In this Aave review, we take a look at the popular DeFi lending protocol that enables users to lend and borrow a diverse range of cryptocurrencies. This may sound similar (in terms of lending and borrowing) to the likes of Compound Finance. However where Aave differs from some other lending platforms is that it offers more diverse assets, both stable and variable interest rates for lending, plus flash loans.

Aave Review: How to Use Aave?

Who is Aave?

Aave was originally launched as ETHLend, a lending platform that was founded in 2017 and then rebranded to Aave in September 2018. The name itself is Finnish and translates to “ghost” in English. And the ghost represents Aave’s focus on creating a transparent and open infrastructure for decentralized finance.

Supported Assets

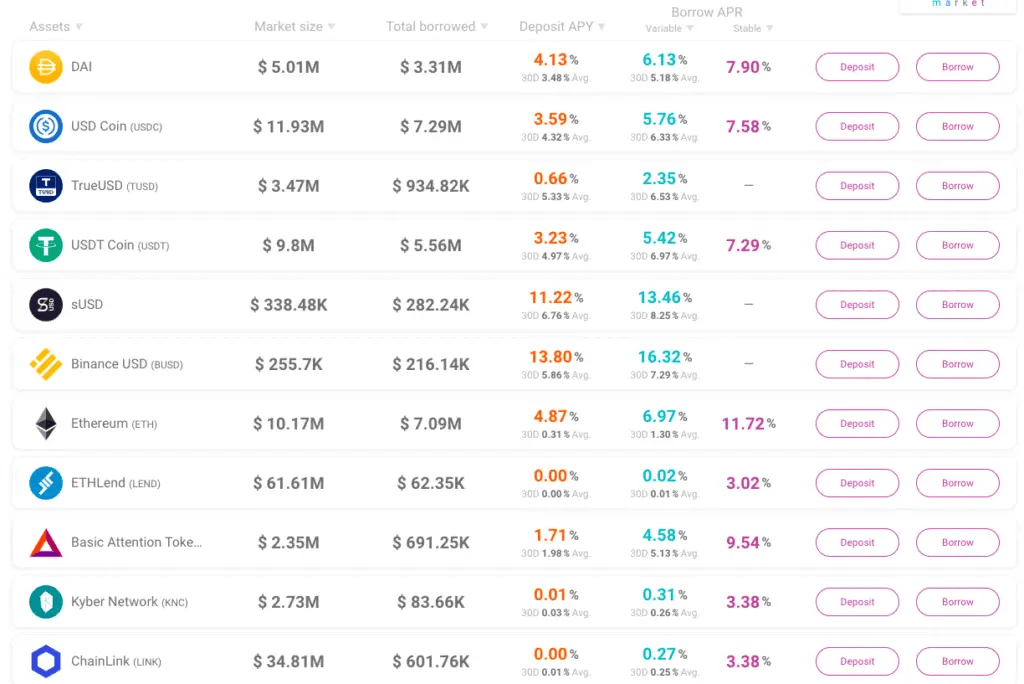

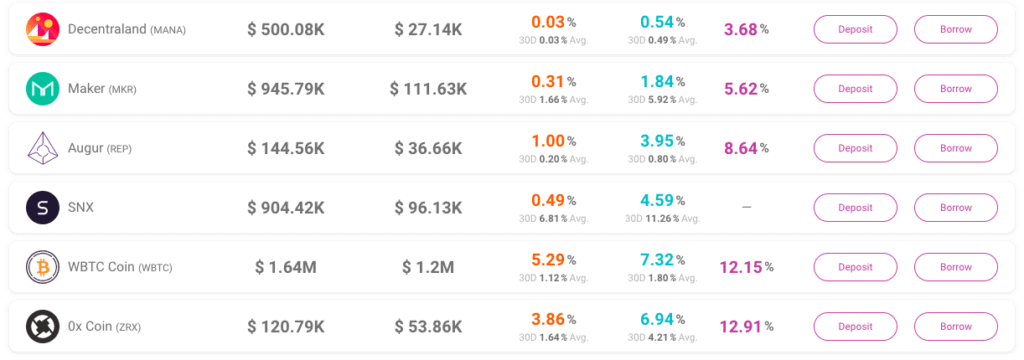

Aave supports a diverse range of assets that you can lend or borrow on the platform. And the list of assets currently includes;

Basic Attention Token (BAT), Dai (DAI), Ethereum (ETH), Kyber Network (KNC), Aave (LEND), ChainLink (LINK), Decentraland (MANA), Maker (MKR), Augur (REP), Synthetix (SNX), TrueUSD (TUSD), USD Coin (USDC), Tether (USDT), Wrapped BTC (WBTC), 0x (ZRX), and Synthetix USD (SUSD).

