In recent years, cryptocurrency has transitioned from a niche interest, primarily for the tech-savvy, to a burgeoning financial frontier accessible to all. It’s now simpler than ever to buy your first crypto assets, with trusted user-friendly platforms, and a wealth of information for beginners and experts alike. This evolution signals a pivotal moment and diving into the world of cryptocurrency is no longer a daunting endeavour but an accessible, exciting opportunity.

Here’s a closer look at why embarking on your crypto journey in 2024 might be easier and more rewarding than you ever imagined.

What is Cryptocurrency?

Cryptocurrency is a type of digital money. Unlike the dollars or euros in your wallet, you can’t hold a cryptocurrency in your hand. It exists only on computers. Cryptocurrencies use a technology called blockchain to keep transactions safe and anonymous. Think of blockchain as a digital ledger that records all the transactions made with a particular cryptocurrency.

One of the most well-known cryptocurrencies is Bitcoin, but there are many others like Ethereum, Ripple, and Litecoin. People like cryptocurrencies because they can make transactions quickly and, in many cases, without extra fees that banks might charge. Also, since it’s digital, it’s supposed to be more secure and harder to fake compared to regular money.

Cryptocurrency can be used for buying things online, investing, or even as a way to send money across the world quickly. More and more places are starting to accept them as a form of payment, making them a part of our everyday financial lives.

5 Reasons to Buy Crypto in 2024

1. Easier Access to Trusted Crypto Exchanges and Secure Wallets

One of the key developments over the last few years is the ease of accessing trusted crypto exchanges and secure wallets. Gone are the days of navigating through a maze of questionable platforms. Now, reputable and user-friendly exchanges are the norm, offering a safe and straightforward way for anyone to buy, sell, and hold cryptocurrencies.

These trusted exchanges not only provide robust security measures to protect your investments but also offer a range of features tailored to both beginners and experienced users. From simple buying and selling processes to advanced trading tools, they cater to a wide spectrum of needs.

The evolution of crypto wallets has also helped grow crypto adoption in the last few years. Today’s wallets are not only more secure, with enhanced encryption and multiple layers of protection, but they are also incredibly user-friendly. Whether it’s a hardware wallet like Ledger for maximum security or a software wallet like Exodus for convenience, getting your wallet is now a straightforward process.

The ease of finding a reliable exchange and secure wallet has significantly lowered the entry barrier for investing in cryptocurrencies, making it a feasible option for a wider audience.

2. Increased Institutional Adoption

One of the most compelling reasons to consider investing in cryptocurrencies in 2024 is the increased institutional adoption. This trend is a game-changer, signalling a major shift in how the financial world views digital currencies.

Large financial institutions, hedge funds, and even some governments are now recognizing the potential of cryptocurrencies. They’re not only investing in them but also integrating them into their financial systems and operations. This institutional backing adds a layer of legitimacy and stability to the crypto market, which was once seen as too volatile and uncertain for mainstream investors.

What does this mean for individual investors? Firstly, it can lead to increased market stability. When big players invest in the market, they tend to become less prone to wild price swings. Secondly, this adoption can drive innovation and growth in the crypto space, as institutions invest in developing new blockchain technologies and applications.

Institutional involvement often attracts regulatory attention, leading to clearer and more investor-friendly regulations. This can make the market safer and more attractive for everyone.

3. Increasing Utility & Real-World Applications

One of the most exciting aspects of cryptocurrency is its increasing utility and wide range of real-world applications. Cryptocurrencies are no longer just digital assets for investment; they are evolving into tools with practical, everyday uses.

Wider Merchant Acceptance: A growing number of businesses, both online and in physical stores, are accepting cryptocurrencies as payment. This trend is not just limited to large corporations but is also being embraced by small and medium-sized enterprises. From buying coffee to booking travel tickets, the use of crypto in everyday transactions is becoming increasingly common.

Decentralized Finance (DeFi): DeFi is revolutionizing the financial industry by offering decentralized alternatives to traditional financial services. This includes lending, borrowing, earning interest, and even insurance – all without the need for a middleman like a bank. DeFi platforms operate on blockchain technology, offering transparency, security, and accessibility.

Tokenization of Assets: Cryptocurrency technology is enabling the tokenization of real-world assets, such as real estate, art, and commodities. This process converts rights to an asset into a digital token on a blockchain, making it easier to trade and divide these assets into smaller, more affordable shares. This opens up investment opportunities to a broader range of people.

Cross-Border Payments and Remittances: Cryptocurrencies are transforming how we send money across borders. With their ability to facilitate fast and low-cost international transactions, they are becoming an increasingly popular choice for remittances, particularly in regions where access to traditional banking is limited.

