Compound Finance is a decentralized service that allows users to lend and borrow crypto assets. Most investors look to buy and store their crypto assets safely in a wallet or on an exchange without earning any interest in the sense that a traditional bank or savings account would. However, Compound Finance is on a mission to change that.

Compound Finance allows users to easily earn interest on their Ethereum, Dai, BAT, etc. As well as lending you can also use your assets as collateral and borrow against your crypto. Allowing both lenders and borrowers to get more out of their cryptocurrency. In this tutorial, I will show you how to get started and this can all be done within a few minutes and without the headaches or rules of traditional banks.

Compound Finance Review

Who Are Compound Finance?

Compound Finance is a San Francisco based company that has the backing of some very prominent investors such as the likes of Polychain Capital, Bain Capital, and Coinbase who have also recently announced the support for the governance token COMP.

You can earn free COMP tokens with Coinbase Earn, just answer a few simple questions are receive your free crypto.

What are COMP Tokens?

The COMP ERC20 token is given to lenders and borrowers to incentivize them to participate in the different markets across the compound protocol.

Every day 2,880 COMP tokens are distributed to lenders, suppliers, and borrowers, and this is done proportionally to how much interest is being paid to each market. With the majority being paid to whichever has the most interest.

COMP tokens can be collected and withdrawn or exchanged on the likes of Uniswap. Or you can use them to vote on proposals for the Compound protocol. Which you can vote manually or you can delegate this out to another user if you wish.

The COMP price has rocketed recently which may be due to Coinbase announcing their support.

What Are Compound Finance Rates?

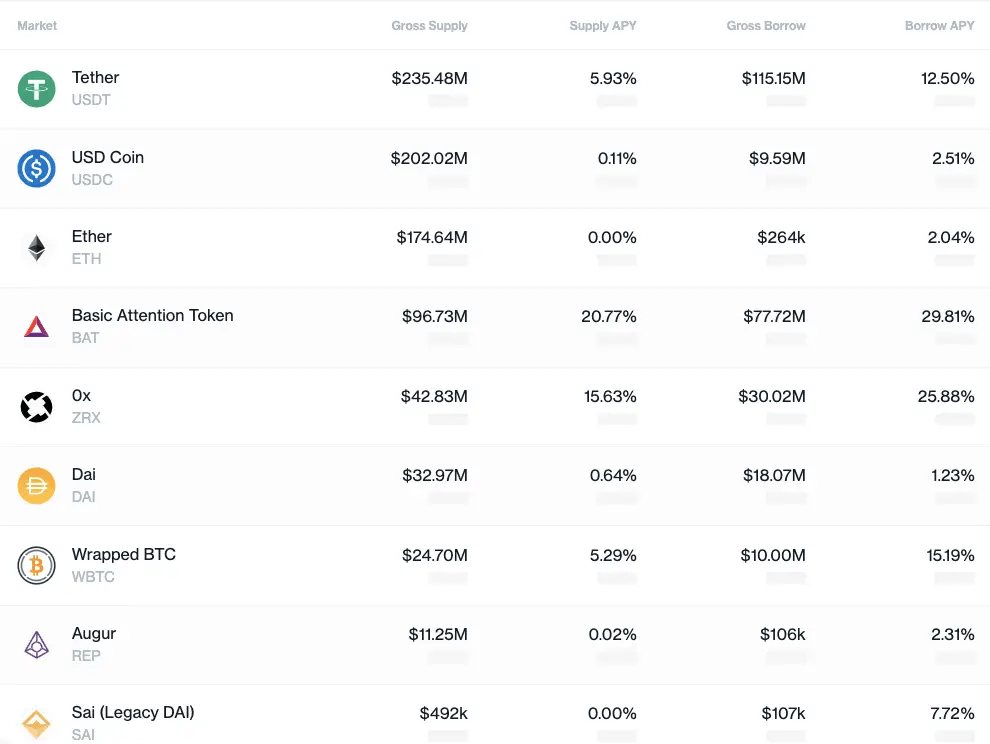

Lending rates with Compound Finance are variable and not fixed and will depend on the market conditions at the time. However, below is a list of current rates for lending and borrowing.

What Tokens Are Available with Compound Finance?

Users can lend and borrow popular cryptocurrencies which currently include; Tether (USDT), USD Con (USDC), Ether (ETH), Basic Attention Token (BAT), 0x (ZRX), DAI (DAI), Wrapped BTC (WBTC), Augor (REP) and Sai (SAI).

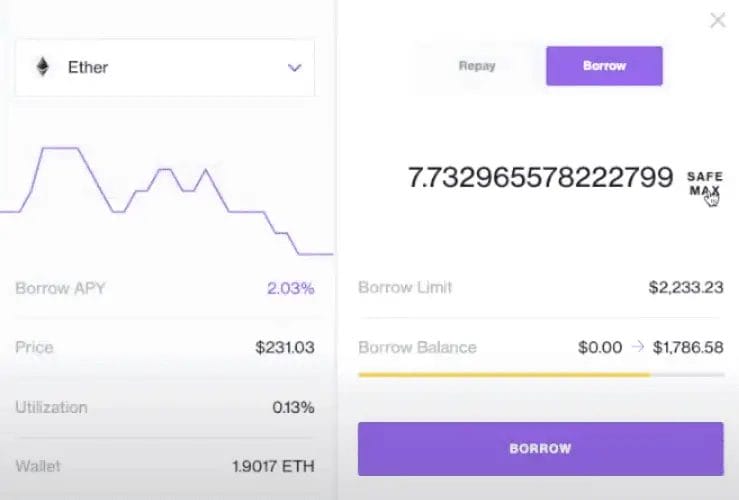

Compound Finance Loans

Many Compound Finance users fixate on the high-interest rates that can be achieved for lenders. However, taking out a loan is an easy process too. All you need is some crypto to deposit as collateral and because it’s decentralised there are no credit checks, income statements, or delays.

You can use the assets that you currently have as collateral to take out Compound Finance loans. However, please do be careful, as there is a liquidation clause. So don’t ever over-borrow.

7 responses

Hello I want help Which platform is profitable. I’m new here more money lost for this . Don’t know more about crypto trading..

I would be cautious getting into DeFi lending/borrowing if you’re new to crypto. Maybe looking into a buy and hold strategy initial and see where that takes you.

Check our DefiRates to see the most profitable Defi platforms https://defirate.com/lend/

Hopefully this will help. Good luck

I would be cautious getting into DeFi lending/borrowing if you’re new to crypto. Maybe looking into a buy and hold strategy initial and see where that takes you.

Check our DefiRates to see the most profitable Defi platforms https://defirate.com/lend/

Hopefully, this will help. Good luck

Lately ive been hearing of this lending and borrowing of crypto, how true is this?

I have some btc laying around and i could lend it out if i trusted whoever or which platform i was lending to and my profit margin.

GAS Fees are very high ATM, so it can be very expensive using platforms like Compound or Aave. Have a look at platforms like Celsius and BlockFi. I have tutorials and sign-up offers for both.

Since gas fees are so high atm, would you say that it is not worth using Compound for small amounts (e.g. <$500)?

Yes, I would avoid Compound Finance ATM if you have small amounts of crypto. You pay GAS fees in and out, so it’s likely to eat into your profit. Maybe look at the likes of Celsius Network or BlockFi, if you´re interested in some returns.