Flash Loans

Flash Loans are an advanced concept aimed at developers. Therefore you must have a good understanding of Ethereum, programming, and smart contracts to take advantage of them.

Flash loans require zero collateral to use, and Aave charges a 0.30% fee on these. Instead of guaranteeing repayment with collateral, Flash Loans simply rely on the timing of the loan’s repayment. As long as the loan is used and paid back in full within the same block it was issued, it is approved. However, the entire transaction fails if the loan is not paid back within the same block.

AAVE Token

The AAVE token was migrated from the token formerly known as LEND. These ERC20 tokens are used to allow users to participate in the Aave protocol governance and can also be staked within the protocol’s Safety Module. In the event of a shortfall in the DeFi protocol, staked tokens would be used as collateral as a last resort.

In July 2020, Aave unveiled plans to hold a token swap. This means that the 1.3 billion AAVE tokens in circulation would be swapped for the newly minted AAVE cryptocurrency at a ratio of 1:100, creating a total supply of 16 million AAVE.

Customize this widgetToken Migration

The first Aave Improvement Proposal has ended, with overwhelming votes in favour of the token migration from LEND to AAVE. This migration is the first step in the Aavenomics. Migrating from the LEND to AAVE tokens allows users to participate in the Aave Protocol Governance and stake within the protocol Safety Module, similar to the likes of Compound and, more recently, Uniswap.

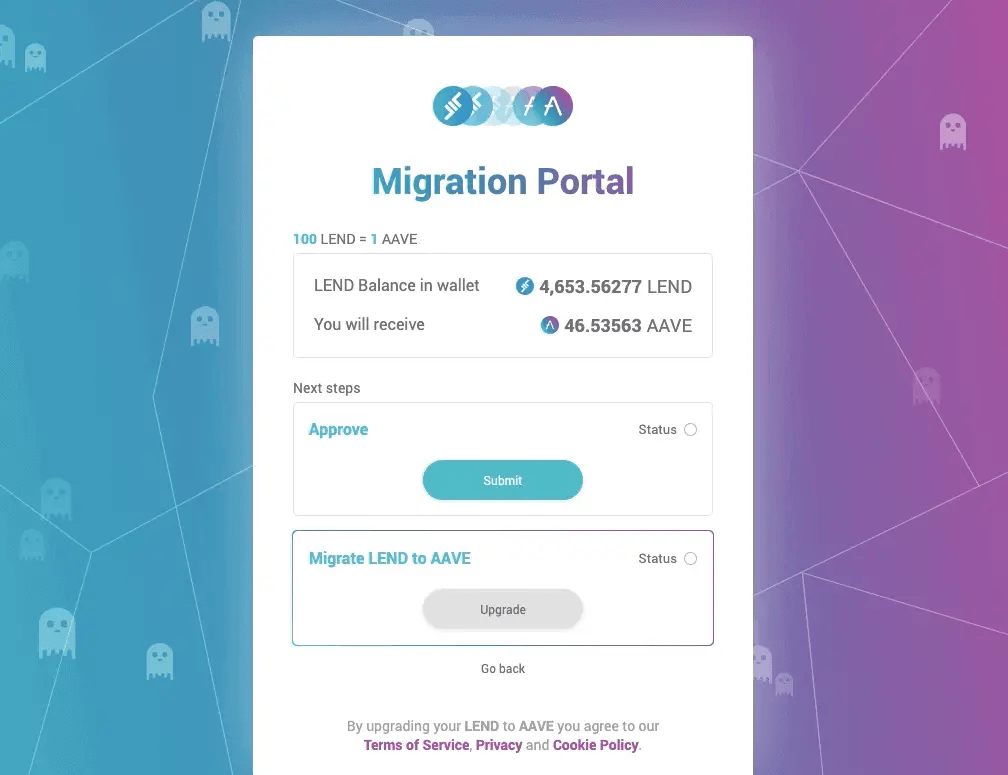

The ratio of the tokens works out to be 100 LEND to 1 AAVE, so if you migrate 100 LEND, you will get 1 AAVE token.

The process to migrate from LEND to AAVE is quite similar to a deposit. I need to approve and then upgrade your tokens, and I’ll take you through that momentarily.

If you have LEND in exchanges or other places, these exchanges will announce themselves if they will handle the migration from their side. Binance has announced its support for the new AAVE token and has also stated that its users can use their token swap functionality on their site to swap from LEND to AAVE.

However, if you have LEND on an exchange that won’t allow it to migrate, then you will have to withdraw to whatever wallet you’re using to connect to Aave Protocol and migrate from there.

