Decentralized money market Aave, has now rolled out version 2, with new features, making the protocol more flexible and efficient. DeFi protocol, Aave has grown at record speed with a market size of over 1 billion dollars. Enabling users to lend and borrow a diverse range of cryptocurrencies and bringing the likes of flash loans and atokens as a way to unlock capital and provide permissionless savings accounts.

As of December 3rd 2020, the Genesis team has now introduced new features in Aave Protocol V2, to unlock even more value in DeFi and make the overall experience more seamless.

Aave V2 What’s New?

Below is a list of features that are new to Aave version 2. However, these won’t all be beneficial to the average users lending and borrowing, and instead, some of these do require developers to build on top.

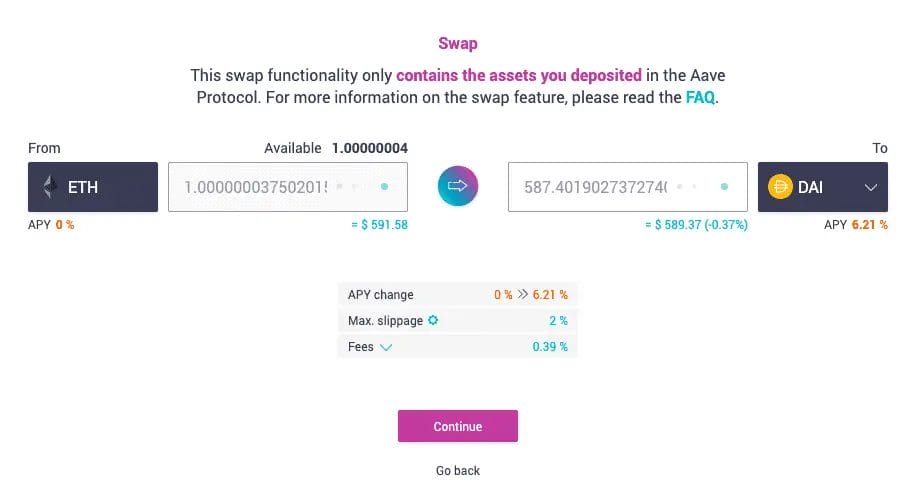

Yield & Collateral Swap

Previously, assets used as collateral were tied up, however in v2 they can be traded freely. Meaning that users can trade their deposited assets, across all currencies supported in the Aave Protocol, even when they are being used as collateral. This “collateral swapping” can be particularly helpful when trying to avoid liquidations. Because If the price of your collateral starts to fall, you can simply trade it for a stablecoin so you don’t have to worry about price fluctuations and potential liquidation.

Repayment with Collateral

Previously, when a user wanted to use part of their collateral to repay a loan, they’d have to withdraw the collateral, use it to buy the borrowed asset, and then finally repay the debt and unlock the deposited collateral. This process required at least 4 transactions across, which was neither time nor cost-efficient, However, users can now close their loan by paying with their collateral directly in a single transaction. This is all powered by flash loans, the Ethereum innovation in which a borrower opens and closes a loan within one Ethereum block.

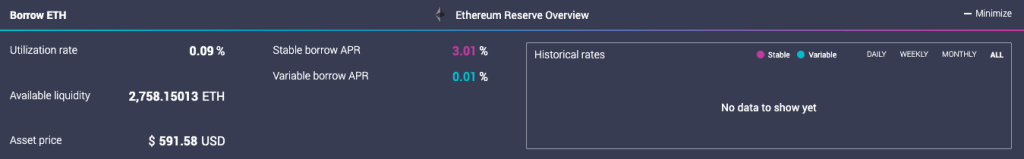

Stable & Variable Rate Borrowing

Users borrowing within Aave can have both a stable borrow position and a variable borrow position at the same time, giving borrowers more options and flexibility for their loan position, and borrowers are still able to switch between the variable and stable rate at any time.

Gas Optimisations

Aave has stated that Aave v2 brings gas optimIsations lowering the cost of transactions up to 50% in some cases. Plus they have also implemented native GasToken Support, to further help users reduce their transaction costs.

Flash Loans & Liquidations

Flash Loans have continued to inspire ideas to make new features possible in Aave V2. They are a great way for everyone to have access to liquidity and take advantage of the financial tools that DeFi offers. With Aave V2, liquidators can utilise Flash Loans to flash borrow the capital from the Aave Protocol itself in order to execute a liquidation.

