In this beginners guide, I explain how to use Binance Liquid Swap. Binance created Binance Liquid Swap also known as BSWAP, its own centralized version of an AMM (automated market maker) to rival popular DEX UniSwap. Binance’s DEX (decentralized exchange) allows users to swap tokens, plus provide liquidity in return for a percentage of the trading fees.

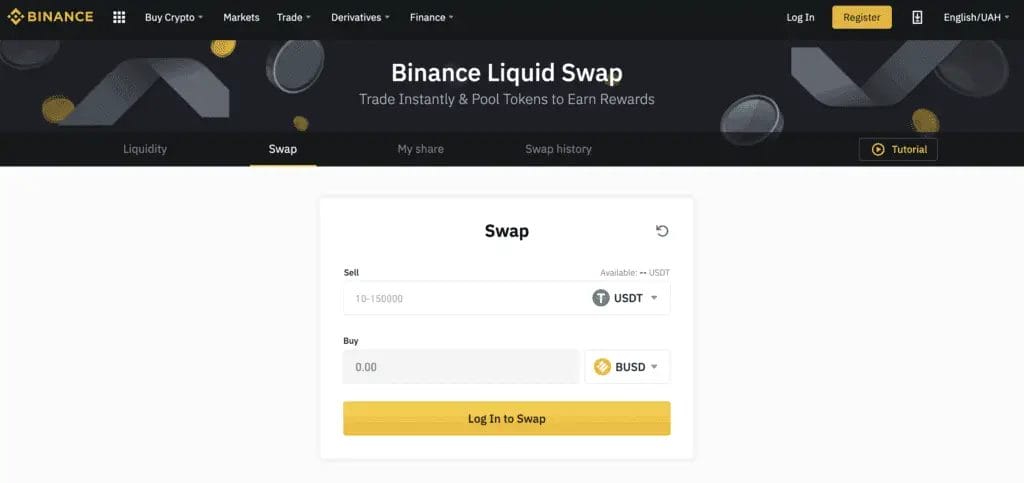

How to Use Binance Liquid Swap?

What is Binance Liquid Swap?

Binance Liquid Swap is an automated market maker (or AMM) pool product, the first of its kind in a centralized exchange. AMMs work by automating the trading process, so that no 2 traders ever have to wait to find each other. Instead, trades are executed via smart contracts, and private reserves are replaced by voluntary liquidity pools.

The benefits of using their AMM will give users lower fees, stable prices, and instant liquidity. Plus trading fees for the first month will be as low as 0.04%

They’ve initially launched with 3 crypto assets for trading which are Binance USD (BUSD), Dai (DAI), and Tether (USDT). Users can deposit these and start earning interest (plus a cut of the transaction fees) in return for pooling their tokens.

Binance, like many other centralized exchanges, are being forced to adopt DeFi tokens, or else risk being left behind. By providing the convenience of being a few clicks away from their centralized exchange, plus having the security and userbase of Binance, they hope to bring some of their users back to their platform and encourage more growth in the DeFi market.