The cryptocurrency market is renowned for its volatility, with prices capable of dramatic shifts in short periods. One phenomenon that has garnered significant attention and speculation within the crypto community is the next Crypto Bull Run, a period marked by rapidly escalating asset values, including those of Bitcoin, the pioneering and most valued cryptocurrency. Given Bitcoin’s dominance and its role as a trendsetter in the broader cryptocurrency market, the Bitcoin bull run is often at the forefront of such market rallies.

Understanding the dynamics of the following Crypto Bull Run and the potential influences of Bitcoin halving and US Bitcoin ETF is crucial for investors, traders, and crypto enthusiasts looking to navigate the turbulent waters of the cryptocurrency market effectively. We hope to provide guidance with our crypto guides on how to approach crypto investment decisions during these tumultuous yet potentially lucrative periods.

Predictions for the Next Crypto Bull Run

What is a Crypto Bull Run?

A Crypto bull run is a term used within the cryptocurrency community to describe a market condition where the prices of cryptocurrencies experience sustained upward momentum over a specific period. This phenomenon is characterized by heightened investor enthusiasm, increased buying activity, and a general sense of optimism regarding the future value of cryptocurrencies.

Historically, Crypto bull runs have been pivotal in the cryptocurrency market, leading to record-breaking price levels and unprecedented growth in market capitalization. The bitcoin bull run often catalyzes broader market rallies, influencing the value of altcoins and shaping market trends. For instance, the 2017 crypto bull run saw Bitcoin reaching its then-all-time high of nearly $20,000, pulling numerous altcoins to new heights.

The impact of a crypto bull run is multifaceted, affecting asset prices, market dynamics, and industry development. It attracts new participants, from retail investors to institutional players, fostering innovation and growth within the blockchain and cryptocurrency sectors. However, it also poses risks, as the rapid and often unsustainable price increases can lead to market corrections, with prices retracting as quickly as they rose.

Bitcoin, the first and most well-known cryptocurrency, often plays a significant role. A Bitcoin bull run typically precedes and triggers increased interest and investment in other cryptocurrencies as investors seek to diversify their portfolios and explore alternative opportunities for profit within the crypto space.

What will Influence the Next Crypto Bull Run?

Predicting the exact timing and magnitude of the next bull run is complex, given the myriad of factors that can influence the crypto market behaviour. However, understanding these factors can offer insights into the potential triggers and sustainers of the next significant market rally. Here are several vital elements that could play a crucial role in shaping the trajectory of the next “crypto bull run” and “bitcoin bull run”:

Bitcoin Halving

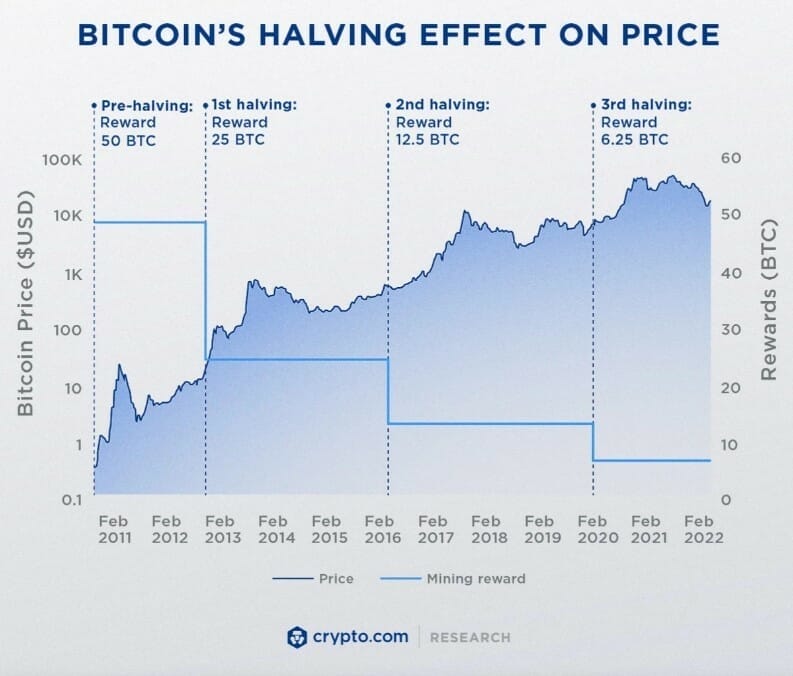

Bitcoin halving is a process embedded in the Bitcoin protocol, designed to reduce miners’ reward for adding new blocks to the blockchain by 50%. This event occurs approximately every four years or after 210,000 blocks have been mined, halving the rate at which new Bitcoins are created and decreasing the overall supply influx.

When a Bitcoin halving occurs, miners’ reward for validating transactions and securing the network is reduced by half. For instance, the reward started at 50 Bitcoins per block in 2009, decreased to 25 in 2012, 12.5 in 2016, and 6.25 in 2020. The next halving is expected in 2024, reducing the reward to 3.125 bitcoins per block.

Historically, Bitcoin halvings have been correlated with significant price increases, contributing to the speculation and anticipation surrounding these events. The reduced supply of new bitcoins entering the market, coupled with constant or increased demand, has led to upward pressure on prices, often resulting in a bull run in the months following the halving.

History of Bitcoin Bull Runs

Bitcoin has undergone several significant bull runs throughout its history, each marked by rapid price escalations followed by corrections. Here’s a concise overview of Bitcoin’s notable bull markets:

2013 Bull Run

The first significant bull run occurred in 2013 when Bitcoin surpassed the $1,000 mark for the first time. After reaching a peak of approximately $1,150, Bitcoin experienced a substantial correction, bottoming out at around $171 in January 2015. This represented an approximately 85% decline from its peak.

2017 Bull Run

Bitcoin’s next significant bull market unfolded between 2016 and 2017, culminating in December 2017 with Bitcoin reaching just under $20,000. Notably, the peaks of the 2013 and 2017 bull runs were spaced nearly four years apart. After reaching its peak, Bitcoin was corrected, finding its bottom at around $3,200 in December 2018, marking an approximately 84% drop from its peak.

2021 Bull Run

The most recent major bull run occurred in 2021, with Bitcoin reaching around $68,770 in November. Following this peak, Bitcoin experienced a sharp correction, reaching a subsequent low of around $30,000. This aligns with the cyclical nature observed in previous bull runs, each followed by a period of consolidation and recovery.

US Bitcoin ETF

The approval of a US Bitcoin ETF would mark a significant milestone in integrating cryptocurrencies into mainstream finance. It would offer a regulated and more accessible avenue for retail and institutional investors to invest in Bitcoin, potentially leading to increased demand, liquidity, and market stability.

A US Bitcoin ETF could act as a catalyst for a Bitcoin bull run by attracting a new wave of investors and injecting substantial capital into the market. It could enhance Bitcoin’s legitimacy and acceptance among traditional investors and financial institutions, potentially driving up prices and fostering a more favourable environment for the broader cryptocurrency market.

Other Factors

Market Sentiment & Public Interest

The overall mood and optimism of investors and the general public can significantly impact the cryptocurrency market. Positive sentiment and increased public interest can drive demand, leading to price increases and potentially initiating a cryptocurrency bull run. Social media, news coverage, and public endorsements can shape market sentiment.

Regulatory Developments

Changes in regulatory landscapes and legal frameworks can profoundly affect the cryptocurrency market. Clear and supportive regulations can foster innovation, attract investments, and boost market confidence, potentially leading to a bull run. Conversely, restrictive or ambiguous regulations can create uncertainty and hinder market growth.

Technological Advancements & Innovations

Innovations and advancements in blockchain technology and the cryptocurrency space can act as catalysts for market rallies. Introducing new features, improvements in scalability and security, and developing novel use cases can enhance the appeal and utility of cryptocurrencies, driving demand and prices upward.

