucky enough to find yourself in that position, could you live off 1 million pounds? And more importantly, what’s the best way to keep your millionaire status?

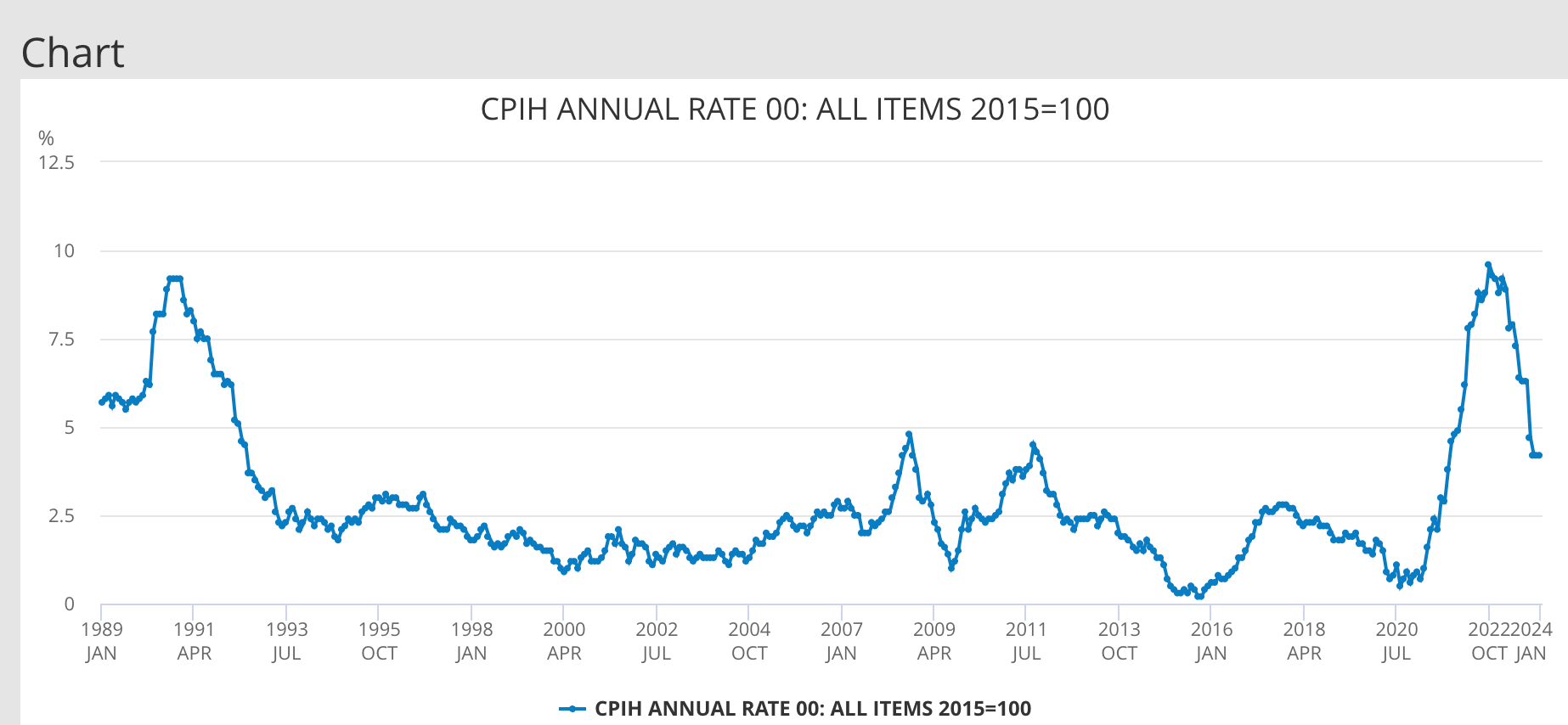

Inflation is one factor that can significantly impact the purchasing power of your money. Inflation was above 10% in 2023, a rate not seen since 1982. Additionally, Bank of England (BOE) interest rates are currently around 5.25%, which means keeping your money in most UK banks will not generate enough interest to keep up with inflation.

