In this beginner guide to the Crypto Fear & Greed Index, we will take a look at how the Fear and Greed Index works, how to use it, and what it can tell us about the cryptocurrency market in 2024.

The Crypto Fear & Greed Index is a thermometer for the market’s emotional climate. By understanding the index and market sentiment, you can make more informed decisions and avoid getting caught in the cycle of fear and greed, which can lead to costly mistakes.

So, let’s jump in and help you understand how the Crypto Fear and Greed Index operates, its role, and what it can reveal to help you make wise investment decisions in the cryptocurrency market in 2024.

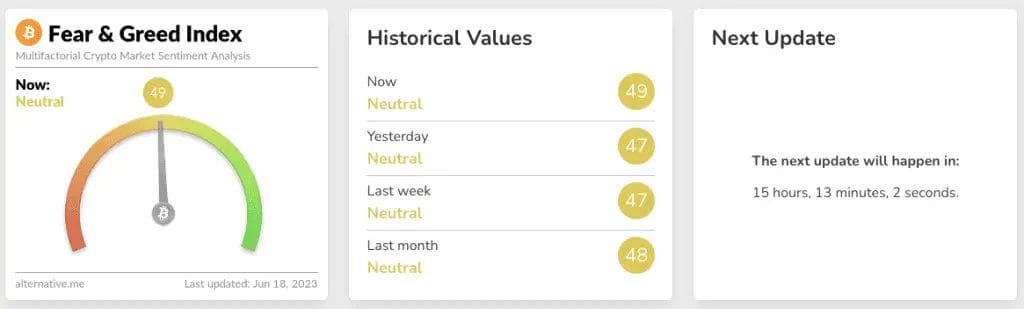

Live Crypto Fear & Greed Index

What is the Crypto Fear & Greed Index?

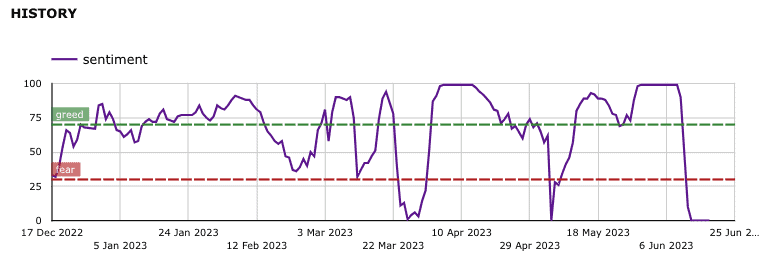

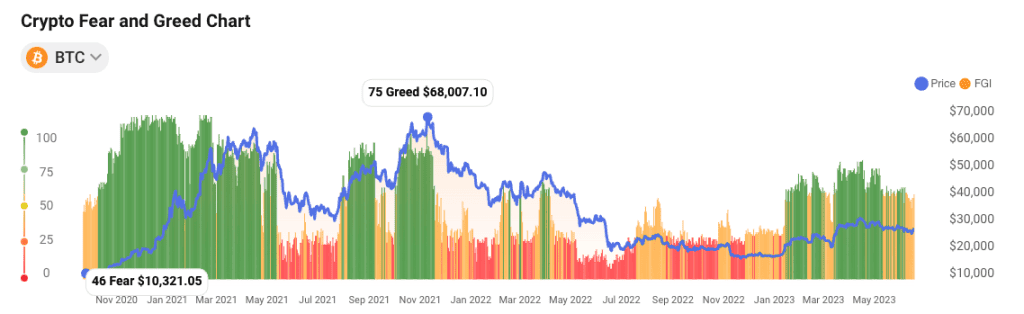

The Crypto Fear & Greed Index is a crucial tool for crypto enthusiasts, investors, and traders. This innovative index presents a daily, weekly, and monthly snapshot of the emotions and sentiments driving the global cryptocurrency market. It’s based on a scale from 0 to 100, with 0 representing “Extreme Fear” and 100 indicating “Extreme Greed”. The closer the index value is to 100, the greater the market greed. Conversely, a score closer to 0 shows high levels of fear.

