This comprehensive guide will navigate you through the steps of how to stake Ethereum ETH 2.0 on Binance, one of the world’s leading cryptocurrency exchanges. By the end of this article, you will have gained the knowledge and confidence to stake your Ethereum on Binance and generate passive income, all while contributing to the security and efficiency of this groundbreaking blockchain network.

Let’s delve into the world of ETH staking on Binance, where your Ethereum can start earning rewards.

Beginner’s Guide to Staking Ethereum 2.0 on Binance

What is Ethereum?

Ethereum is the second-biggest cryptocurrency by market cap after Bitcoin, but it serves different purposes beyond just being a digital currency. It’s a decentralized computing platform, or in other words, it’s a global software platform powered by blockchain technology that enables the creation and operation of decentralized applications, also known as dApps.

The Ethereum network allows the execution of smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. These smart contracts enable transactions and agreements to be carried out without the need for a central authority, legal system, or external enforcement mechanism.

Ethereum was conceived by Vitalik Buterin, who published a white paper about it in 2014. The platform was then launched in 2015 by Buterin and Joe Lubin, founders of the blockchain software company ConsenSys. Ethereum’s vision was to explore the full potential of blockchain technology beyond just enabling digital currencies like Bitcoin.

Ethereum also provides a platform for hundreds of other cryptocurrencies and projects to be built and deployed without creating their own blockchains. This has made it a critical part of the broader cryptocurrency and blockchain ecosystem.

What is Ether (ETH)?

Ethereum’s native cryptocurrency is called Ether (ETH). It is used to pay for transactions and computational services on the Ethereum network. Ether also plays a key role in Ethereum’s consensus mechanism, particularly after Ethereum’s transition to a Proof-of-Stake protocol, which allows users to validate transactions and create new ETH based on their existing Ether holdings.

What is Ethereum 2.0?

Ethereum 2.0 staking is a significant part of the Ethereum 2.0 upgrade, a transition from the current Ethereum network (Ethereum 1.0) that aims to increase the scalability, security, and sustainability of the platform. A core aspect of this upgrade involves a shift from the current Proof-of-Work (PoW) consensus mechanism to a Proof-of-Stake (PoS) system.

In the existing PoW system, miners solve complex mathematical problems to validate transactions and create new blocks. The PoS system, on the other hand, allows users to “stake” their Ether (ETH) to become validators. Validators are chosen randomly to create blocks based on the amount of ETH they hold and are willing to “stake” as collateral.

Ethereum 2.0 Staking

Staking in Ethereum 2.0 is the process where users participate as validators in the network by locking up, or “staking”, their ETH as a form of collateral. The validators are then rewarded for their service to the network, similar to earning interest.

Ethereum 2.0 staking allows users to earn a yield on their ETH holdings, as the network rewards validators with additional ETH for their participation. This introduces a new avenue for users to participate actively in the network and gain rewards, all while contributing to the security and efficiency of the Ethereum network.

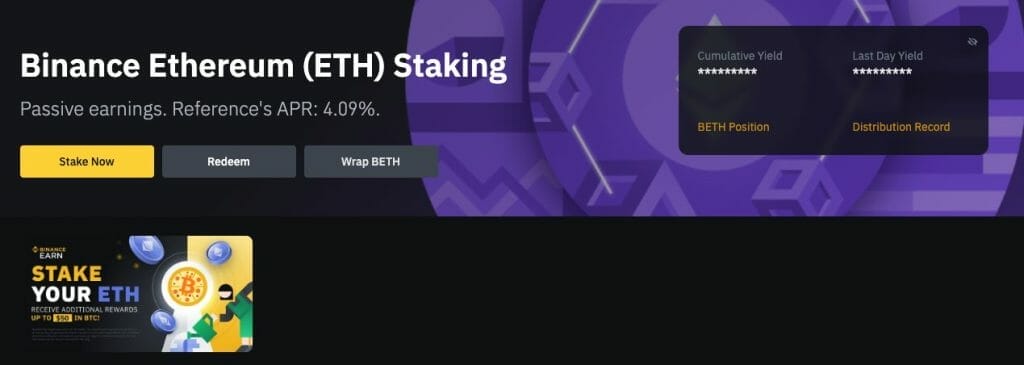

Understanding Binance ETH 2.0 Staking

When you stake your ETH on Binance, you’re essentially participating in Ethereum’s upgrade to the Proof-of-Stake consensus mechanism, known as Ethereum 2.0. In exchange for your staked ETH, Binance gives you BETH at a 1:1 ratio. These tokens represent your stake in the new Ethereum network.