In this post, we’ll explore how much interest 1 million pounds can make you in 2024 and what interest rate you would need to live a comfortable, worry-free lifestyle.

How Much Interest Does 1 Million Pounds Make in 2024?

With the Bank of England’s interest rate at 5.25%, an investor would earn £52,500 in interest on 1 million pounds. This scenario presents a favourable condition for savers, as the inflation rate has now dipped below the central bank’s interest rates, enhancing the actual value of returns on savings.

Why this is significant: If you deposit a million pounds in a savings account offering an interest rate of 5.25%, you would earn £52,500 in interest over a year. With the current inflation rate below this mark, at 4.2%, the purchasing power of your money is preserved and grows in real terms.

This means that unlike when inflation outpaces interest rates, your savings are growing nominally and in terms of actual purchasing power. This shift is a boon for savers as it ensures that the actual value of their savings increases, making their investments more fruitful.

This marks a pivotal moment for investors and savers, highlighting the importance of closely monitoring interest and inflation rates when considering the real return on investment. With the current dynamics, placing your money in a savings account secures it and ensures it grows both nominally and in real value.

There are investment options available to UK investors that can help you beat inflation and earn a return, but these don’t come without risk.

What is Inflation?

Inflation is essentially the term used to describe how the cost of buying things we use daily, like groceries, clothes, or gas, gradually increases over time in the UK. This change affects how much we can buy with the same amount of money. If inflation is high, your money doesn’t go as far as it used to, meaning you might be able to buy less with the same £1 today than you could last year.

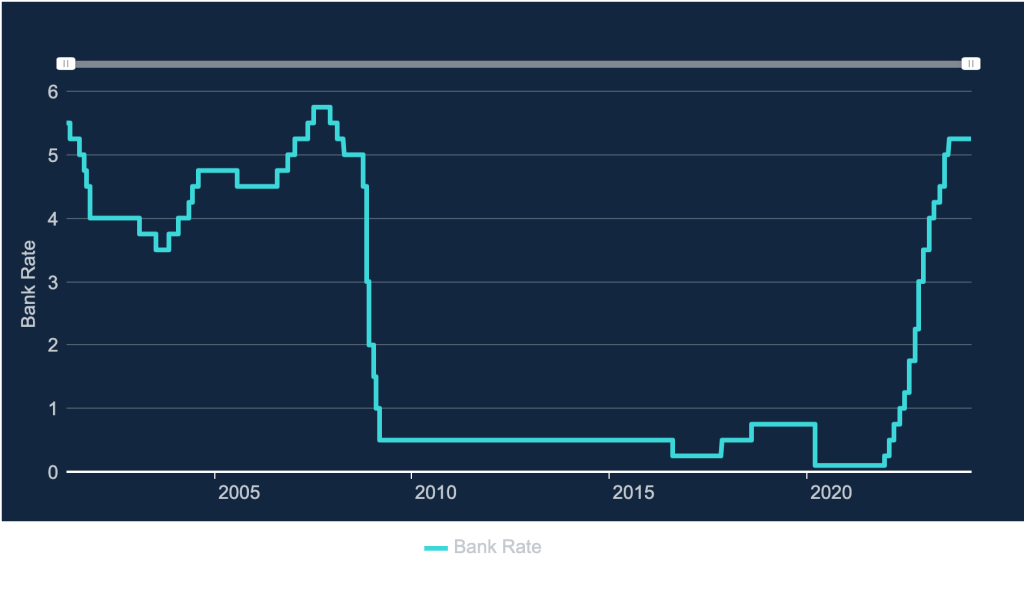

What is the Current BOE Interest Rate for March 2024?

As of March 2024, the Bank of England’s interest rate is 5.25%. UK interest rates decreased following the 2008 Global Financial Crisis, also known as the GFC, hitting a historic low of 0.1%. However, since 2022, UK Interest rates have been rising.

