In this beginner’s guide, we’ll explore the process of how to create a Bitcoin paper wallet and how to use it, a tangible asset that places the security of your Bitcoin literally in your own hands.

Securing Bitcoin safely is paramount, and a crypto paper wallet offers a robust solution. This offline storage method safeguards your assets from online threats, providing enhanced security and peace of mind. A Bitcoin paper wallet ensures that you have exclusive control over your digital wealth, free from the vulnerabilities of online storage.

What is a Bitcoin Paper Wallet?

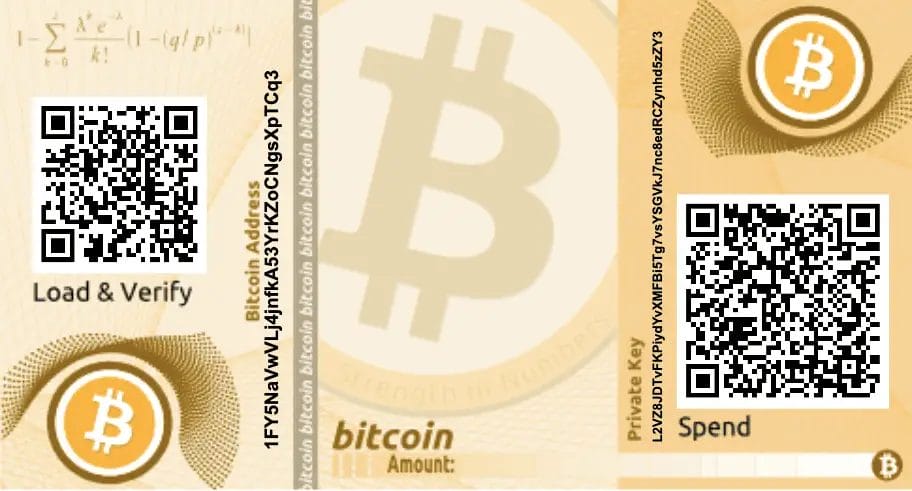

A Bitcoin paper wallet is a physical representation of your digital assets, offering a tangible method to securely store, receive, and send Bitcoin. It consists of a piece of paper (though it can be made of more durable materials for longevity) that prominently displays your public Bitcoin address and private key, often encoded as QR codes for ease of use.

The public address, located on the left side, is your identifiable Bitcoin address that others can see and use to send Bitcoin to you. It’s accompanied by a QR code to facilitate easy scanning and loading of funds.

On the right side, you’ll find the private key, another QR code, which is the secret code that allows you to spend, transfer, or sell your Bitcoin. It’s essential to keep this private and secure, as anyone with access to it can control your funds.

For added convenience, you can note the amount of Bitcoin stored, aiding in easy tracking and management of your assets. While paper wallets are a secure option for storing Bitcoin, being offline and immune to online hacks, they require meticulous care. Protect them from physical damage, loss, or theft to ensure the safety of your digital assets.

Remember, while the term is a “paper” wallet, consider using materials like plastic or metal for enhanced durability, ensuring that the critical information remains legible and intact over time.

What is Bitcoin Cold Storage?

Bitcoin cold storage refers to the practice of keeping a reserve of Bitcoin offline to reduce the risk of cyber theft. It’s one of the most secure methods to store cryptocurrency, protecting it from unauthorized access, cyber hacks, and other vulnerabilities associated with internet exposure.

In cold storage, private keys—digital codes known only to you and required to spend or transfer Bitcoin stored in your wallet—are generated and stored on a device or physical medium without an internet connection. This could be on a hardware wallet such as a Ledger Nano or Trezor, a paper wallet, or even a computer isolated from online networks.

Key Features of Bitcoin Cold Storage:

- Enhanced Security: By being offline, cold storage is immune to online hacking attempts. It’s a secure vault for your digital assets.

- Ownership Control: It provides users with full control over their private keys and, by extension, their Bitcoin.

- Long-term Storage: Ideal for holding Bitcoin as a long-term investment, minimizing the risks associated with constantly changing online environments.

- Physical Access: Depending on the type of cold storage, access to the stored Bitcoin is physical, requiring possession of the hardware or paper wallet.