Binance then distributes staking rewards daily in BETH, allowing users to accumulate more tokens and further their participation in the Ethereum network.

What is BETH, & How Does it Work?

Binance Becon Ethereum, also known as BETH, is a tokenized version of staked Ether (ETH) on the Binance platform. It was developed as a simplified way for users to participate in the staking process associated with the Ethereum 2.0 upgrade, more specifically, the Beacon Chain. When you hold BETH, you are entitled to the staking rewards earned by Binance’s ETH 2.0 staking node.

BETH is a wrapped token issued by Binance that is 1:1 pegged to ETH on the Ethereum blockchain. The main purpose behind launching BETH was to support users who trade or hold ETH on the Binance platform during the duration of time needed to lock in Ethereum on-chain, which is approximately 18-24 months.

This wrapped token allowed users to stake Ether in anticipation of the Ethereum 2.0 upgrade without locking up their Ether directly in the Ethereum network. Instead, users staked their Ether on Binance, and in return, they received BETH tokens. The number of BETH tokens received was equivalent to that of Ether tokens staked.

What is the APR for BETH Statking?

The Annual Percentage Rate (APR) for BETH rewards from ETH 2.0 staking on Binance can change daily, depending on the staking volume and activities on the Ethereum network. For instance, after the Ethereum 2.0 upgrade, known as “The Merge,” the APR for BETH rewards was increased from 4% to 4.5%.

Benefits of Staking Ethereum

Staking Ethereum on ETH 2.0 comes with several benefits. First and foremost, it’s a way to earn passive income. When you stake Ethereum, you’re rewarded with interest on your staked ETH. These rewards are essentially a form of compensation for helping the Ethereum network reach consensus.

In addition to earning rewards, staking Ethereum helps improve the decentralization of the Ethereum network. This is especially beneficial for those who hold a substantial amount of Ethereum (at least 32 ETH) and can maintain a computer connected to the internet round-the-clock.

Staking on Ethereum 2.0 is also a part of the network’s solution to its scaling problem. Ethereum 2.0 uses a method called sharding to increase the performance of the Ethereum blockchain. Sharding involves creating additional blockchains (shards) that attach to the main chain, enhancing Ethereum’s processing capacity. This improvement allows Ethereum 2.0 to handle a significantly larger number of transactions compared to Ethereum 1.0, which further adds to its appeal.

Benefits of Staking Ethereum on Binance

Staking through Binance has several advantages, such as avoiding technical setup, reducing the risks of having your stake slashed (a penalty for violating node operation policies), and reducing the risk of losing your coins to theft.

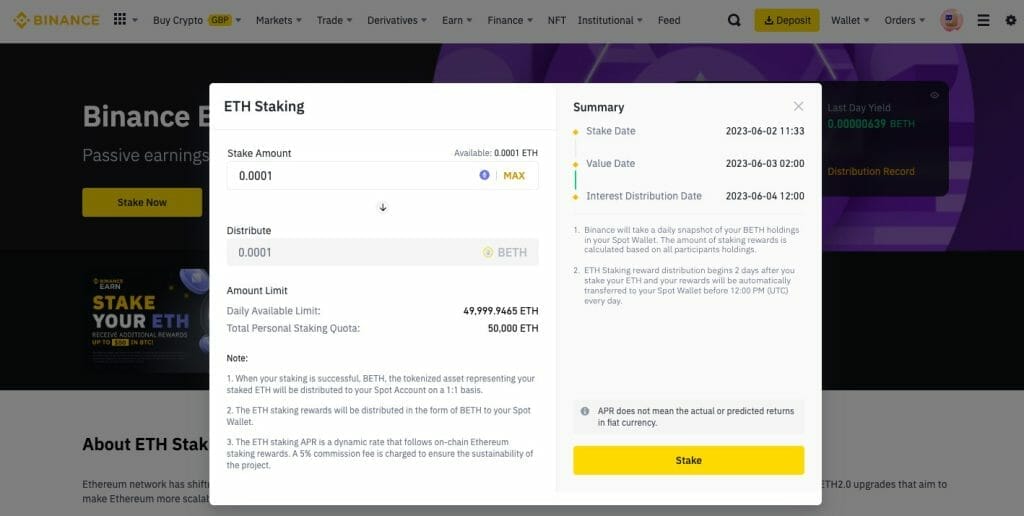

- Accessibility and Low Minimum: Binance’s ETH 2.0 staking service is designed to be accessible to all users. You can start staking with just 0.0001 ETH, which makes it feasible for users with varying amounts of ETH to participate.