How Does the Bank of England Set Interest Rates?

The Bank of England sets interest rates through its Monetary Policy Committee (MPC). The MPC meets eight times yearly to review economic conditions and decide whether to adjust the interest rate.

When deciding whether to adjust interest rates, The MPC considers a variety of economic indicators, including inflation, employment, and economic growth. The goal is to maintain price stability and support the economy through various economic cycles.

How Much Interest Can I Earn on £1 Million at a 0.5% Interest Rate?

At a 0.5% interest rate, you can expect to earn £5,000 in interest annually on 1 million pounds. This amount may not be sufficient to keep up with the current UK inflation rate and maintain the purchasing power of your money.

Although the current BOE rate is currently set at 4%, it is possible to find savings accounts that pay less than this. Wherever you live in the UK, this would unlikely be enough to make a comfortable living, especially with sky-high inflation.

- Daily Return: £13.69

- Weekly Return: £96.15

- Monthly Return: £416.66

- Yearly Return: £5,000

How Much Interest Can I Earn on £1 Million at a 1% Interest Rate?

If you invested £1 million at a 1% interest rate, you could earn £10,000 in interest over one year.

Earning 1% on £1,000,000 wouldn’t be enough to live on in the UK. Fortunately, in 2024 you should be able to find savings accounts with a higher return than 1% without too much of an issue.

- Daily Return: £27.40

- Weekly Return: £192.30

- Monthly Return: £833.33

- Yearly Return: £10,000

How Much Interest Can I Earn on £1 Million at a 2.5% Interest Rate?

If you invest £1 million at a 2.5% interest rate, you could earn £25,000 in interest in one year.

If you opt for a conservative 2.5% interest rate, you could earn a tidy sum of £25,000 in just one year. But hold on, don’t get too excited just yet! With rising inflation, a 2.5% interest rate may not be enough to maintain your purchasing power.

- Daily Return: £68.49

- Weekly Return: £480.77

- Monthly Return: £2,083.33

- Yearly Return: £25,000

How Much Interest Can I Earn on £1 Million at a 5% Interest Rate?

If you’re sitting on a cool million pounds, wondering how to make the most of it. Well, how about earning £50,000 in interest over one year? That’s right – a 5% interest rate could get you there!

With the average UK salary hovering around £29,600 per year, earning a 5% return should leave you in a comfortable position.

A 5% interest rate would have been unthinkable just last year. However, there are investment opportunities out there if you do your research. So, if you’re ready to take your millionaire status to the next level, it’s time to start exploring investment options.

- Daily Return: £136.99

- Weekly Return: £961.54

- Monthly Return: £4,166.66

- Yearly Return: £50,000

How Much Interest Can I Earn on £1 Million at a 10% Interest Rate?

If you invested £1 million at a 10% interest rate, you would earn £100,000 in interest over one year. Notably, a 10% interest rate is high and unrealistic for most investments.

Earning £100,000 per year would be the promised land for most people, but it’s not all sunshine and roses. If you consider inflation, you would just be making a profit. Investing £1 million at a 10% interest rate, and with the current inflation rate at 8.8%, your real rate of return would be 1.2%. This means that after accounting for inflation, your investment would only grow by 1.2%.

Example: If your investment earns £100,000 in interest in one year, but inflation is at 8.8%, the value of that £100,000 in today’s purchasing power would be eroded by 8.8%, leaving you with only a 1.2% real return.

- Daily Return: £273.98

- Weekly Return: £1,923.08

- Monthly Return: £8,333.33

- Monthly Return: £100,000

How Should You Invest 1 Million Pounds?

If you are in the fortunate position to have 1 million pounds to invest, there are several factors you will need to consider. We have put together some tips that may help you:

- Diversify your Portfolio: It’s always wise to spread your investments across different asset classes, such as stocks, bonds, and real estate. A diversified portfolio can help reduce risk and provide a more stable return over time.