- Reduced Vulnerability: It’s not susceptible to online outages, server issues, or maintenance periods, ensuring constant access to your Bitcoin.

However, while cold storage significantly enhances security, it also requires careful management. Losing access to the cold storage medium (like a paper wallet or hardware device) or forgetting passwords and recovery phrases can permanently lose the stored Bitcoin.

How to Create a Bitcoin Paper Wallet

Creating a Bitcoin paper wallet is a straightforward process, but it requires meticulous attention to security protocols to ensure your digital assets are safe and secure. Here’s an enhanced, step-by-step guide to help you through the process, ensuring every step is covered.

What you need to create a Bitcoin paper wallet

- A functioning printer.

- A secure, private environment to ensure no unauthorized viewing or access.

Step 1: Navigate to the Bitcoin Wallet Generator

Open your web browser and go to BitAddress.org.

Step 2: Enhance Security

Before proceeding, enhance your security by saving the webpage for offline use. This precaution ensures your new wallet is created in a secure environment, free from online threats.

- Go to your browser’s menu bar.

- Select File > Save Page As.

- Save the webpage to your desired location.

Step 3: Go Offline

Close your browser and disconnect from the internet to ensure an extra layer of security. Reopen the saved BitAddress.org webpage offline.

Step 4: Generate Your Wallet

Initiate the wallet generation process by moving your cursor randomly across the screen. The randomness aids in creating a unique and secure Bitcoin address. Continue until the progress bar reaches 100%.

Step 5: Choose Your Wallet Type

- For a basic wallet, click “Print.”

- For a customized design, select “Paper Wallet.” You can create single or multiple wallets adorned with a sophisticated gold artwork design.

Step 6: Opt for BIP38 Encryption (Optional)

For enhanced security, consider enabling BIP38 encryption. Tick the checkbox and enter a strong passphrase. This step encrypts your private key, making it accessible only with the passphrase.

Step 7: Print Your Wallet

Click “Print” to get a physical copy of your paper wallet. Consider printing multiple copies to mitigate the risk of loss or damage. Ensure the prints are clear and the QR codes are easily scannable.

Step 8: Secure Storage

Store your printed wallet securely, away from potential threats like moisture, heat, or unauthorized access. Consider a safe, lockbox, or secure storage that protects against environmental and physical damage.

Your Bitcoin Paper Wallet is Ready!

Congratulations! You’ve successfully created a secure Bitcoin paper wallet. Treat it with care, as it holds the keys to your digital assets. Remember, the safety of your investments is in your hands, so take all necessary precautions to protect your wallet.

Tip: Before you print, make sure that your printer is not connected to the internet and that you connect directly to your printer.

How to Send Bitcoin to a Paper Wallet

Transferring Bitcoin to your paper wallet is a crucial step to ensure the safety and security of your digital assets. Follow this comprehensive guide to execute this process seamlessly and securely.

What you need to send Bitcoin to a paper wallet

- A created and printed Bitcoin paper wallet.

- An active account on a cryptocurrency exchange (we’ll use Coinbase as an example).

Step 1: Preparation

Ensure your paper wallet is ready and secure. Avoid storing your Bitcoin on exchanges for extended periods, as you lack control over the private keys, making your assets vulnerable to potential hacks.

Step 2: Access Your Exchange Account

- Log into your Coinbase account.

- Navigate to your Bitcoin wallet within the platform.