Batch Flash Loans

Batch Flash loans have now been introduced making Flash Loans even more powerful. Previously, borrowers could only borrow one currency at a time. However Batch Flash Loans let developers execute a Flash Loan with multiple assets inside the same transaction.

Connect to Aave V2

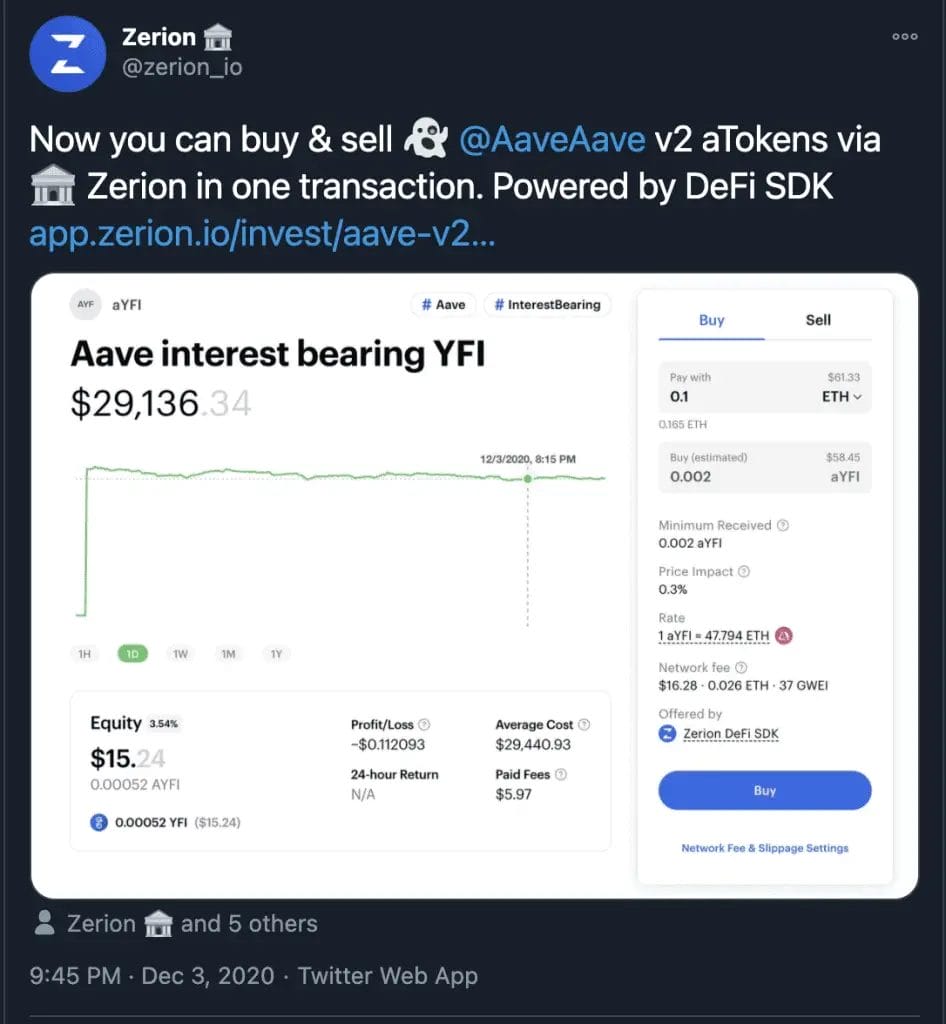

For those of you who use the likes of Argent, Zapper, or Zerion you can access Aave V2 directly. All from inside the wallet or platform, a full list can be found below;

Aave Migration to V2

One thing to be aware of is that deposits or liquidity you have in Aave’s V1 do not yet show on the dashboard of V2. But don’t worry, you won’t have to withdraw and re-deposit into V2 as this will be automated.

Recently AIP-3 was passed to make the migration from V1 to V2 more seamless. By using a Flash Loan powered migration tool, users will be able to make the transition without having to close their V1 loan positions. This migration tool will be introduced later, so if you have V1 positions, no need to close them.

Security & Audits

Aave states that security is a top priority and formal verification has been completed by Certora. For those wanting to take a look, you can read the report here.

Aave V2 has been audited by MixBytes, CertiK, ConsenSys Diligence, and PeckShield. This also includes an additional audit in Chinese, making it the first company in the industry to do this.

Aave Tutorial

If you´re new to Aave, and want to get get started, click here to check out my beginner´s guide. Where you´ll learn how to earn interest and borrow on the platform.