- Handling Operating Expenses and Penalties: Binance covers all validator operating expenses and bears the risk of on-chain penalties. This means that users can stake without worrying about additional costs or risks associated with maintaining a validator node or potential slashing penalties.

- Attractive Yield: When ETH 2.0 staking was initially launched, Binance offered an attractive introductory annual percentage yield (APY) of up to 20%, which decreases with the amount of staked ETH. This yield is the reward users get for staking their ETH.

- Token Safety: Binance Staking provides token quantity protection and slashing coverage. This means that the number of tokens staked by a user that would otherwise be lost through slashing will be returned by Binance, ensuring your staked tokens are safe.

- Passive Income: Staking ETH on Binance allows you to earn passive income through staking rewards. This can be a good way to increase your cryptocurrency holdings without actively trading.

- Supporting the Network: By staking your ETH, you’re helping to support the Ethereum network’s security and operations. This can be seen as a contribution to the overall health and sustainability of the Ethereum ecosystem.

How to Stake Ethereum on Binance?

Staking Ethereum on Binance is a straightforward process. Let’s break down the process of subscribing to Binance ETH 2.0 staking into manageable steps:

- Log in to your Binance account: Start by logging into your Binance account. If you don’t have an account, create one and ensure you have completed the necessary security checks and verifications.

- Navigate to the Binance Staking Platform: From the Binance homepage, choose ‘Earn’ from the menu item at the top of the screen and select ‘ETH Staking’.

- Choose “Stake Now”: From the ETH Staking page, choose the yellow “Stake Now” button.

- Enter your Staking Amount: Input the amount of ETH you want to stake, or choose “Max”.

- Confirm your Stake: Choose “Stake” to confirm, read, and accept the Binance terms.

If you´re not already signed up for the Binance exchange, you can use our referral code to receive a 20% discount on trading fees.

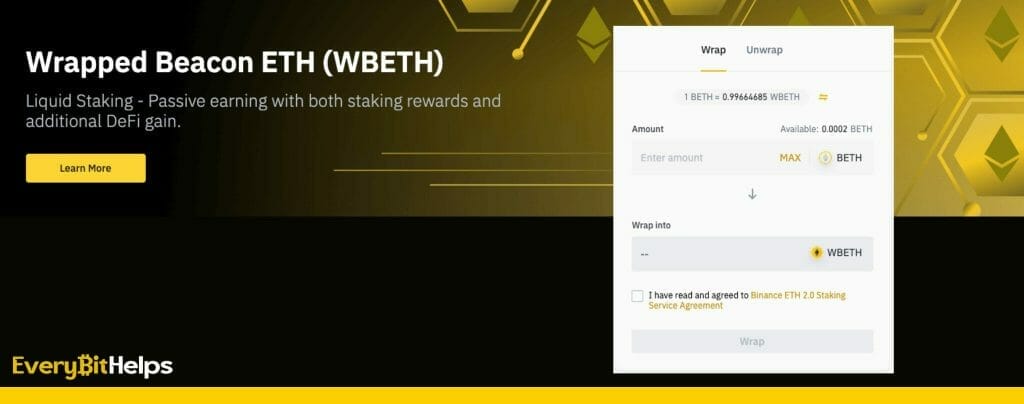

What is Wrapped Beacon ETH (WBETH)?

Wrapped Beacon ETH (WBETH) is a new liquid staking token introduced by Binance. Each WBETH token equals 1 BETH token, representing one staked ETH on the Ethereum network. The difference with WBETH is that it also includes all of the staking rewards accrued by the corresponding BETH token since a certain point in time, specifically from when WBETH’s conversion rate was initialized at 1:1 on April 27th, 2023.