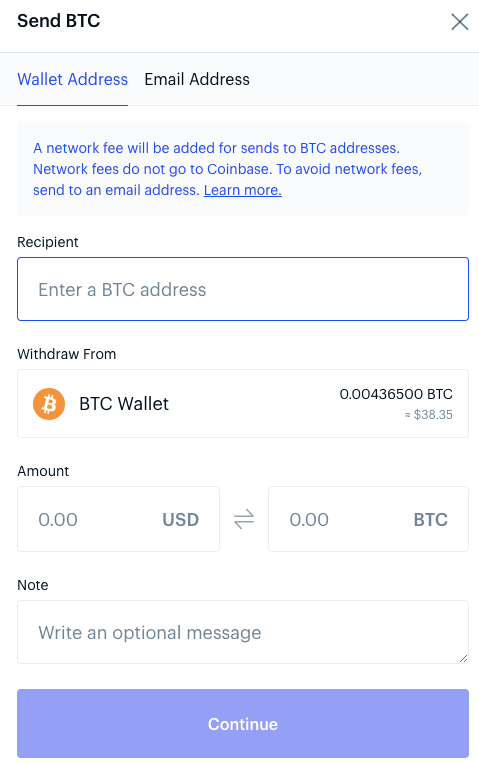

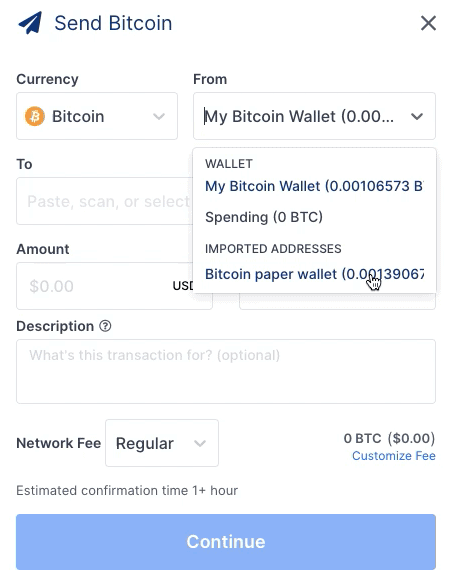

Step 3: Initiate the Transfer

- Click on the ‘Send’ option.

- You’ll be prompted to enter the recipient’s address and the amount to send.

Step 4: Enter Your Paper Wallet’s Public Address

- Copy and paste your paper wallet’s public address into the ‘BTC address’ field. Ensure accuracy to avoid sending your assets to the wrong address.

- If you’re using a mobile device, utilize the camera feature to scan the QR code on your paper wallet, automating the address input process.

Step 5: Specify the Amount

- Enter the amount of Bitcoin you wish to transfer to your paper wallet.

- Review the details meticulously to ensure accuracy before proceeding.

Step 6: Confirm and Execute the Transfer

- Click ‘Continue’ to review the transaction details.

- Confirm the transfer. You might need to authenticate the transaction depending on the security protocols of your exchange.

Step 7: Record the Transaction (Optional)

- Once the transfer is successful, consider noting the transferred amount on your paper wallet for easy reference.

- Ensure the notation is clear and legible to avoid confusion in the future.

Your Bitcoin is Now Securely Stored!

Congratulations! You’ve successfully transferred your Bitcoin to your paper wallet, enhancing the security of your digital assets. Treat your paper wallet with utmost care, store it in a secure location, and consider making multiple copies to mitigate the risk of loss or damage.

Remember, the safety of your Bitcoin is in your hands. Always follow best practices to ensure the security and accessibility of your digital assets.

How to Check a Paper Wallet Balance

Monitoring the balance of your Bitcoin paper wallet is essential to keep track of your digital assets. Here’s an enriched, user-friendly guide to help you check your balance using Blockchain.com.

What you need to check a paper wallet balance:

- A Bitcoin/crypto paper wallet with funds.

- An active Blockchain.com wallet account.

Step 1: Access Your Blockchain.com Wallet

- Log into your Blockchain.com wallet.

- Ensure your internet connection is secure to maintain the safety of your digital assets.

Step 2: Navigate to Settings

- Locate the ‘Settings’ option, typically found in the top right corner of the dashboard.

- Click on it to access a dropdown menu.

Step 3: Go to Wallets & Addresses

- From the dropdown menu, select ‘Wallets & Addresses’ to proceed.

- This section allows you to manage and monitor various wallet addresses associated with your account.