Macro-Economic Factors

The broader economic environment can influence the cryptocurrency market, including inflation rates, monetary policies, and financial stability. Economic uncertainties and unfavourable traditional market conditions can lead investors to seek alternative assets like cryptocurrencies, potentially triggering a bull run.

How to Prepare for the Next Bull Run

Preparing for the next crypto bull run involves more than just monitoring market trends and price movements. It requires a comprehensive approach encompassing research, strategy formulation, risk management, and continual learning.

Here are some tips and advice to help you navigate the potential opportunities and challenges of the next bull run;

Portfolio Diversification

- Spread Your Investments: Avoid putting all your eggs in one basket. To mitigate risks, diversify your investments across different assets, including cryptocurrencies, stocks, bonds, and commodities.

- Explore Different Sectors: To capture diverse growth opportunities, consider investing in different sectors within the crypto space, such as DeFi, NFTs, and blockchain infrastructure.

Risk Management

- Set Clear Investment Goals: Before entering the market, define your investment objectives, risk tolerance, and time horizon.

- Use Stop-Losses and Take-Profit Levels: Implementing stop-losses and take-profit levels can help you manage risks and secure profits in a highly volatile market.

- Only Invest What You Can Afford to Lose: Given the unpredictable nature of the crypto market, invest only the amount you are willing to lose.

Investment Strategies

- Do Your Own Research (DYOR): Conduct thorough research on potential investment opportunities, including project fundamentals, team, technology, use cases, and market potential.

- Stay Informed: Keep abreast of the latest news, developments, and trends in the crypto space. Follow reputable sources and stay updated on regulatory changes, technological advancements, and market sentiment.

- Adopt a Long-Term Perspective: Consider adopting a long-term investment approach, focusing on assets with strong fundamentals and growth potential rather than chasing short-term gains.

Staying Informed & Conducting Research

- Utilize Reliable Information Sources: Rely on credible and authoritative sources for information and news to avoid misinformation and make informed decisions.

- Engage with the Community: Participate in community discussions, forums, and social media to gain insights, share knowledge, and stay informed about the latest developments and sentiments in the crypto space.

- Monitor Market Indicators: Regularly check market indicators, price charts, and analytical tools to assess market conditions, identify trends, and make informed investment decisions.

The next crypto bull run could present lucrative opportunities, but due to the crypto market’s inherent volatility, it also comes with substantial risks. By staying informed, diversifying your portfolio, managing risks effectively, and conducting thorough research, you can enhance your chances of successfully navigating the turbulent waters of the crypto market and capitalizing on the opportunities that arise.

When is the Next Crypto Bull Run?