Smart Contracts: The use of smart contracts in various sectors, including legal processes, supply chain management, and even voting systems, is on the rise. These are self-executing contracts with the terms directly written into code, which can automate and streamline processes while ensuring transparency and reducing the risk of fraud.

4. Access to Information and Advanced Analysis Tools

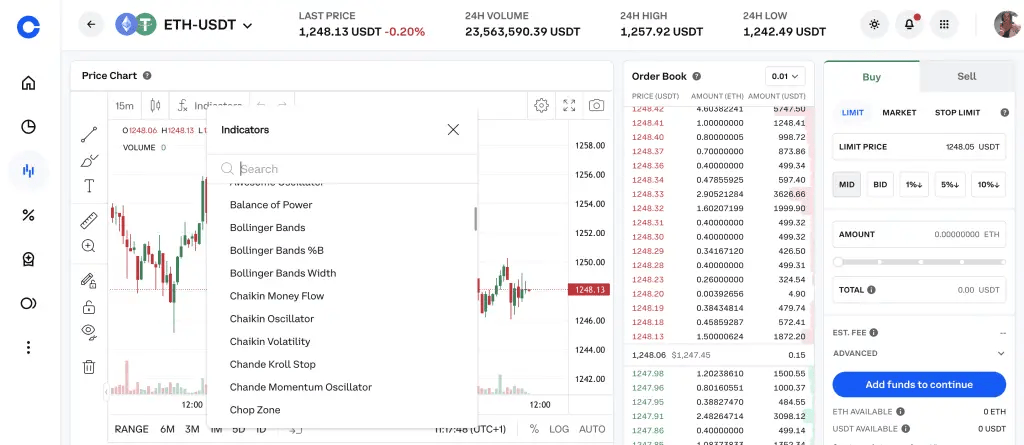

The availability of information and analysis has become more abundant, making it easier than ever for investors to make informed decisions. This change is twofold: the widespread availability of information and the advancement of technical analysis tools.

Universal Information Access: Gone are the days when crypto news and insights were scarce or confined to niche groups. Now, information is universally available and diverse in its sources. From dedicated online communities on platforms like Reddit and Facebook to specialized crypto blogs and newsletters, staying updated is just a few clicks away. These resources not only provide the latest news but also offer in-depth discussions and insights, helping you to spot emerging trends and promising coins early.

Advanced Analytical Tools: Alongside this information boom, the tools for analyzing cryptocurrencies have also matured. The field, once considered too young for sophisticated analysis, now boasts AI-driven tools capable of making highly accurate projections. These tools leverage the rich history and data accumulated over the years, offering consistent and reliable insights.

With the combination of easily accessible information and advanced analytical tools, investors are better equipped than ever to find the next altcoins to invest in. Whether you’re conducting your research or relying on expert analyses, the crypto world has become more open and approachable for everyone.

To find more information check this investment analysis here.

5. Diversification of Investment Portfolio

One of the most strategic reasons to invest in cryptocurrencies in 2024 is the diversification they offer to an investment portfolio. Diversification is key in managing risk and improving potential returns, and cryptocurrencies, with their unique market dynamics, provide an excellent avenue for this.

Unique Asset Class: Cryptocurrencies behave differently from traditional assets like stocks and bonds. They have their own set of market drivers and are often less correlated with other financial markets. This means when stocks or bonds are not performing well, your crypto investments might still hold strong, or even appreciate, providing a cushion against market downturns.

Copy Trading as a Diversification Tool: For those new to crypto or those looking to diversify their crypto holdings without deep market knowledge, copy trading can be an invaluable tool. This strategy involves mimicking the trades of experienced and successful crypto traders. By selecting a range of traders with different strategies and asset preferences, you can effectively diversify your crypto investments.

Through copy trading, you can benefit from the expertise of seasoned traders who have different approaches to the market. Some might focus on long-term growth potential, while others might excel in short-term trades. By spreading your investments across various trading styles and cryptocurrencies, you enhance diversification within your crypto portfolio.

Furthermore, copy trading can serve as an educational tool. By observing the decisions and strategies of the traders you’re copying, you can gain insights and knowledge, which can be invaluable if you decide to start trading independently in the future.

Conclusion

Cryptocurrency is no longer a fringe financial asset; it has become an integral part of our global financial landscape. The advancements in technology, regulatory clarity, and the growing acceptance of digital currencies in everyday transactions underscore this change.

While the cryptocurrency market continues to mature and offer new opportunities, it remains essential to approach it with a balanced perspective. The reasons to buy crypto in 2024 are compelling, but they should be weighed against a clear understanding of the risks and rewards involved. As always, the golden rule of investing applies: never invest more than you can afford to lose.