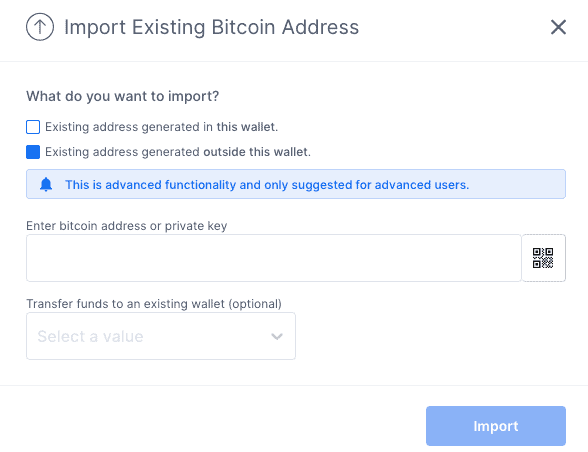

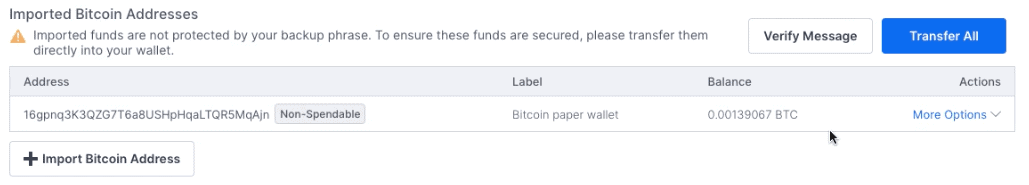

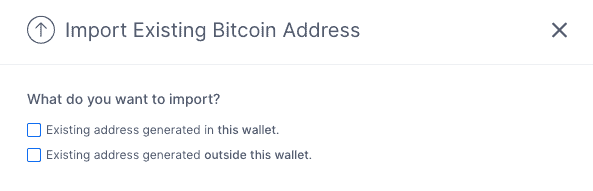

Step 4: Import Bitcoin Address

- Click on ‘Import Bitcoin Address’ to add your paper wallet details.

- A prompt will appear, asking for the necessary information.

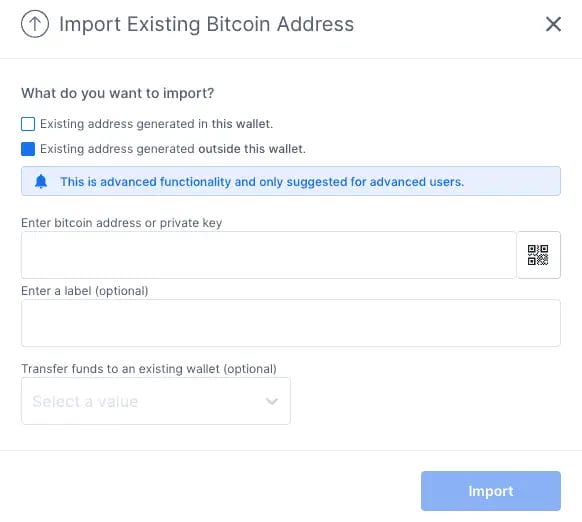

Step 5: Choose Existing Address

- Select the option labelled ‘Existing address generated outside this wallet.’

- This allows you to add an address not originally created on Blockchain.com.

Step 6: Enter the Address or Scan the QR Code

- Input your paper wallet’s Bitcoin address manually or scan the QR code for automatic entry.

- Ensure the entered address is accurate to access the correct wallet information.

Step 7: View Your Balance

- Once the address is imported, your Bitcoin balance will be displayed beside the imported address.

- Review the balance to keep track of your assets.

Your Balance is Now Accessible!

Congratulations! You’ve successfully checked the balance of your Bitcoin paper wallet using Blockchain.com. Always ensure to log out of your online wallet account after checking to maintain the security of your digital assets.

Remember, the process might vary slightly depending on your software wallet. Always follow the specific instructions and security protocols associated with your chosen platform.

How to Withdraw from a Paper Wallet

Withdrawing Bitcoin from a paper wallet is a critical process that requires precision and security. In this enhanced guide, we’ll walk you through the steps to transfer your Bitcoin to a Blockchain.com wallet, enabling you to convert it to fiat currency or send it to another address.

What you need to withdraw from a paper wallet:

- A Bitcoin or crypto paper wallet with a balance.

- An active Blockchain.com wallet account.

Step 1: Access Your Blockchain.com Wallet

- Log into your Blockchain.com wallet securely.

- Ensure you are in a secure environment to maintain the confidentiality of your wallet details.

Step 2: Navigate to Settings

- Locate and click on the ‘Settings’ option, typically found in the top right corner of the dashboard.