But what does this mean for the crypto landscape? The Fear & Greed Index is derived from analysing volatility, market momentum, social media, surveys, dominance, and trends. When the market shows excessive fear, it’s generally a buying opportunity. When the market is being driven by greed, it might be time to consider selling.

How the Crypto Fear & Greed Index Works

The Crypto Fear & Greed Index draws upon diverse sources of market data and uses the data to create a comprehensive and accurate picture of market sentiment.

Here’s a closer look at how the Fear & Greed Index functions:

- Volatility: The index examines the current market volatility and compares it with average values from the past. Higher volatility tends to signal fear, while lower volatility is associated with greed.

- Market Momentum/Volume: The index compares the current volume and momentum with average figures from the past. When there’s an upward trend with high volumes, it generally indicates greed.

- Social Media: Using APIs from various significant platforms, the index scours the internet for posts about cryptocurrencies. Sentiment analysis is then used to classify these as indicating fear or greed.

- Surveys: Periodic surveys of crypto traders provide direct insight into their sentiments. These are then incorporated into the index.

- Dominance: The index looks at Bitcoin’s market dominance. Spikes in Bitcoin dominance usually correlate with fear as traders retreat to the most well-known crypto asset.

- Trends: The index keeps tabs on Google Trends data for various Bitcoin-related search queries. A sudden increase in these can indicate greed is taking over.

A proprietary formula combines these diverse data sources into a composite index. This index is then scaled from 0 to 100, providing a clear indication of market sentiment. The result is the Crypto Fear & Greed Index, which investors know and use to make investment decisions.

How to Use the Crypto Fear & Greed Index to Make Informed Investment Decisions

The Crypto Fear & Greed Index is an exciting snapshot of market sentiment and a powerful tool for strategic investment decisions.

Here’s how you can use this index to guide your cryptocurrency investments:

- Identifying Market Extremes: A fundamental investment principle is to buy low and sell high. The Crypto Fear & Greed Index can help you identify these extreme points. When the index shows ‘Extreme Fear’, it may be an opportune moment to consider buying as prices are likely lower. Conversely, ‘Extreme Greed’ might suggest that the market is overheating, which could be a suitable time to sell.

- Contrarian Investing: Following the herd isn’t always the best strategy in investing. Sometimes, going against the general sentiment can yield significant rewards. If the market is fearful, it may be the perfect time to be greedy, and vice versa. This strategy aligns with Warren Buffet’s famous advice: “Be fearful when others are greedy and greedy when others are fearful.”

- Risk Management: The index can serve as a risk indicator. If the market exhibits extreme greed, it might signal increased risk, as the market may be in a bubble. A period of extreme fear, on the other hand, might signal a market correction.

- Balancing your Portfolio: You can use the index as a guide to balance your portfolio. During periods of extreme greed, it might be wise to move some of your investments into less risky assets. Conversely, you might consider increasing your exposure to cryptocurrencies during periods of extreme fear.

- Understanding the Market Cycle: Fear and greed are the driving forces behind the market cycles. By monitoring the Fear & Greed Index, you can understand where the market might be in its cycle and adjust your investment strategy accordingly.

Remember, the Crypto Fear & Greed Index is a tool that should be used in conjunction with other market indicators and your personal investment strategy. It’s not a silver bullet, but it provides valuable insights that can assist you in making informed investment decisions in the dynamic world of cryptocurrencies.

Best Fear & Greed Indexes to Follow

Navigating the world of cryptocurrencies can be daunting, but luckily, several trustworthy and reliable indices can guide you through this volatile landscape. Here are some of the best Bitcoin and Crypto Fear & Greed Indices that provide comprehensive insight into market sentiment:

1. Alternative.me Crypto Fear & Greed Index

The Alternative.me Crypto Fear & Greed Index is among the most popular and commonly referred to in the crypto community due to its comprehensive approach and user-friendly design.