WBETH was created to offer liquidity while earning staking rewards from Ethereum. This means that you can still participate in other decentralized finance (DeFi) applications while your Ethereum tokens are staked, accruing rewards.

Why Should I Wrap BETH for WBETH?

Wrapping BETH into WBETH offers several benefits. Firstly, it allows you to transfer your staked ETH to other platforms or self-custodied wallets on the blockchain, including Ethereum and Binance Smart Chain (BSC). This means you are not confined to keeping your staked ETH within Binance.

Another advantage is that even when WBETH is held in your personal wallets outside of Binance, it generates staking rewards, potentially increasing its value over time.

WBETH can also be utilized to earn additional yield through various decentralized finance (DeFi) protocols or decentralized applications (dApps). This includes strategies like yield farming and vaults, which results in a potential double-yield scenario.

Finally, when you decide to exit, you can easily convert your WBETH back into BETH, and subsequently redeem your original staked ETH.

How to Wrap BETH into wBETH on Binance?

Once you’ve received your BETH, you can increase your earning potential by wrapping your BETH into wBETH. The wrapping process essentially allows your BETH to be used in external DeFi projects that accept wBETH. This way, you can potentially earn additional rewards from these projects. Plus, the good news is, users who have wrapped their BETH still continue to receive the Binance ETH 2.0 staking daily rewards. Here’s the process to wrap BETH:

- Log into your Binance account

- Navigate to “Earn”, then the ETH Staking Page: and choose “Wrap BETH”.

- Enter the Amount: Enter the amount of BETH you wish to wrap into wBETH, or choose MAX.

- Read & Agree to the Terms: Tick the box to accept

- Wrap: Review your details and click ‘Wrap’ to complete the process. You’ll receive your wBETH shortly after the transaction gets approved.

How to Redeem Staked ETH on Binance

To redeem staked ETH on Binance, you would follow these steps:

- Log in to your Binance account.

- Navigate to the “Earn” section, then select “ETH Staking”.

- Click on the yellow “Redeem” button.

- Enter the amount of ETH you wish to redeem from your BETH (Beacon chain Ethereum) balance.

- Click the “Redeem” button again to complete the process.

After the Shapella hard fork, starting from April 19, 2023, Binance users who staked ETH through the platform can redeem their coins with their BETH holdings on a 1:1 basis. Once the redemption process is completed, the redeemed ETH will be returned to your account.

Conclusion

Staking Ethereum on Binance presents an innovative avenue for investors to maximize their crypto assets. Staking on Binance has its significant advantages, including the ability to earn passive income and reduced risks associated with technical setup and staking operations. Stakers can also benefit from the platform’s new features, such as wrapping BETH into WBETH, thus gaining increased flexibility and the potential for double yield.

However, it’s worth noting that staking isn’t without its challenges. Staked assets are not as liquid as their non-staked counterparts. While Binance strives to secure staked assets, no platform can fully eliminate the risk of hacking or other security breaches.

As Ethereum 2.0 evolves and other blockchain platforms continue to mature, it’s anticipated that staking services on Binance will grow in popularity and sophistication. The introduction of features such as BETH and WBETH exemplifies Binance’s commitment to innovation in the staking sector. As blockchain technology continues to disrupt traditional finance, Binance’s staking services stand to become increasingly integral to the new financial landscape.

Investing in cryptocurrency, including through staking, should always be done with a careful understanding of the risks and rewards. As with any investment, it’s important to conduct thorough research and seek advice from a financial advisor.

FAQ

What is the min amount of BETH I can wrap or unwrap?

There’s no minimum when wrapping or unwrapping BETH on Binance; you have the freedom to convert any quantity of BETH.

Can I stake Ethereum on Binance?

Yes, you can stake Ethereum on Binance. Binance launched its ETH 2.0 staking service to offer a more accessible way for everyone to participate in Ethereum staking. You can begin staking with as little as 0.0001 ETH, and Binance will cover all validator operating expenses and bear the risk of on-chain penalties.

Is Binance ETH 2.0 staking safe?

Binance’s ETH 2.0 staking service is generally considered safe, but like any investment, it comes with its own risks. Binance is a leading cryptocurrency exchange, widely recognized and respected in the crypto community, which lends credibility to its staking service.