Step 3: Go to Wallets & Addresses

- Select ‘Wallets & Addresses’ from the dropdown menu to manage and monitor various wallet addresses associated with your account.

Step 4: Import Bitcoin Address

- Click ‘Import Bitcoin Address’ to add your paper wallet details to Blockchain.com.

Step 5: Choose Existing Address

- Select ‘Existing address generated outside this wallet’ to input the details of your paper wallet.

Step 6: Input Address Details

- Enter your paper wallet’s public Bitcoin address. You’ll be prompted to provide the private key later during the transaction process.

- Optionally, add a label to describe the imported address, like ‘Bitcoin Paper Wallet,’ for easy identification.

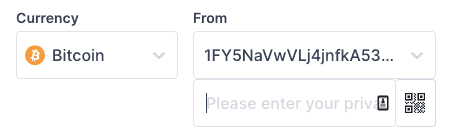

Step 7: Initiate the Transfer

- Click ‘Send.’ Your imported paper wallet address, along with its balance, will be displayed.

- Ensure all details are accurate before proceeding.

Step 8: Transfer Funds

- You can now send funds from your paper wallet to a cryptocurrency exchange, like Blockchain Exchange, or another recipient’s address.

- Follow the on-screen instructions, ensuring each step is completed securely and accurately.

Step 9: Convert to FIAT (Optional)

- If desired, convert your Bitcoin to fiat currency following the specific procedures of your chosen exchange.

Your Funds are Now Transferred!

Congratulations! You’ve successfully withdrawn Bitcoin from your paper wallet to Blockchain.com. Always ensure to follow security protocols and best practices to safeguard your digital assets.

How to Create a Crypto Paper Wallet?

Creating a crypto paper wallet is a straightforward process, akin to setting up a Bitcoin paper wallet, with the primary difference lying in the choice of platform tailored for specific altcoins.

- Select a Trusted Platform: Ensure your website or platform is reputable and supports the specific cryptocurrency you’re looking to store.

- Security First: Always prioritize your security. Generate your paper wallet offline to avoid potential online threats.

- Verification: Verify the integrity of your paper wallet, ensuring your public and private keys are visible and legible.

- Safe Storage: Store your paper wallet in a secure location, safe from environmental damage and unauthorized access.

We’ve prepared a detailed video tutorial to make the process more accessible. It offers a visual, step-by-step guide on creating your own crypto paper wallet, ensuring you have all the tools and knowledge needed to safeguard your investments effectively. From selecting the right platform to the final steps of securing your private and public keys, we’ve got you covered.

Paper Wallet Alternatives

While secure, paper wallets have limitations, such as the risk of physical damage or loss. Here are some alternatives to paper wallets for storing your cryptocurrencies:

1. Hardware Wallets:

Hardware wallets are compact, portable devices similar in size to a USB drive, specifically designed to store cryptocurrency in a secure environment. They store the user’s private keys offline, not exposing them to online threats like hacking or malware. To access or manage the funds, the user connects the hardware wallet to an internet-enabled device, inputs a PIN, and uses the wallet’s interface.

This type of wallet combines cold storage security with the convenience of quick transactions when needed. The hardware is often encrypted for additional security, and some models feature screens for verifying transactions.

- Examples: Ledger Nano S, Trezor One, KeepKey.

- Pros: Highly secure, portable, and supports multiple cryptocurrencies.

- Cons: Can be expensive, risk of physical loss or damage.

2. Mobile Wallets:

Mobile wallets are applications downloaded and installed on smartphones that facilitate storing, sending, and receiving cryptocurrencies. They are known for their convenience and accessibility, allowing users to access their crypto assets anytime, anywhere. Mobile wallets store private keys on the phone, and transactions can be made easily by scanning QR codes. They often come with security features like biometric authentication, multi-signature support, and backup options to recover funds if the phone is lost or stolen.

- Examples: Trust Wallet, Exodus Mobile, Mycelium.

- Pros: Convenient, user-friendly, quick transactions.

- Cons: Can be less secure, dependent on mobile security, and risk if the phone is lost or stolen.

3. Desktop Wallets:

Desktop wallets are software programs installed on a personal computer or laptop. They store the user’s private keys on the device’s hard drive. Desktop wallets offer a high level of security as long as the computer is free from malware and other security threats. They provide users with complete control over their funds and private keys.