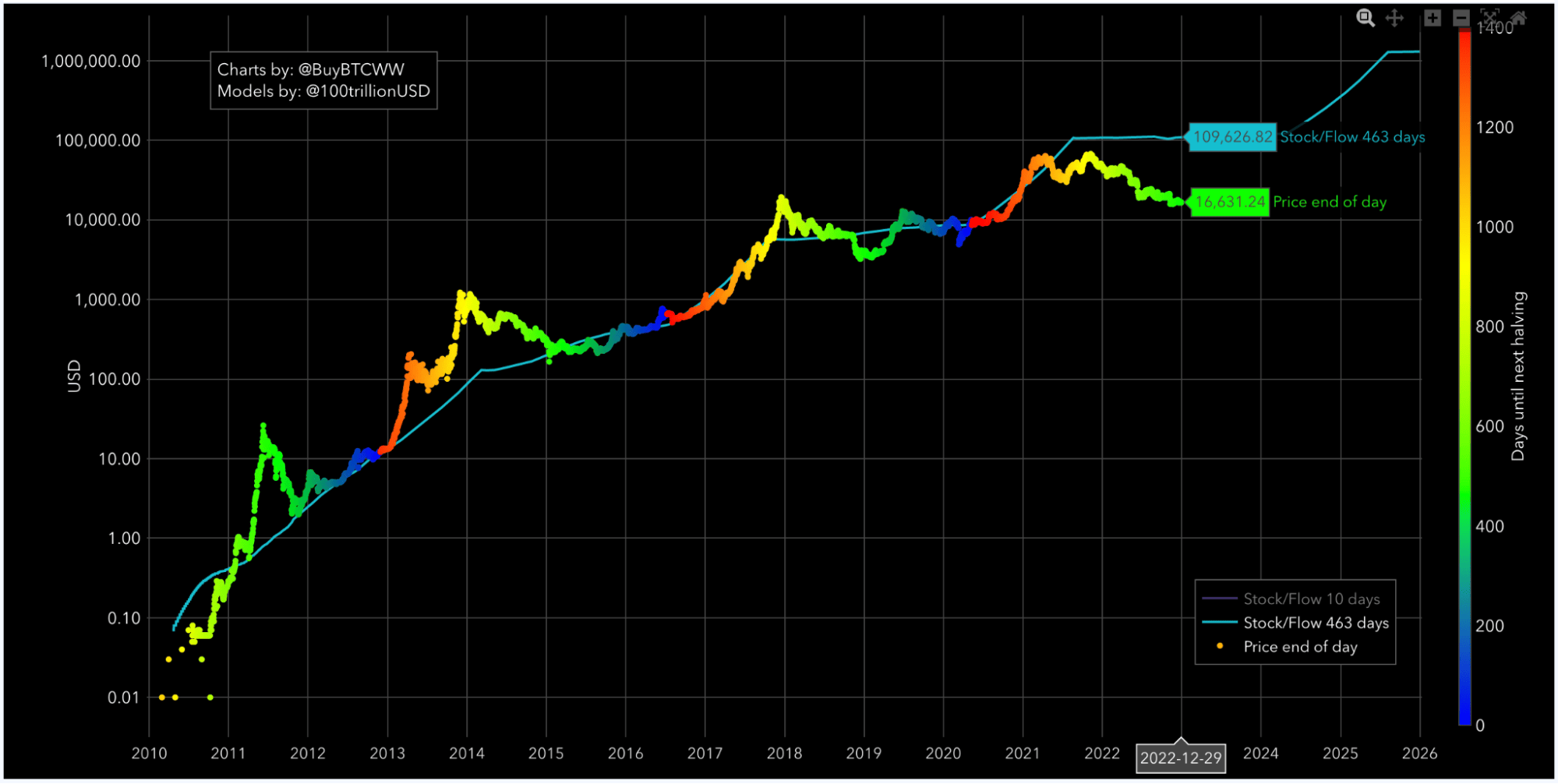

Based on historical patterns and market cycles, there is speculation that the next Bitcoin bull run could commence around 2024. It is anticipated to gradually build momentum, potentially reaching its zenith in early 2025.

However, it is crucial to approach these projections with caution. Bitcoin spans just over a decade, providing a relatively limited data set and market cycles to analyze. This limited historical context means the market could exhibit deviations from past behaviours, giving rise to unexpected trends and price movements.

In previous market cycles, Bitcoin prices have seen at least 77% retracements at it peak. Historical data suggests that Bitcoin typically undergoes a cycle lasting approximately four years from its lowest ebb to reach a new pinnacle following a period of decline.

Should You Invest Before a Crypto Bull Run?

Investing before a crypto bull run can be lucrative and risky, requiring careful consideration, research, and strategy.

Potential Rewards:

- Substantial Gains:

- Investing before a crypto bull run can lead to substantial gains as asset prices escalate rapidly during such periods.

- Early investments in projects with solid fundamentals and growth potential can yield high returns.

- Diversification Opportunities:

- A bull run often brings a surge in various cryptocurrencies and projects, allowing investors to diversify their portfolios and spread risks.