The index measures the current sentiment of the Bitcoin market and represents it on a scale from 0 to 100. It incorporates factors such as volatility, social media sentiment, and market dominance. Providing a daily, weekly, and monthly sentiment score makes it a versatile tool for investors.

2. CNN Money’s Fear & Greed Index

While not exclusively focused on cryptocurrencies, CNN Money’s Fear & Greed Index is a well-respected tool that can offer a broad perspective on the financial markets. It includes seven different fear and greed indicators. Though it is primarily targeted towards the stock market, its insights can often align with the overall sentiment in the crypto world.

3. 4. Alpha Data Analytics Index

Alpha Data’s Analytics Index is an advanced sentiment analysis tool tailored to the crypto market. It uses artificial intelligence and machine learning techniques to analyze sentiments expressed on social media platforms and other relevant online sources. The index can provide real-time insights into market sentiment, making it an invaluable resource for crypto traders and investors.

The Alpha Data Analytics Index stands out for its sophisticated use of technology to offer nuanced and predictive sentiment analysis.

4. CoinStats Fear & Greed Index

CoinStats, a popular platform for tracking crypto prices and managing investments, also provides its own Fear & Greed Index. This user-friendly tool integrates seamlessly with its comprehensive suite of resources, making it an excellent choice for novice and experienced investors.

5. BTCTools.io Fear & Greed Index

BTCTools.io is a specialized platform that offers a wide range of analytical tools for Bitcoin traders. Their Fear & Greed Index incorporates multiple data points, including market volatility, social media sentiment, and Google Trends data, offering users a well-rounded view of the current market sentiment.

By utilizing these indices in tandem with your own research and insight, you can navigate the cryptocurrency market more effectively. Remember that these tools provide guidance but should not replace thorough market analysis and well-thought-out investment strategies.

Conclusion

The Crypto Fear & Greed Index is a powerful tool for measuring the sentiment of the cryptocurrency market. It provides real-time data to help investors navigate market changes and make informed investment decisions by tracking factors such as volatility, trading volume, and social media sentiment.

As the cryptocurrency market continues to evolve and grow, the Crypto Fear & Greed Index will remain essential for investors looking to succeed in this exciting and dynamic market. By incorporating the index into your investment strategy, you can increase your chances of success and make informed decisions based on real-time data and market sentiment.

FAQs

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that gives investors a snapshot of the current sentiment within the cryptocurrency market based on various sources, including market volatility, trading volume, and social media sentiment.

How is the Crypto Fear & Greed Index calculated?

The index is calculated by analyzing market volatility, trading volume, social media chatter, trends, and market dominance. These factors are then aggregated using a proprietary formula, resulting in an index score between 0 (Extreme Fear) and 100 (Extreme Greed).

How can I use the Crypto Fear & Greed Index to make investment decisions?

The Crypto Fear & Greed Index can guide investment decisions by monitoring market sentiment. When the index indicates ‘Extreme Fear,’ it might be an opportunity to buy. Conversely, when it shows ‘Extreme Greed,’ it might be a good time to sell or hold off on making new investments.

What are the alternatives to the Crypto Fear & Greed Index?

There are several alternatives to the Crypto Fear & Greed Index, including CNN Money’s Fear & Greed Index, CryptoMeter’s Fear & Greed Index, Santiment’s Fear & Greed Index, CoinStats Fear & Greed Index, BTCTools.io Fear & Greed Index, and Alpha Data Analytics Index.

Does the Crypto Fear & Greed Index work?

Yes, the Crypto Fear & Greed Index does work as a tool to gauge market sentiment. However, like any investment tool, it should not be used in isolation. Instead, it should be incorporated into a broader investment strategy, including other indicators and market research.

What is the highest Crypto Fear & Greed Index score?

The Crypto Fear & Greed Index is calculated from 0 to 100. A score of 100 would represent ‘Extreme Greed,’ indicating strong market optimism. It’s worth noting that high scores may also suggest overbuying and potential market correction.