These wallets often feature intuitive interfaces, making managing and transferring cryptocurrencies, checking balances, and conducting transactions easy. Security can be enhanced by keeping the computer offline when not making transactions, turning it into cold storage.

- Examples: Exodus, Electrum, Atomic Wallet.

- Pros: Secure, easy to use, and supports many cryptocurrencies.

- Cons: Vulnerable to malware and hacks, dependent on computer security.

4. Web Wallets:

Web wallets are accessible through internet browsers and are often hosted by third parties. Users can access their funds by logging into their account on the wallet provider’s website. These wallets are convenient for quick transactions and easy access from any internet-enabled device. However, they can be vulnerable to online threats, including hacking and phishing attacks.

Some web wallets offer control over private keys, while others are custodial, meaning the service provider maintains control of the keys.

- Examples: Blockchain.com, MyEtherWallet, Coinbase Wallet.

- Pros: Easily accessible, user-friendly, suitable for beginners.

- Cons: Vulnerable to online threats, dependent on the security of the website.

5. Metal Wallets:

Metal wallets are essentially an upgraded version of paper wallets designed to offer enhanced durability. They involve engraving or etching the private and public keys onto a metal plate, making them resistant to physical damage such as fire, water, or wear and tear over time. These wallets are ideal for long-term storage of cryptocurrency, as they ensure that the critical information remains intact and legible throughout the years. They are often used to store backup copies of keys safely.

- Examples: Cryptosteel, Billfodl.

- Pros: Durable, resistant to physical damage, secure.

- Cons: Can be expensive, still at risk of loss or theft.

When considering an alternative to a paper wallet, evaluate factors like security, convenience, accessibility, and the types of cryptocurrencies you intend to store. Each alternative has its unique strengths and weaknesses. For maximum security, hardware wallets are often recommended. Mobile and web wallets are suitable options for ease of access and convenience. Always ensure to consider the security protocols and backup options each alternative offers to safeguard your digital assets effectively.

Conclusion

We’ve provided the step-by-step process of creating a Bitcoin paper wallet, a secure and offline method to store your valuable digital assets. From the intricate steps of generating the wallet ensuring it’s safely stored, to the nuances of adding Bitcoin, and checking the balance, each phase is pivotal in safeguarding your assets from potential online threats and vulnerabilities.

Although paper wallets are an older method of securing Bitcoin, they still hold significant relevance for their robust security features, especially for long-term holders. The tangibility of having your digital assets stored in a physical form, coupled with the enhanced security protocols of being offline, offers a peace of mind often sought after in cryptocurrencies’ volatile and unpredictable landscape.

However, with the boon of security comes the bane of responsibility. The safety of your paper wallet hinges on meticulous handling, secure storage, and an acute awareness of the associated risks and mitigation strategies. It’s a testament to the adage, “With great power comes great responsibility.”

FAQs

Are paper wallets free?

Yes, creating a paper wallet is typically free. You can generate them using online tools at no cost. However, it’s paramount to use trusted and secure generators to ensure the safety of your cryptocurrency. Always prioritize security when creating and storing your paper wallet.

What are the risks of paper wallets?

Paper wallets, though secure, come with risks like potential physical damage, loss, or theft. They require careful handling and secure storage. Additionally, the process of generating a paper wallet should be done offline to mitigate the risk of online threats.

Can you make a paper wallet for any cryptocurrency?

While many cryptocurrencies can be stored on paper wallets, not all of them are compatible. It’s crucial to check the specific cryptocurrency’s compatibility and use a dedicated paper wallet generator to ensure the safety and accessibility of your digital assets.

Are paper wallets still safe?

Paper wallets are considered a secure option for storing cryptocurrencies as they are immune to online hacking attempts. They store your crypto offline, reducing the risk of theft. However, they must be created and stored securely, safeguarding them from physical damage or loss.

Can I store any crypto on a paper wallet?

Yes, paper wallets can support a variety of cryptocurrencies, not just Bitcoin. However, it’s essential to use a trusted and specific generator compatible with the cryptocurrency you intend to store. Always verify the compatibility to ensure the safe and secure storage of your digital assets.