How to Migrate LEND to AAVE Tokens

The process to migrate from LEND to AAVE is quite similar to a deposit, which you’ll need to approve (to allow the migration contract to move your LEND tokens to migrate them to AAVE) before upgrading your tokens. Plus, you’ll also need some Ethereum to pay for the gas fees.

Once you’ve connected your wallet (containing the LEND tokens) to the Aave site, you simply need to head across to the Migration Portal from the left of the screen. Then Approve, pay a gas fee. Then Upgrade your tokens and pay another gas fee!

How to Stake AAVE Tokens

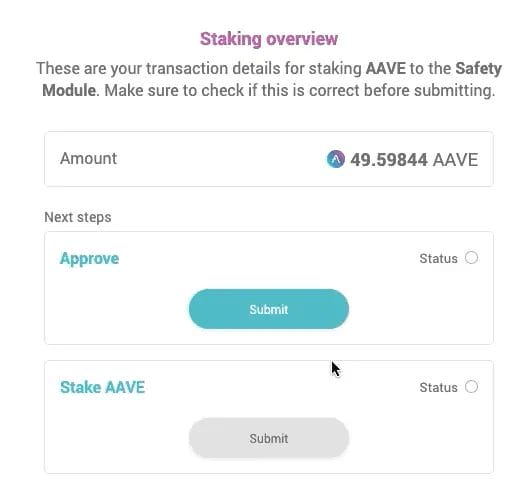

Once you have your new Aave tokens, you can now stake them. Staking consists of depositing your AAVE tokens within the protocol Safety Module. The purpose of staking is to act as a mitigation tool in case of a shortfall event. Safety Module stakers will receive Safety Incentives as an incentive for this service.

The initial rewards are 400 AAVE/day and will be distributed among the stakers. Stakers will also receive a percentage of protocol fees, which will come later if the governance votes.

Now, there are some risks to staking too… In the case of a shortfall event, the Safety Module uses up to 30% of the assets locked to cover the deficit. This protocol protection won’t be active on the initial launch, and they will inform users when the slashing is activated.

To stake your tokens, head across to “Staking” on the left-hand side of the screen. Select the amount. Then, approve and pay a gas fee. Then stake and pay another gas fee! Your tokens will be staked in the Safety Module when that’s confirmed.

Your staked AAVE tokens will appear on the screen’s right side. It will show you the amount you’ve staked: the claimable amount and the AAVE per week and month.

How to Unstake on Aave

If you want to un-stake you’ll need to do this after the cool-down period has been activated. This cool-down period is currently set to 10 days. So, to un-stake, you first need to pay for a transaction to activate the cool-down period. And then pay for another transaction to un-stake after this period is complete.

Aave Token Migration and Staking Tutorial

Aave V2

Aave released V2 of their protocol on December 3rd 2020. It brings with it new features, making the protocol more flexible and efficient. For more information and to take a look at the platform, click this link for my tutorial.

8 responses

Good to see someone signed up for brave rewards 🙂 currently you have 4% of my attention for the month.

Thank you Thomas, much appreciated!

Amount in “Available to stake” is zero, how do I get some Aave there ?

Have you already purchased Aave and sent it, if not, you can purchase Aave on the likes of Uniswap which I have a tutorial for.

Hello Louise. I was hoping you can help me regarding AAVE. I originally had my LEND tokens stored on my Ledger Nano S. Following your video tutorial (which was great by the way), I successfully migrated my LEND to AAVE. When I connect to app.aave.com using my Ledger Nano S, I can see my AAVE token balance. I have not deposited or staked. I would like to transfer my AAVE from my app.aave.com wallet address to an external ETH address, but I can’t seem to find where within the app.aave.com to do so. I’m assuming I will need to my Ledger Nano S to sign the transfer transaction. I’ve tried clicking on every button but no success. Obviously, I’m a newbie here. Any help would be greatly appreciated. Thanks and have a nice day.

So, you’re trying to send your Aave tokens to an external ETH wallet/address? Or are you trying to send your tokens to the Aave website to stake?

Very Nice presentation on Aave staking. I would like very much to just deposit my Aave to the Aave platform for

just to generate interest. But I have no Idea how to do that. Plus it seems low risk. I have a coinbase account , but Aave is not supported at this time . But I have a Kucoin, and Atomic wallet holding Aave, but not listed on the Aave plateform.

I would like to support Aave by depositing my Aave for intrest. I need some help getting this done.

Could someone please help me with this matter , and the features and beneifts .

Many Thanks

Vaughn Johnson

Aave is an ERC20 token on the Ethereum network. If you have your Aave in your Atomic wallet you can send this to Aave and follow the process in the video which should allow you to start staking your tokens to earn rewards.

For any risks and benefits, you should be able to find them on the Aave website.