- Time Horizon: Your investment goals and time horizon will determine the types of investments you can choose. For example, if you have a long-term horizon, you may want to consider investing in the stock market or real estate, which tends to offer higher returns over the long run.

- Be Tax-Efficient: Consider investing in tax-efficient vehicles such as ISAs, pensions, and property. These types of investments can help you to reduce your tax bill and increase your returns.

- Fees: Fees can quickly eat into your investment returns, so choose investments with low fees and avoid unnecessary charges.

- Consult a Financial Advisor: A financial advisor can help you develop an investment plan aligning with your goals and risk tolerance. They can also guide you in the best investment options based on your financial situation.

Investing comes with risks, and it’s essential to consider your circumstances before making any investment decisions. Always seek professional advice before making any investment decisions.

Can I Live Off the Interest on £1,000,00 Million?

Whether you can live off the interest on your million pounds will depend on the interest rate you are earning, lifestyle expenses, and investment strategy.

Assuming you earned a conservative interest rate of 4%, the annual interest on 1 million pounds would be £40,000. While this may seem significant, supporting a lavish lifestyle or covering expenses may not be enough.

If you are willing to take on more investment risk, you may be able to earn a higher interest rate, but this could also come with greater volatility and potential loss. Alternatively, you may consider a diversified investment strategy that includes the stock market, bonds, and other assets that can generate income and growth over time.

Whether you can live off the interest on 1 million pounds will depend on your circumstances, financial goals and risk tolerance.

| Interest Rate | Monthly Return | Yearly Return |

|---|---|---|

| 1% | £833 | £10,000 |

| 2% | £1,666 | £20,000 |

| 3% | £2,500 | £30,000 |

| 4% | £3,333 | £40,000 |

| 5% | £4,166 | £50,000 |

| 8% | £6,666 | £80,000 |

| 10% | £8,333 | £100,000 |

What is the Tax on 1 Million Pounds?

The amount of tax you owe on one million pounds will depend on the sources of your income and your personal tax situation. Here is a general overview of the tax rates for various types of income in the UK:

- Income Tax: If you earn a million pounds, you will be subject to the highest tax rate of 45% for income over £150,000 per year, plus National Insurance contributions.

- Capital Gains Tax: If you sell assets such as property or investments for a profit, you may be subject to capital gains tax. The rate for higher-rate taxpayers in the UK is currently 20%. However, an annual allowance of £12,300 can be used to offset gains.

- Inheritance Tax: If you leave one million pounds as part of your estate when you pass away, your beneficiaries may be subject to inheritance tax. The rate for amounts over the tax-free threshold of £325,000 is currently 40%.

Conclusion

If you’re fortunate enough to have 1 million pounds, you might dream of moving to a tax haven like Monaco and living off the interest while soaking up the sun. However, for most people, that’s not a realistic option. If you’re in this position, it’s essential to have a plan in place to maintain this status. With the current UK inflation rate exceeding 10%, leaving your money in UK banks is not a good option.

A 5% interest rate could earn you £50,000 annually, but it’s essential to research investment opportunities and remember that high-interest rates come with risks. With the right investment plan, you can live worry-free and enjoy your millionaire status.

FAQs

How much interest will I earn on 20 million pounds?

At a 5% annual interest rate, one could expect to earn interest in the region of £1 million from a £20 million investment in a year. However, actual returns can vary based on market conditions, investment type, and other factors.

How much do I need to retire?

The ideal retirement fund target varies based on the expected retirement age, desired retirement lifestyle, anticipated medical expenses, and the cost of living in the chosen retirement location. Financial experts often recommend saving up at least 25 times your annual expenses. For instance, if you anticipate needing £40,000 per year in retirement, you’d aim to save £1 million.

What is the 4% rule?

The 4% rule states that if you withdraw 4% of your retirement savings in the first year and then adjust that amount for inflation each subsequent year, your savings should last for at least 30 years. This rule is based on historical stock and bond return data over the 20th century.