- Diversification can help capture growth from crypto market segments, such as DeFi, NFTs, and blockchain platforms.

- Market Leadership and Innovation:

- Bull runs often coincide with technological advancements, innovations, and the emergence of market leaders.

- Investing in innovative and leading projects can provide exposure to long-term growth and value accrual.

Risks & Considerations:

- Market Volatility:

- The crypto market is inherently volatile, and prices fluctuate dramatically, leading to potential losses.

- It’s crucial to assess risk tolerance and implement risk management strategies to mitigate potential downsides.

- Speculative Nature:

- Crypto bull runs are often fueled by speculation and hype, leading to unsustainable prices and subsequent corrections.

- Investing based on speculation without considering fundamentals can be risky, and thorough research is essential.

- Regulatory Uncertainties:

- The crypto market is subject to regulatory developments that impact prices and market stability.

- Staying informed about regulatory changes and considering their implications is vital for making informed investment decisions.

Strategies & Recommendations:

- Conduct Thorough Research:

- Before investing, conduct extensive research on potential investment opportunities, considering project fundamentals, market trends, and risk factors.

- Evaluate the technology, use cases, team, community support, and market potential of the projects you consider.

- Implement Risk Management:

- Allocate investments based on risk tolerance, investment goals, and market conditions.

- Use stop-losses, take-profit levels, and diversification to manage risks effectively.

- Stay Informed and Vigilant:

- Keep abreast of the latest market developments, news, and trends to make timely and informed investment decisions.

- Be wary of scams, misinformation, and overly hyped projects, and verify information from reputable sources.

Conclusion

Historical patterns suggest the potential for future crypto bull runs, with speculations pointing towards 2024 as the commencement of the following significant market rally, potentially peaking in late 2025. However, the inherent unpredictability of the market necessitates caution and diligence.

Bitcoin halvings, occurring approximately every four years, are pivotal events historically correlated with substantial price increases and market rallies. The next Bitcoin halving is anticipated in 2024, and its impact on supply dynamics could influence Bitcoin’s price and the broader crypto market.

Recognizing the signs of a crypto bull run, such as increased investor interest, favourable market sentiment, rising asset prices, and heightened levels of innovation, is crucial for capitalizing on market opportunities. However, the speculative nature of the market, coupled with regulatory uncertainties and limited historical data, underscores the importance of thorough research, risk management, and portfolio diversification.

FAQs

What will the next Bitcoin halving happen?

The next Bitcoin halving is anticipated to occur in 2024, based on the protocol’s approximately four-year cycle between halvings. This event will reduce miners’ block reward for adding new blocks to the blockchain, impacting Bitcoin’s supply dynamics and potentially influencing its price.

What is a Bitcoin ETF?

A Bitcoin ETF (Exchange-Traded Fund) is a financial product that tracks the price of Bitcoin and allows investors to trade and invest in Bitcoin without actually owning the cryptocurrency. It will enable individuals to gain exposure to Bitcoin’s price movements without the complexities of buying, storing, and securing the actual cryptocurrency.

Is a Crypto bull run coming?

Predicting the exact timing of a crypto bull run is challenging due to the market’s inherent volatility and unpredictability. However, historical patterns, market sentiment, technological advancements, and macroeconomic factors are all indicators that can suggest the likelihood of an upcoming crypto bull run.

What year is the next bull run in Crypto?

While it is impossible to predict with certainty based on historical patterns and market cycles, some speculations suggest the possibility of the next crypto bull run commencing around 2024 and potentially peaking in the latter part of 2025.

What are the signs of a bull run in Crypto?

Signs of a crypto bull run include increased market sentiment and investor interest, rising asset prices and trading volumes, positive media coverage, and heightened levels of innovation and development within the blockchain and cryptocurrency sectors. Additionally, macroeconomic factors, regulatory clarity, and institutional adoption can signal the onset of a bull market in crypto.